Get the free Beneficiary Contact Form

Get, Create, Make and Sign beneficiary contact form

Editing beneficiary contact form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary contact form

How to fill out beneficiary contact form

Who needs beneficiary contact form?

Beneficiary contact form: A comprehensive how-to guide

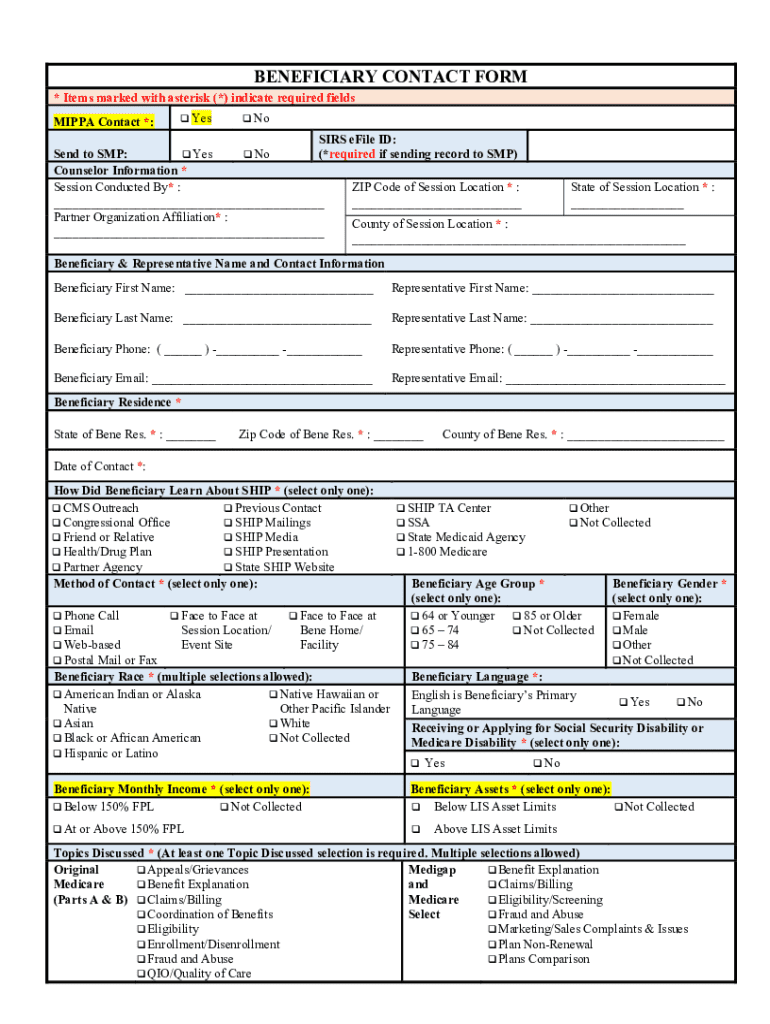

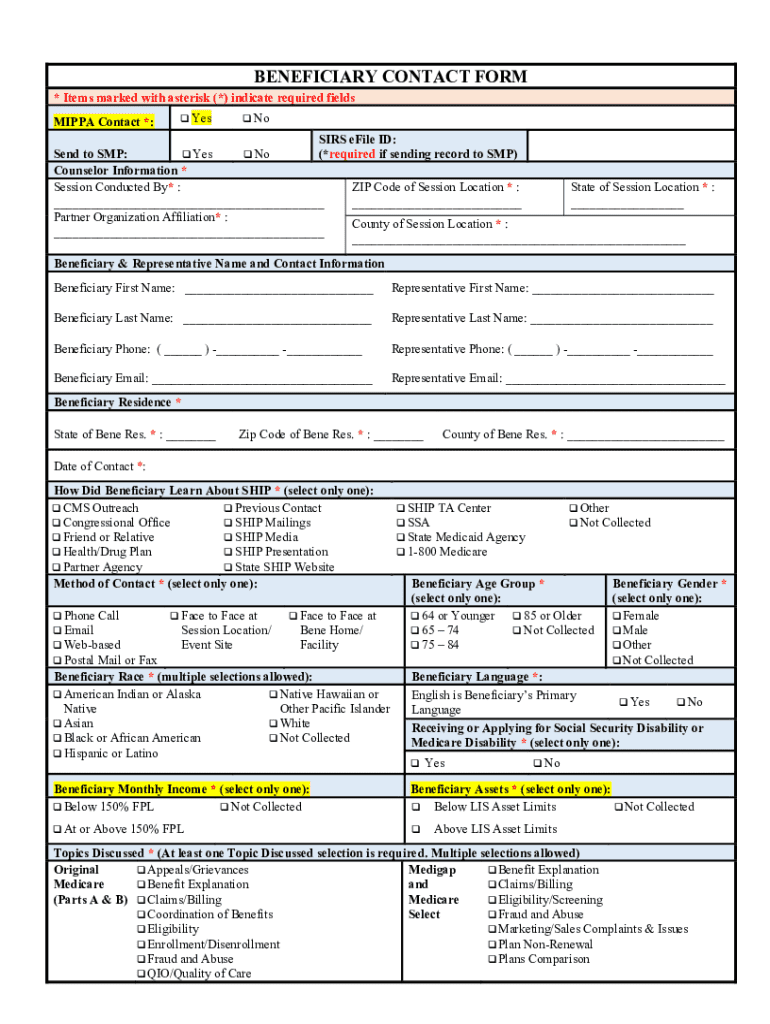

Understanding the beneficiary contact form

A beneficiary contact form serves a crucial role in various financial and legal contexts, primarily ensuring that an individual's designated beneficiaries are clearly identified and their contact information is readily available. This form becomes the bedrock of establishing who will receive benefits or assets when the account holder passes away. It’s essential to complete this form with accurate and current information, as any discrepancies can lead to misunderstandings and potentially hinder the distribution of assets.

The significance of a beneficiary contact form extends beyond mere documentation; it affects the smooth transition of wealth, insurance benefits, or retirement savings, impacting loved ones' financial futures. By designating specific beneficiaries, you eliminate the guesswork for financial institutions concerning your wishes, fostering clarity after your passing.

When is this form required?

This form is primarily required during critical life events—especially when setting up insurance policies, retirement accounts, estate plans, or any accounts where asset distribution may occur posthumously. Situations like enrolling in a health or life insurance policy, initiating retirement plans such as IRAs or 401(k)s, or drafting a will necessitate filling out a beneficiary contact form. In any scenario where your assets might need to be distributed after your demise, ensuring you complete this form accurately can save your family considerable stress and confusion.

Key components of the beneficiary contact form

A thorough understanding of the key components of the beneficiary contact form is vital for effective completion. Each section works collaboratively to give a comprehensive understanding of your estate distribution wishes and ensures clarity in communication with financial institutions.

Personal information section

The personal information section includes necessary details such as your full name, date of birth, and contact numbers. Providing accurate information here is critical because it helps to identify you unequivocally against records held by financial institutions. This information serves as the groundwork for linking your account with the specified beneficiaries.

