Get the free Application for Individual Life Insurance

Get, Create, Make and Sign application for individual life

How to edit application for individual life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for individual life

How to fill out application for individual life

Who needs application for individual life?

Application for Individual Life Form: A Comprehensive Guide

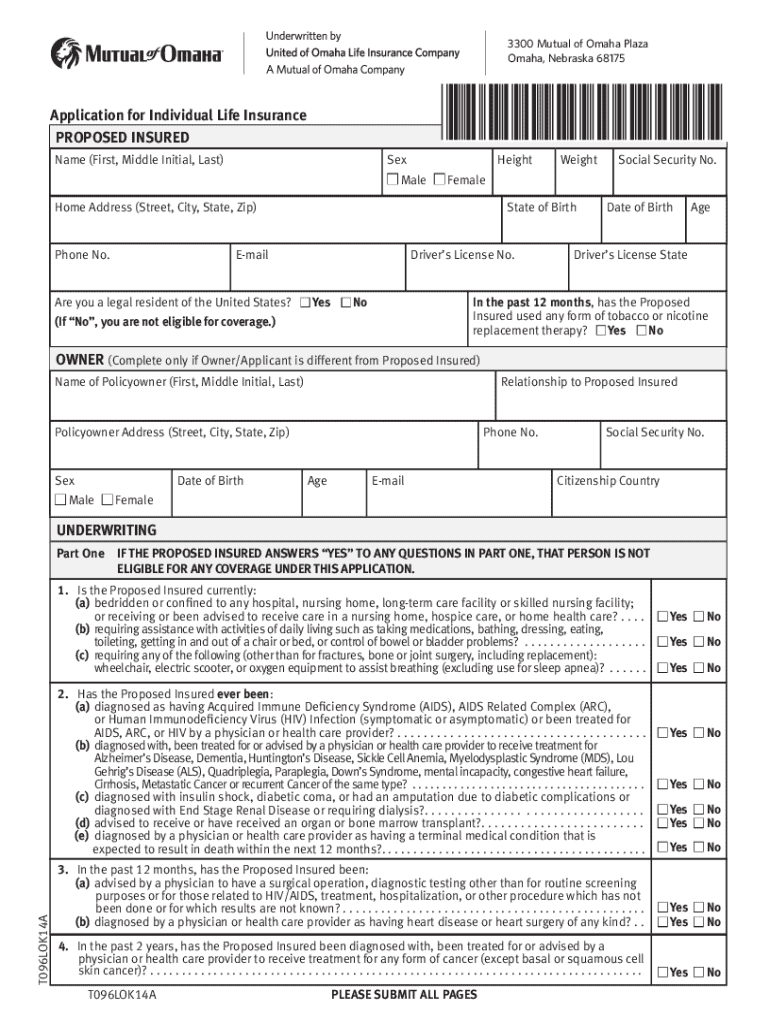

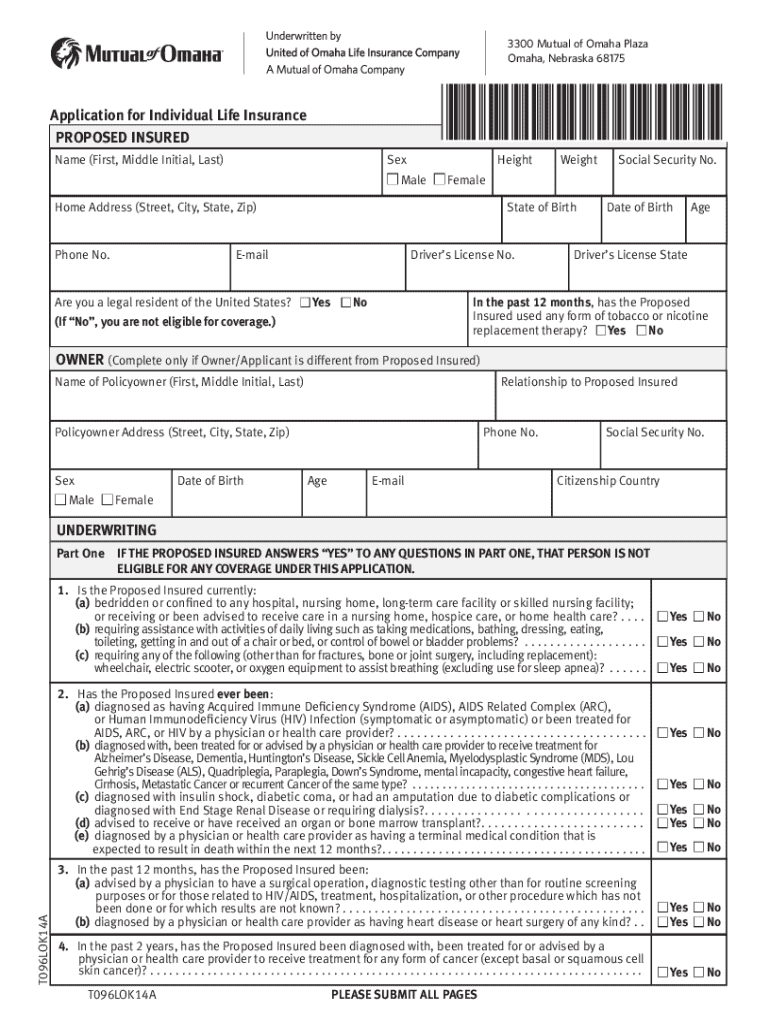

Understanding Individual Life Insurance Applications

Individual life insurance is a contract between an individual and an insurer that provides financial protection to the policyholder's beneficiaries upon their death. This insurance is crucial for ensuring financial security for loved ones, covering expenses like debts, funeral costs, and living expenses after the policyholder's passing. Thus, the application for individual life form becomes the first critical step towards securing this financial safety net.

Submitting a proper application is vital. Insurers assess this information to determine the risk of insuring an individual and the appropriate premium to charge. Different types of individual life insurance policies cater to various needs. Understanding these can help applicants choose the right one.

Key Components of the Individual Life Insurance Application

When filling out the application for individual life form, accuracy is essential. Start with personal information, which lays the foundation for the application. Insurers rely on this data to identify the applicant and assess risk.

Health information follows, which typically includes medical history, current health status, and family medical history. This section is crucial as it helps insurers evaluate potential health risks associated with the applicant. Lifestyle information plays a pivotal role in influencing premiums as well. Hence, be honest regarding occupation, hobbies, and habits like smoking or drinking.

Detailed Steps for Completing the Application

Completing the application for individual life form involves several critical steps that can facilitate a smooth process. Start by gathering necessary documents such as your ID, medical records, and other pertinent information. This not only saves time but also ensures accuracy. Carefully fill out personal and health information, paying attention to detail to avoid errors.

Once you have completed the application, take the time to review and confirm the accuracy of all details. This review is crucial to prevent misrepresentation or omitting vital information. Finally, submit the application through the prescribed channels provided by the insurer.

Be mindful of common mistakes. Inaccurate information can lead to delays or denials in approval. Omissions can also cause complications, so ensure you answer every question and clarify if you’re unsure. Misunderstanding questions can cause you to provide information that doesn’t reflect your true circumstances; therefore, don’t hesitate to reach out to the insurer for clarification.

After Submission: What to Expect

Once you submit the application for individual life form, the underwriting process begins. Underwriting is the evaluation process insurers use to determine risk and set the premium pricing. Insurers consider various factors such as age, health, lifestyle, and the amount of coverage requested.

