Get the free Sec Form 3

Get, Create, Make and Sign sec form 3

How to edit sec form 3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 3

How to fill out sec form 3

Who needs sec form 3?

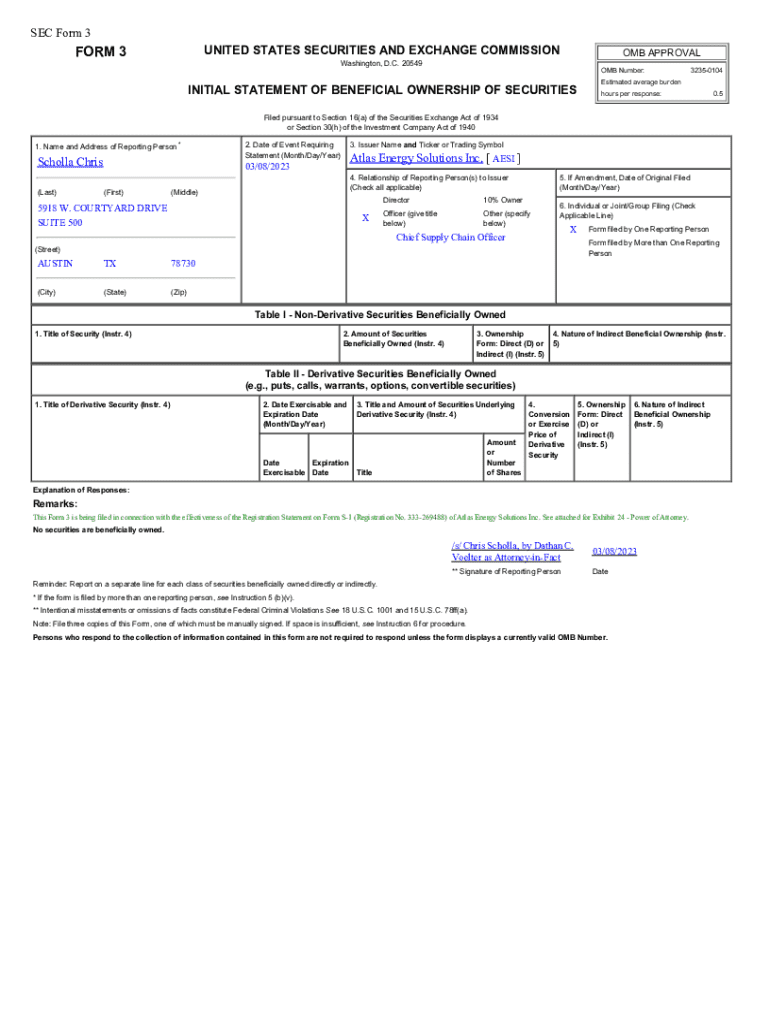

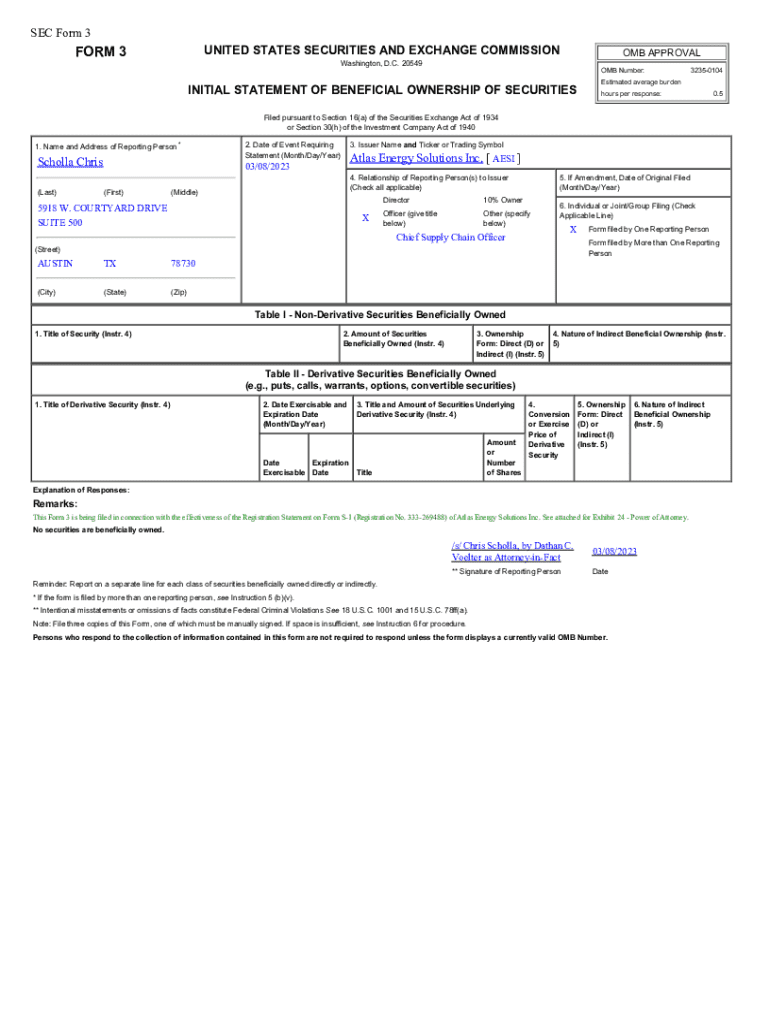

Understanding SEC Form 3: A Comprehensive Guide

Understanding SEC Form 3

SEC Form 3 is a crucial document in the securities reporting landscape, specifically designed for companies and individuals who hold significant ownership stakes in publicly traded companies. This form is often the first step in disclosing beneficial ownership of a company’s securities to the SEC and is fundamental to maintaining market transparency.

