Get the free Marine Commercial Liability – Stevedores Supplementary Information

Get, Create, Make and Sign marine commercial liability stevedores

Editing marine commercial liability stevedores online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marine commercial liability stevedores

How to fill out marine commercial liability stevedores

Who needs marine commercial liability stevedores?

A comprehensive guide to marine commercial liability stevedores form

Understanding marine commercial liability

Marine commercial liability is an essential aspect of the shipping industry that protects businesses from the risks associated with stevedoring operations, specifically the loading and unloading of cargo from vessels. Proper understanding of this liability is crucial, as it safeguards companies against claims resulting from property damage, bodily injury, or other risks that may occur during operations.

Key terms in marine liability include indemnity, which refers to a guarantee against loss, and liability insurance, a type of coverage that protects the insured from claims resulting from injuries and damage to people or property. A thorough overview of stevedore responsibilities highlights their role in ensuring that cargo is safely handled, stored, and moved, thereby avoiding accidents that could result in significant financial losses.

What is the stevedores form?

The stevedores form serves as a crucial document in the maritime industry, providing a detailed account of the stevedoring operations to evaluate potential risks and required liability coverage. It's a way for stevedores to communicate specific operational needs to insurers, ensuring they tailor coverage that protects against the unique challenges faced in this field.

This form is particularly required when businesses seek to establish or renew marine liability insurance. It helps not only in assessing risks but also offers insights into the nature of the operations conducted. Companies involved in stevedoring—whether large port operators or smaller freight handling entities—should utilize this form to facilitate smoother interactions with insurers and ensure comprehensive coverage.

