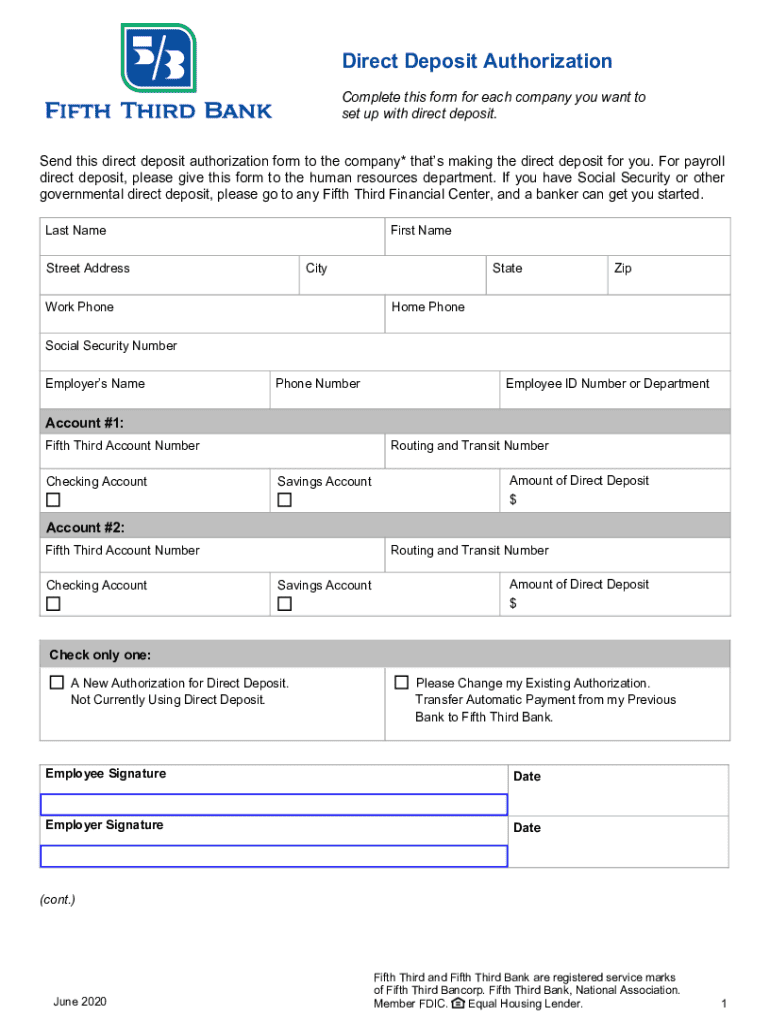

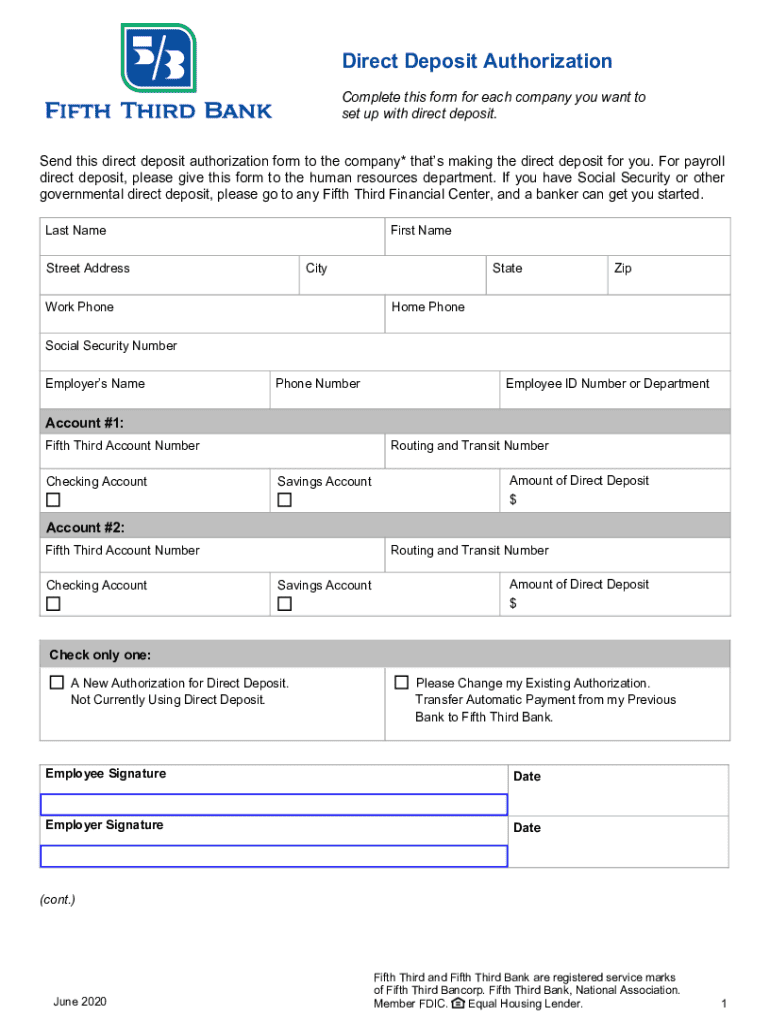

Get the free Direct Deposit Authorization

Get, Create, Make and Sign direct deposit authorization

How to edit direct deposit authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization

How to fill out direct deposit authorization

Who needs direct deposit authorization?

Understanding and Using the Direct Deposit Authorization Form

Understanding the direct deposit authorization form

A direct deposit authorization form is a critical document that allows employers or organizations to electronically deposit payments directly into an individual's bank account. This automated process eliminates the need for paper checks and simplifies payroll distribution. The form essentially serves as an agreement, where the employee or payee grants permission to the employer or payer to deposit the specified amounts directly into their bank account.

Direct deposit has become increasingly popular due to its efficiency, safety, and speed. Employers benefit from reduced administrative tasks associated with paper checks, while employees and clients enjoy quicker access to their funds. Overall, using a direct deposit authorization form streamlines payment processes for both parties.

Key components of the direct deposit authorization form

The direct deposit authorization form generally consists of several key components that help ensure all necessary information is accurately captured. Understanding these components is vital for correctly completing the form.

How to fill out the direct deposit authorization form

Completing the direct deposit authorization form may seem straightforward, but attention to detail is essential. Here’s a step-by-step guide on how to fill it out accurately.

Tips for submitting your direct deposit authorization form

Once you've completed your direct deposit authorization form, the next step is submission. Here's how to ensure you're submitting your form correctly and securely.

Frequently asked questions (FAQs) about direct deposit authorization

It's common to have questions about the workings of a direct deposit authorization form. Here are some frequently asked questions that can provide clarification.

Common mistakes to avoid when using the direct deposit authorization form

While filling out the direct deposit authorization form is simple, errors can lead to complications in receiving your payments. Here are some common mistakes to avoid.

Managing your direct deposit

Post-submission management of your direct deposit is just as important as filling out the form correctly. Here’s how to manage and monitor your payments effectively.

The benefits of using an online platform for managing your forms

Managing your direct deposit authorization form can be streamlined through digital solutions, such as pdfFiller. This cloud-based platform offers users an efficient way to create and manage forms securely.

Final checklist before submission

Before you finalize your submission of the direct deposit authorization form, it's best practice to perform a final review. This checklist can help ensure that your document is ready for processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get direct deposit authorization?

How do I edit direct deposit authorization on an iOS device?

How do I fill out direct deposit authorization on an Android device?

What is direct deposit authorization?

Who is required to file direct deposit authorization?

How to fill out direct deposit authorization?

What is the purpose of direct deposit authorization?

What information must be reported on direct deposit authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.