Get the free Business Banking Switch Kit

Get, Create, Make and Sign business banking switch kit

How to edit business banking switch kit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business banking switch kit

How to fill out business banking switch kit

Who needs business banking switch kit?

Your Comprehensive Guide to the Business Banking Switch Kit Form

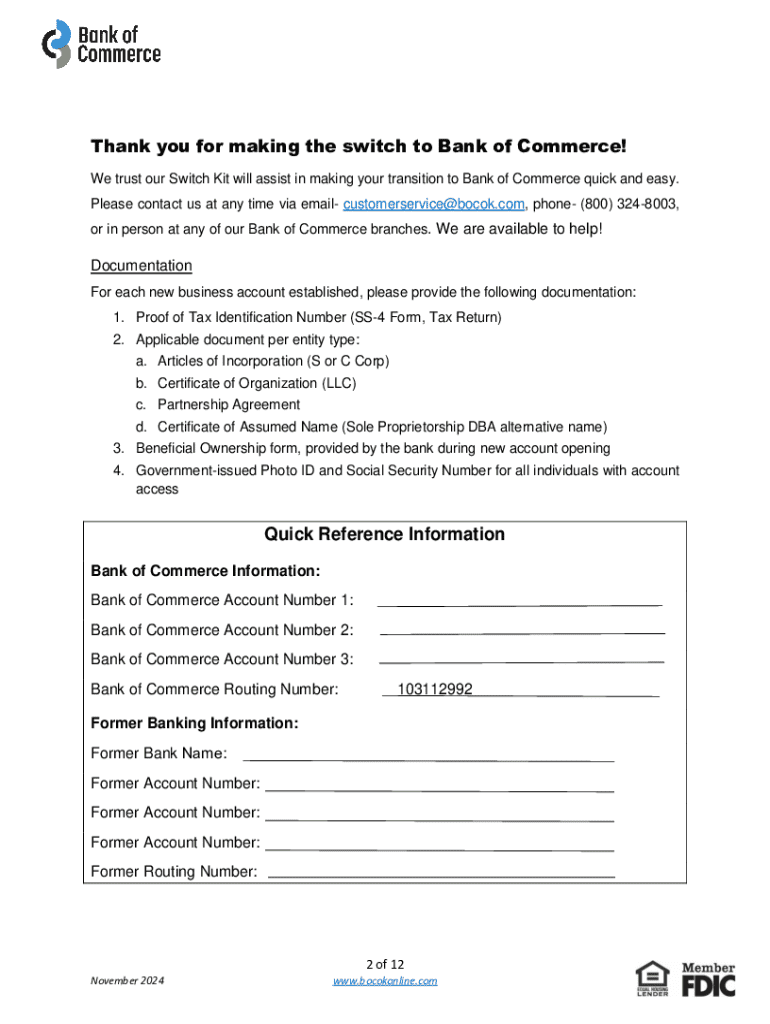

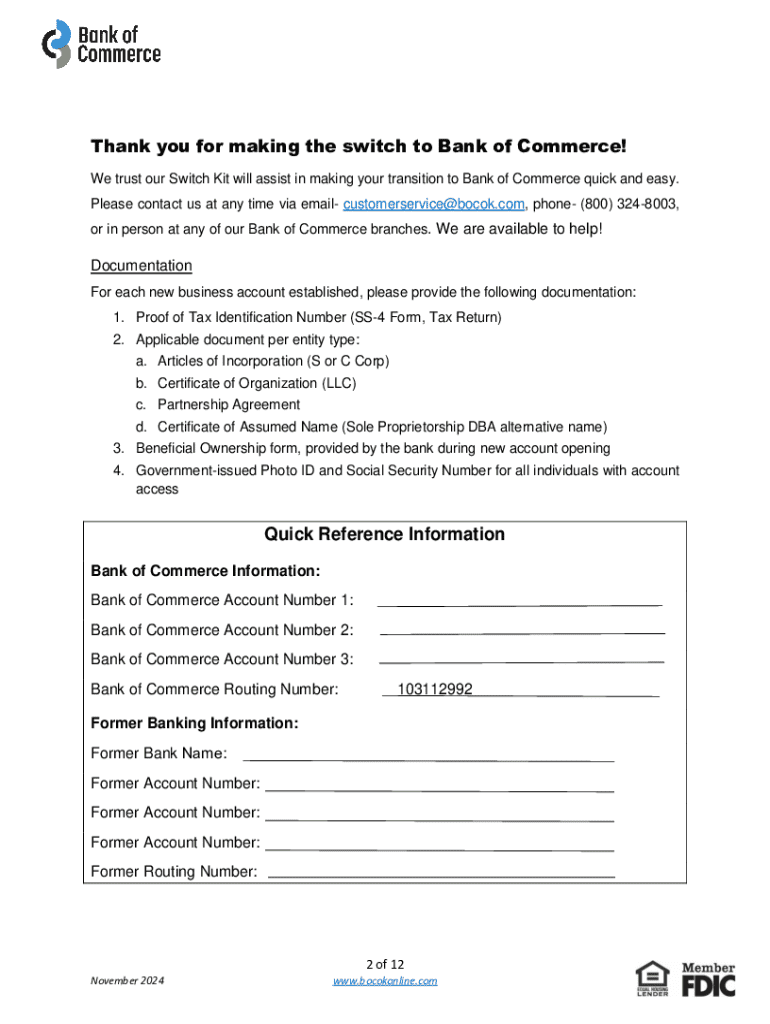

Understanding the Business Banking Switch Kit

The Business Banking Switch Kit is an essential tool for businesses looking to transition from one banking provider to another. It simplifies the complex process of switching accounts by providing a structured approach to managing important documentation and facilitating communication with your new bank. Understanding the nuances of this kit is critical for ensuring a seamless transition that minimizes disruptions to your business operations.

Businesses frequently need to evaluate their banking relationships due to factors such as fees, customer service quality, or the need for specific financial services. The importance of switching banking providers lies in retaining competitive advantages and achieving operational efficiency. By using a business banking switch kit form, you can streamline this process, saving time and reducing the risk of financial mishaps.

Why choose pdfFiller for your switch kit needs?

pdfFiller emerges as a top choice for those handling their business banking switch kit needs due to its user-friendly interface and robust features. The platform allows for seamless document editing and management, making it easy to customize the switch kit forms required by your new bank. With pdfFiller, businesses can quickly adapt their documents to meet specific bank requirements, removing the guesswork involved in traditional paperwork.

