Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A comprehensive guide to SEC Form 4

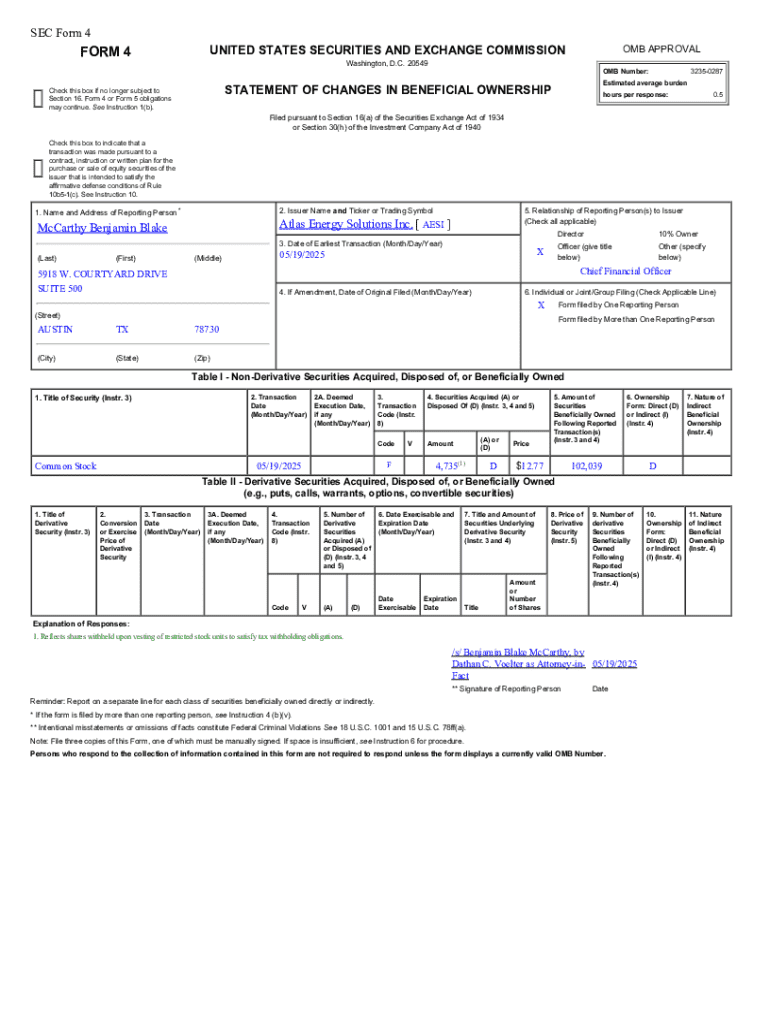

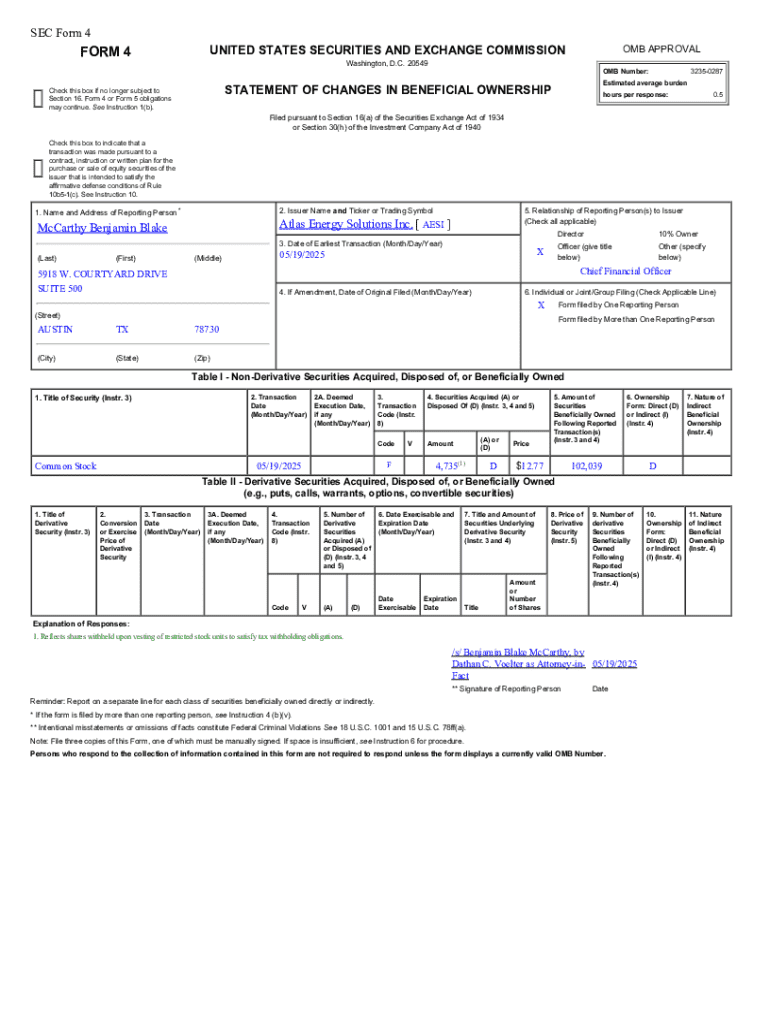

Overview of SEC Form 4

SEC Form 4 is a crucial document filed with the U.S. Securities and Exchange Commission (SEC) that provides insights into the transactions of a company's insiders—namely, its officers, directors, and beneficial owners holding more than 10% of a company's stock. The purpose of this form is to report changes in ownership stakes, which helps promote transparency in the trading of securities and aims to prevent insider trading.

Insider trading, whether legal or illegal, plays a significant role in the investment landscape. SEC Form 4 serves as a vital tool in this regard by ensuring that market participants have access to key information about the trading activities of the company’s insiders, thus leveling the playing field for all investors.

Understanding the components of SEC Form 4

SEC Form 4 consists of two main parts that categorize the information submitted by insiders. Part I contains insider information, while Part II provides a detailed table of transactions that have occurred. In Part I, the insider—who may be a company executive or board member—must disclose their name, title, and relationship to the company.

Part II breaks down the specific transactions performed by the insider, detailing the transaction codes used, transaction type, and effective date. Each of these codes is crucial for understanding the nature of the insider's trades.

The filing process

Filing SEC Form 4 is mandatory for any corporate insider who trades in their company's stock. These filings must generally be made within two business days of the transaction, which helps ensure timely access to insider trading information.

To complete SEC Form 4 accurately, insiders should follow these steps: first, gather all relevant information, including transaction dates and types. Next, fill out each section of the form meticulously, ensuring that the data accurately reflects the transactions carried out. Avoiding common pitfalls, such as incorrect codes or missing signatures, is crucial to maintaining compliance.

Analyzing SEC Form 4 filings

Interpreting the information on SEC Form 4 involves looking beyond the numbers to understand market sentiment. Large volumes of insider buying, for example, may indicate confidence in a company's future performance, while significant selling could signal uncertainty or a desire to cash out before potential downturns.

Investors can use these filings to identify potential opportunities or risks. By analyzing trends in insider trading activity, one can gauge the sentiment among company leaders, which may influence investment decisions.

SEC Form 4 in the context of insider trading

