Get the free Non Resident Alien Notification Form

Get, Create, Make and Sign non resident alien notification

Editing non resident alien notification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non resident alien notification

How to fill out non resident alien notification

Who needs non resident alien notification?

Comprehensive Guide to the Nonresident Alien Notification Form

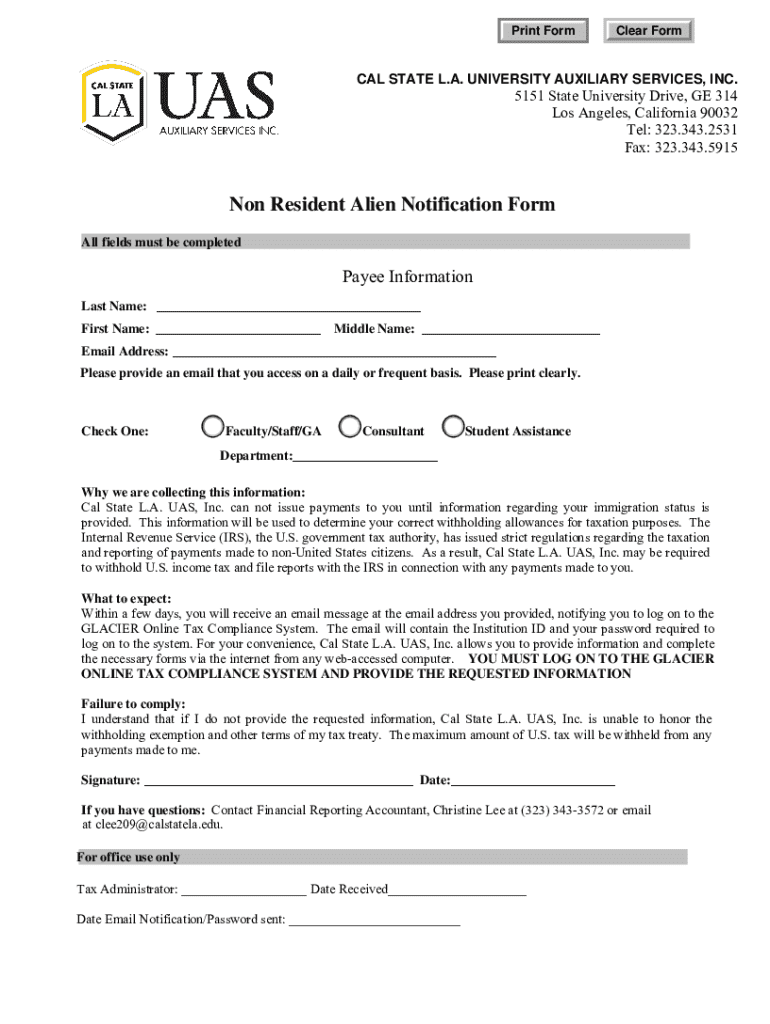

Overview of nonresident alien notification form

The Nonresident Alien Notification Form is crucial for individuals and businesses that engage with nonresident aliens (NRAs) in the United States. Defining a Nonresident Alien, these are individuals who are not U.S. citizens and do not meet the requirements to be considered residents for tax purposes. The purpose of the Nonresident Alien Notification Form, therefore, is to aid in tax compliance by accurately reporting income and withholding taxes. This form becomes essential for businesses paying foreign individuals or entities, ensuring adherence to IRS regulations and avoiding potential penalties.

Moreover, compliance with this form is not just a legal obligation but also vital for maintaining proper tax reporting practices. For NRAs, filling out this form accurately can significantly influence their tax liability and aid in claiming benefits and exemptions as defined by IRS guidelines.

Understanding the nonresident alien status

Determining who qualifies as a nonresident alien is essential, primarily based on the IRS residency tests for tax purposes. Generally, if an individual is neither a U.S. citizen nor meets the 'Substantial Presence Test' or the 'Green Card Test', they are classified as an NRA. The Substantial Presence Test considers the number of days an individual is present in the U.S. over a three-year period, while the Green Card Test evaluates whether the individual holds lawful permanent resident status.

Being classified as an NRA has significant implications for tax liabilities. Nonresident aliens are often taxed solely on their U.S.-source income at a fixed withholding rate, which is generally 30%. However, this rate can be reduced if there are applicable tax treaties between the U.S. and the individual’s home country. Understanding this status ensures NRAs can make informed decisions about their tax obligations.

Types of forms for nonresident aliens

There are several IRS forms that NRAs should be aware of when dealing with U.S. taxation. Each form serves a different purpose, catering to various scenarios that nonresident aliens may encounter in their financial dealings.

