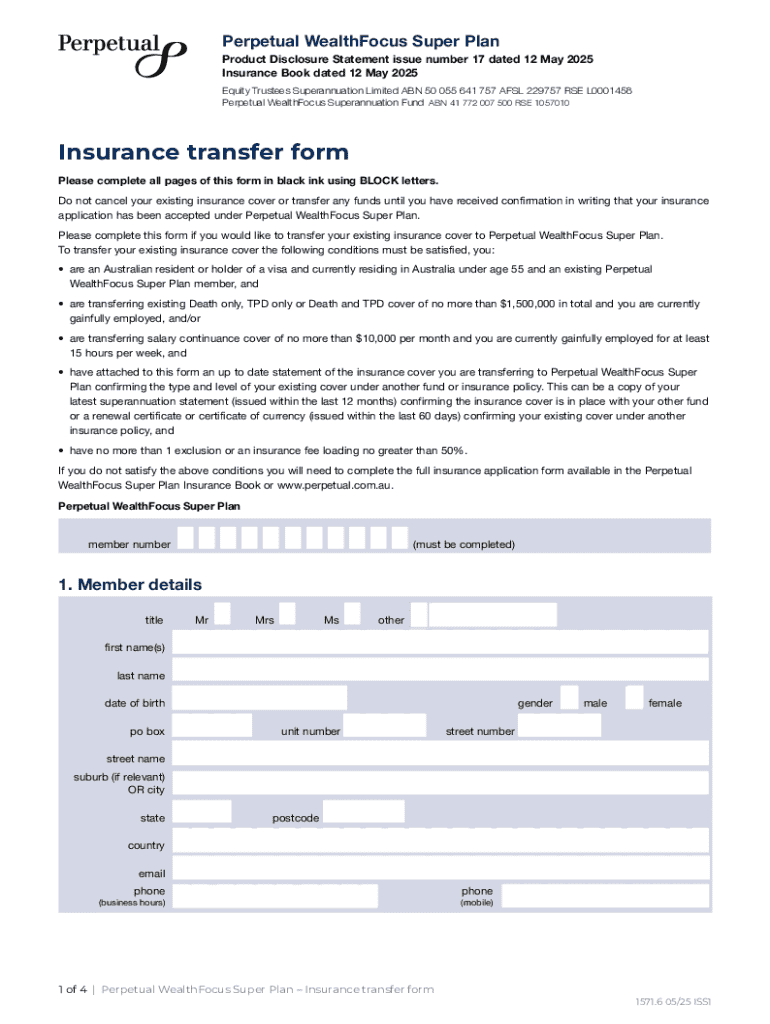

Get the free Perpetual Wealthfocus Super Plan Insurance Transfer Form

Get, Create, Make and Sign perpetual wealthfocus super plan

Editing perpetual wealthfocus super plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out perpetual wealthfocus super plan

How to fill out perpetual wealthfocus super plan

Who needs perpetual wealthfocus super plan?

Comprehensive Guide to the Perpetual Wealthfocus Super Plan Form

Understanding the Perpetual Wealthfocus Super Plan Form

The Perpetual Wealthfocus Super Plan is designed to help individuals and teams manage their superannuation effectively. This form serves as the cornerstone of creating a tailored superannuation plan that aligns with personal financial goals. By understanding this plan, users can leverage its features to maximize their investment returns and ensure financial security in retirement.

The purpose of the Perpetual Wealthfocus Super Plan form extends beyond mere documentation; it is a strategic tool that encapsulates vital personal and financial information needed to craft an effective super plan. Accurate completion of this form is critical, as it directly influences the investment strategies that will ultimately determine retirement income and lifestyle.

Key components of the Perpetual Wealthfocus Super Plan form

The form consists of several key components that facilitate a comprehensive understanding of your financial situation. Each section is designed to gather essential information to tailor your superannuation plan effectively.

Firstly, personal information requirements include your full name, address, and contact details. This foundational information allows for accurate identification and communication regarding your superannuation account.

Secondly, financial information must reflect a holistic view of your income and assets. This may include your salary, bonuses, and a detailed asset inventory. Understanding these elements will help you discern your financial strengths and weaknesses.

Lastly, investment preferences must be outlined, which includes your risk tolerance, investment time horizon, and financial goals. Addressing these preferences is crucial for setting realistic and achievable targets within your superannuation plan.

Step-by-step instructions for completing the form

Completing the Perpetual Wealthfocus Super Plan form involves several crucial steps that will yield a cleaner and more effective document for your superannuation needs.

Step 1: Preparing Your Information. Begin by gathering all necessary documents and financial data such as pay slips, tax returns, and asset listings. This preparation step will streamline the filling process.

