Get the free Business Personal Property Tax Return

Get, Create, Make and Sign business personal property tax

How to edit business personal property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business personal property tax

How to fill out business personal property tax

Who needs business personal property tax?

Comprehensive Guide to Business Personal Property Tax Form

Understanding business personal property tax

Business personal property tax is levied on the tangible assets owned by businesses that are not classified as real property, such as machinery, equipment, furniture, and inventory. Understanding this tax is crucial for business owners, as it impacts financial planning and compliance with local taxation laws.

Not every business is subject to this tax; it largely depends on the local jurisdiction and the specific local laws governing personal property tax. However, typically all businesses operating within a municipality may need to report their personal property and file accordingly.

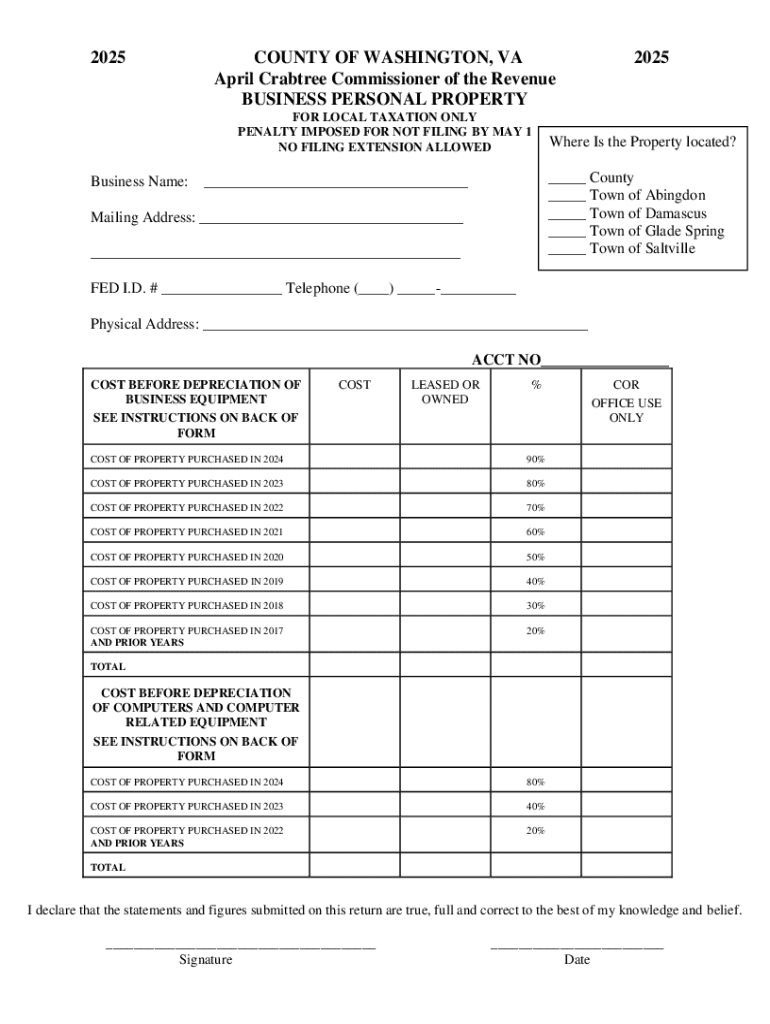

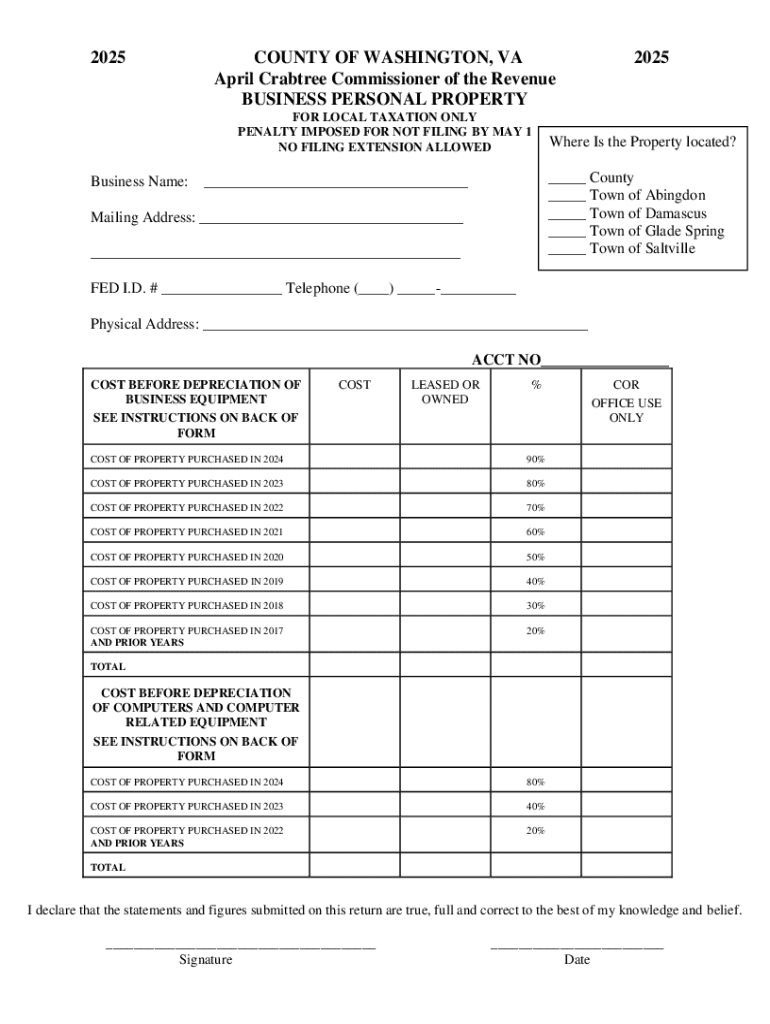

The business personal property tax form: An overview

The business personal property tax form is an essential document that businesses must prepare and file to report their eligible assets to local tax authorities. This form ensures accurate assessment and collection of taxes owed on business personal property.

Typically, all businesses that own tangible property within a local jurisdiction are required to file this form by specific deadlines, often coinciding with the annual tax assessment cycle. The deadlines vary by location, so it’s imperative to verify local regulations to avoid penalties.

Preparing to fill out the business personal property tax form

Before tackling the business personal property tax form, it's important to gather the necessary documentation. This preparation can streamline the filing process and help to avoid errors that could delay submission or lead to penalties.

Essential documents often include a detailed listing of all business property owned, accurate valuations for each asset, and prior year tax returns. Keeping these documents organized will make it easier to complete the form correctly.

Step-by-step instructions for completing the form

Filling out the business personal property tax form requires attention to detail and accuracy. Start with identifying the taxpayer information, ensuring all business details are correct. Continue with the property description section, where specific classifications of each asset must be documented.

Next, report each asset individually, including their value, and calculate the total taxable value by considering factors such as depreciation. Provide accurate data to minimize discrepancies and facilitate a smoother review process.

Editing and customizing your form with pdfFiller

Using pdfFiller, you can edit your business personal property tax form efficiently with interactive tools that allow for adding text, fields, and annotations. Being able to customize these forms helps ensure that every detail is accounted for, reflecting your business's unique valuation and asset classification.

You can effortlessly edit a PDF form to correct mistakes or update any information required as circumstances change. Additionally, the eSignature feature makes it easy to sign digitally, enhancing convenience and speeding up the filing process.

Submitting your business personal property tax form

