Get the free Flexible Spending Account Reimbursement Request Form

Get, Create, Make and Sign flexible spending account reimbursement

Editing flexible spending account reimbursement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out flexible spending account reimbursement

How to fill out flexible spending account reimbursement

Who needs flexible spending account reimbursement?

Comprehensive Guide to the Flexible Spending Account Reimbursement Form

Understanding flexible spending accounts (FSAs)

Flexible Spending Accounts (FSAs) are pre-tax benefit accounts that allow employees to manage out-of-pocket expenses for eligible healthcare and dependent care costs. By contributing to these accounts, individuals can use pre-tax dollars to cover expenses, effectively reducing their taxable income and enhancing their overall benefit proposition.

There are primarily two types of FSAs: Healthcare FSAs and Dependent Care FSAs. Healthcare FSAs are designed for medical-related expenses such as doctor visits, prescription medications, and certain over-the-counter items. Dependent Care FSAs cover expenses related to childcare, allowing parents to allocate funds for daycare or babysitting services.

The benefits of using an FSA are multifold; individuals experience tax savings, enhanced budget flexibility, and increased access to necessary healthcare services, which collectively contribute to better financial health for families.

Key components of FSA reimbursement

FSA reimbursement allows employees to recoup eligible expenses paid out-of-pocket. Understanding what qualifies for reimbursement is crucial for maximizing the benefits of your FSA. Common eligible expenses include medical expenses, eyecare and dental services, and dependent care costs.

Typically, medical expenses eligible for reimbursement include deductibles, copayments, and prescription drug costs. Eyecare services like eye exams and glasses, as well as dental procedures including cleanings and fillings, also qualify. For dependent care, costs related to childcare while you work can be submitted as well.

It’s also essential to be aware of limits on reimbursement amounts and important deadlines associated with your FSA. Each plan may have its specifics regarding the maximum amount that can be contributed and reimbursed within a plan year.

