Get the free Nebraska E-file Opt-out Record for Fiduciary

Get, Create, Make and Sign nebraska e-file opt-out record

How to edit nebraska e-file opt-out record online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska e-file opt-out record

How to fill out nebraska e-file opt-out record

Who needs nebraska e-file opt-out record?

Nebraska E-File Opt-Out Record Form: A Comprehensive Guide

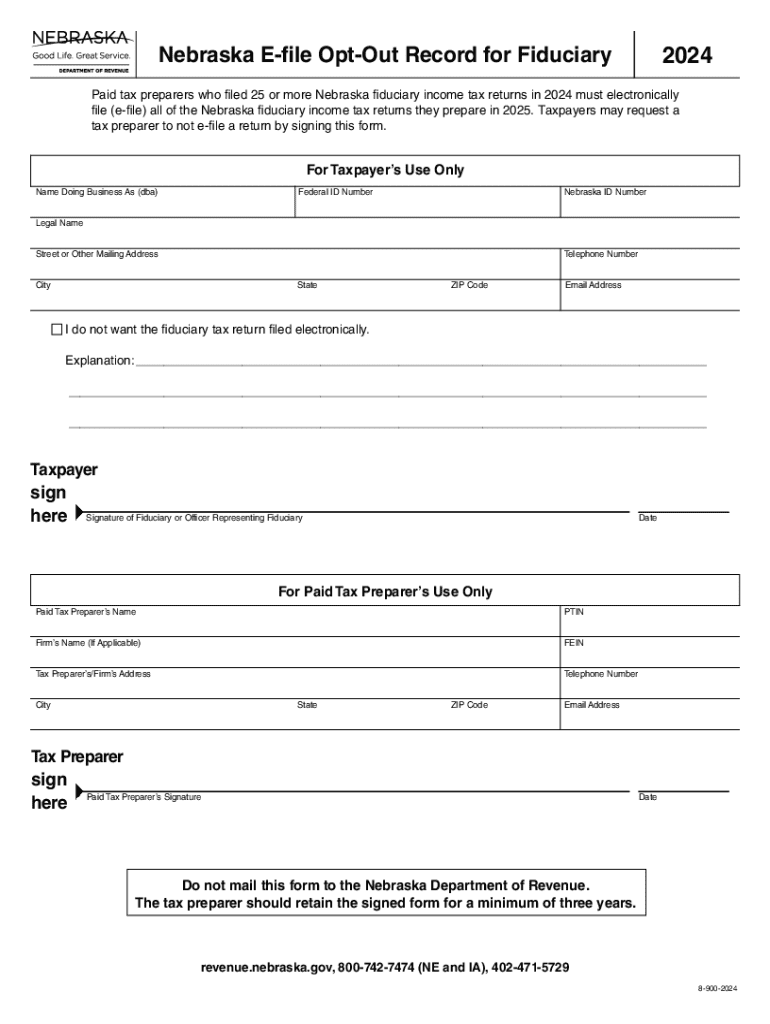

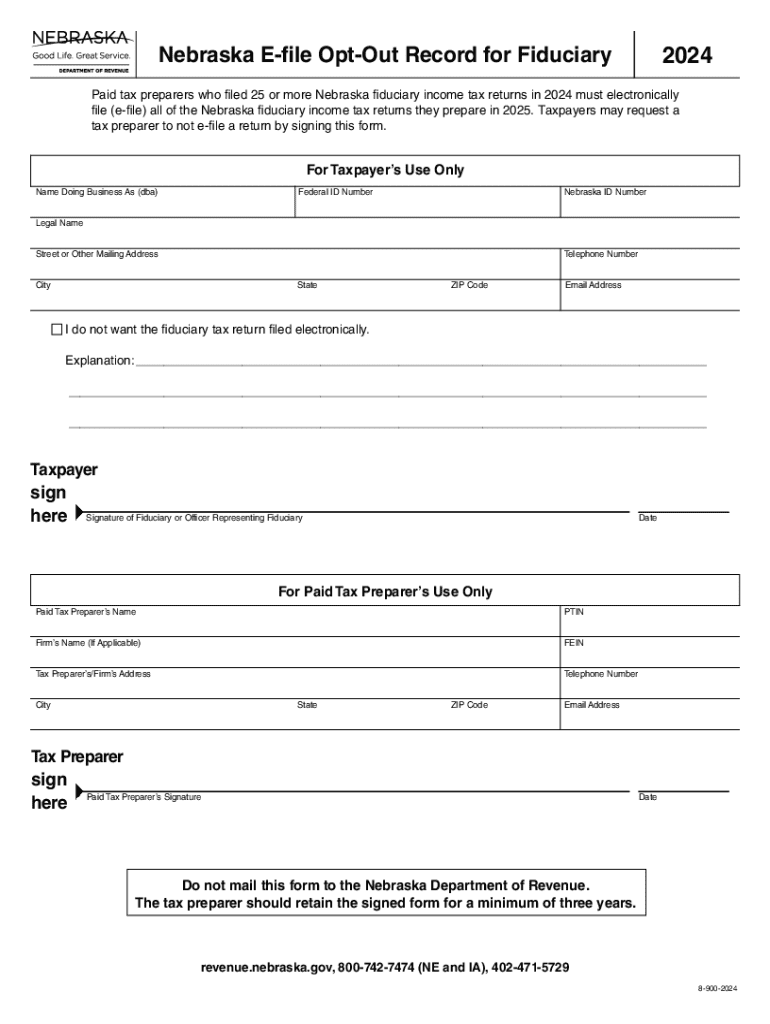

Understanding the Nebraska E-File Opt-Out Record Form

The Nebraska E-File Opt-Out Record Form is a crucial document for individuals who wish to maintain tighter control over their personal tax information. Opting out of the e-file system allows taxpayers to manage their data privacy and confidentiality actively. This process is important for those who have specific concerns regarding electronic filing due to various reasons including security risks or personal preferences.

Opting out via the E-File Opt-Out Record can be a protective measure, especially for individuals who have previously experienced data breaches, or who simply prefer traditional paper filing methods. Understanding this process fully can empower taxpayers to make informed decisions about their engagement with state tax systems.

Preparing to Use the Nebraska E-File Opt-Out Record Form

Before initiating the process of opting out, it's essential to evaluate your eligibility. The Nebraska E-File Opt-Out Record Form is accessible to a broad range of individuals. Generally, any taxpayer who has a valid Social Security Number (SSN) and is filing taxes in Nebraska can submit this form. However, certain circumstances such as having a history of identity theft or concerns with electronic data handling might empower your decision to opt out.

Equipped with the right documentation is also critical. Essential information when filling out the Nebraska E-File Opt-Out Record Form includes your full name, address, and SSN. Additionally, it might be wise to provide documents supporting your reasons for opting out.

Navigating the E-File Opt-Out Record Form

Accessing the Nebraska E-File Opt-Out Record Form is straightforward. The official Nebraska Department of Revenue website provides a downloadable version of the form. You can also utilize platforms like pdfFiller to fill out the form conveniently online. This cloud-based solution makes the process more efficient.

When filling out the form, specificity is key. Begin with your personal details followed by clearly stating your decision to opt out. Ensure that you double-check all entries for accuracy, as mistakes can delay processing. Once completed, reviewing your application can prevent potential issues that may arise from overlooked mistakes.

Submitting the Nebraska E-File Opt-Out Record Form

Once you have completed the Nebraska E-File Opt-Out Record Form, the next step is submission. There are several methods to do this. If you prefer electronic submission, follow the guidelines outlined on the Nebraska Department of Revenue site. Alternatively, you can mail the form. Be sure to use the correct postal address to avoid processing delays.