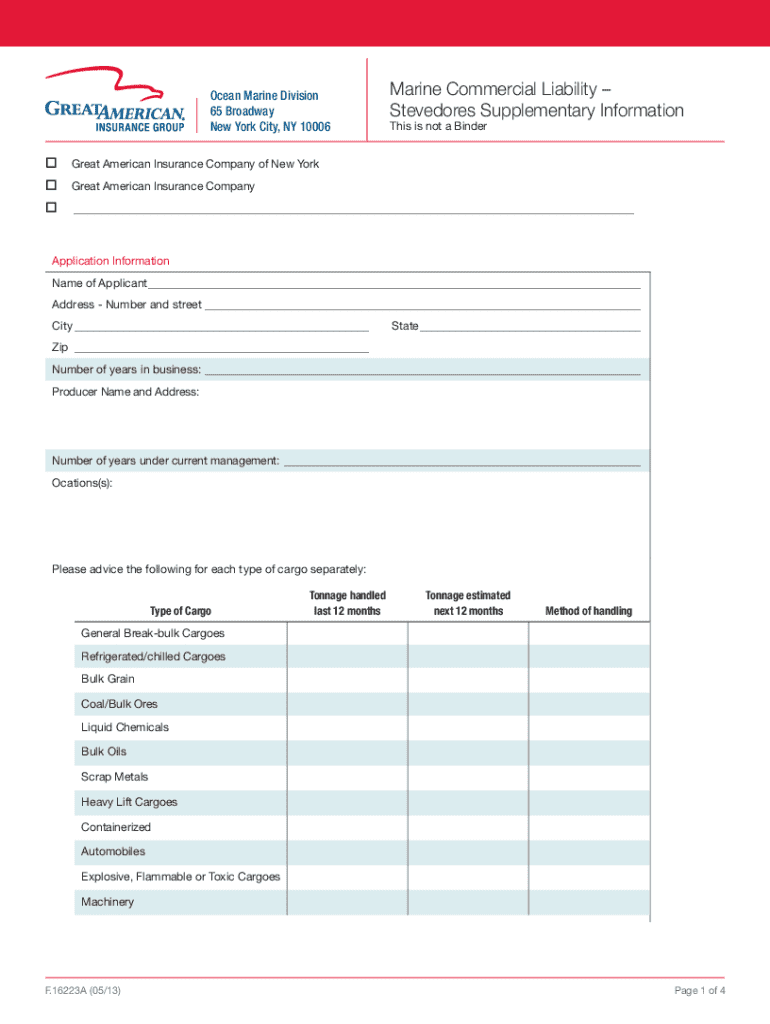

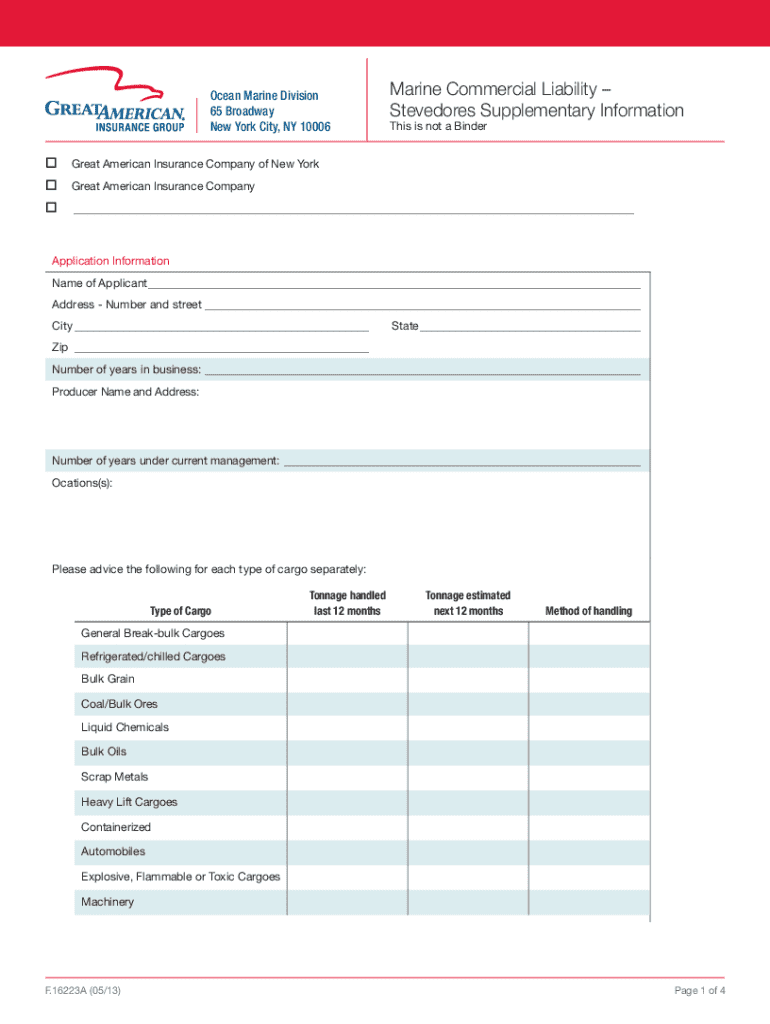

Key components of the marine commercial liability stevedores form

The marine commercial liability stevedores form consists of several critical components, each vital to ensuring appropriate coverage and risk management. Firstly, general information such as company name, contact details, and a description of operations are required, as this helps insurers understand the business landscape.

Additionally, the insurance details section defines the types of coverage available, including coverage for bodily injury and property damage, along with specifying policy limits and deductibles. Risk management information is also important; employers must document safety and security protocols and highlight any previous claims history, allowing insurers to gauge the business's risk profile effectively.

Step-by-step instructions for filling out the form

Filling out the marine commercial liability stevedores form requires careful attention to detail to ensure the accuracy of the information provided.

Section 1 involves entering company information. For instance, you should enter the business name and structure (LLC, corporation, etc.) and specify contact information like phone numbers and email addresses. This section serves as the cornerstone for identifying the operations and must be completed accurately.

In Section 2, the description of operations needs to detail the specific stevedoring services offered, including cargo types handled, equipment used, and any unique operational practices. Likewise, it’s beneficial to illustrate the shipping routes and ports used to provide a comprehensive context for insurers.

