Get the free Bric Staff Development Expense Reimbursement Form

Get, Create, Make and Sign bric staff development expense

Editing bric staff development expense online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bric staff development expense

How to fill out bric staff development expense

Who needs bric staff development expense?

A Comprehensive Guide to the BRIC Staff Development Expense Form

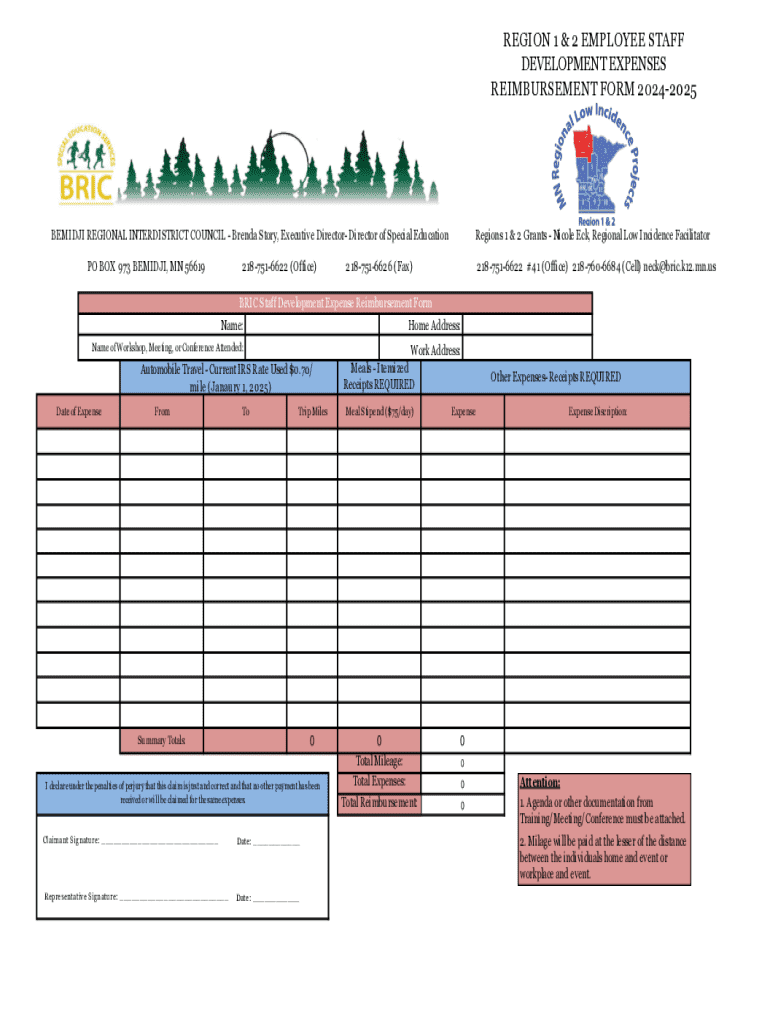

Overview of the BRIC staff development expense form

The BRIC Staff Development Expense Form serves a vital role in managing professional development funds allocated to staff members within organizations. Its primary purpose is to streamline the process for employees to report and get reimbursed for developmental expenses, ensuring that both personal and organizational growth is supported efficiently. This form is particularly important in environments where continuous learning and skill enhancement are pivotal to success.

Eligible users of the BRIC Staff Development Expense Form generally include employees who have incurred expenses related to professional development, such as attending conferences, workshops, or enrolling in courses. By utilizing this form, staff can easily submit detailed accounts of their expenditures, thus facilitating timely reimbursement and enhancing financial transparency.

Key features of the BRIC staff development expense form

One of the standout aspects of the BRIC Staff Development Expense Form is its comprehensive expense tracking capabilities. Users can itemize their expenses, categorize them, and keep a detailed record that meets organizational requirements. This not only simplifies the reimbursement process but also provides a clear overview of how development funds are being utilized.

Additionally, the form offers integration capabilities, allowing users to connect it with other necessary documentation, such as receipts or invoices. This feature saves time and minimizes the risk of misplacing important documents. Furthermore, real-time collaboration options mean that team members and supervisors can engage with the form simultaneously, enabling more efficient communication and quicker resolutions to any issues that arise.

Preparing to fill out the BRIC staff development expense form

Before diving into filling out the BRIC Staff Development Expense Form, it’s essential to gather all the required information and documentation. Typically, this includes personal identification details, a description of the expenses incurred, the date of the transaction, and supporting documents such as receipts or invoices. Having this information on hand simplifies the process and reduces the risk of errors.

Common pitfalls to avoid when preparing data include overlooking receipt organization and failing to address itemized expenses adequately. Users should also be mindful of the deadlines set for submission to ensure timely reimbursement. Tips for gathering necessary receipts include keeping a digital copy and using an expense tracker app to log transactions immediately after they occur.