Tracking your submission's status post-submission is crucial to ensure that your request has been received and is being processed. Most submissions have a processing timeline, which you can typically verify through the state department's online tracking tools.

Frequently Asked Questions (FAQs)

It’s normal to have concerns about opting out of the e-file system. One common question is whether opting out will affect your tax filing status. The answer is no; you can still file your taxes via paper methods without any impact on your filing status. Another important consideration is knowing what to do if you decide to change your mind about opting out. You will need to contact the Nebraska Department of Revenue to reinstate your e-filing capabilities.

If your submission encounters issues or requires additional information, the best approach is to communicate directly with the Nebraska Department of Revenue. Being proactive in addressing these challenges can facilitate a smoother experience.

Enhancing Your Experience with pdfFiller

Using pdfFiller can significantly streamline the process of managing your Nebraska E-File Opt-Out Record Form. This platform allows users to edit PDFs easily, sign forms electronically, and collaborate with others in real-time, enhancing efficiency and organization. With the ability to access your documents from anywhere, you can manage all your forms without hassle.

The cloud-based platform provides a host of features that not only facilitate form completion but also ensure that your documents are securely stored and easily retrievable whenever needed. This can provide peace of mind, especially when dealing with sensitive tax documents.

Closing thoughts on the Nebraska E-File Opt-Out Process

Staying informed about tax regulations is vital. Regularly visiting the Nebraska Department of Revenue's website can provide updates and insights into any changes in the e-filing process or opt-out requirements. The ever-evolving nature of tax regulations means that keeping yourself educated will empower you to navigate these waters more effectively.

In conclusion, properly understanding the Nebraska E-File Opt-Out Record Form is crucial for anyone considering opting out of e-filing. By following best practices in completing and submitting your form, along with utilizing tools like pdfFiller, you can ensure a seamless and efficient experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nebraska e-file opt-out record to be eSigned by others?

How do I complete nebraska e-file opt-out record online?

Can I edit nebraska e-file opt-out record on an iOS device?

What is Nebraska e-file opt-out record?

Who is required to file Nebraska e-file opt-out record?

How to fill out Nebraska e-file opt-out record?

What is the purpose of Nebraska e-file opt-out record?

What information must be reported on Nebraska e-file opt-out record?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.