Get the free New Business Personal Property Account Setup

Get, Create, Make and Sign new business personal property

How to edit new business personal property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new business personal property

How to fill out new business personal property

Who needs new business personal property?

Navigating the New Business Personal Property Form: A Comprehensive Guide

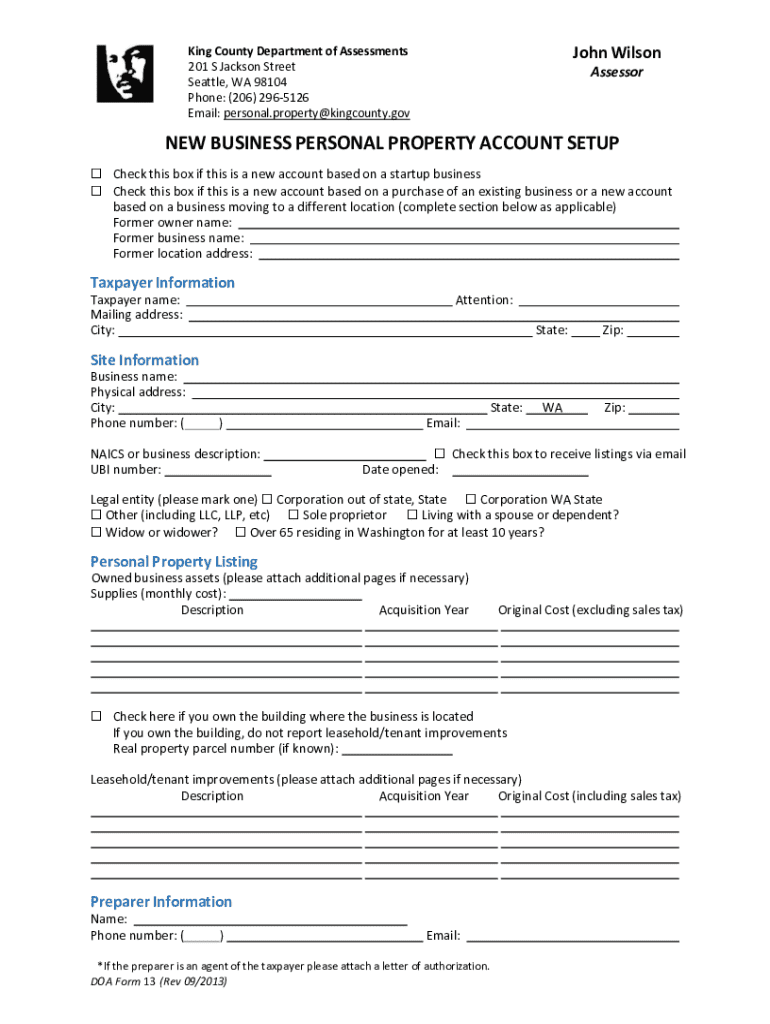

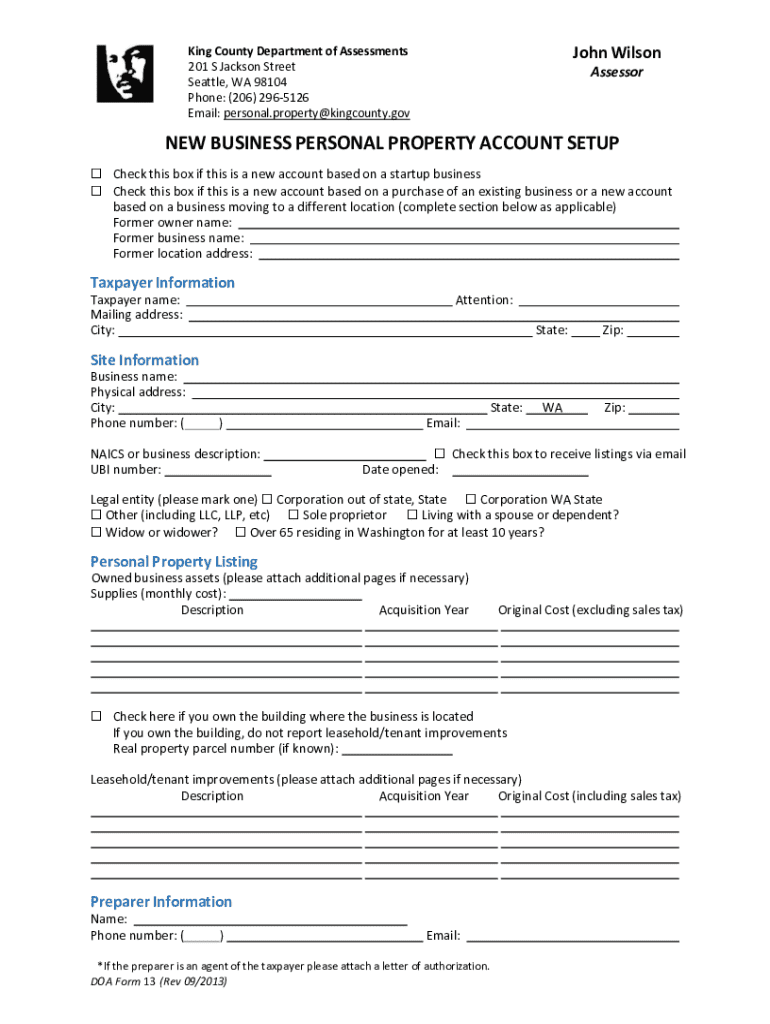

Understanding the new business personal property form

The new business personal property form is essential for businesses to report their personal property for taxation purposes. This form establishes a record of the personal assets held by a business, which can include equipment, furniture, and any other tangible items considered necessary for operation. Understanding and accurately completing this form is crucial as it directly impacts the tax assessments and valuations made by local taxing authorities.

Filing the new business personal property form is not merely a bureaucratic obligation; it serves significant financial implications for businesses. Accurate filings can ensure businesses maintain fair tax obligations while avoiding penalties and audits. On the contrary, failing to file can lead to unforeseen tax liabilities, increased penalties, and potential legal issues.

Eligibility criteria for filing

Not all businesses need to file the new business personal property form; eligibility varies by several factors, including the size of the business and the value of personal property. Generally, businesses that own personal property valued above a specific threshold, which can vary significantly between jurisdictions, must file. For example, a small business with minimal equipment may not meet the threshold required for filing, but a medium-sized enterprise with substantial assets will.

Additionally, certain types of businesses may have exemptions or differ in their reporting requirements. For instance, non-profits may not be required to file, while home-based businesses may have simplified forms or home office exemptions. It’s vital for business owners to assess their particular situation in relation to the local regulations surrounding personal property tax.

