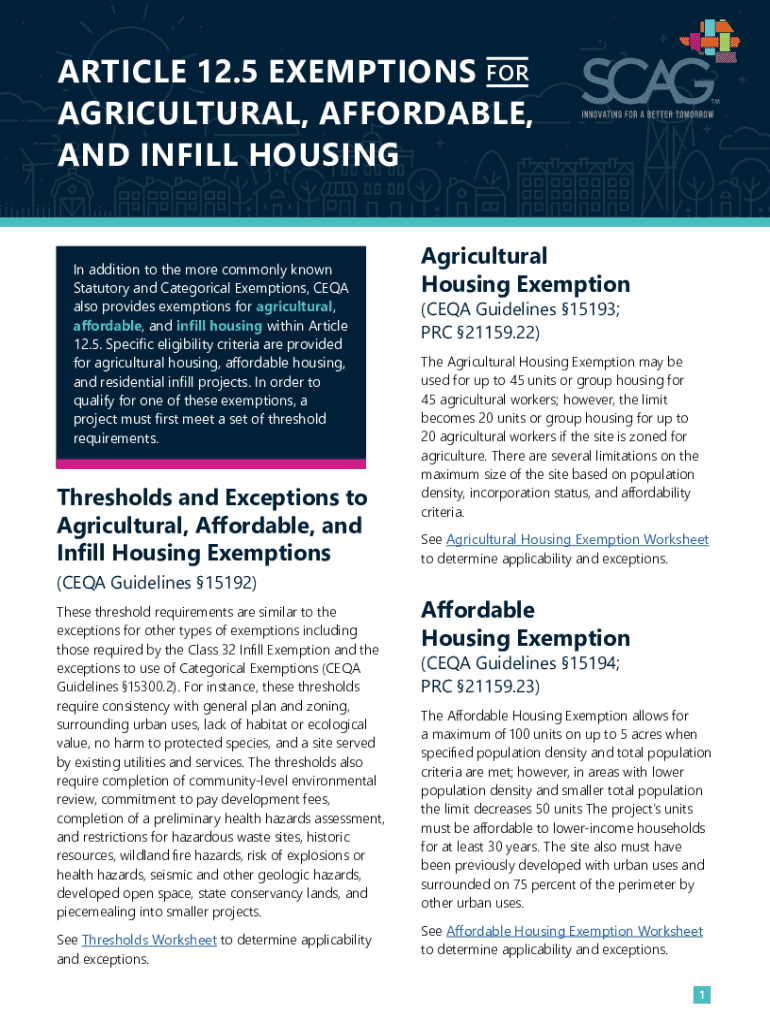

Get the free Article 12.5 Exemptions for Agricultural, Affordable, and Infill Housing - scag ca

Get, Create, Make and Sign article 125 exemptions for

Editing article 125 exemptions for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out article 125 exemptions for

How to fill out article 125 exemptions for

Who needs article 125 exemptions for?

