Get the free Property Disclosure Exemption Form

Get, Create, Make and Sign property disclosure exemption form

How to edit property disclosure exemption form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property disclosure exemption form

How to fill out property disclosure exemption form

Who needs property disclosure exemption form?

Understanding the Property Disclosure Exemption Form: A Comprehensive Guide

Understanding the property disclosure exemption form

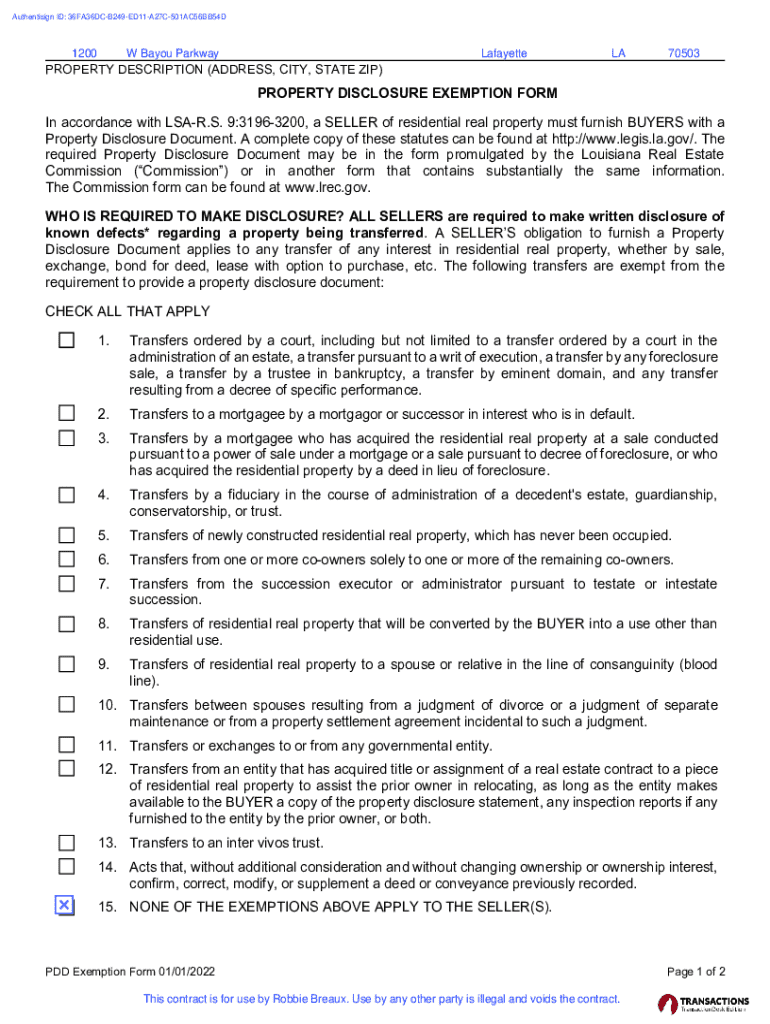

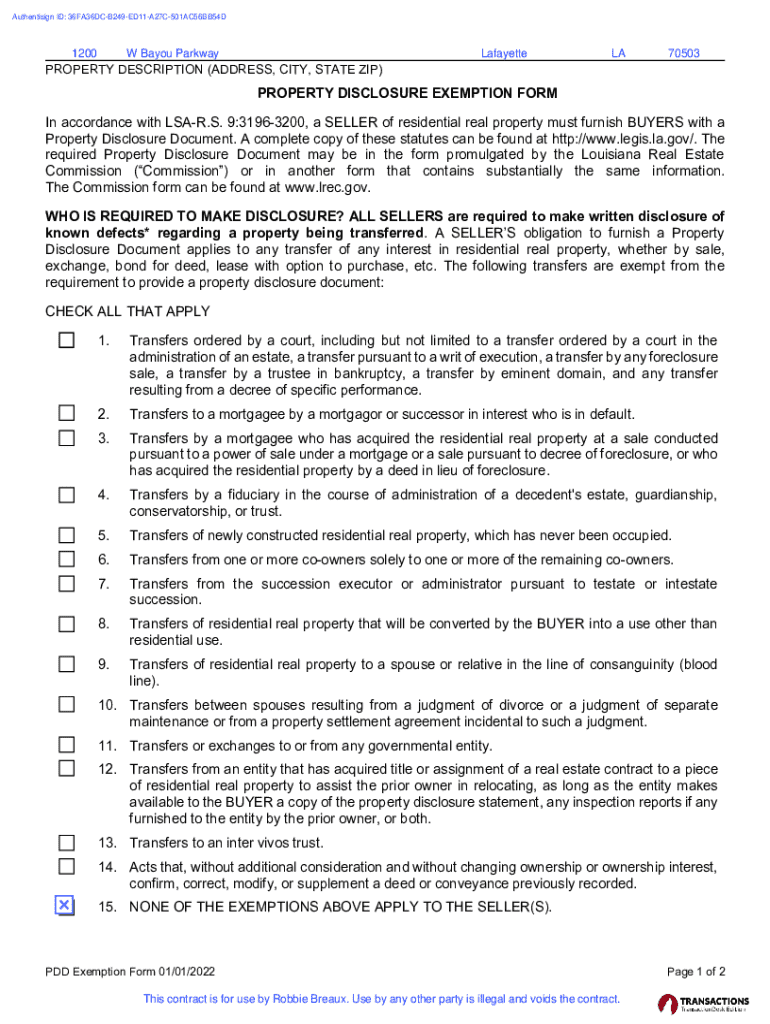

A Property Disclosure Exemption Form is a crucial document in real estate transactions that allows sellers to declare certain exemptions from standard disclosure requirements. Its primary purpose is to inform potential buyers about the seller's obligations to disclose property-related issues. This form facilitates transparent communication between buyers and sellers, serving as a foundation for trust in real estate dealings.

