Get the free Beneficiary Nomination Form

Get, Create, Make and Sign beneficiary nomination form

Editing beneficiary nomination form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary nomination form

How to fill out beneficiary nomination form

Who needs beneficiary nomination form?

Understanding the Beneficiary Nomination Form: A Comprehensive Guide

Understanding the beneficiary nomination form

A beneficiary nomination form is a crucial document used in estate planning that allows individuals to designate who will receive their assets after they pass away. This form plays a vital role in ensuring that one's wishes are respected and that beneficiaries are clearly identified, thereby avoiding disputes and legal complications.

The importance of the beneficiary nomination form lies in its ability to simplify the transfer of assets. Without it, assets may be distributed according to state laws, which might not align with an individual's intentions. The form also clarifies the distribution of assets such as insurance policies, retirement accounts, and other financial instruments.

Eligibility and considerations

Anyone involved in planning their estate should consider using a beneficiary nomination form. This includes both individuals with significant assets as well as those with modest estates who wish to ensure their wishes are documented. It's an essential tool for parents, particularly when minor children are involved, as it determines who will manage their inheritances.

Before filling out the form, several factors need attention. Firstly, one should evaluate the relationship with potential beneficiaries. It's wise to consider how these designations might affect family dynamics or lead to disputes. Additionally, it's vital to understand the legal implications of naming beneficiaries directly, as this may have tax effects or influence eligibility for government benefits.

