Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

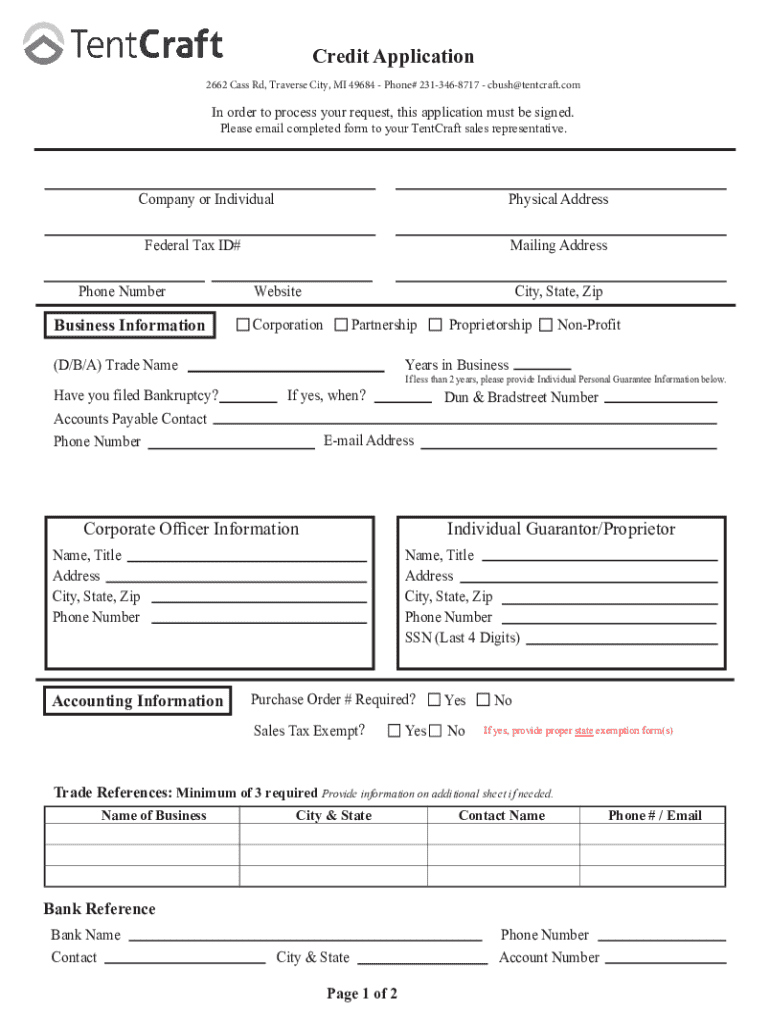

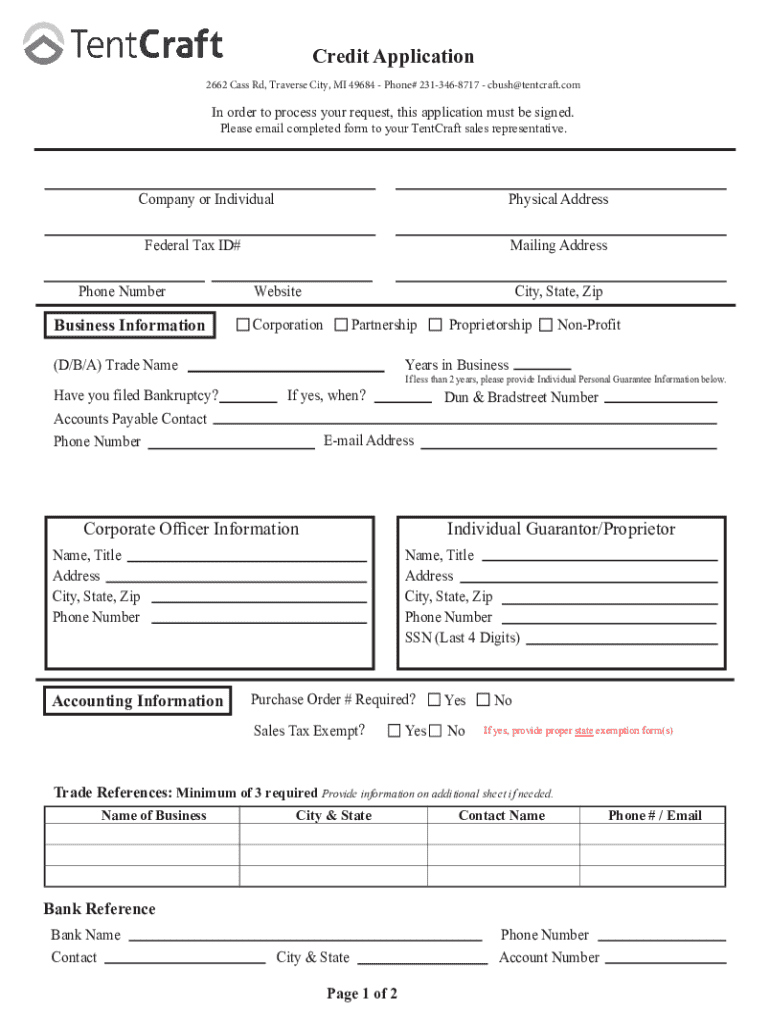

Comprehensive Guide to the Credit Application Form

Understanding the credit application form

A credit application form is a vital document used by lenders to evaluate the creditworthiness of an individual or business seeking financial assistance. This form captures essential information that helps the lender assess the risk associated with extending credit. By collecting personal and financial data, including credit history and income levels, lenders can make informed decisions.

The importance of credit application forms extends beyond simple documentation. They serve as a standardized way to gather the necessary details required for assessing loan eligibility, terms, and conditions. Businesses rely on credit applications to establish trust and accountability in financial transactions, protecting both lenders and borrowers.

Key components of a credit application form

A well-structured credit application form consists of several key components crucial for lenders to make an accurate assessment:

Step-by-step instructions for filling out a credit application form

Filling out a credit application form requires careful attention to detail. Here’s a straightforward guide to ensuring that your application is complete and accurate:

Common mistakes to avoid on credit application forms

While completing a credit application form may seem straightforward, many applicants fall victim to common pitfalls that can delay approval or lead to rejection. Avoid the following mistakes:

Best practices for submitting a credit application form

To enhance your chances of a successful credit application, consider these best practices:

How to address creditworthiness

Lenders heavily weigh an applicant's creditworthiness when reviewing credit applications. Here are vital factors that influence their decision:

To demonstrate creditworthiness on your application, incorporate accurate and positive details from your credit history, alongside clear financial statements.

Frequently asked questions (FAQs)

Here we address some common concerns about credit applications that applicants might have:

The role of automation in streamlining credit applications

Automation can significantly enhance the efficiency of credit application processes, reducing the burden on both lenders and applicants. Using platforms like pdfFiller helps facilitate a seamless flow of information.

Advantages of automated processing include reduced paperwork errors and time savings through faster processing. Digital tools also support collaborative efforts, allowing teams to work on applications concurrently.

Tips for businesses to mitigate risk using credit applications

Businesses can employ several strategies to evaluate potential borrowers and set appropriate credit limits:

Improving your credit application process

Optimizing your credit application process can safeguard against errors and delays. Implementing a systematic approach ensures that everything runs smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit application to be eSigned by others?

Where do I find credit application?

How do I make changes in credit application?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.