Get the free Business Tangible Property Return

Get, Create, Make and Sign business tangible property return

Editing business tangible property return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tangible property return

How to fill out business tangible property return

Who needs business tangible property return?

Your Comprehensive Guide to the Business Tangible Property Return Form

Overview of business tangible property tax

Business tangible property tax refers to taxes levied on physical assets owned by businesses, including equipment, machinery, and furniture. This type of tax is crucial for local governments, providing them with necessary funding for public services like education and infrastructure.

Filing a tangible property return is mandatory for asset assessment purposes. This ensures that businesses contribute fairly based on the value of their physical assets. However, many business owners are unaware of the nuances involved, leading to misunderstandings and potential penalties.

Eligibility and requirements for filing

Organizations that possess tangible assets must file a tangible property return. This includes businesses across various sectors—from retail to manufacturing. However, there are exceptions; for instance, small businesses with minimal asset value may qualify for exemptions, depending on the jurisdiction.

Key deadlines for filing may vary based on location, but businesses typically have a designated time frame post-end of the fiscal year. Late filings could incur penalties, emphasizing the need for timely submissions. Understanding the deadlines and specific requirements within your city or state is vital.

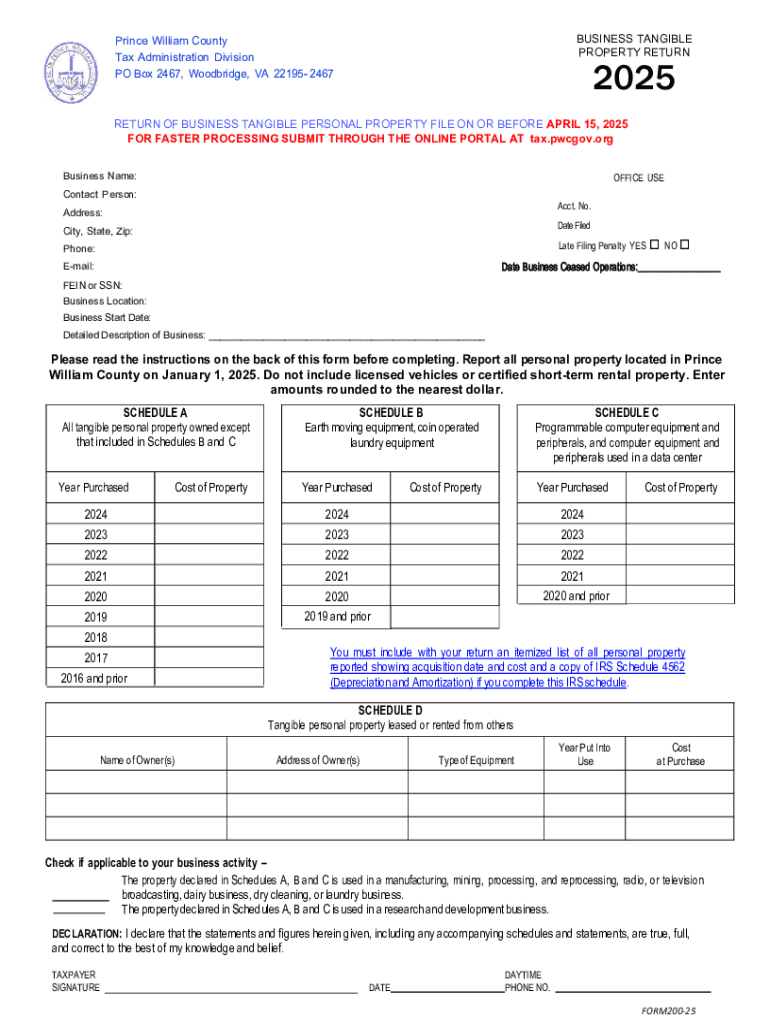

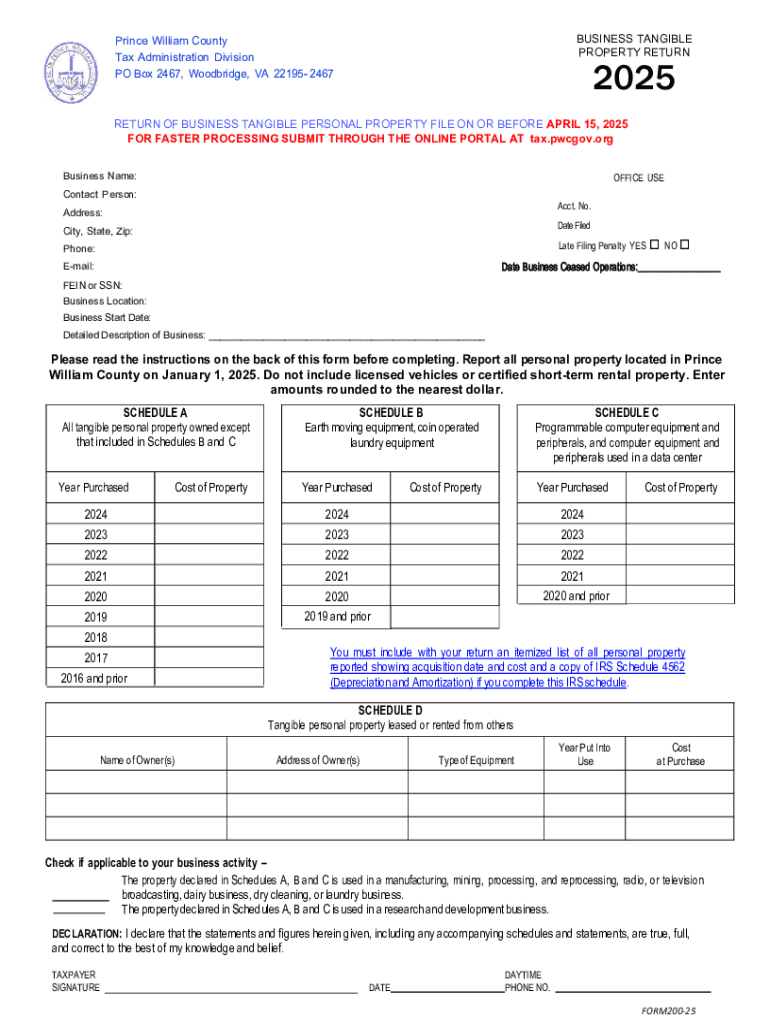

Understanding the business tangible property return form

The business tangible property return form is a structured document designed to gather information about a business’s tangible assets. Depending on your state or locality, the specific forms may vary, and it’s crucial to choose the correct one. Forms usually include sections for reporting asset types, valuations, and other relevant business details.

Each segment within the form has specific requirements, from general information about the business to a detailed breakdown of each asset's valuation. Understanding these sections’ nuances can significantly ease the filing process, ensuring no critical information is overlooked.

Completing the business tangible property return form

Filling out the tangible property return form accurately is essential for proper tax assessment. Start by gathering all pertinent information, such as business identification details and a comprehensive inventory of your assets. This could include items like computers, office furniture, and industrial machines.

Next, fill each section methodically, starting from the basics and moving towards asset details. Each line of the form requires attention to ensure accuracy. Common mistakes include misclassifying assets or providing outdated valuations, which can lead to audits or penalties.

Depreciation and valuation of tangible property

Understanding depreciation is fundamental when filing the business tangible property return. Two main methods commonly used are straight-line and declining balance. Straight-line depreciation spreads the cost of an asset evenly over its useful life, while declining balance offers greater deductions in the initial years of an asset’s life.

The tax basis for various property types may differ, affecting how businesses report these assets. For instance, vehicles might require specific reporting methods compared to machinery due to their different depreciation rates or specialized deductions.

