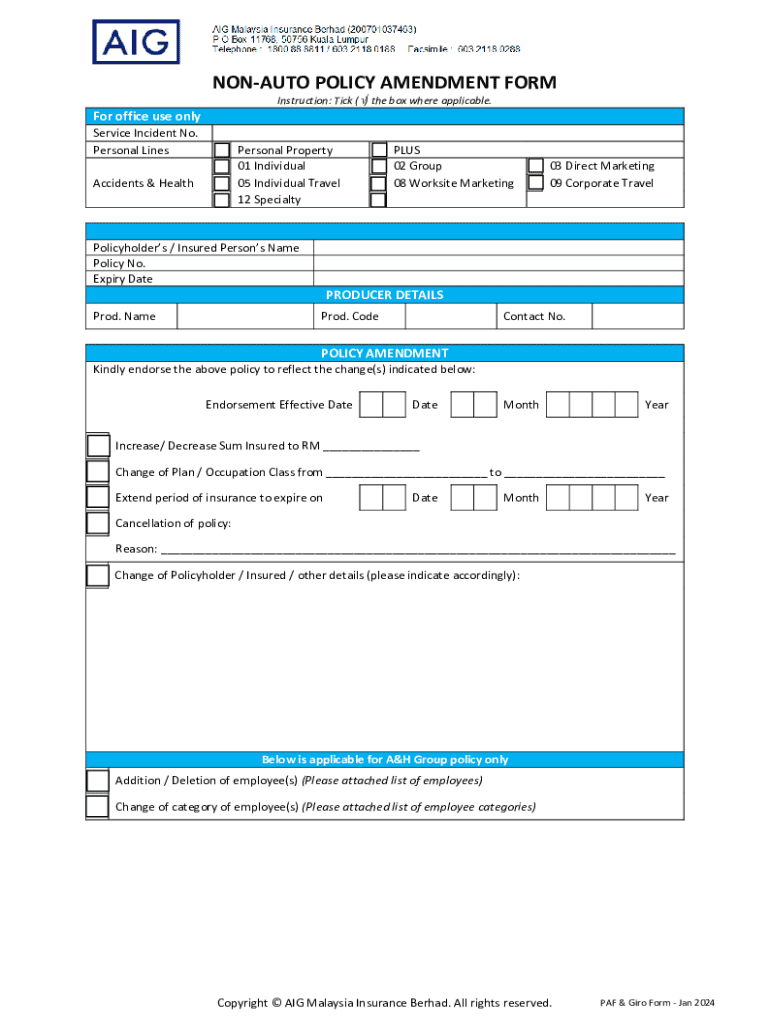

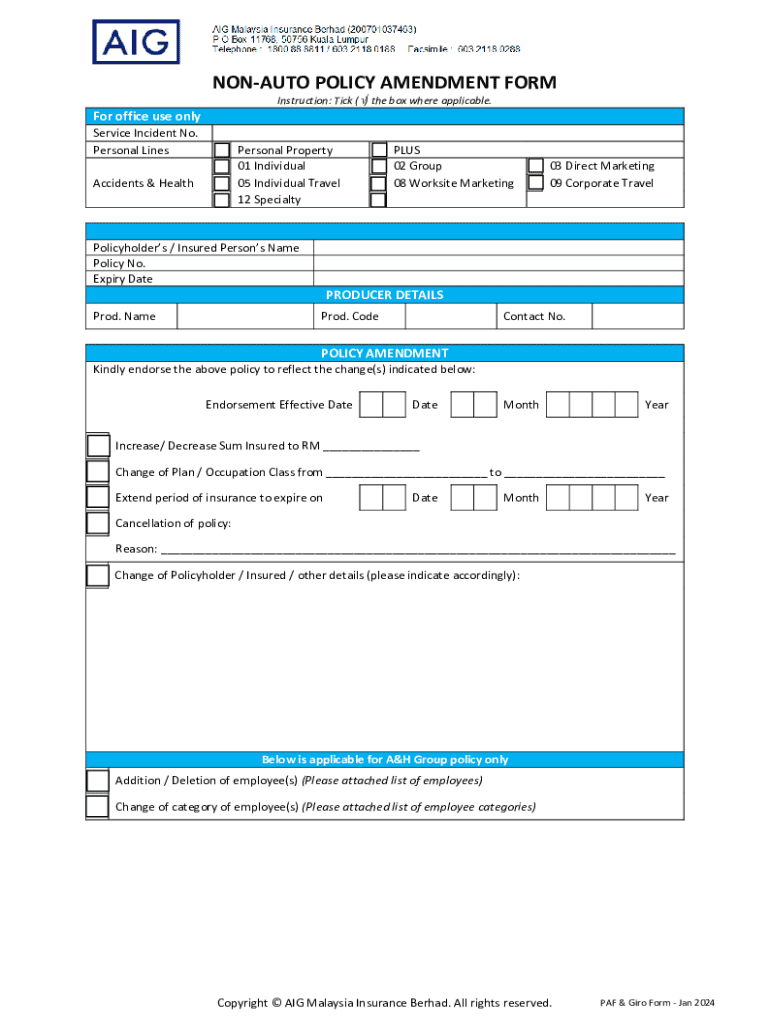

Get the free Non-auto Policy Amendment Form

Get, Create, Make and Sign non-auto policy amendment form

Editing non-auto policy amendment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-auto policy amendment form

How to fill out non-auto policy amendment form

Who needs non-auto policy amendment form?

Non-auto policy amendment form: A comprehensive how-to guide

Overview of non-auto policy amendments

Non-auto policy amendments serve to modify existing insurance policies that are not related to vehicles. They can encompass various changes, enhancing coverage, or adjusting terms based on an individual's circumstances. This flexibility is essential in ensuring that the policy remains relevant and meets the needs of the policyholder.

Properly completing a non-auto policy amendment form is crucial. Incomplete or incorrect forms can lead to processing delays or even rejections, which may leave policyholders exposed to risks they intend to mitigate. Understanding how to navigate the amendment process can save time and ensure your coverage aligns with your current situation.

One key distinction between non-auto amendments and auto policy amendments is the nature of the policies themselves. Non-auto amendments often deal with homeowner's insurance, renters insurance, or life insurance, whereas auto policy amendments pertain specifically to vehicles. This crucial difference requires separate considerations during the amendment process.

Understanding the types of non-auto policy amendments

Non-auto policy amendments can vary widely depending on the policyholder's needs and the insurance product involved. Understanding the different types of amendments can help you determine what specific changes you might need to address.

Preparing to fill out the non-auto policy amendment form

Before diving into the non-auto policy amendment form, it’s wise to gather all necessary documentation. Proper preparation can streamline the process and reduce errors.

It's also beneficial to have clear details outlined regarding the change you want to initiate. This preparation not only speeds up the form completion process but also minimizes the likelihood of errors.

Step-by-step instructions for completing the form

Completing the non-auto policy amendment form may seem daunting, but breaking it down into manageable steps can help clarify the process.