Understanding Article 125 Exemptions for Form

Understanding Article 125 exemptions

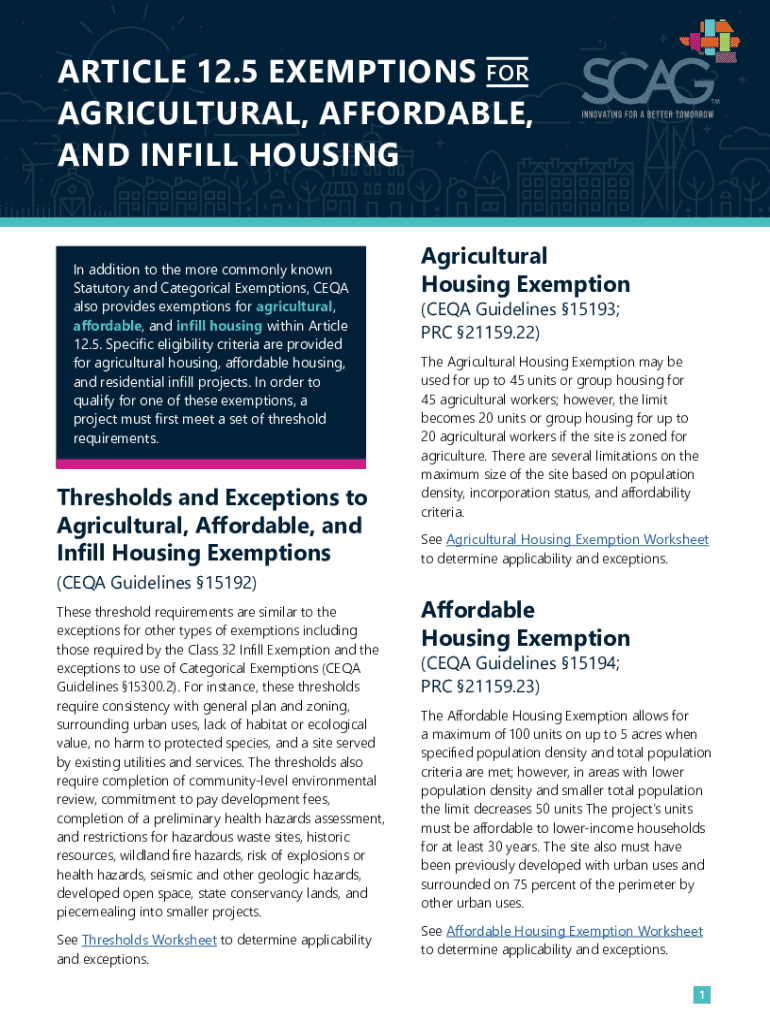

Article 125 refers to specific provisions in tax or financial legislation that provide exemptions to certain forms and paperwork. These exemptions can significantly ease the burden of compliance for individuals and businesses, ensuring that unnecessary red tape is minimized. Understanding what Article 125 is and how it functions can help you navigate the paperwork landscape more efficiently.

The significance of knowing these exemptions lies in their ability to save time and reduce potential penalties or complications in the filing process. Not all forms require the same level of detail or documentation, and being aware of exemptions can streamline your experience when dealing with various requirements.

The scope of Article 125 exemptions

Exemptions under Article 125 cover a range of forms and documents, particularly those that may not require detailed financial disclosures or extensive documentation. Common examples of forms that qualify for these exemptions include certain tax returns, financial statements for small entities, and benefits claim paperwork.

Both individuals and teams may utilize these exemptions, allowing those filing independently, as well as organizations managing multiple submissions, to take advantage of streamlined processes.

How to identify eligibility for Article 125 exemptions

To assess your eligibility for Article 125 exemptions, consider criteria such as the type of income being reported, the scale of the entity involved, and whether specific conditions are met as outlined in the governing regulations. These criteria often include income thresholds, the nature of business operation, or residency status.

Common factors that may qualify you for exemptions include being categorized as a small business, having minimal annual revenue, or falling under specific industry classifications. It's advisable to conduct a thorough review of exemption guidelines before proceeding with form submission to avoid potential rejections.

Step-by-step guide to filling out the appropriate form

Filling out forms with Article 125 exemptions considered can be simplified by following these procedural steps:

Editing and managing exemption forms with pdfFiller

pdfFiller significantly eases the document management process for exemption forms. Its intuitive interface allows users to edit, fill out, and manage PDF documents with ease, ensuring that adjustments can be made quickly without confusion.

With interactive tools such as text editing, checkbox addition, and comment features, teams can collaborate effectively on forms, making sure everyone’s input is captured and correctly reflected in the final submissions.

eSigning and submitting your exemption form

The eSigning feature of pdfFiller holds significant importance, ensuring that your forms are securely signed and legally binding. Using pdfFiller, you can easily add your signature by following a simple process, thus eliminating the need for physical paperwork.

Frequently asked questions about Article 125 exemptions

Several common queries arise regarding Article 125 exemptions, including the types of forms that benefit from these exemptions. A frequent concern is checking the status of an exemption application. Individuals may also wonder about their recourse if their exemption claim is denied or how to appeal decisions regarding their exemption status.

The benefits of understanding Article 125 exemptions

Understanding Article 125 exemptions can yield substantial benefits for both individuals and businesses. By becoming aware of available exemptions, one can save significant time and reduce overall administrative costs during the filing process.

Moreover, knowing how to navigate these exemptions enhances accuracy in managing documents, leading to fewer errors and rejections. Empowered with this knowledge, individuals and teams can streamline their operations, focusing more on core activities instead of paperwork.

Real-world case studies and experiences

Numerous case studies highlight the successful utilization of Article 125 exemptions. For instance, small business owners have reported smoother filing processes and better cash flow management by leveraging these exemptions.

Feedback from users of pdfFiller also underscores how the platform supports easier completion of forms under these exemptions, leading to increased satisfaction and less stress overall.

Additional support and resources

For those seeking assistance with Article 125 exemptions, extensive resources are available. pdfFiller provides vibrant tutorials that guide users through their platform's functionalities, ensuring everyone can make the most of its features.

Moreover, links to official government resources can clarify any remaining doubts about exemptions and required documentation.

Maximize your experience with pdfFiller

pdfFiller stands out for its array of tools specifically designed for handling forms that fall under Article 125 exemptions. From collaborative editing to secure eSigning capabilities, pdfFiller enhances user experience in document management.

Engaging with community forums on the pdfFiller platform can further enrich your experience, as users share insights and tips that make form management even more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify article 125 exemptions for without leaving Google Drive?

How do I complete article 125 exemptions for on an iOS device?

Can I edit article 125 exemptions for on an Android device?

What is article 125 exemptions for?

Who is required to file article 125 exemptions for?

How to fill out article 125 exemptions for?

What is the purpose of article 125 exemptions for?

What information must be reported on article 125 exemptions for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.