Beneficiary information

The most significant section is the beneficiary information. Here, you’ll need to identify both primary and contingent beneficiaries. Primary beneficiaries are first in line to receive assets, while contingent beneficiaries are backup options, stepping in if the primary cannot inherit. For each beneficiary, ensure you include their full name, relationship to you, and the percentage of the total asset each will receive. This clarity helps prevent disputes and confusion among heirs.

Acknowledgment and signature

The acknowledgment and signature section emphasizes your understanding of the terms and conditions set out by the financial institution. Signing and dating the form explicitly indicates that you agree and affirm your selected beneficiaries. It is crucial to follow the instructions for signing to ensure the form is not rejected due to a technical misstep.

Step-by-step instructions for filling out the form

Filling out the beneficiary contact form can feel daunting, but breaking it down into steps simplifies the process. Start with gathering the necessary documents to ensure you have all the information at hand before diving into the form.

Gathering necessary documents

Before starting, it's important to have relevant documents such as identification cards, existing beneficiary contact forms, and any legal documentation regarding your assets. Having access to this information streamlines the process and reduces the likelihood of errors.

Filling out the personal information

Take your time while filling out the personal information section. Double-check that your name is spelled correctly, and all relevant numbers, including the ones associated with your estate, are accurate. Errors in this section can lead to delays or complications in asset transfer.

Entering beneficiary information

When entering beneficiary information, ensure accuracy in spelling and relationships. Common scenarios include naming a spouse, children, or friends as primary beneficiaries. Make sure to note any percentages each beneficiary is receiving—this is especially important in blended family situations where clarity can prevent future disputes.

Review and edit

Once you have filled in the form, carefully review all sections for completeness. Look out for typographical errors or missing information, as even small mistakes can create major issues down the line. Consider having a trusted friend or family member review it as well—they may catch errors you overlooked.

