Get the free Market Linked Securities Term Sheet

Get, Create, Make and Sign market linked securities term

How to edit market linked securities term online

Uncompromising security for your PDF editing and eSignature needs

How to fill out market linked securities term

How to fill out market linked securities term

Who needs market linked securities term?

Comprehensive Guide to Market Linked Securities Term Form

Understanding market linked securities

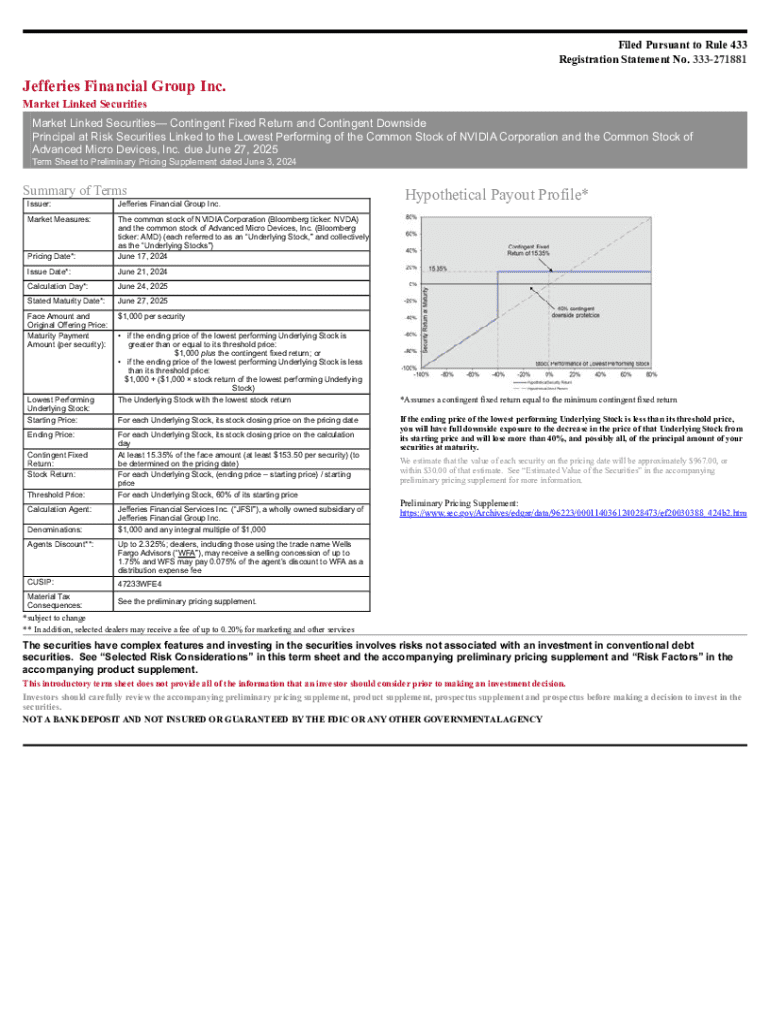

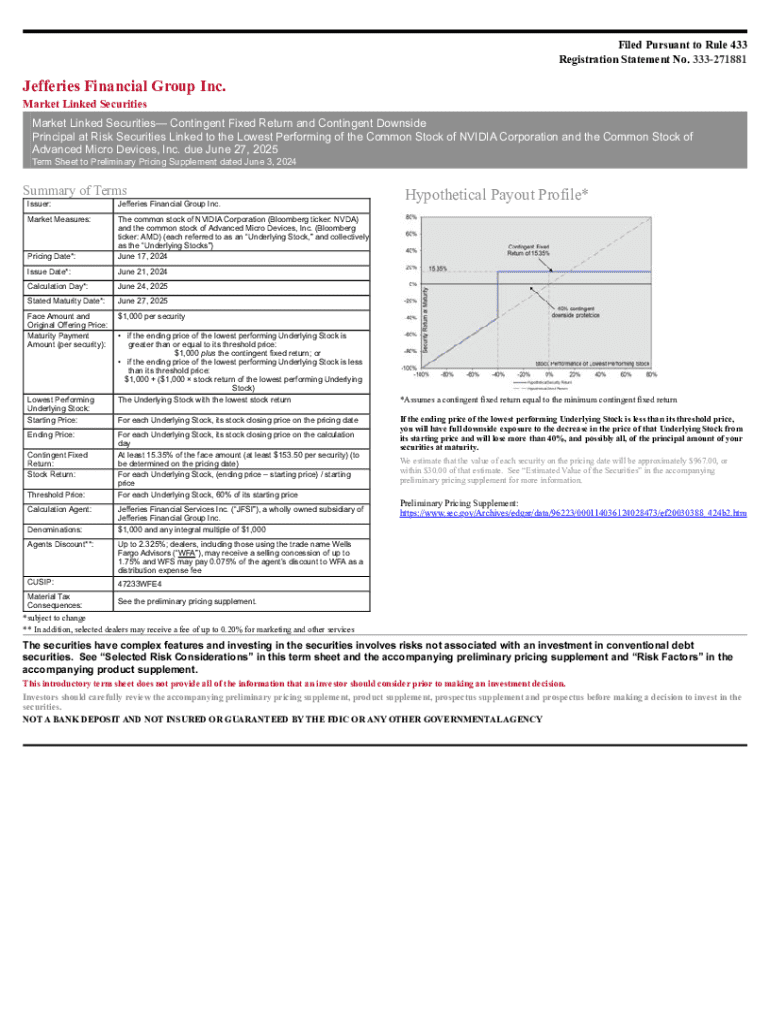

Market linked securities (MLS) are innovative investment products that offer returns based on the performance of underlying assets such as equities, interest rates, or market indices. These securities bridge the gap between fixed-income instruments and equities, providing unique investment opportunities.