As a cloud-based platform, pdfFiller provides access to your documents from anywhere, enabling you to manage your banking transitions on the go. This flexibility is particularly useful for business owners who may be traveling or working remotely. Moreover, the collaborative eSigning and document organization features ensure that all stakeholders can participate in the switching process efficiently, contributing to a more organized and effective transition.

Getting started with the business banking switch kit

To effectively utilize the business banking switch kit, it’s essential to gather all required documents and information beforehand. This includes your existing account information, business identification documents, and any relevant financial statements. Utilizing pdfFiller can guide you through filling out these necessary forms with ease.

When assessing your current banking situation, take note of any fees you are incurring, the quality of customer service, and how well your current bank meets your needs. Creating a checklist of services you use regularly will help ensure that your new banking provider aligns with your business objectives.

Four key steps to effectively switch your business banking

Switching your business banking can be broken down into four key steps, designed to ensure a smooth and structured transition.

Keeping these steps in mind will help you manage this change efficiently and maintain your business's financial health.

Step 1: Open your new business account

Opening a new business account involves researching the types of accounts available that best suit your cash flow and operational needs. These may include checking accounts, savings accounts, or accounts designed for specific industries. Essential documents needed for account opening generally include your business license, tax ID number, and identification for the owners and authorized signers.

pdfFiller can help you complete your application form efficiently, allowing you to fill, sign, and submit it all in one platform.

