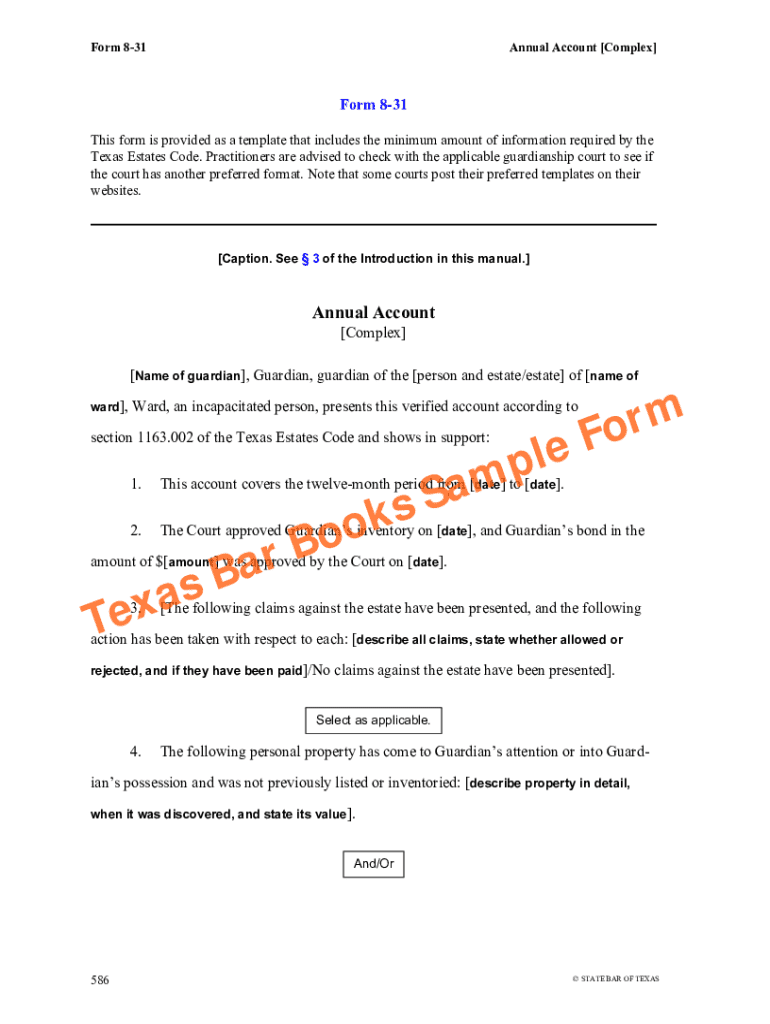

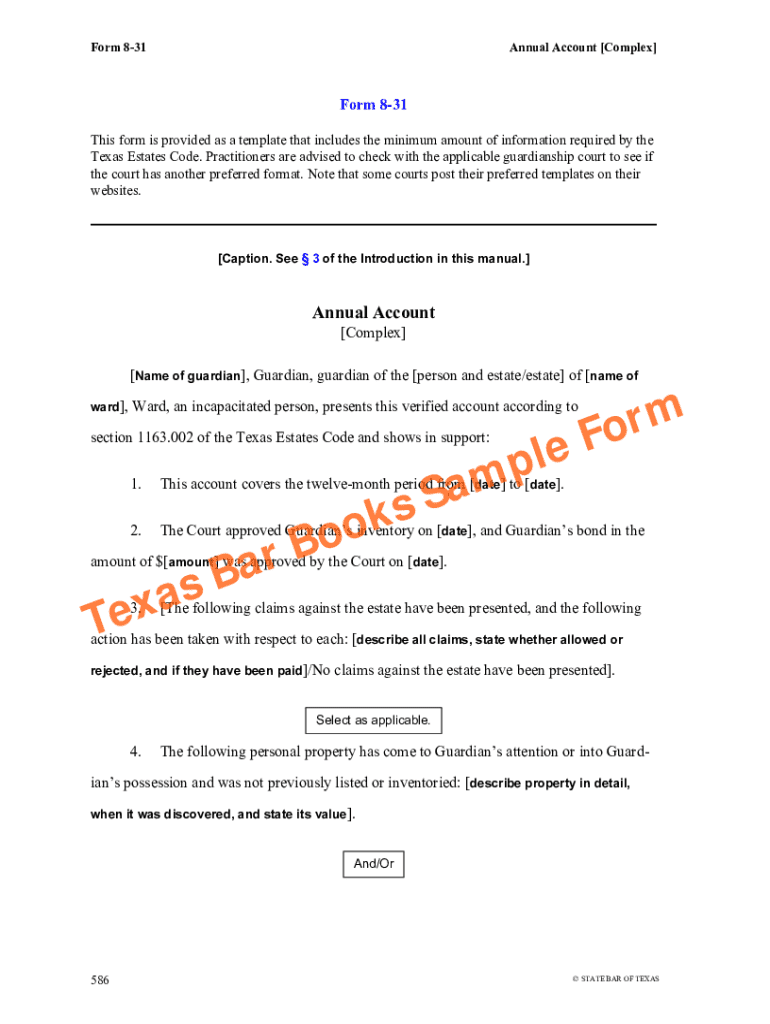

Get the free Form 8-31 Annual Account [complex]

Get, Create, Make and Sign form 8-31 annual account

Editing form 8-31 annual account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-31 annual account

How to fill out form 8-31 annual account

Who needs form 8-31 annual account?