Signing and submitting the form

Follow the instructions for signing the form meticulously, indicating your consent to the information provided. After signing, submissions can vary; typically, they must be sent to an insurance provider or financial institution either via mail or electronically. Be sure to follow up to confirm receipt.

Common mistakes to avoid

Even minor mistakes can significantly affect the validity of your beneficiary contact form. The most prevalent errors can be avoided with careful attention to detail and awareness of common pitfalls.

Incomplete information

Leaving sections blank or failing to provide essential information can render the form invalid. Ensure each area requiring information is filled accurately to prevent any delays in the processing of your wishes.

Incorrect beneficiary designation

Designating beneficiaries requires clarity. Avoid vague terms and general labels as they can lead to conflicts. Instead, specify relationships clearly to eliminate confusion among heirs. Educational misunderstandings can lead to detrimental disputes during emotionally charged times.

Not keeping a copy

Upon submission, you must keep a copy of the beneficiary contact form. This document acts as your reference and safeguard against any disputes or complications that might arise should concerns emerge about your beneficiary designations in the future.

Managing your beneficiary contact form

Managing your beneficiary contact form effectively ensures that your asset distribution aligns with any life changes. Considering how fluid life circumstances can be—such as marriage, divorce, or changes in financial status—keeping this form updated is crucial.

Making changes to your submission

If you need to change beneficiary information after submission, consult the institution's guidelines. Many will provide you with specific processes for updating beneficiary designations. Always ensure any changes are documented formally to prevent surprises later.

Contacting support for assistance

Customer service teams can be invaluable resources. Many institutions have dedicated lines for beneficiaries or estate handling queries, making it easy to get the help you need. Be prepared with your personal information and original submission details to streamline the support process.

Tools for document management on pdfFiller

pdfFiller offers robust tools designed specifically for document management, enabling users to edit, sign, and store forms from any location. Their features can assist you in maintaining accurate records of your beneficiary contact form, ensuring that you can quickly update or access the document when required.

Case studies and examples

Hearing about real-life situations helps to understand the importance of managing a beneficiary contact form effectively. These examples illustrate successful submissions and challenges faced, shedding light on the practical applications of these procedures.

Successful beneficiary contact form submissions

Consider the experience of Angela, who successfully submitted her beneficiary contact form for her retirement account. By thoroughly reviewing her information and confirming the beneficiaries’ details with them in advance, she ensured a smooth distribution process. Upon her passing, her wishes were followed seamlessly, illustrating the significance of being proactive.

Challenges faced by users

In contrast, John faced challenges when he updated his contact form but neglected to keep a copy of the previous version. After his passing, his family discovered that his updated beneficiary list conflicted with an earlier version, leading to a legal dispute over distribution. This case exemplifies why retaining copies of all submitted forms is vital.

Interactive tools and resources

Embracing interactive tools can significantly streamline your experience with the beneficiary contact form. Many platforms, like pdfFiller, offer templates that facilitate the filling-out process, making it quicker and more efficient.

Integrating with digital solutions on pdfFiller

On pdfFiller, users can access a variety of templates and form assistance features, which can simplify the task of creating or altering beneficiary contact forms. The user-friendly interface allows for easy editing and collaboration, making it beneficial for both individuals and teams.

FAQs about the beneficiary contact form

Many individuals have similar questions regarding beneficiary contact forms. Common queries often include concerns about how often the form should be updated, what to do if a beneficiary predeceases the form's creator, and how to protect their information. pdfFiller provides insights and answers to these frequent inquiries to assist users in navigating their obligations.

Final remarks

Navigating the complexities of a beneficiary contact form doesn’t need to be overwhelming. Utilizing structured approaches and digital platforms like pdfFiller ensures the execution of these important documents meets all requirements. It’s essential to verify details before submission, ensuring that your loved ones inherit your wishes as intended.

Benefits of using pdfFiller for document handling

Employing pdfFiller for managing your beneficiary contact form offers significant advantages. From streamlined document handling to the ability to create, edit, eSign, and store forms in a secure cloud-based environment, pdfFiller empowers users to manage their documents effortlessly. This efficiency and accessibility are indispensable for individuals and teams who seek to maintain control over sensitive information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete beneficiary contact form online?

How do I complete beneficiary contact form on an iOS device?

Can I edit beneficiary contact form on an Android device?

What is beneficiary contact form?

Who is required to file beneficiary contact form?

How to fill out beneficiary contact form?

What is the purpose of beneficiary contact form?

What information must be reported on beneficiary contact form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.