Step 2: Enroll in online and mobile banking

In today’s fast-paced business environment, enrolling in online and mobile banking is crucial. The advantages are manifold—immediate access to your accounts, the ability to track spending in real-time, and tools for managing payroll and invoices effectively. The enrollment process often requires you to fill out specific forms provided by your new bank.

Utilizing pdfFiller for this enrollment form guarantees that you can fill it out conveniently and securely while ensuring all entries are accurate.

Step 3: Discontinue use of your old account

Transitioning away from your old account must be approached with caution. Ensure that all pending transactions are settled to avoid complications. Finalizing your old account closure should also be documented; request a formal closure confirmation from your old bank to maintain a clear record.

A checklist can be helpful to ensure that you don’t overlook important tasks such as notifying clients or vendors of changes to your payment details, ensuring a smooth transition without interruption.

Step 4: Switch your recurring incoming/outgoing payments

Identifying all your automatic payments and deposits is essential in making a successful banking switch. This step involves notifying payees of your new banking details and managing updates in payment systems. Using the tools available in pdfFiller facilitates managing these notifications efficiently, eliminating manual entry tasks and potential errors.

Helpful tools and resources within pdfFiller

pdfFiller offers a collection of robust tools to make the switching process smoother. An interactive checklist for the switching process acts as a guiding framework to ensure you don’t miss any crucial steps. Moreover, templates for recurring payment notifications save you time and effort by simplifying this often cumbersome task.

Additionally, pdfFiller includes account close form templates, making it easier to properly document your final transitions and closures with your previous banking provider.

FAQs about the business banking switch kit

Frequently raised questions during the business banking switching process often focus on documentation requirements and timelines. Common queries include how long it takes to process a switch and what documents must be provided to ensure a smooth transition.

For anyone feeling uncertain during the transition, troubleshooting tips on common problems—such as delayed payments or banking errors—can provide the guidance needed to effectively manage these challenges.

Navigating your new business banking experience

Once you've switched to your new bank, maximizing this new relationship will be key to your business’s financial health. Understanding the features and benefits offered by your new banking institution can leverage your operations significantly. Take time to engage with the customer support provided by your new bank, as they can help you unlock services that further optimize your banking experience.

In addition, keeping your accounts organized using tools from pdfFiller can streamline your financial record-keeping and improve efficiency as you transition into a new financial phase.

Unique features of pdfFiller for document management

pdfFiller's unique features extend beyond simple document editing. Its collaborative capabilities allow multiple team members to work on documents simultaneously, enhancing productivity. eSigning capabilities are compliant with legal regulations, ensuring that your documents are valid and enforceable.

Moreover, the option to store and easily access past forms can be a valuable resource for future needs. This means that you no longer have to start from scratch when dealing with recurring banking tasks or documentation.

Contact support for further questions

For any lingering doubts or inquiries about the business banking switch kit, accessing customer support through pdfFiller is straightforward. The platform provides extensive resources to help users navigate not only document management but also other banking-related services and forms.

Whether you're facing a specific issue or simply need general assistance, reaching out to customer support will ensure you receive the guidance needed to facilitate your transition.

Checklist for a successful transition to your new business account

For an organized and efficient transition to your new business account, having a comprehensive checklist can be invaluable. Here’s a bullet-point checklist summarizing each significant step:

By following these key steps and ensuring all tasks are completed, you can enjoy the numerous benefits that come from switching to a banking solution that better serves your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business banking switch kit in Gmail?

How do I execute business banking switch kit online?

How do I edit business banking switch kit in Chrome?

What is business banking switch kit?

Who is required to file business banking switch kit?

How to fill out business banking switch kit?

What is the purpose of business banking switch kit?

What information must be reported on business banking switch kit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.