Step-by-step instructions for completing the form

Accessing the BRIC Staff Development Expense Form is straightforward when using pdfFiller. To start, navigate to the site and either log in or create an account. Once logged in, locate the form in the template library. Click on the form to begin filling it out.

Filling out the form requires attention to detail. Each section is designed to capture specific information: personal details such as name and contact information; expense details like date and nature of expenditure; and justification for the expense, where applicable. Users can also upload documents and supporting materials directly through the platform to provide clarity and verification of the reported costs.

After completing the required fields, users can save the form and return to it later if needed, ensuring they have adequate time to review before submission.

Utilizing interactive tools for enhanced efficiency

pdfFiller comes equipped with various interactive tools designed to enhance the filling and submission process of the BRIC Staff Development Expense Form. For instance, features available for form editing enable users to make adjustments easily and insert digital signatures where required. This feature significantly reduces the time spent on paperwork and enhances the overall user experience.

Moreover, utilizing cloud storage functionality provides easy access to the form from any location, allowing for seamless sharing among team members or supervisors. Real-time collaboration options allow multiple users to view and alter the document, promoting efficient teamwork and ensuring everyone is on the same page regarding the submitted expenses.

Managing and submitting your expense form

Before submitting the BRIC Staff Development Expense Form, it’s crucial to undergo a thorough review process. This includes double-checking the accuracy of all entries, ensuring that all supporting documents are correctly attached, and confirming that the form adheres to company policies.

Submission is available electronically via pdfFiller, providing a swift and secure way to send the form directly to the responsible department. After submission, users can track the status of their expense claims through the platform, offering transparency and peace of mind throughout the reimbursement process.

Common FAQs about the BRIC staff development expense form

Many users may have questions when navigating the BRIC Staff Development Expense Form. One common question is what to do if issues arise while filling out the form. It's advisable to use the support resources from pdfFiller for assistance, or consult with HR for clarification on company-specific requirements.

Another frequent inquiry involves the approval time for submitted expense forms. While this can vary depending on the organization’s processes, having all necessary documentation and accurate entries generally expedites approval. In cases where changes are needed post-submission, users should follow the designated procedures outlined by their organization for amending claims.

Additional tips for efficient expense management

To ensure effective management of expenses, it’s essential to maintain personal records that synchronize with submitted forms. This might involve keeping digital backups of receipts alongside copies of the submitted expense forms. Additionally, utilizing pdfFiller's features for future expense management can help streamline subsequent submissions.

Understanding budget constraints and funding limits can also significantly enhance an employee’s experience with the BRIC Staff Development Expense Form. Staff members should familiarize themselves with their organization’s policies regarding what counts as allowable expenses, ensuring that their submissions align with budgeting guidelines.

User testimonials and success stories

User testimonials highlight the effectiveness of the BRIC Staff Development Expense Form in facilitating seamless expense reporting. Many users cite an improved experience with the reimbursement process, thanks to the organization and structure the form provides. For instance, users report faster reimbursements and increased transparency in how funds are used for professional development.

Case studies also reveal successful outcomes where organizations implemented pdfFiller tools alongside the expense form. In one instance, a company decreased processing time for reimbursements by 40% after transitioning to a digital workflow using the BRIC form via pdfFiller.

Next steps after submission

Once the BRIC Staff Development Expense Form has been submitted, users can anticipate a processing period during which their expenses will be reviewed. Depending on the organizational structure, this could take anywhere from a few days to a few weeks. During this time, users should keep an eye on updates or notifications regarding the status of their claim.

For approved expense claims, follow-up actions typically include addressing any reimbursements received and documenting them for personal records. In the event of a rejected submission, users are advised to consult with the finance department or HR for specific feedback and next steps.

Contact and support information

If assistance is needed while using the BRIC Staff Development Expense Form, users can reach out to pdfFiller support for help. They offer various support channels, including chat and email assistance, catering to users at all levels of familiarity with the platform. Furthermore, community forums provide opportunities for users to exchange experiences and tips, making it a valuable resource for troubleshooting and shared learning.

Tools and resources at your disposal within pdfFiller

pdfFiller provides access to an extensive library of templates for similar forms, which can be useful as organizations often have multiple expense-related documents. Users can also explore advanced features designed for streamlined document management and team collaboration, ensuring a cohesive process for any necessary paperwork.

Navigating user guides and video tutorials further equips individuals with skills to maximize their use of the BRIC Staff Development Expense Form and related tools. Familiarizing oneself with these resources can significantly improve the efficiency of filling, signing, and managing various documents on the pdfFiller platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify bric staff development expense without leaving Google Drive?

How can I send bric staff development expense to be eSigned by others?

How do I edit bric staff development expense on an Android device?

What is bric staff development expense?

Who is required to file bric staff development expense?

How to fill out bric staff development expense?

What is the purpose of bric staff development expense?

What information must be reported on bric staff development expense?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.