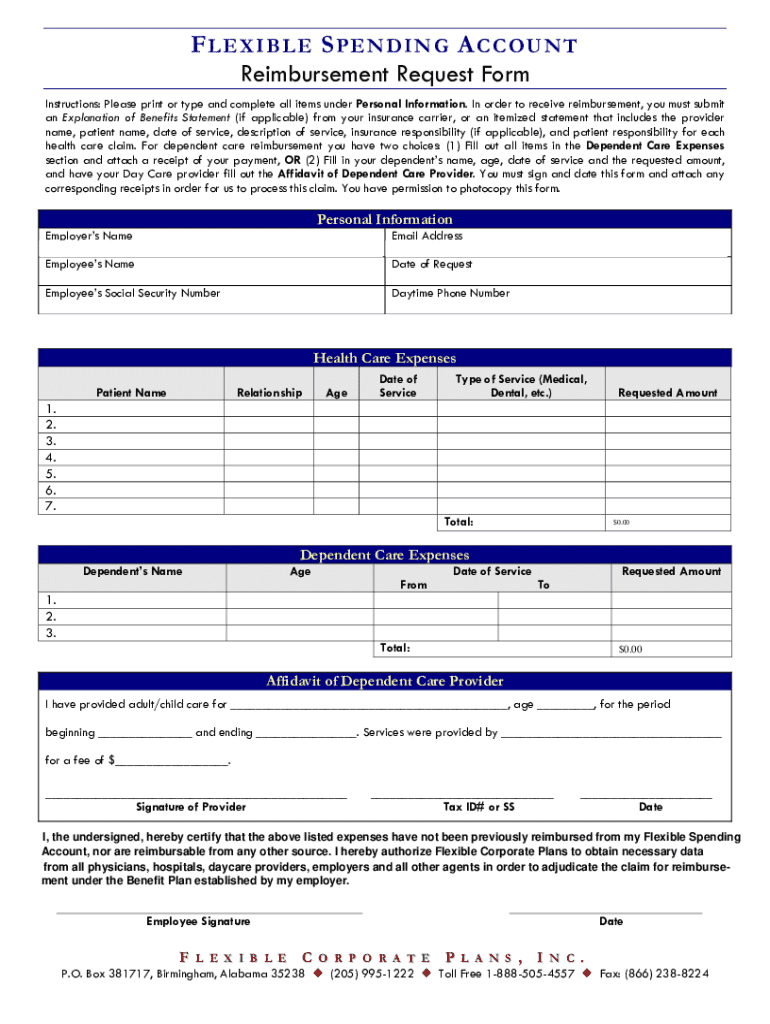

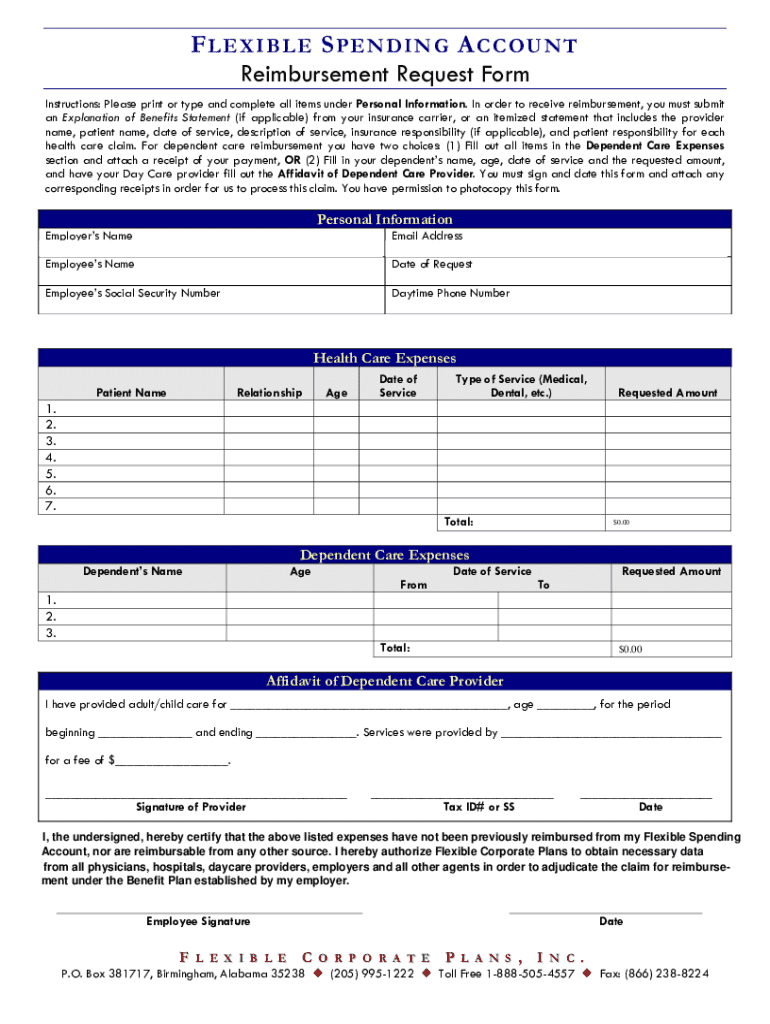

The flexible spending account reimbursement form explained

The FSA reimbursement form is a crucial document for processing your claims. It serves a dual purpose: streamlining the reimbursement process and ensuring that your claims for eligible expenses are correctly submitted and approved.

Essential information required on the form includes personal details like your name and contact information, FSA account information, and documentation proving the incurred expenses. Accurate completion of these fields is vital for a smooth reimbursement experience.

Preparing to fill out the reimbursement form

Before diving into the reimbursement form, gather all necessary documents and receipts. This preparation ensures that you have everything at your fingertips, simplifying the process. Make a checklist of the receipts to verify you have documentation for all your eligible expenses.

Identify what expenses are eligible under your specific FSA. Utilizing tools available on the pdfFiller platform can assist in tracking what qualifies and manage your documents effectively.

To organize your expenses for submission, consider categorizing your receipts by type (medical, eyecare, dental, dependent care) and ensuring your documentation aligns with what is allowed. Understanding claims submission limits specific to your plan year will also help avoid any potential issues.

Step-by-step guide to completing the FSA reimbursement form

Completing the reimbursement form can be daunting, but by following a structured approach, you can simplify the task. Here’s a step-by-step guide:

Interactive tools for efficient form completion

Using fsA reimbursement related forms has never been easier, especially with innovative platforms like pdfFiller. These tools provide features that simplify the process from filling to submission.

With pdfFiller, you can utilize document editing features to customize your FSA form as needed. eSigning options make your submissions faster and more secure.

Collaboration tools allow teams to manage their documentation collectively, tracking changes and updates in real time. Moreover, accessing templates specific to reimbursement forms ensures you always have the most up-to-date versions.

Common mistakes and how to avoid them

Navigating the FSA reimbursement process can sometimes lead to errors that delay or hinder claims. Being aware of these common pitfalls can save you time and frustration.

Tracking your reimbursement request

Once your reimbursement request has been submitted, knowing how to track its progress is essential. Most FSA providers have a processing timeline that indicates how long it typically takes to process claims.

You can often check the status of your claim through your FSA provider's online portal. If delays occur, be proactive; contact customer service for guidance and to ensure your claim is being processed correctly.

Solutions for lost reimbursement checks

A lost reimbursement check can be frustrating, but there are steps you can take to resolve the issue. Firstly, if you suspect your check is missing, retrace your steps to ensure it wasn’t misplaced.

Filing a lost check claim typically involves contacting your FSA provider to report the issue and follow their specific instructions. Utilizing pdfFiller can help in documenting the incident correctly to expedite the process.

Additional support and FAQs

Navigating the nuances of FSA reimbursement might prompt questions that need answering. Ensuring you have reliable support for your reimbursement queries is essential for a seamless experience.

Many FSA providers offer FAQs on their websites and dedicated customer service lines for assistance. Some of the commonly asked questions include: Can an FSA carry over unused funds? and How should I handle FSA funds after changing jobs?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my flexible spending account reimbursement directly from Gmail?

How can I modify flexible spending account reimbursement without leaving Google Drive?

How do I execute flexible spending account reimbursement online?

What is flexible spending account reimbursement?

Who is required to file flexible spending account reimbursement?

How to fill out flexible spending account reimbursement?

What is the purpose of flexible spending account reimbursement?

What information must be reported on flexible spending account reimbursement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.