Disclosure is vital in real estate transactions as it protects both parties. Buyers need comprehensive information to make informed decisions, while sellers mitigate risks of future legal disputes. Misrepresentations can lead to significant financial consequences, emphasizing the need for clear documentation like the Property Disclosure Exemption Form.

Key features and benefits

Embracing modern technology, the Property Disclosure Exemption Form offers cloud-based document management systems. This approach enables users to access their documents from any device, providing flexibility and convenience. Irrespective of whether you're at home, in the office, or on the go, important real estate documents are just a click away.

The ease of collaboration is another significant feature. With tools available for seamless PDF editing and eSigning, multiple stakeholders can work on the same document simultaneously. The digital signature benefits eliminate the need for physical paperwork, reducing turnaround time significantly.

When to use the property disclosure exemption form

Specific situations necessitate the use of the Property Disclosure Exemption Form, particularly when selling a property 'as-is.' This means that the property does not need to meet the traditional standards of disclosure regarding issues such as past repairs or ongoing troubles. Different states may also have distinct exemptions, making it essential to be informed about local regulations.

Compliance with local laws is non-negotiable. Real estate agents and sellers must familiarize themselves with their jurisdiction's legal requirements governing disclosures. These laws vary widely across states, impacting when and how the Property Disclosure Exemption Form is utilized.

Step-by-step guide to filling out the form

Filling out the Property Disclosure Exemption Form starts with gathering necessary information, including the seller's identification and property details. It’s vital to provide accurate data that correlates with the exemption categories applicable to your situation.

When you begin filling out the form, focus on several critical sections: Personal Information for capturing seller details, Property Information that describes the property accurately, and Disclosure Statements that contain checkboxes for marking applicable exemptions.

Common pitfalls include incomplete disclosures and incorrectly marked exemptions. Each section of the form should be reviewed meticulously to ensure compliance and completeness.

Editing and managing the form

Managing your Property Disclosure Exemption Form using pdfFiller's tools allows for maximum efficiency. The editing capabilities enable users to add or remove information as necessary and ensure that details remain accurate even after initial completion. Progress saving is essential, particularly for long documents, to prevent data loss.

Organizing forms effectively is key to productivity. Users can benefit from folder management systems and robust search functions to locate documents quickly. Furthermore, collaborative features allow teams to work cohesively, tracking changes and maintaining transparency.

ESignatures and finalizing your submission

ESignatures enhance the efficiency of real estate transactions by ensuring that documents are signed quickly and securely. The use of electronic signatures is legally recognized in all states, providing peace of mind for sellers when finalizing the Property Disclosure Exemption Form.

pdfFiller simplifies the eSigning process. To execute your Property Disclosure Exemption Form with an eSignature, follow these steps: select the document, choose the eSigning option, and either draw, type, or upload your signature. Once signed, the document can be sent or stored as needed.

Frequently asked questions (FAQ)

Understanding the Property Disclosure Exemption Form often brings several misconceptions. A common one is that sellers can wholly avoid disclosure. It’s crucial to clarify that exemptions still require some level of disclosure based on state laws. To ensure compliance, sellers should consult local regulations or a real estate professional.

In disputes involving exemption claims, keeping thorough documentation of all communications and disclosures is essential. This record can support the seller's position should claims arise post-transaction.

Success stories and testimonials

Real-life examples highlight the benefits of using the Property Disclosure Exemption Form. Many sellers have reported smoother transactions and fewer disputes by using this form to declare their exemptions clearly. The clarity it provides has been instrumental in cultivating trust between sellers and buyers.

Customer testimonials underscore the ease of use associated with pdfFiller's tools. Users have praised how intuitive the interface is for completing the form and the convenience of electronic management throughout the sales process.

Get help with your property disclosure exemption form

For those who require assistance while completing the Property Disclosure Exemption Form, reaching out to customer support can provide invaluable help. pdfFiller offers resources like webinars and tutorials designed to guide users through the process smoothly.

Engaging with legal professionals for more complex questions can also ensure you’re making the right decisions. Resources are abundant for personalized guidance when entering the realm of property sales.

Additional considerations

The landscape of property sales is constantly evolving, which is why staying updated on the Property Disclosure Exemption Form and the surrounding regulations is essential. Sellers should actively seek information about any changes that might impact their disclosures to remain fully compliant.

Awareness of real estate regulations not only protects sellers but also contributes to a more transparent market, benefiting buyers as well.

Related documents and forms

In addition to the Property Disclosure Exemption Form, several other forms play vital roles in real estate transactions. Documents such as the Purchase Agreement, Lead-Based Paint Disclosure Form, and Seller's Disclosure Statement complement the Property Disclosure Exemption Form to provide a complete picture to buyers.

Accessing additional pdfFiller templates will assist users in navigating the complexities of selling a property, ensuring that all angles are covered in these significant transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit property disclosure exemption form from Google Drive?

Can I sign the property disclosure exemption form electronically in Chrome?

Can I create an eSignature for the property disclosure exemption form in Gmail?

What is property disclosure exemption form?

Who is required to file property disclosure exemption form?

How to fill out property disclosure exemption form?

What is the purpose of property disclosure exemption form?

What information must be reported on property disclosure exemption form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.