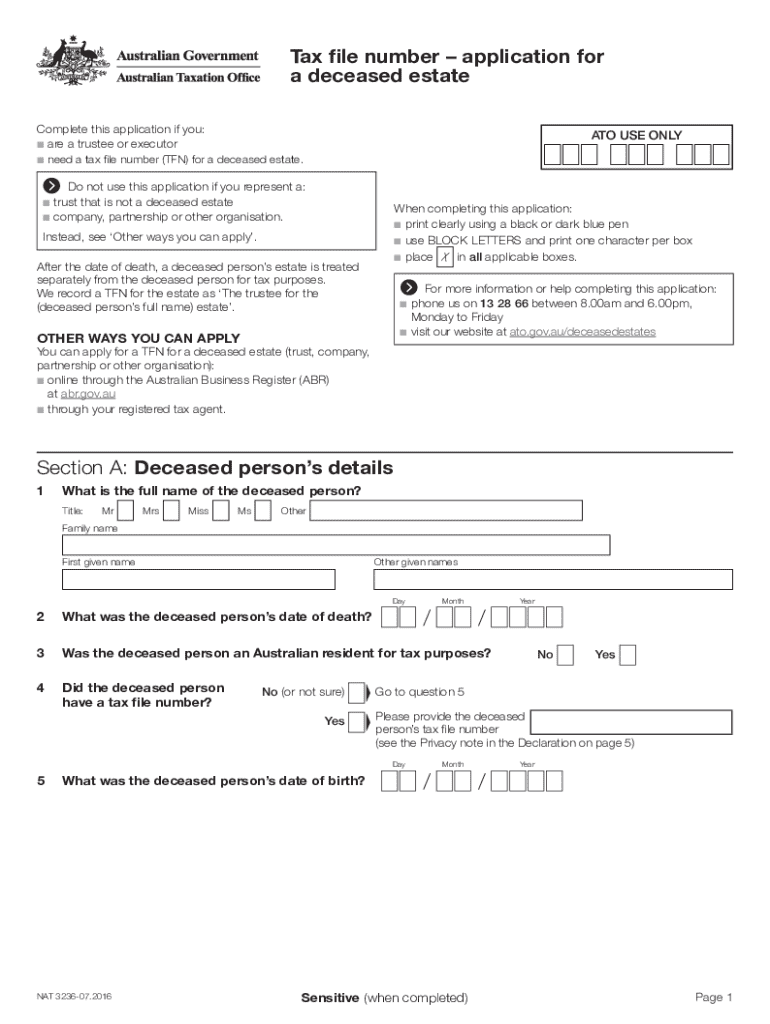

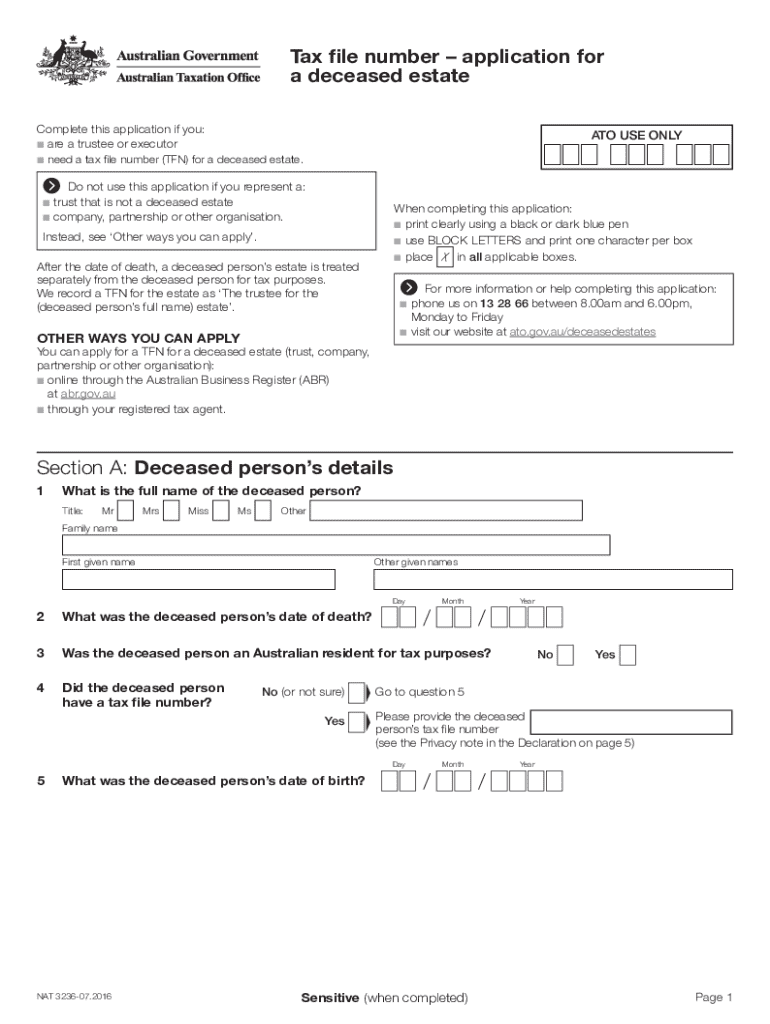

Get the free Tax File Number – Application for a Deceased Estate

Get, Create, Make and Sign tax file number application

Editing tax file number application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax file number application

How to fill out tax file number application

Who needs tax file number application?

