Get the free Business Corporation Annual Report

Get, Create, Make and Sign business corporation annual report

How to edit business corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business corporation annual report

How to fill out business corporation annual report

Who needs business corporation annual report?

Business Corporation Annual Report Form: A Comprehensive Guide

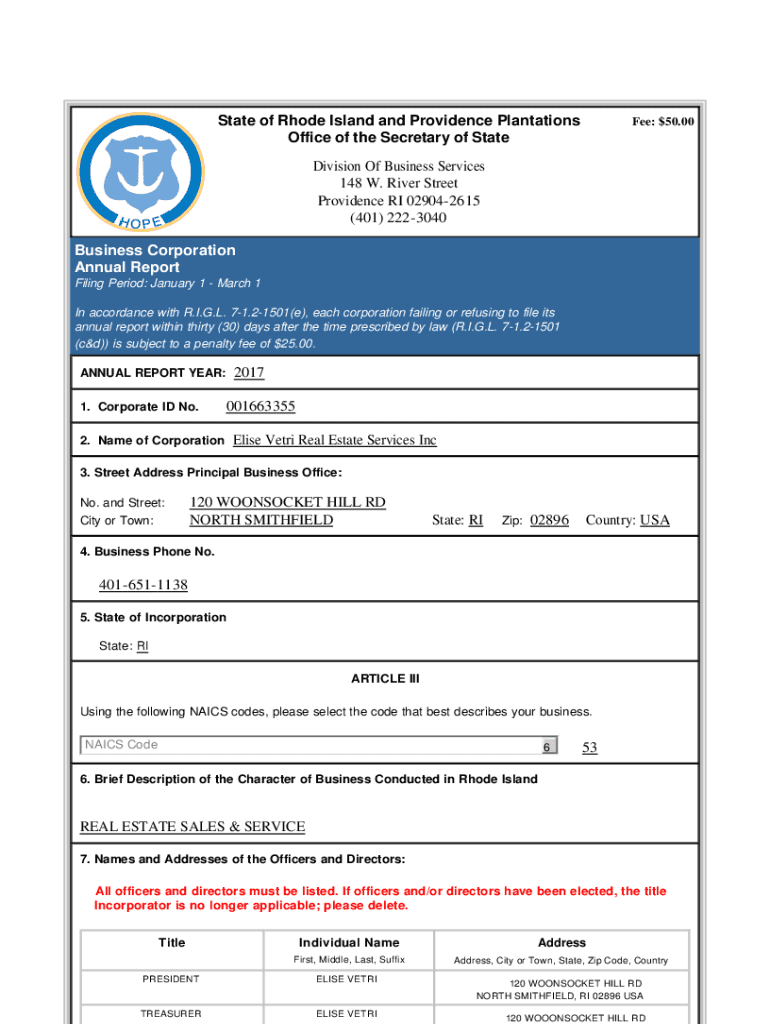

Understanding the business corporation annual report

A business corporation annual report is a formal document prepared once a year that provides detailed information about a company’s financial performance, operations, and future outlook. Its main purpose is to inform shareholders, stakeholders, and potential investors about the company’s status and performance over the past year. This report serves as a crucial tool for transparency, accountability, and trust between the corporation and its stakeholders.

Annual reports are significant not only for compliance purposes but also for strategic decision-making. They contain valuable insights that help stakeholders gauge the company’s stability and growth trends. From investors to employees, each stakeholder relies on the annual report to understand how the corporation is performing and what future plans entail. Thus, crafting a comprehensive annual report is vital for any business corporation.

Filing requirements for business corporations

Every business corporation must adhere to specific legal requirements for filing their annual report. These regulations ensure that information remains up-to-date, accurate, and transparent for stakeholders. The filing requirements can vary based on the corporation's geographical location, business structure, and specific industry regulations. Understanding these requirements is essential for compliance and for avoiding any legal repercussions.

Those eligible to file an annual report typically include LLCs, C corporations, S corporations, and non-profit organizations, among others. However, corporations must verify the precise eligibility criteria as they can differ based on state laws and federal regulations.