Submitting the non-auto policy amendment form

Once you have completed your non-auto policy amendment form, the next crucial step is submitting it correctly to ensure a swift process.

Submitting your form through the correct channels strengthens your insurance policy and can expedite the processing time significantly.

Tracking the status of your amendment request

It's essential to keep track of your amendment request after submission to ensure it is being processed. Knowing where your request stands can provide peace of mind.

Frequently asked questions (faqs)

In the realm of non-auto policy amendments, several common inquiries emerge. Addressing these can prevent confusion and enhance the overall experience.

Troubleshooting common issues

While filling out the non-auto policy amendment form through [pdfFiller], encountering issues can happen. Knowing how to troubleshoot can save time and frustration.

Handling issues swiftly not only aids in expedient resolution but also enhances your confidence in managing your non-auto policy effectively.

Leveraging pdfFiller for document management

Using [pdfFiller] offers various features that can aid in the management of non-auto policy amendments. From document storage to eSigning capabilities, a comprehensive solution awaits users.

By taking advantage of these features, users can ensure their non-auto policy amendment process is both straightforward and effective.

Conclusion

Non-auto policy amendment forms are critical tools for adapting insurance policies to evolving personal circumstances. By understanding the process, documenting necessary information, and utilizing platforms like [pdfFiller], you can ensure a smooth experience.

Ultimately, staying proactive with amendments helps mitigate risks and keeps you adequately covered as your life changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my non-auto policy amendment form in Gmail?

How do I edit non-auto policy amendment form straight from my smartphone?

How do I complete non-auto policy amendment form on an Android device?

What is non-auto policy amendment form?

Who is required to file non-auto policy amendment form?

How to fill out non-auto policy amendment form?

What is the purpose of non-auto policy amendment form?

What information must be reported on non-auto policy amendment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.