Tax File Number Application Form: A Comprehensive Guide

Understanding the tax file number (TFN)

A Tax File Number (TFN) is issued by the Australian Taxation Office (ATO) to individuals and organizations to help identify taxpayers within the system. The primary purpose of the TFN is to manage tax obligations and ensure that the right amount of tax is collected. In Australia, possessing a TFN is crucial, as it streamlines the tax process, aids in accessing government services, and helps avoid situations where higher tax rates apply due to a lack of identification.

For everyone from employees to contractors to business owners, having a TFN facilitates smoother interaction with the Australian Taxation Office. The significance of a TFN extends beyond tax compliance; it plays a key role in various aspects of financial life, ensuring individuals and businesses can navigate the tax landscape effectively.

Who needs a tax file number?

In Australia, various groups are required to apply for a TFN. This includes:

Key benefits of having a TFN

Acquiring a TFN has several advantages that simplify financial interactions in Australia. One of the most significant benefits is access to government services. With a TFN, individuals are eligible for various tax benefits, social security payments, and Medicare services. This access streamlines the process of receiving financial aids when needed.

Another critical benefit is the simplified tax filing process it offers. A TFN allows for easier reporting of income and expenses, ultimately preventing withholding tax at a higher rate due to inadequate documentation. Additionally, individuals and businesses gain credibility with financial institutions, which can facilitate loan applications and enhance the likelihood of securing an edge in competitive financial markets.

Preparing for your TFN application

Before beginning the TFN application process, it's essential to prepare the required documentation and information. The following documents are typically necessary to complete your application:

In terms of eligibility criteria, applicants must meet age and residency requirements. Generally, anyone over 16 years old can apply for their own TFN, while minors may require parental consent. Non-residents also face explicit considerations, and it is crucial to be aware of the particular conditions that apply to them.

Steps to fill out the TFN application form

To successfully fill out your tax file number application form, you can begin by downloading the form from the ATO website or using platforms like pdfFiller. Here’s how to navigate the process:

After filling out the form, pdfFiller offers tools for easy editing and signing, enhancing collaboration among team members, especially for businesses with multiple applications.

Submission process

Once the application is complete, it’s time to submit it. There are options to send your completed application online or via mail. For online submissions, follow the guidelines set by ATO to upload your application securely. When opting for a paper application, be sure to send it to the precise address specified to avoid any processing delays.

After submission, expect a waiting period for processing, typically around 28 days. You can track the status of your application through the ATO’s online services, ensuring you remain informed throughout the process.

Common issues and troubleshooting

Some common issues may arise during the TFN application process. In particular, applicants should be mindful of mistakes such as mismatched identification documents or incomplete forms. To amend a submitted application, you typically need to follow the same process through which you initially applied, updating any discrepancies.

To ensure smooth navigation through the application, it’s helpful to look into frequently asked questions related to the TFN application. Understanding the common hurdles faced and how to overcome them can greatly assist in achieving a successful application.

Alternative options for non-residents and special cases

Non-residents and certain special cases require additional steps when applying for a TFN. For non-residents, unique documentation patterns such as a valid visa, along with various identity proofs, are essential. This tailored process ensures compliance with Australian tax regulations and may involve specific distinctions based on the applicant’s country of origin or residency status.

International students, for instance, must present documents confirming their study status in Australia, along with their identification. Understanding these special requirements helps applicants navigate the system more efficiently.

Links to related transactions

Managing your TFN doesn't end with acquiring it. Individuals may need to make changes to their TFN details, which involves updating personal information such as address, name, or residency status. The process to make these alterations is straightforward and can usually be handled online through the ATO's official platforms, ensuring your records remain current.

Furthermore, connecting your TFN to tax returns is vital. By accurately reporting your income on tax returns using your TFN, you'll ensure compliance and avoid potential penalties. Additionally, managing other tax documents, like ABN applications, becomes more manageable with a valid TFN, simplifying the overall tax preparation process.

Rate the information on this page

Your feedback is invaluable in ensuring that the content provided meets your needs and expectations. If you found this guide helpful on the tax file number application form, please take a moment to rate your experience. Suggestions for improvements are always welcome as we strive to enhance our offerings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax file number application in Gmail?

How can I edit tax file number application from Google Drive?

Can I create an electronic signature for the tax file number application in Chrome?

What is tax file number application?

Who is required to file tax file number application?

How to fill out tax file number application?

What is the purpose of tax file number application?

What information must be reported on tax file number application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.