Get the free Business Tax Application / Certificate of Use

Get, Create, Make and Sign business tax application certificate

Editing business tax application certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax application certificate

How to fill out business tax application certificate

Who needs business tax application certificate?

Understanding the Business Tax Application Certificate Form

Understanding the Business Tax Application Certificate Form

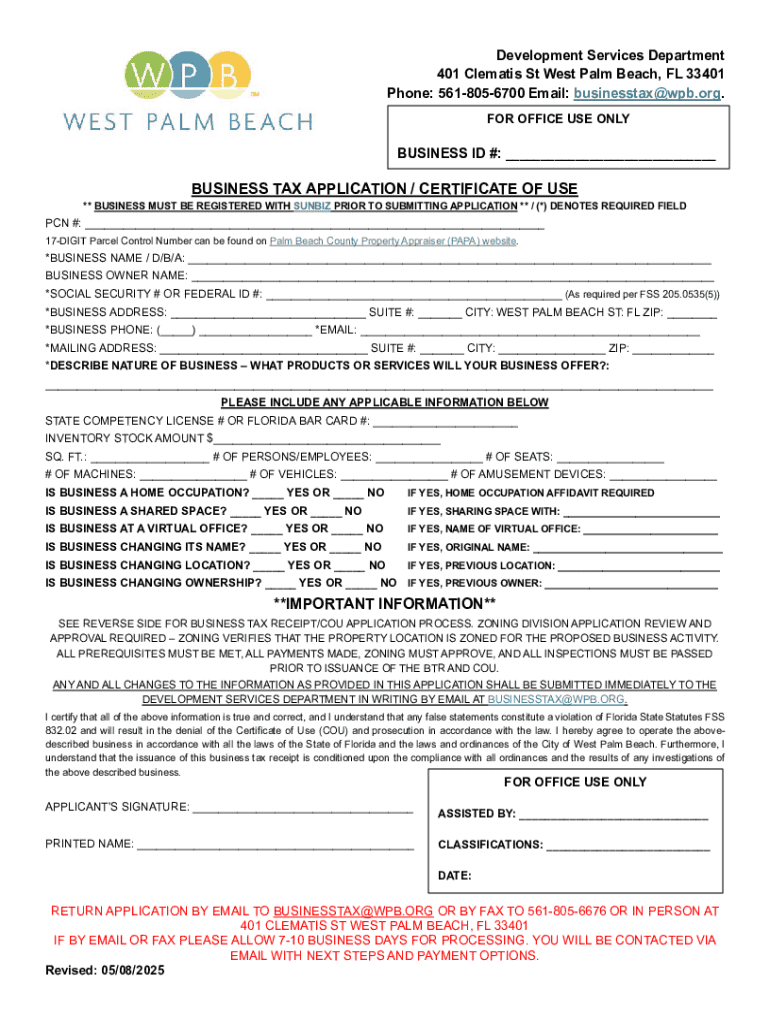

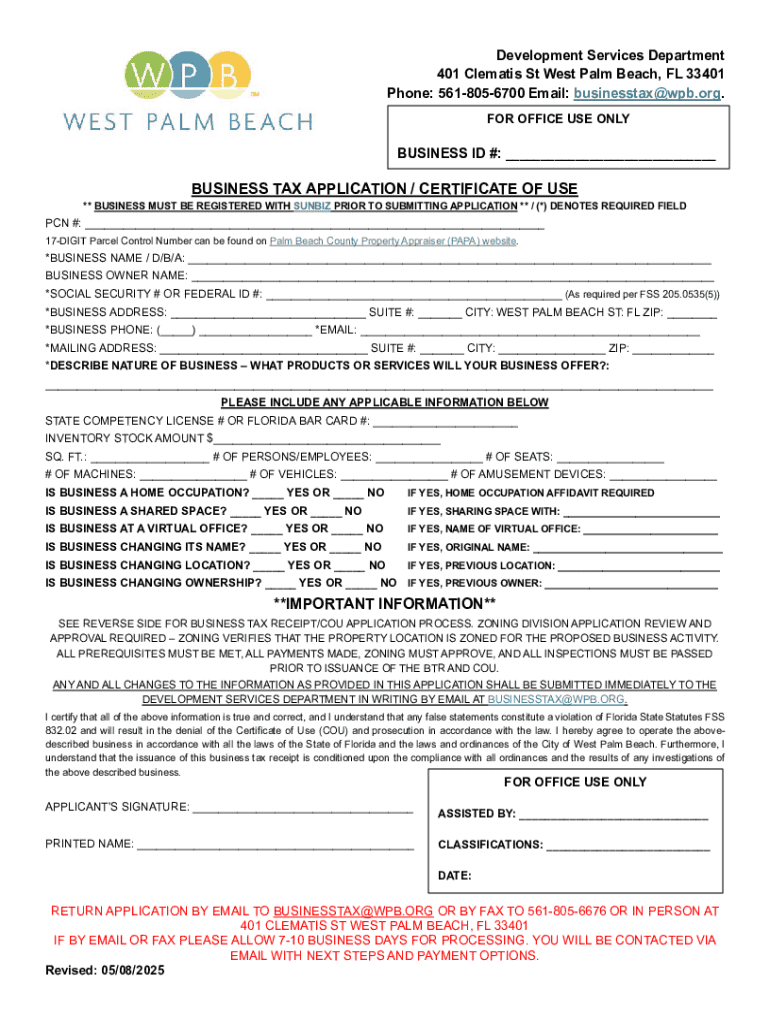

The Business Tax Application Certificate Form is a crucial document that businesses must complete to operate legally within a specific jurisdiction. This form serves as an application for a business tax certificate, enabling owners to pay local taxes and operate lawfully. Its importance cannot be understated, as it validates the business's existence to tax authorities, ensuring compliance with local and state regulations.

Obtaining a Business Tax Application Certificate is pivotal for businesses to avoid fines and legal troubles. With this certificate, businesses demonstrate their commitment to fulfilling tax obligations, thus preventing potential audits and penalties that may arise from operating without proper registration.

Key requirements for completing the form

Before you start filling out the Business Tax Application Certificate Form, understanding the eligibility criteria is essential. Most states require businesses to be registered and compliant with local laws to be eligible for a tax certificate. This might include being properly registered with the state and having the necessary permits to conduct business.

Detailed instructions for filling out the Business Tax Application Certificate Form

Completing the Business Tax Application Certificate Form can seem daunting, but following a step-by-step guide can simplify the process. Start by gathering all necessary documents and information to ensure that the submission is fluid and error-free.

To ensure accurate completion, take your time with each section. Double-check for typos or inconsistencies which could delay processing time or lead to rejection.

Common mistakes to avoid

When completing the Business Tax Application Certificate Form, it's easy to make mistakes that could lead to setbacks. Common errors include entering incorrect tax identification numbers, mismatching business names with registration details, or failing to sign the application. These errors not only complicate the approval process but can also result in delays that affect your business operations.

Additionally, submitting outdated or irrelevant documents can lead to rejection. Always ensure that your documentation is current and relevant to avoid unnecessary complications.

How to submit the Business Tax Application Certificate Form

Once you've completed the Business Tax Application Certificate Form, the next step is submission. There are typically two methods available: online and paper submission. Many jurisdictions now offer online portals for easier access, while paper submissions may still be required in certain cases.

After submission: What to expect

