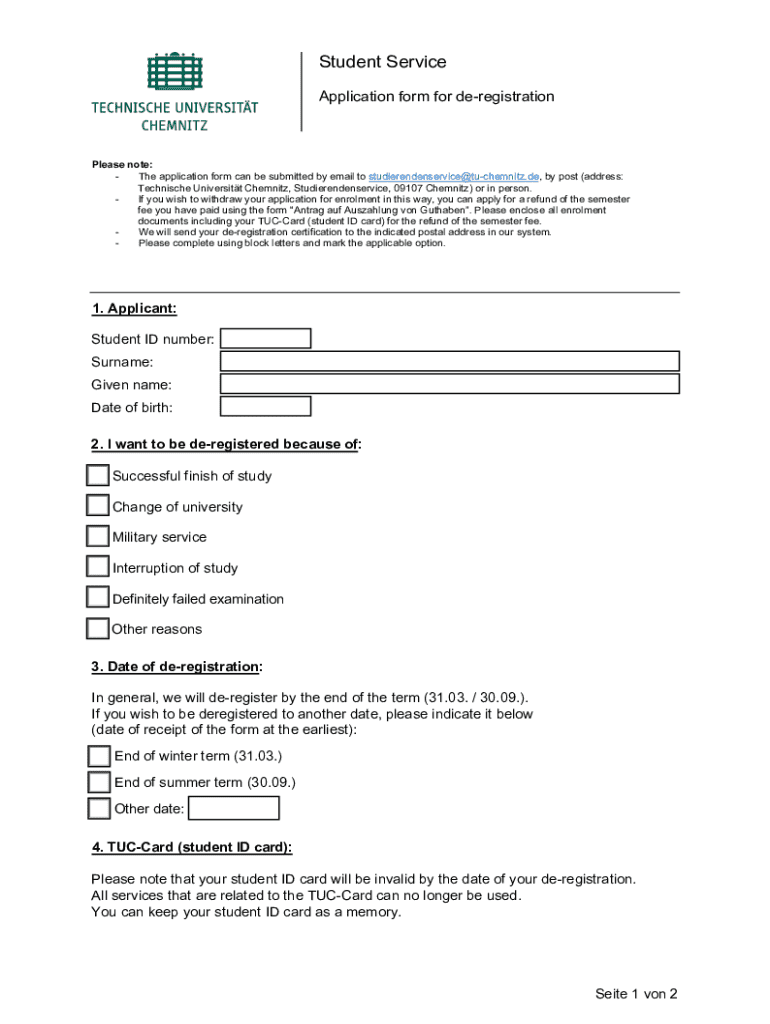

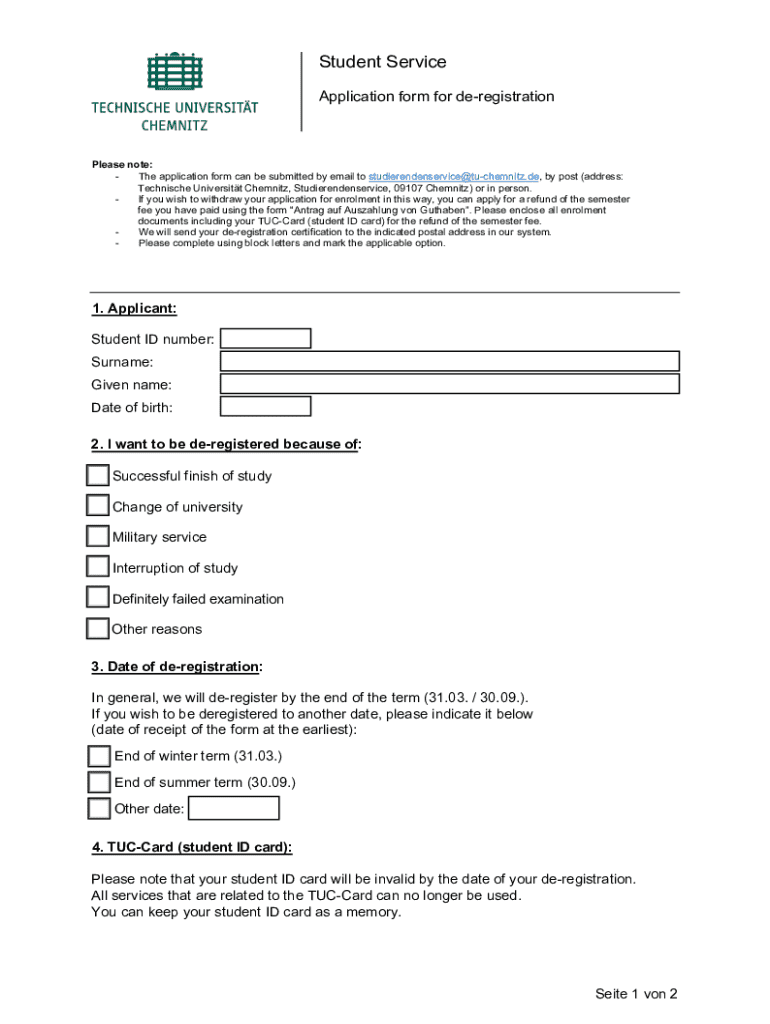

Get the free Application Form for De-registration

Get, Create, Make and Sign application form for de-registration

Editing application form for de-registration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for de-registration

How to fill out application form for de-registration

Who needs application form for de-registration?