Preparing your annual report: A step-by-step guide

Preparing your annual report can be a daunting task, but breaking it down into manageable steps simplifies the process significantly. Let’s explore how to effectively prepare this crucial document.

Step 1: Gathering necessary documentation

Start by collecting essential documents that will form the core of your report. This includes up-to-date financial statements, management discussion and analysis, and any auditor reports available. Accurate documentation underpins the reliability of your report.

Step 2: Formatting your report

The format of your annual report is crucial as it impacts readability and flow. Utilize required formats and templates which can usually be accessed directly on platforms like pdfFiller, helping to ensure compliance with formatting standards.

Step 3: Completing the report

Your report should be comprehensive yet concise. Essential sections to include are company information, an overview of the financial performance, and shareholder information. Providing context through narrative is vital in this section.

Step 4: Review and edit

Once the report is drafted, utilize pdfFiller’s editing tools for final adjustments. Inviting collaboration among team members can streamline this process and incorporate diverse insights from your team.

Step 5: Finalizing and signing

Finally, it’s time to finalize your report. Using eSign features can simplify the signing process, ensuring compliance with legal standards for authenticated signatures.

Submission process for annual reports

Submitting your annual report is the last critical step in the process. Understanding where and how to submit ensures that nothing falls through the cracks. Most states offer online submission platforms, making the process quicker and more efficient.

However, mail-in options are also available, specifically for those who prefer physical documentation or require certification. Check specific submission deadlines to avoid penalties.

Common mistakes in filing annual reports

Filing an annual report may appear straightforward, but many corporations make critical errors during the process. Common mistakes include submitting incomplete information, missing the filing deadline, and misunderstanding the required formats and regulations.

To avoid complications, consider utilizing templates available on pdfFiller, which can guide you through the requirements and help ensure that no section is overlooked.

Consequences of failing to file

Neglecting to file your annual report can have immediate and long-term consequences for your business operations. Initially, failing to file can lead to penalties and fines, which can strain a corporation’s resources.

In the long run, a continued failure to file may lead to the loss of corporate status and potential legal repercussions. Negative impacts on reputation and trust in the eyes of stakeholders can also ensue.

Best practices for managing annual reports

Effective management of annual reports requires a strategic approach. Establishing a calendar for reporting can facilitate timely submissions and prevent last-minute stress. Regular updates and ongoing tracking of your corporation's finances can ease the reporting process.

Utilizing cloud-based solutions for document management can help in organizing and retrieving necessary documentation. Additionally, employing collaborative tools enhances efficiency and ensures that all team members contribute their insights.

Exploring related topics for business owners

For business owners, understanding business licenses and permits is critical, as they may impact operations directly alongside annual reporting. The role of AI in financial reporting is another exciting area, offering potential advancements in data analysis and accuracy.

Exploring tools for measuring corporate compliance and risk management can also complement your financial understanding. Staying current with trends in taxation and accounting for corporations is imperative for strategic planning.

Interactive tools and resources available on pdfFiller

pdfFiller offers a suite of interactive tools to assist with the document creation process. With customizable document templates, users can streamline the preparation of their annual reports effectively.

The eSign features enhance the report submission process, allowing for quick and secure electronic signatures. Team engagement can be maximized through collaborative tools, facilitating a better workflow by allowing simultaneous editing and commenting.

Lastly, pdfFiller's resource library provides numerous templates and guidance, enabling users to navigate filing requirements with greater ease.

Frequently asked questions about annual reports

Cost is a common concern when it comes to filing annual reports. Fees may vary based on the corporation's structure and state requirements; always prepare for these costs in advance.

There may arise situations where a corporation needs to amend a submitted annual report. Familiarize yourself with the process specific to your state to handle such issues efficiently. Likewise, accessing previously filed reports can typically be done through state business registration websites.

pdfFiller provides substantial support during the filing process, including access to templates, editing features, and guidance tailored to foster compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete business corporation annual report online?

How do I complete business corporation annual report on an iOS device?

How do I edit business corporation annual report on an Android device?

What is business corporation annual report?

Who is required to file business corporation annual report?

How to fill out business corporation annual report?

What is the purpose of business corporation annual report?

What information must be reported on business corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.