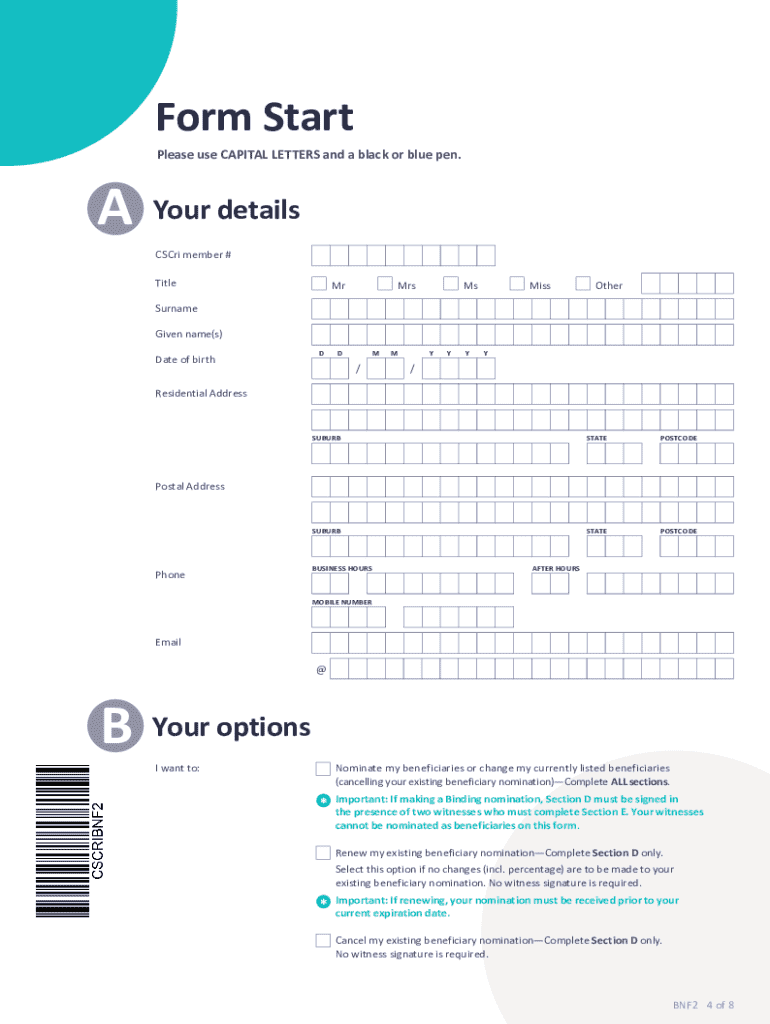

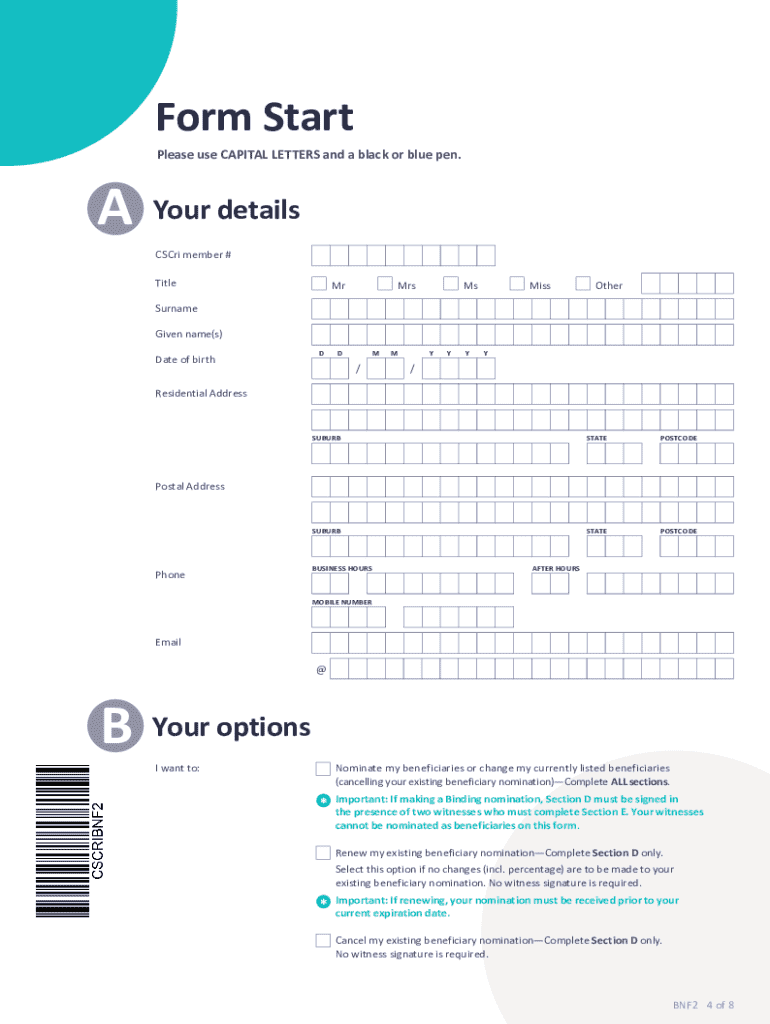

Detailed navigation of the form

Accessing the beneficiary nomination form can be done easily through various online platforms, with pdfFiller providing a straightforward way to either fill out a PDF version or utilize an interactive online format. Its features ensure accessibility across devices, making it convenient for users to complete their forms anytime, anywhere.

Completing the form involves several key sections, each designed to gather specific details necessary for effective beneficiary designation. Each section should be approached carefully to ensure all information is accurate.

Completing the form efficiently

Utilizing interactive tools available on pdfFiller can streamline the process of filling out your beneficiary nomination form. The platform offers digital editing tools that allow you to modify information easily, while real-time collaboration features enable you to work with family members or advisors to finalize details, ensuring everyone is on the same page.

When filling out the form, it's advisable to take time and ensure accuracy. Double-checking each section against your personal records can help avoid common mistakes. A structured review mechanism can be employed, allowing you to look over the completed form before submission.

Special considerations in beneficiary designation

When naming a minor child as a beneficiary, certain legal requirements must be met, often involving the appointment of a guardian. This ensures that a responsible adult oversees the management of the inheritance until the child reaches adulthood. It's also prudent to indicate who that guardian would be in your will or estate documents.

Designating a trust as a beneficiary can provide additional layers of management for your assets. Different types of trusts exist, from revocable to irrevocable, each with different legal implications for how assets are handled and taxed. Furthermore, naming entities like charities or businesses as beneficiaries requires specific naming conventions to adhere to legal guidelines.

Assigning and managing percentages

When filling out your beneficiary nomination form, assigning percentages rather than equal shares can reflect your personal wishes more accurately. For example, if you want one child to receive 60% of an estate and another 40%, specifying these percentages can help eliminate ambiguity and ensure your intent is clear.

Example calculations show how this can be applied in various scenarios. In a typical case where an estate is worth $100,000, setting a 60/40 split means one beneficiary receives $60,000 while the other gets $40,000. Such explicit designations mitigate the potential for misunderstandings.

Reviewing and submitting your beneficiary nomination form

After completing the beneficiary nomination form, it is essential to conduct a thorough review to ensure all information is correct and complete. A final checklist can help you confirm that no sections are overlooked and that your designations are clear and unambiguous.

Submitting your form can be done through several common methods, such as mailing a hard copy to your estate planner or directly to the financial institution involved. Pay attention to any submission deadlines that may apply, especially in the context of life insurance or retirement plans, to guarantee your designations are acknowledged.

Common questions and troubleshooting

It’s common to have questions regarding changes in your beneficiary designations. If you find that your selected beneficiary changes or passes away, you'll want to update your beneficiary nomination form promptly to ensure that your wishes are accurately reflected. Such changes should be documented and communicated clearly to all parties involved.

For individuals needing assistance with their documents, pdfFiller's customer support is an excellent resource. They provide guidance on updating existing designations and any other related inquiries to make sure you're not left in the dark when managing your important documents.

Related resources and further reading

For those looking for more information on estate planning and beneficiary designations, pdfFiller offers a wealth of resources. Access templates for related documents and guides that explain nuances in estate planning. These tools can help you make more informed decisions while ensuring your estate documents align with your wishes and legal requirements.

Utilizing these additional resources can provide clarity on complex situations, such as naming co-beneficiaries or understanding the impact of state laws on inheritance. pdfFiller serves as a comprehensive platform for all your document creation and management needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary nomination form for eSignature?

Where do I find beneficiary nomination form?

How can I fill out beneficiary nomination form on an iOS device?

What is beneficiary nomination form?

Who is required to file beneficiary nomination form?

How to fill out beneficiary nomination form?

What is the purpose of beneficiary nomination form?

What information must be reported on beneficiary nomination form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.