Step-by-step guide to completing the form

Completing the new business personal property form can seem daunting, but with adequate preparation, the process becomes straightforward. Start by gathering all necessary documentation, including asset lists, invoice records, and any existing tax documents related to your personal property. Understanding the required information fields — such as business identification, descriptions of personal property, and financial information — can ensure smooth completion.

When filling out the form, pay careful attention to each section: begin with clear business identification information that includes your business name, address, and tax identification number. Next, provide a detailed description of your personal property, including age, condition, and estimated value of the assets. Finally, accurately represent financial information while considering any tax implications. This methodical approach will limit errors and streamline the review process.

Interactive tools for calculating personal property tax

Utilizing interactive tools can significantly ease the burden of calculating personal property tax owed. Many local governmental websites now provide personal property tax calculators that allow business owners to enter their asset details and receive an estimate of their tax liabilities. These calculators can help businesses gain insights into their expected tax obligations, facilitating better financial planning.

Be sure to use these tools effectively by entering accurate information about your assets, including purchase dates and current market values. The estimates generated from these interactive tools can guide decision-making processes, helping businesses to budget and allocate resources effectively in anticipation of tax liabilities.

Common mistakes to avoid when completing the form

Mistakes while filling out the new business personal property form can have lasting implications. One of the most common pitfalls is submitting incomplete information, which may lead to a rejection of the form or delays in processing. Business owners should ensure they've answered every question and provided all required documentation before submission.