Complete Guide to the Form 8-31 Annual Account Form

Overview of the Form 8-31 Annual Account Form

The Form 8-31 Annual Account Form serves as a critical financial disclosure tool for various organizations including businesses and nonprofits. This document captures a detailed account of the financial operations over the past year, highlighting income, expenses, assets, and liabilities. Filing the Form 8-31 is not just a regulatory formality; it ensures compliance with legal obligations and provides stakeholders with valuable insights into the organization’s financial health.

Organizations required to file the Form 8-31 include corporations, limited liability companies, partnerships, and nonprofit organizations. These entities must submit the form when they reach the end of their fiscal year or if their operation structure mandates annual reporting. Regular filing of this form ensures transparency and accountability, which are crucial for maintaining trust with investors, clients, and regulatory bodies.

Key features of the Form 8-31

The Form 8-31 is divided into several sections, each requiring meticulous attention. Key components include income declarations, where your organization's revenue streams are outlined. Following this, a detailed report of expenses is required, covering operational costs, salaries, and other expenditures. The form also necessitates disclosures of assets and liabilities, allowing for a comprehensive overview of the organization's financial standing.

To assist in the completion of the Form 8-31, interactive tools are available online. These include financial calculators for forecasting and instructional videos that guide users through the process of filling out the form accurately.

Step-by-step guide to completing the Form 8-31

Successfully filing the Form 8-31 begins with adequate preparation. Step one involves gathering necessary documentation, such as financial statements, receipts, and references from the previous year’s filing. This foundational work sets the stage for accurate reporting and helps prevent errors later in the process.

Next, you will fill out the form itself. Each section has specific requirements, and it’s essential to follow guidelines carefully. Common pitfalls include miscalculations and inaccurate reporting of figures, which can have serious repercussions. To ensure accuracy, dedicate time to reviewing additional documentation against the figures reported.

After completing the form, it is critical to review all provided information. Creating a checklist can facilitate this process, ensuring no detail is overlooked. Lastly, the form must be signed and submitted. As digital signatures are now widely accepted, familiarize yourself with the eSignature options available including deadlines and submission channels.

Editing and managing your Form 8-31

Once completed, the Form 8-31 can be edited and managed using platforms like pdfFiller. Uploading your draft into pdfFiller allows you to utilize powerful editing features, providing tools for annotating and correcting documents effectively before final submission. This functionality ensures your filing is polished and accurate.

Managing your filing history is crucial for future reference and compliance. PDFfFiller's platform allows for seamless document management, making it easier to retrieve past filings when updating or completing new forms.

FAQ about the Form 8-31

As with any regulatory form, several questions often arise about the Form 8-31. One common concern is what to do if a mistake is discovered after submission. In such cases, organizations can submit an amended form that correctly reflects the information. It's essential to notify the relevant authorities about this correction.

In addition, pdfFiller offers dedicated support aimed at helping users maintain compliance beyond the filing process. Exploring additional resources can further facilitate understanding and efficiency in managing your Form 8-31.

History and evolution of the Form 8-31

The Form 8-31 has evolved over the years, adapting to changes in financial reporting standards and regulatory requirements. Significant revisions have occurred due to adjustments in laws governing business structures and transparency practices, shifting the landscape for annual reporting.

As technology continues to progress, tools like pdfFiller are redefining how organizations approach the annual reporting process, making it easier and more compliant.

Best practices for filing the Form 8-31

Adoption of best practices can significantly enhance the accuracy and efficiency of filing the Form 8-31. Key recommendations include proactive preparation, timely submission, and double-checking for potential errors before submitting the form. Establishing a system for regular financial updates can greatly ease the year-end reporting responsibilities.

Utilizing pdfFiller features can significantly improve your filing process efficiency, enabling collaboration among team members and ensuring your documents meet all necessary requirements.

Compliance and legal implications

Filing the Form 8-31 entails legal responsibilities that organizations must take seriously. Inaccuracies or late submissions can result in penalties, including fines or actions from regulatory bodies. Understanding these implications is essential for ensuring that you meet your obligations and avoid potential consequences.

pdfFiller’s features ensure that your documents comply with legal standards, providing tools for audit trails and maintaining a comprehensive document history for internal reviews.

Additional tools for document management

Beyond the Form 8-31, organizations often find themselves needing to fill out various other documents. PdfFiller excels in accommodating a wide range of forms and is compatible with numerous file types, facilitating a seamless document management process.

Integrating other financial tools alongside pdfFiller can lead to a comprehensive management solution, simplifying the documentation process across all business operations.

User experiences and testimonials

User experiences reveal the impact of using pdfFiller for Form 8-31 filings. Many have reported an enhanced filing process, citing features that streamline data entry and reduce errors.

Overall, user feedback has driven continuous improvements within pdfFiller, ensuring the platform remains user-friendly while effectively supporting Form 8-31 submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 8-31 annual account?

Can I edit form 8-31 annual account on an iOS device?

How do I complete form 8-31 annual account on an Android device?

What is form 8-31 annual account?

Who is required to file form 8-31 annual account?

How to fill out form 8-31 annual account?

What is the purpose of form 8-31 annual account?

What information must be reported on form 8-31 annual account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.