Get the free Certificate of Insurance Request Form

Get, Create, Make and Sign certificate of insurance request

Editing certificate of insurance request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance request

How to fill out certificate of insurance request

Who needs certificate of insurance request?

Comprehensive Guide to the Certificate of Insurance Request Form

Understanding the certificate of insurance (COI)

A Certificate of Insurance (COI) is a document that serves as proof that an individual or organization has an active insurance policy. It outlines the types and limits of coverage provided, along with the policyholder's name and relevant insurance details. COIs are essential in various business transactions, as they assure involved parties that adequate insurance protections are in place.

The importance of COIs in business transactions cannot be overstated. They help mitigate risks associated with potential liabilities that may arise during business operations. Additionally, they can be crucial during negotiations and contracts, providing assurance to clients, vendors, or partners that the responsible party has the financial backing necessary to cover any unforeseen incidents.

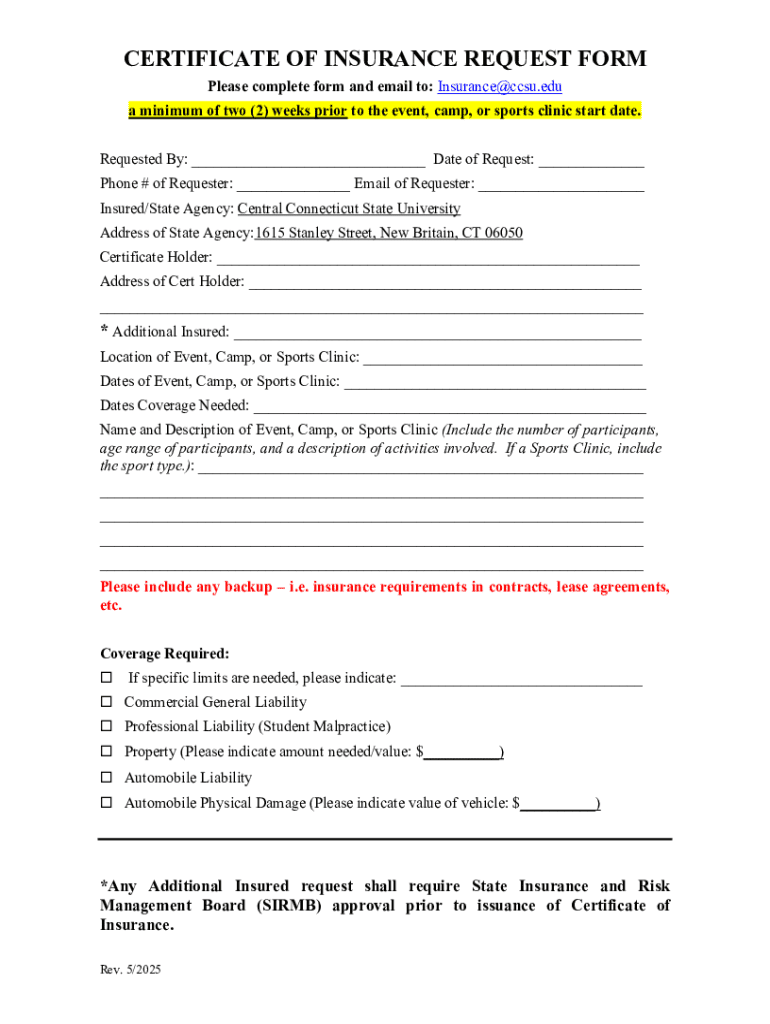

Key components of a COI request form

Filing a certificate of insurance request form requires specific information to ensure accurate documentation. Essential components include the requestor's details, certificate holder information, event or activity dates, and the types of insurance coverage needed.

The requestor's information section typically includes the name, contact details, and address of the individual or entity requesting the COI. The certificate holder information identifies who will be receiving the certificate, which may include clients or regulatory bodies.

The form also requires the scope and duration of coverage, specifying the event or activity's date range. Additionally, clear indications of the types of insurance policies needed—such as general liability, auto liability, and professional liability—must be defined.

A well-designed sample layout of a COI request form can enhance clarity and usability. It typically includes all of the aforementioned sections arranged logically for easy completion.

The purpose of a COI request form

Businesses require certificates of insurance from vendors to protect themselves from the financial risks associated with accidents, injuries, or damages that might occur during projects or transactions. Having a COI on file assures that the vendor carries adequate insurance to cover potential liabilities, thus safeguarding the contracting business.

The legal and financial implications of not obtaining COIs can be significant. Should an incident occur and no valid COI is on file, businesses may be held liable for damages, which can lead to loss of reputation and financial distress. In addition, regulators may impose penalties for non-compliance with insurance requirements.