Filling out the nonresident alien notification form

Completing the Nonresident Alien Notification Form, specifically Form W-8BEN, requires meticulous attention to detail. Here’s a step-by-step breakdown of the form:

Common pitfalls include failing to provide a tax identification number, neglecting treaty benefits claims, or not signing the form. Ensure that special circumstances, such as being an international student or scholar, are properly indicated to avoid complications.

Submission and filing process

After completing the form, understanding where to submit the Nonresident Alien Notification Form is vital. For individuals, the form should be presented to the withholding agent or financial institution, while businesses might handle submissions differently based on their structure and practices. Always check the provided instructions to ensure proper handling.

Generally, there’s no specific filing deadline for submitting Form W-8BEN, but it's advisable to submit it before the first payment is made to avoid withholding issues. Processing times may vary, and having timely submissions is critical in avoiding complications. Businesses should establish a clear protocol for obtaining and filing these forms to maintain compliance and avoid unnecessary delays.

Managing and storing your nonresident alien documents

Proper document management practices for Nonresident Alien forms can streamline compliance efforts. It’s advisable to keep copies of all submitted forms, as well as any correspondence related to them. Using a digital solution like pdfFiller can significantly enhance your efficiency. This platform allows users to edit, eSign, and securely store their forms in a cloud-based environment, making retrieval convenient.

Furthermore, for teams working on nonresident alien documentation, utilizing collaborative tools within pdfFiller enables seamless tracking, editing, and sharing of forms. This can help mitigate errors and promote a smoother workflow, especially in environments where multiple stakeholders are involved.

Tax withholding guidance for nonresident aliens

Understanding tax withholding requirements is critical for nonresident aliens. Typically, income paid to NRAs is subject to a 30% withholding tax unless reduced by a tax treaty. The specific income types—like dividends, interest, and other payments—come with varying withholding rules. For instance, effectively connected income (ECI) will be taxed based on the graduated rates under the U.S. income tax system.

To manage withholdings correctly, NRAs and their U.S. payers must keep track of all sources of income and the corresponding withholding tax rates. In cases where too much tax has been withheld, the procedures to claim refunds typically involve filing a U.S. tax return. Therefore, understanding which forms to use and how to navigate the refund process can save NRAs from unnecessary financial strain.

Navigating challenges with nonresident alien tax forms

Many nonresident aliens face challenges related to IRS forms, especially during tax season. Common issues may include not receiving proper guidance on completing forms, misidentifying their tax residency status, or misunderstanding tax treaty benefits. Providing comprehensive resources linked to these forms and IRS guidelines can help NRAs navigate their obligations more effectively.

Additionally, access to legal or tax advice is invaluable for NRAs dealing with complex situations. It’s crucial for individuals to remain updated on changing regulations that may affect their tax implications, as tax laws and IRS practices are subject to revision. Partnering with reliable tax professionals or using interactive tools available on pdfFiller can enhance understanding and ensure compliance.

Useful tools and resources

Utilizing interactive tools available on pdfFiller can significantly ease the management of forms associated with nonresident aliens. Users can easily edit, eSign, and store forms, enhancing accessibility and compliance. Furthermore, linking to official IRS resources dedicated to nonresident aliens offers critical information, including updates on regulations and policies.

Supplemental guides that clarify common nonresident alien scenarios—such as tax obligations for students or independent contractors—can be invaluable. These resources empower individuals and teams with the knowledge required to manage their nonresident alien documentation efficiently.

FAQs about nonresident alien notifications

Clarifying frequently asked questions about the Nonresident Alien Notification Form can demystify its usage. For instance, many NRAs may wonder about the necessity of the form if they don’t owe taxes. The answer lies in the fact that even NRAs with no U.S. tax liability might still need to submit corresponding forms to establish their nonresident status.

Moreover, misconceptions often arise regarding tax treaty benefits and their applicability. NRAs should be informed about the specific provisions of treaties between the U.S. and their home country. Each scenario could have different implications, and providing clear guidance can alleviate confusion among NRAs navigating these unique situations.

Conclusion

The Nonresident Alien Notification Form is a vital document for individuals and entities engaging with nonresident aliens in the U.S. Thorough comprehension of each section of the form, the submission process, and the associated tax obligations simplifies compliance efforts. Utilizing tools like pdfFiller not only streamlines the management of these forms but also ensures compliance through accustomed solutions tailored to these requirements.

In striving for efficiency and accuracy, leveraging a comprehensive document management solution allows users to focus on their core activities while maintaining compliance with U.S. tax regulations related to nonresident aliens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non resident alien notification directly from Gmail?

How can I send non resident alien notification to be eSigned by others?

How can I get non resident alien notification?

What is non resident alien notification?

Who is required to file non resident alien notification?

How to fill out non resident alien notification?

What is the purpose of non resident alien notification?

What information must be reported on non resident alien notification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.