Get the free Confidential Charge Account Application

Get, Create, Make and Sign confidential charge account application

How to edit confidential charge account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confidential charge account application

How to fill out confidential charge account application

Who needs confidential charge account application?

Comprehensive Guide to the Confidential Charge Account Application Form

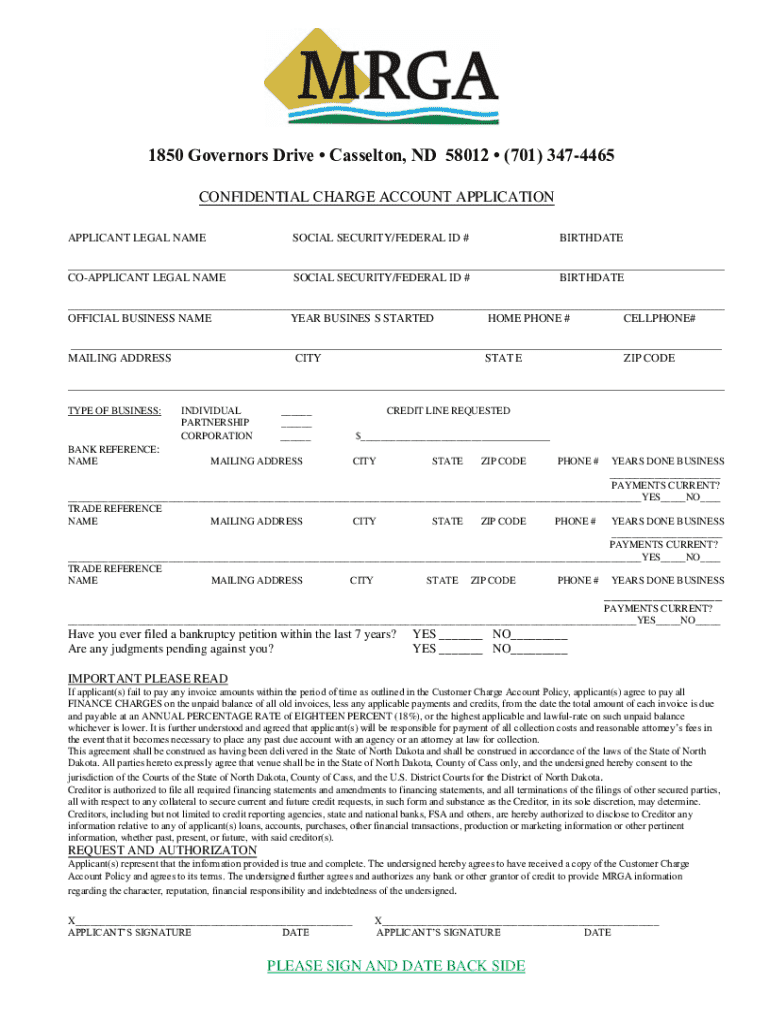

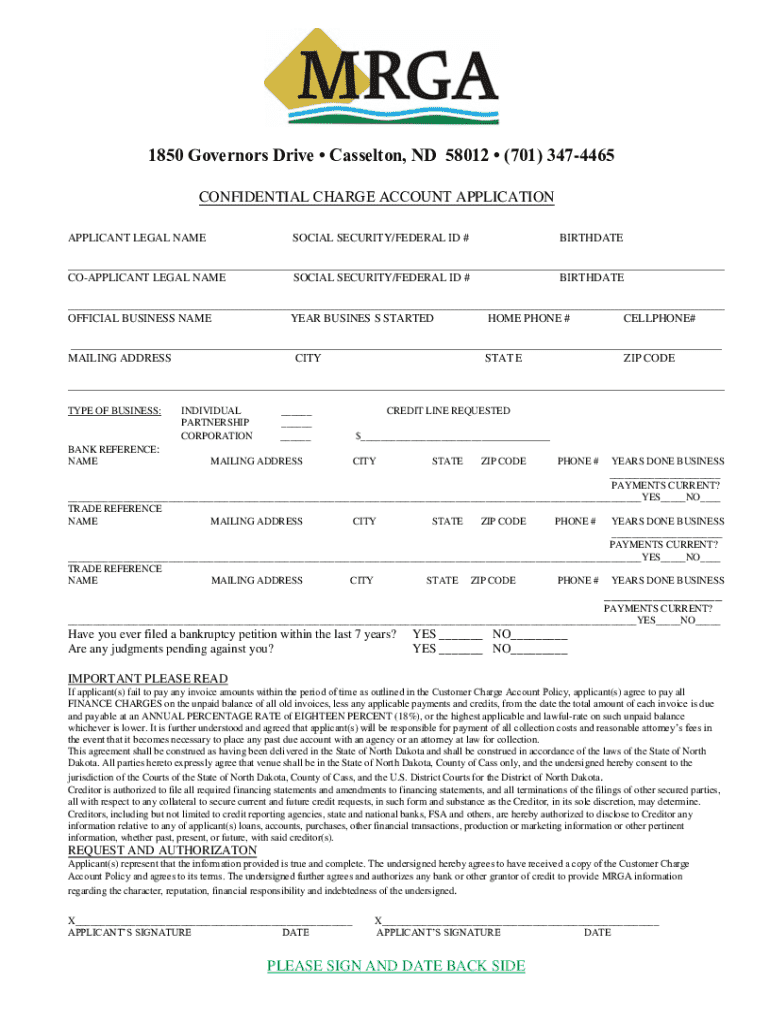

Understanding the confidential charge account application form

A confidential charge account is a specialized credit account that allows customers to make purchases on credit without publicly linking them to their identity or financial status. This form of account is particularly appealing for those who wish to maintain privacy during transactions. Harsh competition among retailers and financial institutions has made safeguarding customer information critical, which is where the confidential charge account application form comes into play.