Effective COI management can be critical for risk mitigation. By systematically collecting and organizing these documents, businesses can better manage their liabilities and ensure compliance with contractual and regulatory obligations.

How to complete a certificate of insurance request form

Filling out a certificate of insurance request form requires attention to detail and systematic organization. Begin by gathering all necessary information pertaining to the event, insurance coverage requirements, and involved parties.

Next, fill in the requestor section accurately with comprehensive personal or organizational details. Follow this by specifying the certificate holder details, ensuring the right entity is documented to receive the insurance coverage.

A common mistake individuals make is not providing enough detail under coverage types, which may delay processing. Always be specific to ensure your insurance needs are met appropriately.

Submitting your COI request

The method for submitting a COI request form can vary based on the organizational structure and capabilities of the issuing insurance agency. Common methods include online platforms, email submissions, and cloud services, which streamline the process.

For those who prefer in-person submission, ensure that you bring a hard copy of your completed form and any supporting documents. Following up on your COI request is crucial. It can be as simple as sending a polite email or making a quick phone call to inquire about the status of your request.

Managing COI renewals and updates

Keeping your Certificates of Insurance current is vital in minimizing risks associated with potential liabilities. It ensures that all parties are protected under the most recent coverage agreements. When insurance policies are updated, it is important to request renewals or updates in a timely manner.

Procedures for requesting renewals should ideally be integrated into your regular business practices. As changes in insurance coverage occur, notifying the certificate holders promptly is necessary to maintain compliance and reassure stakeholder confidence.

Challenges and solutions in COI management

Businesses often encounter various challenges in tracking and managing Certificates of Insurance. Common issues may include disorganization of documents, missed renewal deadlines, or difficulty in tracking multiple COIs across different vendors.

To overcome these challenges, implementing automation tools can significantly enhance efficiency. Centralized Document Management Systems, such as pdfFiller, allow companies to streamline document creation, storage, and collaboration, ensuring that all necessary documents are easily accessible and manageable.

Best practices for COI compliance

Establishing a COI tracking system is vital for maintaining compliance and reducing risks associated with uninsured parties. Training staff on the importance of COIs and their procedures can significantly boost compliance rates and ensure that all employees are aware of their responsibilities.

Conducting regular audits and assessments of the COI documentation is another best practice. This ensures all certificates are valid and up-to-date, thus preventing any lapses in coverage that could expose the organization to potential liabilities.

Industry-specific COI requirements

Different industries have specific COI requirements tailored to their unique risks and operational environments. For example, the construction industry typically demands broader coverage due to the higher likelihood of accidents and injury claims.

Event planners often need to obtain COIs that reflect coverage against event cancellations and liability for property damage. In healthcare, COIs must demonstrate adequate malpractice and patient liability coverage. Understanding these industry nuances is key for tailoring COI requests effectively.

Leveraging pdfFiller for efficient COI management

Using pdfFiller for managing COI requests enhances the efficiency of the process. This platform allows users to create and edit documents seamlessly. One of the standout features is its capability to facilitate electronic signatures, which can expedite the approval process significantly.

Alongside electronic signatures, pdfFiller offers templates that streamline document creation, reducing the chances of errors and inconsistencies. The cloud storage feature ensures that all documents are easily accessible and can be collaborated on in real-time, making it ideal for teams.

Customer testimonials frequently highlight the ease of use and effectiveness of pdfFiller in managing COI workflows, with many users citing improved turnaround times and reduced administrative burdens.

Frequently asked questions about COI requests

Understanding the specifics surrounding COI requests can often raise questions. For example, what is the typical processing time for a COI request? Generally, it can take a few days to a week, depending on the insurance provider's workload and the completeness of the request submitted.

Another common query involves the cost of obtaining a COI. In the US, fees typically range from $15 to $100, depending on the insurance provider and the complexity of the request. It's crucial to communicate with your insurance provider to determine specific rates and any additional costs associated with changing coverage or issuing multiple certificates.

Continuous improvement in COI management

Technology plays a pivotal role in enhancing COI processes. By utilizing software solutions and management tools, businesses can ensure more accurate tracking and efficiency in obtaining the necessary certificates. Continuous improvement in these processes not only serves to maintain compliance but also fortifies risk mitigation strategies.

Future trends in COI management are likely to include more integrated systems that offer real-time updates and notifications regarding insurance renewals. Being proactive with COI requests is essential, as it demonstrates due diligence and reinforces the organization's commitment to risk management and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate of insurance request for eSignature?

Can I create an electronic signature for the certificate of insurance request in Chrome?

Can I edit certificate of insurance request on an Android device?

What is certificate of insurance request?

Who is required to file certificate of insurance request?

How to fill out certificate of insurance request?

What is the purpose of certificate of insurance request?

What information must be reported on certificate of insurance request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.