One of the defining characteristics of market linked securities is their capacity to provide potentially higher returns tied to market performance, making them appealing for investors willing to accept some level of risk. Unlike traditional securities that offer fixed returns, MLS can enable investors to capitalize on favorable market conditions while still offering some protection against downside risks.

While traditional securities like stocks and bonds provide fixed income or fixed dividends, market linked securities can deliver returns that dynamically align with the market trends, making them a versatile addition to an investment portfolio.

Overview of the market linked securities term form

The market linked securities term form is a critical document that outlines the specifics of the investment vehicle. Its primary purpose is to provide all relevant parties with essential details regarding the terms and conditions governing the securities, ensuring clarity and compliance throughout the investment process.

Key components of the market linked securities term form include investor details, the specific structure of the securities, maturity dates, and returns mechanisms. Each of these elements plays a vital role in determining how the securities will perform and the responsibilities of all involved parties.

Regulatory requirements necessitate that all parties involved fully understand the implications of the securities, so thorough compliance considerations are embedded within the form structure.

Step-by-step guide to filling out the market linked securities term form

Completing the market linked securities term form requires careful attention and a collection of essential documentation. Investors should prepare by gathering personal information and investment details to accurately fill out the form.

Once the initial information is gathered, the next step involves detailing specific sections of the form.

One common mistake to avoid is not reviewing the terms and conditions thoroughly before signing. This could lead to unexpected obligations or interpretations of the investment agreement.

Editing and customizing the term form using pdfFiller

To accurately fill out the market linked securities term form, leveraging digital tools can streamline the process significantly. pdfFiller provides access to the form online, offering functionality for editing and customization that simplifies completion.

Accessing the market linked securities term form through pdfFiller is straightforward. Users can search for the specific form directly on the platform and easily edit it according to individual investment needs.

Customizations can include altering the input fields to focus on specific investment needs or terms that reflect individual agreements, enhancing clarity and personalized communication.

Signing the market linked securities term form

Once the necessary information has been filled out, the next step is signing the market linked securities term form. Understanding the eSignature process is crucial to ensure that both parties legitimize the contract without the need for physical paperwork.

Best practices for secure signing include using strong passwords, ensuring the signer’s identity is verified, and being aware of the sharing settings of the document to maintain its confidentiality.

Remote signing solutions are readily available, allowing collaborative teams to execute and manage the document efficiently. This can significantly lower the turnaround time for finalizing investments, enabling faster engagement with market opportunities.

Managing your documents efficiently

After completion and signing, the market linked securities term form must be stored efficiently for future reference and compliance. Organizing documents systematically will prevent loss and promote ease of access when needed.

Furthermore, sharing the term form with financial advisors or legal teams is seamless through digital platforms. This open communication fosters proactive management of investments, allowing teams to track document history and any changes made.

FAQs about market linked securities term form

Investors may have questions regarding potential issues related to the market linked securities term form. One common concern is what to do if complications arise after submission. Maintaining clear communication with the issuer’s support team can assist in resolving these issues promptly.

Additionally, understanding the impact of market conditions on securities is vital for investors. Market fluctuations can directly affect returns, so being informed about economic indicators and trends becomes essential.

The processing time after submission varies depending on the issuing entity. Typically, it could range from a few hours to several days, depending on regulatory reviews and the complexity of the investment structure.

Using pdfFiller for ongoing document management

Continuing with document management, pdfFiller offers an array of features that enhance the workflow for securing, signing, and tracking forms like the market linked securities term form. The platform’s user-friendly interface and collaborative tools streamline communications and updates.

Key features include comprehensive editing tools to customize documents, secure sharing options, and the ability to maintain an audit trail of changes, ensuring accountability and transparency.

Regularly updating security settings and increasing access restrictions will enhance data protection in a cloud-based environment, guarding sensitive financial information associated with market linked securities.

Appendix

To further enhance your understanding of market linked securities, the appendix includes a glossary of terms used frequently in this domain, along with a sample completed market linked securities term form. This resource can be invaluable for investors and professionals aiming to navigate the complexities of MLS with greater confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute market linked securities term online?

Can I create an electronic signature for signing my market linked securities term in Gmail?

How do I fill out market linked securities term using my mobile device?

What is market linked securities term?

Who is required to file market linked securities term?

How to fill out market linked securities term?

What is the purpose of market linked securities term?

What information must be reported on market linked securities term?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.