Get the free Form 13f-nt

Get, Create, Make and Sign form 13f-nt

Editing form 13f-nt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 13f-nt

How to fill out form 13f-nt

Who needs form 13f-nt?

Comprehensive Guide to the Form 13F-NT Form

Understanding the Form 13F-NT

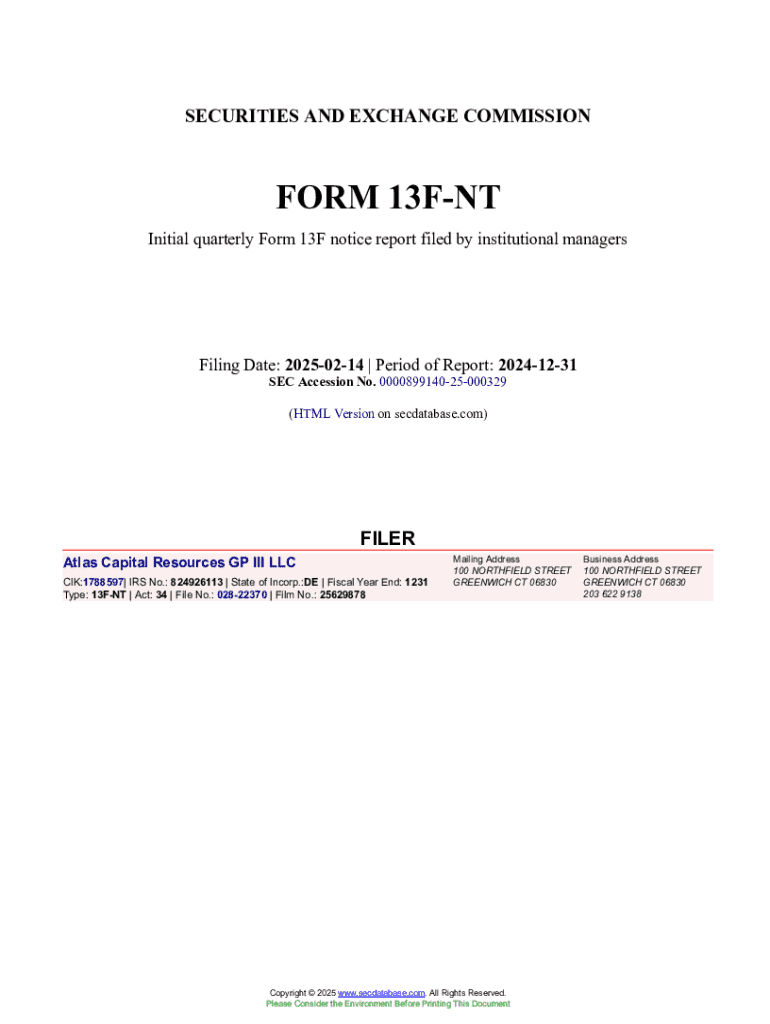

Form 13F-NT is a specific filing mandated by the Securities and Exchange Commission (SEC) in the United States, designed for institutional investment managers who manage assets surpassing $100 million. This form facilitates transparency and accountability within the investment community, providing insights into the holdings of significant institutional players.

The primary purpose of Form 13F-NT is to track the holdings of institutional investors, helping regulators and the public understand how these entities manage vast amounts of capital. By requiring large investors to regularly disclose their portfolios, the SEC aims to promote fair and efficient markets.

Who must file this form? Only institutional investment managers managing $100 million or more are required to file the Form 13F-NT. Key terms associated with this form include ‘institutional investment manager’, which refers to individuals or firms that manage investment assets on behalf of others, and ‘reporting manager’, which denotes the entity that files the form.

The filing requirements for Form 13F-NT

To file Form 13F-NT, the institutional investment manager must first determine if they meet the eligibility criteria—managing at least $100 million in securities. The filing process involves several steps, starting with the proper identification of ownership and classification of securities held.

Institutional managers are required to file Form 13F-NT quarterly, typically no later than 45 days after the end of each quarter. This timeline ensures that the financial disclosures reflect the most recent holdings.

Filing can be done electronically through the SEC's EDGAR system or via a paper submission. Electronic filing is generally preferred for its efficiency and immediacy. Late filings or non-compliance can result in significant penalties, emphasizing the importance of adhering to deadlines.

Key components of the Form 13F-NT

Form 13F-NT contains several critical sections that need attention during completion. Firstly, it includes essential information about the reporting manager, such as name, address, and contact details. This is crucial for the identification of the manager and their portfolios.

Another significant component is the list of securities. This section requires managers to categorize their holdings into appropriate classes, such as equity securities, options, and other investments. Declaration statements assure the accuracy and truthfulness of the information provided in the filing.