Step 2: Filling Out Personal Information. Carefully enter your personal details to avoid any inaccuracies. Use clear, legible handwriting or digital entry methods, making sure to double-check your contact information.

Step 3: Disclosing Financial Facts. Be comprehensive while detailing your income and assets. Include all sources of income, and ensure you have an updated inventory of your assets to avoid overlooking potentially valuable information.

Step 4: Specifying Your Investment Goals. Understand your risk appetite, which can range from conservative to aggressive. Set realistic expectations based on your financial situation and future needs.

Step 5: Review and Verify Your Entries. Before submitting the form, create a checklist to ensure every section is filled out correctly and all necessary documents are attached. This double-checking step significantly reduces mistakes.

Editing and personalizing your Perpetual Wealthfocus Super Plan form

pdfFiller offers various tools to edit and personalize your Perpetual Wealthfocus Super Plan form seamlessly. You can add, modify, or delete information based on your evolving financial status.

Utilizing pdfFiller's editing tools involves a simple process. Start by uploading your document into the platform, and then use features like text boxes and signature fields for customization. It’s user-friendly, allowing for quick adjustments.

You can also add additional sections or notes where you feel necessary. This functionality is especially useful for tracking changes or adding reminders about investment goals. After personalizing your form, ensure you save your changes in the cloud to access them anytime, anywhere.

Signing the Perpetual Wealthfocus Super Plan form

The digital signing process has been simplified with pdfFiller. eSigning the Perpetual Wealthfocus Super Plan form not only speeds up the process but also ensures legal compliance, making it an efficient choice.

To eSign your form using pdfFiller, navigate to the signing section of your document. Here, you’ll find clear instructions on how to place your signature electronically, either by using a mouse, touchpad, or by uploading an image of your signature.

Best practices for digital signatures include ensuring the security of your signature and being aware of the legal implications of your eSignature. Always confirm that the platform used for signing complies with electronic signature laws to avoid legal issues.

Managing your Perpetual Wealthfocus Super Plan form

Managing your documents effectively is crucial, especially when it comes to your Perpetual Wealthfocus Super Plan form. With pdfFiller, you can organize your forms into folders, making it easier to locate important documents.

Collaboration with financial advisors is simplified, allowing for secure sharing of documents. This ensures that your financial stakeholders can easily access the information they need to provide beneficial advice.

Additionally, keep track of version control and document history within pdfFiller. This feature allows you to see all changes and revisions, providing clarity on how your document has evolved over time.

Common mistakes to avoid when using the Perpetual Wealthfocus Super Plan form

Navigating the Perpetual Wealthfocus Super Plan form can be straightforward, yet common mistakes can arise. One common error is misunderstanding financial terminology. It’s essential to clarify these terms to ensure the data provided accurately reflects your situation.

Another mistake involves overlooking essential fields in the form. Make sure to review all parts thoroughly, as even minor omissions can impact your superannuation planning negatively.

Lastly, failing to review your entries before submission can lead to significant errors. Taking the time to verify all information will aid in achieving an effective and tailored financial plan, ultimately enhancing your retirement strategy.

Frequently asked questions (FAQs)

After submitting the Perpetual Wealthfocus Super Plan form, you may have several questions. One common inquiry is about what happens next. Typically, you can expect a follow-up from your financial advisor with recommendations tailored to your inputs.

Another question often revolves around the ability to update the form post-submission. Yes, updates are possible, and it's advisable to revisit your form regularly to reflect any changes in your financial situation.

Lastly, security is a top concern for many users. pdfFiller ensures the confidentiality of your information through robust security measures, allowing you to complete your form without worrying about data breaches.

Additional tips for maximizing your Wealthfocus Super Plan experience

To enhance your experience with the Perpetual Wealthfocus Super Plan, consider seeking resources for continuous education around superannuation. Understanding the nuances of your super will empower you to make informed decisions.

It’s also beneficial to regularly track your progress and adjust your goals as needed. Markets change and personal circumstances shift, so revisiting your plan ensures that you stay aligned with your financial aspirations.

Lastly, tap into the support and community resources provided by pdfFiller. Engaging with peers and experts can yield new insights and aid in refining your superannuation strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify perpetual wealthfocus super plan without leaving Google Drive?

Can I create an eSignature for the perpetual wealthfocus super plan in Gmail?

How do I fill out the perpetual wealthfocus super plan form on my smartphone?

What is perpetual wealthfocus super plan?

Who is required to file perpetual wealthfocus super plan?

How to fill out perpetual wealthfocus super plan?

What is the purpose of perpetual wealthfocus super plan?

What information must be reported on perpetual wealthfocus super plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.