Insider trading involves the buying and selling of stock based on non-public information about a company. While legal under certain circumstances, illegal insider trading can lead to serious consequences. SEC Form 4 serves as a safeguard, ensuring that insiders disclose their trading activities and enabling regulators to monitor compliance with the law.

There are noteworthy cases where violations of SEC Form 4 have resulted in hefty penalties for the involved individuals. Real-world implications highlight the importance of transparency and adherence to trading regulations, serving as a reminder to insiders of their responsibilities.

Interactive tools and resources for managing SEC Form 4

For individuals or teams engaged in frequent SEC Form 4 management, tools like pdfFiller simplify the process significantly. This platform allows users to upload, edit, and manage SEC Form 4 documents seamlessly. Moreover, eSigning features facilitate real-time collaboration, making it easier to finalize filings efficiently.

The collaborative capabilities mean team members can share and modify documentation as needed, ensuring accuracy and compliance with filing timelines.

Advanced insights on SEC Form 4

SEC Form 4 can be compared to other SEC forms such as Form 3 and Form 5, which have distinct purposes and filing requirements related to insider trading. Understanding these differences helps investors analyze disclosures most effectively.

By using various tools and platforms that offer predictive analytics based on filing trends, investors can forecast potential stock movements driven by insider trading patterns. Case studies of major companies that have reported notable SEC Form 4 transactions provide empirical evidence of how insider behavior correlates with stock performance.

Common FAQs about SEC Form 4

One common question is how often insiders must file SEC Form 4. Typically, a filing is required within two business days of a transaction. If a filing is missed, it could lead to legal consequences and potential fines imposed by the SEC. Furthermore, individuals can access historical Form 4 filings via the SEC's EDGAR database, which serves as a comprehensive resource for investigating insider activity.

Testimonials and case studies

Users of pdfFiller have shared their positive experiences regarding the seamless completion of SEC Form 4. The platform's user-friendly interface and collaborative features have simplified the filing process, allowing teams to sign and manage documents efficiently.

Success stories often include investors who have made informed decisions based on insider trading data filtered through SEC Form 4 disclosures, demonstrating the substantial value these filings offer to savvy market participants.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the sec form 4 in Gmail?

How do I fill out sec form 4 using my mobile device?

How can I fill out sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.