Special considerations in filing

When filling out your return, special consideration is needed for fully depreciated assets or those claimed as business expenses on IRS filings. These may not need reporting as they do not hold tax value anymore, thus reducing reportable assets.

Moreover, leased property needs specific reporting; ensure you differentiate between leased and owned items. Vehicles used in operations also warrant special attention, particularly in how expenses may impact their valuation on tax filings.

Submitting the form

Proper submission of the business tangible property return form is vital. Be aware of where to file your return, as this varies by locality. Many jurisdictions now offer electronic filing options, which can expedite the submission process compared to traditional paper filing.

Once filed, it is prudent to seek confirmation of receipt. Engaging with local revenue departments post-submission can help clarify any questions regarding your filing or next steps.

Managing business tangible property taxes

Understanding tax rates and payment options is essential for effective tax management. Rates can differ between localities, impacting overall business operation costs. Timely payments are crucial, as penalties for late payments can accumulate rapidly, adding financial strain to your business.

Consider exploring tax relief options or exemptions available within your jurisdiction. Depending on local laws, certain businesses may qualify for partial exemptions, reducing tax burdens significantly.

Resources for assistance

Navigating business tangible property tax can be complex, and having access to resources is beneficial. Many websites provide common questions and answers about filing and managing property taxes. Additionally, tax assistance hotlines may offer direct support for your queries.

It's advantageous to interact with local tax authorities directly for specific inquiries. They can provide targeted information, ensuring your business meets compliance requirements effectively.

Additional tools and features on pdfFiller

pdfFiller provides several interactive features to make the process of creating and managing your business tangible property return form more efficient. With editing tools, you can seamlessly modify your document to ensure all information is current and accurate.

Collaboration features allow you to share the form with team members for review and signatures, enhancing your document’s accuracy and completeness before final submission.

Stay informed and updated

Staying informed about changes in tax laws and regulations is essential for businesses. Subscribing to updates from tax authorities or participating in tax-related webinars can provide valuable insights into best practices and compliance.

Regular engagement with such resources ensures your business adapts to any regulatory shifts, maintaining compliance and avoiding penalties associated with ignorance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business tangible property return from Google Drive?

How do I edit business tangible property return in Chrome?

How can I edit business tangible property return on a smartphone?

What is business tangible property return?

Who is required to file business tangible property return?

How to fill out business tangible property return?

What is the purpose of business tangible property return?

What information must be reported on business tangible property return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.