Following the submission of your Business Tax Application Certificate Form, there are a few key points to keep in mind regarding processing times and notifications. Generally, processing can take anywhere from a few days to several weeks depending on local authority workloads.

To check the status of your application, you can often use tracking provided by the online submission tools or contact the relevant tax office directly. Notifications regarding approval or any required follow-up actions will typically be sent via email or postal mail.

Managing your Business Tax Application Certificate

Once you receive your Business Tax Application Certificate, it’s essential to manage it properly. If changes are needed, such as updating business information or making amendments, most states have specific procedures for this. Consulting local tax authority guidelines can provide pathways for making these adjustments.

Additional insights and resources

Having comprehensive resources at your disposal while managing the Business Tax Application Certificate Form is advantageous. Many state and local tax authorities provide invaluable insights on their websites regarding the application process and tax obligations.

Utilizing pdfFiller's features for your document needs

pdfFiller offers a comprehensive suite of tools to aid users in document creation and management, including the Business Tax Application Certificate Form. This platform allows users to edit PDFs, e-sign documents, and collaborate seamlessly, all from a cloud-based interface.

Frequently asked questions

When it comes to the Business Tax Application Certificate Form, potential applicants often have numerous questions. Common queries usually revolve around eligibility, required documents, and submission guidelines. Being informed about these aspects can drastically improve your application experience.

User experiences and testimonials

Numerous users have shared their positive experiences regarding the Business Tax Application Certificate process, particularly when utilizing platforms like pdfFiller. Many emphasize the ease of document management and the efficiency of online submission features.

Testimonials reflect how pdfFiller has empowered them in navigating tax requirements effortlessly. Users underline the clarity and guidance provided by the platform throughout the application process.

Contact information for assistance

If you're seeking assistance with the Business Tax Application Certificate Form, various resources are accessible. Users can contact local tax authorities for specific questions regarding the form itself. Additionally, pdfFiller offers customer support options for its users who require additional help throughout their document management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business tax application certificate for eSignature?

How do I fill out business tax application certificate using my mobile device?

Can I edit business tax application certificate on an iOS device?

What is business tax application certificate?

Who is required to file business tax application certificate?

How to fill out business tax application certificate?

What is the purpose of business tax application certificate?

What information must be reported on business tax application certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.