After completing your business personal property tax form, the next step is submission. Various submission methods are available, including online submission through local government portals and traditional mail options. It’s important to choose the method that is most reliable and secure for your documents.

Ensure you track your submission status to confirm receipt by the tax authority. This can usually be done online, giving you peace of mind that your tax obligations have been met.

Common challenges and solutions

Filing your business personal property tax form can come with its challenges. Often, forms are either rejected for incomplete information or submitted with errors. Ensure that each detail is accurate, as rejections can lead to complications and possible penalties for late filing.

If you encounter any issues, there are steps you can take to address them. Corrections or amendments to your submission can often be made within a specified timeframe without additional penalties, but proactive communication with tax authorities is essential.

Managing your documents post-submission

Once your business personal property tax form has been submitted, maintaining organization of your documents is key. Using pdfFiller, business owners can easily store and manage tax-related documents, ensuring that all relevant paperwork is securely accessible for future reference.

Good record-keeping practices not only help in complying with annual reporting requirements, but they also prepare your business for audits or evaluations. Plan ahead for future tax years by creating a clear documentation strategy.

Resources and support

For those navigating the complexities of the business personal property tax form, various resources are available. Local government offices can provide guidance on specific requirements unique to your jurisdiction, helping clarify what must be reported and how taxes are calculated.

Additionally, pdfFiller offers comprehensive customer support to assist with document management and the use of its features, ensuring that users can effectively navigate form complexities.

Additional tax considerations for businesses

Every business has a unique tax obligation beyond the personal property tax form. It's essential to acknowledge and understand other local and state tax responsibilities, as failing to comply can lead to severe ramifications. Businesses may also be liable for income taxes, sales taxes, or employer-related taxes that should be kept in mind during financial planning.

Consulting with a tax professional can provide invaluable insights into your tax strategy, helping identify potential deductions and ensuring compliance across all obligations.

Insights on property tax appeals

If you disagree with your assessed value or feel you’re being taxed unfairly, understanding your rights as a taxpayer is essential. Property tax appeals offer a recourse mechanism that allows businesses to contest valuations overestimates or discrepancies.

The process for filing an appeal typically involves submitting a formal request to the appropriate local authority, often with supporting documentation to substantiate your claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business personal property tax?

Can I create an electronic signature for signing my business personal property tax in Gmail?

How do I edit business personal property tax on an iOS device?

What is business personal property tax?

Who is required to file business personal property tax?

How to fill out business personal property tax?

What is the purpose of business personal property tax?

What information must be reported on business personal property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.