Application form for De-Registration Form: A Comprehensive Guide

Overview of de-registration

De-registration refers to the formal process of removing a vehicle, vessel, or business entity from an official register. This process is essential for various reasons, primarily to ensure that records remain accurate and up-to-date. Filing a de-registration form is crucial for preventing liability and regulatory complications, allowing individuals or businesses to efficiently manage their assets.

By completing the de-registration form, the applicant formalizes the discontinuation of registration, often necessary when a vehicle is sold, destroyed, or no longer in use. Not only does this safeguard the owner from tax obligations, but it also mitigates issues with insurance and law enforcement.

Types of de-registration

There are primarily three categories of de-registration: vehicle, vessel, and business entity. Each type has its distinct guidelines and reasons for initiation.

Vehicle de-registration

Vehicle de-registration typically occurs when a vehicle is sold, scrapped, or no longer in operational condition. Common reasons include moving to a different region, changing ownership, or when a vehicle is deemed unsafe for the road. Ensuring that the de-registration of a vehicle is processed helps avoid any future liability if the vehicle is used illegally.

Vessel de-registration

Vessels also require de-registration, often due to sale, abandonment, or destruction. Common scenarios for vessel de-registration include a change in vessel use, moving to another jurisdiction, or a decision to cease operations. Proper de-registration is critical to avoid potential fines or legal issues stemming from abandoned vessels.

Business entity de-registration

Business de-registration can occur when a company ceases operations or merges with another entity. Criteria such as outstanding debts, legal liabilities, and compliance issues can affect a business's eligibility for de-registration. Ensuring that all criteria are met will prevent future complications.

Eligibility for de-registration

Eligibility varies depending on the type of de-registration. Typically, the registered owner or authorized representative may apply. In some cases, certain conditions may affect eligibility, such as unresolved legal issues or outstanding payments related to the registered item.

For vehicle and vessel de-registration, it’s vital that all fees are settled, and relevant documentation is in order. In business contexts, ensuring that all creditors are satisfied and documenting the closure appropriately is crucial for smooth operations post-de-registration.

Process for completing the de-registration form

Completing the application form for de-registration can seem daunting, but by following a structured approach, you can simplify the process.

Common mistakes to avoid during the application include overlooking documentation requirements, misrepresenting information, or submitting incomplete forms. Cross-checking details can significantly reduce processing time and stress.

Submission methods for de-registration

Once the application form for de-registration is complete, submitting it is the next critical step. There are various methods available for submission.

Online submission

Many states and organizations offer online submission for de-registration applications. Completing it online can take as little as 30 minutes, and users can often receive immediate confirmation upon completion.

Submitting by mail

If you choose to mail your application, ensure that you package it securely. Include all necessary documentation and utilize a mailing method that can provide tracking. Expected processing times can vary based on location but typically range from two to six weeks.

In-person submission

Submitting in person can often expedite the process. Be sure to visit the designated location specified by your local government or regulatory authority. Bring original identification documents as well as copies of your application.

De-registration fees

Most de-registration processes incur fees, which can vary significantly by jurisdiction and the asset type being deregistered. Familiarizing yourself with the costs involved can save unexpected expenses.

Payment methods generally include credit cards, online payment platforms, or bank transfers, depending on the submission method chosen. Ensure to keep all receipts as proof of payment.

After submission: What to expect

Once your application has been submitted, you should receive a confirmation receipt. This receipt is essential for tracking the progress of your application.

Most jurisdictions offer an online portal to check application status, providing peace of mind during the waiting period.

Frequently asked questions about de-registration

Tools and resources for managing de-registration

pdfFiller offers interactive tools to assist users in completing their de-registration forms efficiently. From editable templates to eSign capabilities, users can manage their documents from any location.

Additional template options related to de-registration

Pro tips for effective document management

When utilizing pdfFiller for your de-registration application, consider the following tips:

User experiences and testimonials

Many pdfFiller users have reported significant improvements in their document management processes. With easy-to-use features, the platform simplifies de-registration activities, ensuring that users can focus more on what matters.

Success stories include individuals and businesses who managed to de-register complex assets smoothly using pdfFiller, illustrating the ease and efficiency of the platform.

Further actions post de-registration

Once your application for de-registration is approved, it is essential to take further actions to ensure compliance and inform relevant parties.

This can include returning items like number plates for vehicles, informing insurance companies, and updating records with tax authorities to prevent future discrepancies.

Explore more with pdfFiller

pdfFiller provides seamless access to related forms and templates that can ease the de-registration process. By leveraging the solutions offered, individuals and businesses can handle their document management effectively.

Contact support for help with your form

If you encounter challenges while completing your application form for de-registration, do not hesitate to seek assistance. PdfFiller offers support for quick resolution of any issues you may face, ensuring that your de-registration process is as smooth as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application form for de-registration in Gmail?

Can I sign the application form for de-registration electronically in Chrome?

How do I complete application form for de-registration on an Android device?

What is application form for de-registration?

Who is required to file application form for de-registration?

How to fill out application form for de-registration?

What is the purpose of application form for de-registration?

What information must be reported on application form for de-registration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.