To ensure a smooth filing process, it is vital for managers to avoid common pitfalls. For instance, inaccurately categorizing holdings or providing outdated information can result in complications or penalties.

Submission types for Form 13F-NT

There are different types of submissions related to the Form 13F filing process. The initial submission includes the first instance of the filing by a reporting manager, while amendments are made to correct previously filed forms. It's essential for institutional managers to ensure all submissions are accurate and up-to-date.

Additionally, confidential filings are available under certain criteria, allowing managers to request confidentiality for specific holdings to mitigate market impact or protect sensitive strategies. Understanding these filing types helps managers determine the appropriate submission method for their situation.

It's essential to draw a distinction between Form 13F and Form 13F-NT, as the former generally refers to the detailed filings while the latter is used for specific short-form disclosures. Knowing the difference can simplify the filing process.

Filing deadlines and timelines

Timely filing of Form 13F-NT is crucial for compliance with SEC regulations. The deadlines are set at 45 days following the end of each quarter, providing institutional managers with a clear timeline for preparing their disclosures. Missing these deadlines can result in complications, therefore managers must be diligent in tracking filing periods.

It's also essential for firms to have a timeline in place for reviewing and updating their filings. Regular internal audits can help ensure that filings are accurate and meet all compliance requirements. Managers should also be aware of potential extensions, though these should be utilized only in unavoidable circumstances.

How to fill out Form 13F-NT

Filling out Form 13F-NT can seem daunting, but by following a step-by-step process, managers can ensure accuracy and compliance. First, gather all necessary information, including details about the reporting manager and a comprehensive list of the securities held.

Using templates and digital tools, such as pdfFiller, can streamline the completion process. pdfFiller offers features tailored specifically for form filling, including easy edits, e-signing capabilities, and collaboration tools, enhancing the overall efficiency of the submission.

Finally, before submission, conduct a thorough review of the completed form. Ensure all entries are correct and up to date. Data integrity is vital, as inaccuracies could lead to delays or issues with regulatory compliance.

Managing your Form 13F-NT submissions

Effective management of Form 13F-NT submissions involves implementing best practices for tracking and organization. Keeping meticulous records of both submitted forms and their respective deadlines ensures that institutional managers maintain compliance and avoid penalties.

Utilizing document management tools can significantly enhance this process. Features such as version control and shared access available on platforms like pdfFiller allow teams to collaborate seamlessly, ensuring that everyone involved is on the same page during the filing process.

Consistent communication among team members is vital when submitting Form 13F-NT. Establishing roles and setting clear guidelines will streamline the process and minimize potential errors.

Resources for assistance with Form 13F-NT

As institutional managers navigate the complexities of Form 13F-NT, resources are available to provide assistance. Platforms like pdfFiller enhance the filing process by offering tools for document editing, signing, and collaboration, ensuring that managers can focus on accuracy and compliance.

In addition to utilizing document management tools, managers should consider contacting regulatory bodies for specific inquiries regarding filing nuances. Besides, engaging in educational webinars will equip them with deeper insights into best practices and updates related to Form 13F-NT.

Common challenges faced when filing Form 13F-NT

Filing Form 13F-NT is not without its challenges. Many institutional managers encounter frequent errors stemming from misclassification of securities or oversights during the data entry process. To avoid these mistakes, establishing a thorough review process prior to submission is essential.

Additionally, troubleshooting issues with electronic submissions can arise, particularly if systems are down or if there are discrepancies in data formatting. Proper training and understanding of submission requirements can help alleviate these challenges.

Real-life case studies offer insights into both successful filings and common challenges. Learning from previous errors can provide valuable lessons for institutional managers aiming to improve their filing accuracy.

Trends and updates in Form 13F-NT compliance

The landscape of Form 13F-NT compliance is continually evolving, with recent regulatory changes impacting how institutional investors must report their holdings. Recent years have seen increased scrutiny on disclosures, requiring firms to be more transparent in their reporting practices.

Looking to the future, companies must adapt to the changing financial regulations and shifting investor expectations. Developing robust compliance frameworks and data management practices will be critical for navigating this evolving environment.

As institutional managers prepare for these changes, staying informed about upcoming legislation and best practices will ensure they remain compliant while maintaining investor trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 13f-nt directly from Gmail?

How do I make changes in form 13f-nt?

Can I create an electronic signature for the form 13f-nt in Chrome?

What is form 13f-nt?

Who is required to file form 13f-nt?

How to fill out form 13f-nt?

What is the purpose of form 13f-nt?

What information must be reported on form 13f-nt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.