Applicants can expect a typical timeline for approval, which may vary depending on specific circumstances. On average, the approval process can take anywhere from a few days to several weeks. Factors affecting this timeline include the complexity of the application and the need for additional medical evaluations.

Managing Your Individual Life Insurance Policy

Once your application is approved, it is crucial to understand your policy document. This document is the cornerstone of your coverage, detailing the type of policy, coverage amounts, and any exclusions. Familiarize yourself with key terms and conditions to effectively manage your policy.

Making changes to your application or policy can also be necessary as life circumstances evolve. This can include modifications to coverage amounts or updating beneficiary information. Knowing how to navigate these changes is vital.

Interactive tools for insurance applicants

Navigating the application for individual life form can be made easier with various online tools. Online calculators can help assess your life insurance needs based on factors like age, dependents, and financial obligations. These tools allow you to estimate the appropriate coverage amount you should apply for.

Additionally, comparison tools can assist you in evaluating different policy types so you can make an informed decision tailored to your specific needs. Document organization templates are also available to streamline the paperwork process and keep essential information at your fingertips.

Closing thought: Empower your documentation process with pdfFiller

pdfFiller simplifies the entire documentation process for individuals seeking life insurance. Their cloud-based solutions allow seamless editing of PDFs, signing, and collaboration, all in one platform. This makes the document handling aspect of your insurance application much more accessible.

Utilizing pdfFiller not only streamlines your insurance applications but also extends to broader document management needs. By leveraging this platform, you can ensure your forms are filled out correctly, submitted on time, and safely stored for future reference.

Frequently Asked Questions (FAQs)

Understanding the application for individual life form can raise various questions, especially for first-time applicants. Common queries often revolve around eligibility, documentation requirements, and the overall process of applying for life insurance.

Many applicants seek clarity regarding policy management and the ability to make changes post-application. Addressing these concerns can empower applicants to pursue their insurance needs confidently, ensuring that their loved ones are protected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find application for individual life?

How do I make changes in application for individual life?

How do I fill out application for individual life on an Android device?

What is application for individual life?

Who is required to file application for individual life?

How to fill out application for individual life?

What is the purpose of application for individual life?

What information must be reported on application for individual life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.