The primary purpose of SEC Form 3 is to provide the Securities and Exchange Commission (SEC) with details about beneficial ownership. This form must be filed whenever an individual or entity becomes a beneficial owner of more than 10% of a class of a company’s equity securities registered pursuant to the Securities Exchange Act of 1934. It serves as a vital tool for regulation and oversight, enabling investors to understand who controls a company.

Key legislation surrounding SEC Form 3 includes the Securities Exchange Act, which mandates timely and accurate reporting by insiders. Compliance is essential, as it helps to foster trust and integrity within the financial markets.

Who is required to file SEC Form 3?

Beneficial owners are defined as individuals or entities that possess the power to vote or direct the voting of the securities, or to dispose of, or direct the disposition of such securities. This definition often applies to executives, directors, and shareholders owning more than 10% of the company.

Certain situations trigger the need to file SEC Form 3, including acquiring shares through direct purchases, stock options, or other means. Timeliness is critical; filing must occur within 10 days of becoming a beneficial owner to ensure compliance and maintain the integrity of market information.

Key components of SEC Form 3

SEC Form 3 requires various pieces of information, including personal details of the beneficial owner, specific security ownership information, and any reporting obligations the owner may have. Each component plays a role in both the accuracy of ownership disclosure and in fulfilling regulatory requirements.

The form includes itemized sections, such as personal information (name and address) and details on security ownership (including the number of shares owned and their class). It's crucial to ensure all information is accurate to prevent potential penalties or issues. Common mistakes can include failing to report certain security holdings or incorrectly filling out personal identification details.

Detailed step-by-step guide to completing SEC Form 3

Preparation for filing SEC Form 3 is key. Start by gathering necessary documentation such as your recent stock certificates and transaction records. Identifying beneficial ownership is crucial—confirm that you meet the 10% threshold for ownership.

Filling out the form can be done in several steps: 1. **Section-by-section instruction:** Begin by entering your personal information accurately, followed by detailing the security ownership. 2. **Tips for accurate reporting:** Double-check figures and ensure all classes of securities are documented. 3. **Reviewing and submitting your filing:** Before submission, use a checklist to verify completeness and accuracy, then confirm that your filing has been processed, ensuring compliance and accuracy.

Filing examples and scenarios

Real-life case studies help illustrate the importance and nuances of SEC Form 3 filings. For instance, a new beneficial ownership may arise if a director of a firm exercises stock options resulting in ownership exceeding the 10% threshold, prompting the need for an SEC Form 3 filing.

Several common filing scenarios include changes in ownership percentages that necessitate updates to filed forms. These adjustments can result from stock sales or additional share purchases, underscoring the dynamic nature of security ownership which must be reported regularly.

Frequently asked questions about SEC Form 3

Missing the deadline for filing SEC Form 3 can lead to penalties; thus, it’s imperative to stay organized. Senor beneficial owners must also be aware they can amend their filings; this feature enables corrections as needed.

SEC Form 3 is the introductory form in a sequence, followed by Forms 4 and 5, each with different requirements and reporting timelines. Understanding the distinctions among these forms is essential for comprehensive compliance.

Contextualizing SEC Form 3 in the bigger picture

SEC filings play a pivotal role in maintaining market transparency. They provide valuable insights to investors, enabling informed decisions based on the ownership structures of publicly traded companies. Awareness of SEC Form 3's role encourages investor confidence, ultimately leading to a healthier market.

Comparatively, understanding Forms 4 and 5—required for reporting transactions and holdings, respectively—helps complete the picture of insider reporting. This systemic visibility promotes accountability among executives and directors, reinforcing the integrity of financial markets.

Interactive tools provided by pdfFiller

pdfFiller offers a suite of features that enhance the experience of users filing SEC Form 3. With cloud-based editing capabilities, users can edit, eSign, and collaborate seamlessly from anywhere. This flexibility is particularly valuable for individuals and teams engaged in detailed financial reporting.

User testimonials highlight the effectiveness of pdfFiller's solutions in streamlining document management processes. These real-world case highlights demonstrate how pdfFiller empowers users to maintain compliance while simplifying the often complex filing process.

Best practices for managing SEC filings

To effectively manage SEC filings, consider implementing reminder systems for future filings. Utilizing document management tools can help centralize form records and ensure timely updates.

Keeping track of changes in ownership is equally important. Set up alerts for significant ownership changes within your company or peers, which aids in proactive compliance and awareness of fluctuations in beneficial ownership.

Available resources for SEC Form 3

Numerous official resources are available through the SEC website, providing guidelines and tools for completing SEC Form 3 accurately. These resources offer templates, filing instructions, and specifics on filing amendments if necessary.

Several third-party websites also provide valuable insights and tutorials on completing SEC Form 3. Video tutorials offered through platforms like pdfFiller can be particularly beneficial, guiding users through the nuances of form completion and common pitfalls to avoid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sec form 3 online?

How do I edit sec form 3 in Chrome?

Can I edit sec form 3 on an iOS device?

What is sec form 3?

Who is required to file sec form 3?

How to fill out sec form 3?

What is the purpose of sec form 3?

What information must be reported on sec form 3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.