Moving to Section 3 focuses on insurance coverage. Here, businesses select the types of coverage desired and input relevant policy information, including coverage limits and deductibles—critical to understanding potential liabilities.

Lastly, Section 4 pertains to risk management practices. Documenting safety procedures and any quality control measures in place can demonstrate the company’s commitment to operational safety. A referral for additional documentation could strengthen the application further.

Interactive tools for form management

Utilizing interactive tools significantly streamlines the management of the marine commercial liability stevedores form, and pdfFiller offers a robust platform in this regard. The site hosts a plethora of features aimed at enhancing efficiency and accessibility.

Users can easily edit their forms directly on the platform, allowing for modifications without the need to recreate documents. The eSigning feature enables secure digital signatures, eliminating the need for cumbersome physical copies. Moreover, sharing and collaborating with team members becomes a breeze, as documents can be accessed anytime and anywhere in the cloud.

Common mistakes to avoid when completing the form

When filling out the marine commercial liability stevedores form, some common pitfalls might lead to complications during the insurance application process. For instance, incomplete information can delay approvals. It's essential to ensure every field is accurately filled out, providing a complete picture of the company and its operations.

Another frequent issue arises from misunderstanding insurance terms. Familiarity with different types of coverage, limits, and industry jargon can help prevent miscommunication with insurers. Additionally, not keeping updated with current protocols may result in outdated safety practices being presented, leading to potential underinsurance or claims denial.

Frequently asked questions (FAQs)

Filling out forms can sometimes be daunting, and questions may arise during the process. One common inquiry is about what to do if you’re unsure about filling out a section. The best strategy is to consult with your insurer for clarification or to work with a knowledgeable industry consultant.

Another frequent question pertains to managing multiple submissions or revisions. It’s handy to keep a clear record of changes made and to save versions of your document periodically. This method allows for easy reference and correction if needed.

Furthermore, users often ask whether the form can be saved and edited later. With pdfFiller, documents can be saved in the cloud, allowing users to return to complete or edit forms at their convenience.

Best practices for managing marine commercial liability

To effectively manage marine commercial liability, it’s vital to keep your insurance up to date. Scheduling regular policy reviews allows companies to adjust their coverage according to the evolving nature of their operations, ensuring no gaps exist in protection.

Regularly reviewing risk assessments is another best practice. Regular audits of safety measures can unveil potential weaknesses or new risks that need to be addressed, thus minimizing liability exposure. Additionally, proper documentation of all processes and communications helps create a robust defense should a claim arise.

Benefits of using pdfFiller for your stevedores form

Adopting pdfFiller for managing the marine commercial liability stevedores form offers numerous advantages due to its comprehensive suite of features. Its cloud-based hosting means that users can access their documents from anywhere, which is a significant benefit for teams with multiple locations or remote staff.

The platform’s user-friendly editing tools facilitate quick modifications, even for those who are less tech-savvy. Furthermore, pdfFiller ensures comprehensive support for users, empowering them to streamline their document management process seamlessly. The focus on collaboration fosters efficient teamwork around form completion and submission.

Additional considerations

In the maritime industry, various regulations impact your liability exposure, making it crucial to remain aware of legal requirements. Compliance with international conventions and local laws can significantly influence your liability risks, ensuring your operations adhere to industry standards.

Moreover, the role of technology in maritime insurance is continually evolving. Leveraging tech-driven solutions for risk management and insurance processing can provide a competitive edge, enhancing safety measures while optimizing operational efficiency in a rapidly changing industry landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit marine commercial liability stevedores in Chrome?

Can I create an electronic signature for the marine commercial liability stevedores in Chrome?

Can I edit marine commercial liability stevedores on an iOS device?

What is marine commercial liability stevedores?

Who is required to file marine commercial liability stevedores?

How to fill out marine commercial liability stevedores?

What is the purpose of marine commercial liability stevedores?

What information must be reported on marine commercial liability stevedores?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.