Another frequent mistake is misclassifying personal property. For instance, incorrectly listing equipment as supplies can result in inaccurate tax assessments. Deadlines for submission are equally critical; missing these can lead to penalties and other complications. Keeping a close calendar for deadlines is an essential practice for all businesses.

Managing and submitting your form

Business owners have several options for submitting the new business personal property form, including online and paper filing. Many jurisdictions now offer online submission portals, which can expedite the process and minimize errors. However, some may still prefer mailing a paper application for various reasons, including compliance with personal preferences or legal advice.

Important deadlines for submission vary by locality, often aligning with specific dates like April 1st of each year. After submitting the form, follow the submission by confirming receipt through whatever method was used, whether digital or mail. Keeping a record of submission provides essential documentation should any further questions or issues arise with the filing.

Understanding the review process

After submitting the new business personal property form, it undergoes a review process initiated by the local tax authority. Procedures may vary based on jurisdiction, but typically, the authority reviews the information for accuracy and compliance with relevant tax laws. Expect potential outcomes such as approval, requests for additional information, or even rejections due to inaccuracies.

If a rejection occurs, business owners are usually provided with a clear explanation and an opportunity to rectify any issues. It’s essential to address these promptly, as failure to comply can worsen tax liabilities or lead to further complications. Being proactive and maintaining open communication with tax authorities can greatly ease the resolution process.

Keeping records and maintaining compliance

Maintaining accurate records of business personal property is vital not only for tax reporting but also for overall business management. Regularly updating inventory lists is necessary to reflect changes, such as purchasing new equipment or disposing of old assets. Additionally, it’s prudent to keep records of past filings for reference and future filing ease.

Furthermore, understanding when and how to file amendments on the new business personal property form, especially when circumstances change, is crucial for compliance. Establishing a timetable for regular reviews can help ensure that records stay relevant and accurate, promoting efficient business operations and adherence to tax regulations.

Resources and support for business owners

For business owners seeking assistance with the new business personal property form, numerous resources are available online. Many state and local tax authorities provide comprehensive FAQ sections and detailed guides on filling out the form. Additionally, a help desk or customer service contacts, such as phone, email, and live chat options, can offer personalized assistance for more complex queries.

Links to additional useful forms and tools, including downloadable resources through pdfFiller, can enhance the filing experience by providing templates and examples. These resources are invaluable for simplifying the filing process and ensuring compliance with regulations.

Conclusion: Navigating your responsibilities with confidence

Successfully managing the new business personal property form is essential for maintaining business health and compliance. By understanding the filing process, utilizing available tools, and keeping thorough records, business owners can navigate their responsibilities with confidence. The importance of this form cannot be overstated, as it not only influences tax obligations but also impacts overall business financial health.

Harnessing the capabilities of pdfFiller can further streamline document management. With features for editing, signing, collaborating, and managing documents all within a single cloud-based platform, business owners can ensure a seamless filing experience, save time, and reduce stress in compliance-related tasks.

Related topics for further exploration

Expanding your knowledge on the new business personal property form paves the way for more informed decision-making. Look into state-specific personal property regulations as these can significantly differ and may impact your business. Additionally, keeping abreast of changes in tax law that affect business personal property can help ensure compliance and avoid pitfalls.

Finally, understanding how to accurately value your business personal property for tax purposes can further enhance your financial strategy and tax planning. This knowledge is indispensable for any business looking to optimize its asset management and ensure long-term growth.

Documenting your business growth

Tracking asset purchases and sales is vital for understanding your business's financial landscape. Keeping meticulous records of all personal property not only aids in tax reporting but serves as a comprehensive resource for financial reporting and strategic planning. Leveraging business personal property records effectively can also create a solid foundation for future business growth.

Properly organizing these documents enhances operational efficiency, allowing business owners to access important information quickly. As businesses grow and evolve, ensuring that documentation and records remain organized can significantly streamline your decision-making processes, making it easier to focus on development opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new business personal property to be eSigned by others?

Where do I find new business personal property?

How do I fill out the new business personal property form on my smartphone?

What is new business personal property?

Who is required to file new business personal property?

How to fill out new business personal property?

What is the purpose of new business personal property?

What information must be reported on new business personal property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.