The significance of confidentiality cannot be overstated in charge account applications. By ensuring sensitive information is protected, businesses enhance customer trust, encouraging more people to apply. A well-structured application form includes sections specifically designated to collect various types of necessary information, while simultaneously assuring applicants that their data will be treated with the highest level of confidentiality.

Benefits of using a confidential charge account application form

Utilizing a confidential charge account application form comes with numerous advantages that significantly enhance the application experience for both businesses and customers. One profound benefit is a streamlined approval process. By effectively collecting the necessary information, businesses can process applications more rapidly than traditional methods, allowing for quicker access to credit options.

Additionally, confidentiality plays a key role in ensuring enhanced security for sensitive information. With robust mechanisms in place, customers can trust that their data is secure against potential breaches. Improved customer trust and satisfaction also result from the knowledge that their financial privacy is paramount, leading to increased loyalty and repeat applications.

How to fill out a confidential charge account application form

Filling out a confidential charge account application form accurately is crucial for a successful application. Here, we provide a step-by-step guide to help you navigate through the process.

Tips for completing the application accurately

Completing your application accurately is essential in avoiding delays and dissatisfaction. Numerous mistakes can occur during this process, and identifying these common pitfalls can save you time and effort. One common mistake is providing incorrect personal details, which can lead to application denial.

Best practices include reading each section carefully, verifying that your information matches supporting documents, and seeking clarification on any parts you do not understand. Emphasizing accuracy and honesty in providing your financial details strengthens your application and establishes credibility with the lender.

Where to find a confidential charge account application form

Finding a reliable confidential charge account application form is easier than ever with digital solutions. pdfFiller offers a seamless experience for accessing and editing forms through its platform. Users can download the confidential charge account application form directly from pdfFiller’s extensive library.

In addition to downloading forms, pdfFiller provides interactive tools for editing and customizing documents to meet individual needs. For those seeking versatile templates, there are options available for various purposes, ensuring you always have the most relevant and compliant forms at your fingertips.

Managing your charge account after submission

Once you have submitted your confidential charge account application form, understanding the approval process becomes essential. Generally, the application will undergo review to verify the provided information. Depending on the institution, this process can take anywhere from a few days to a couple of weeks.

After submission, applicants should be prepared for follow-up communication, which may include requests for additional documentation or clarification. Keeping track of your application status may require checking in with the institution periodically, which can usually be accomplished through their website or customer service channels.

Frequently asked questions (FAQs)

Addressing common queries regarding the confidential charge account application form is crucial for prospective applicants. Here are some frequently asked questions that can help clarify the process:

Legal considerations surrounding charge account applications

When dealing with charge account applications, understanding the legal landscape is crucial. Regulations surrounding confidentiality ensure that personal data is handled responsibly and in compliance with applicable laws. Compliance is particularly important to protect against data breaches and unauthorized access to sensitive customer information.

Moreover, it’s essential for applicants to be aware of credit reporting guidelines and the necessity of providing consent for their data to be shared with third parties. This knowledge helps in formulating a comprehensive view of your rights as an applicant and the responsibilities of the institution managing your charge account.

Related documentation and forms

The realm of charge accounts includes various forms and documentation, offering valuable options for different financial situations. While the confidential charge account application form serves a distinct purpose, comparing it with other charge account variants can offer insights into their respective advantages.

Supplemental forms, such as consent forms, may also be significant in establishing permissions for data usage. Links to other relevant templates and resources can assist applicants in navigating their options efficiently, ensuring a smoother financial experience.

Optimizing your use of the confidential charge account application form

Utilizing pdfFiller enhances the management of your confidential charge account application form significantly. The platform provides users with a robust suite of tools for document management, enabling efficient edits, eSignatures, and collaboration all through a single, cloud-based solution.

Engaging with pdfFiller’s interactive features allows applicants to enjoy a seamless processing experience. Users can save their progress, adjust fields as needed, and receive real-time support, ensuring that their applications are well-prepared for submission.

Staying informed: Updates and changes

Considering the evolving nature of charge accounts, staying informed about updates and changes in procedures is essential. Signing up for subscription options can provide users with the latest insights and notifications, allowing them to stay ahead of developments in the financial sector.

Resources for ongoing education on financial responsibilities further equip individuals and teams to manage their credit effectively, making a significant difference in their financial well-being.

Testimonials and success stories

User experiences with the confidential charge account application form paved the way for many success stories. Case studies illustrate how applicants have leveraged the ease of use provided by pdfFiller’s tools and templates to streamline their applications.

These testimonials not only reflect satisfaction with the application process but also the accessibility of resources offered by pdfFiller that contribute to successful financial outcomes.

Alternative solutions to consider

Exploring alternative forms of credit applications can provide essential insights into your financial options. While confidential charge accounts offer unique benefits, evaluating line of credit alternatives may expand your choices and lead to enhanced financial flexibility.

Residential and commercial options exist, allowing applicants to tailor their financial strategies to specific needs and preferences. Assessing the advantages of various account types can lead to more informed personal finance decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify confidential charge account application without leaving Google Drive?

How do I complete confidential charge account application online?

How do I edit confidential charge account application on an iOS device?

What is confidential charge account application?

Who is required to file confidential charge account application?

How to fill out confidential charge account application?

What is the purpose of confidential charge account application?

What information must be reported on confidential charge account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.