UT TC-40W 2024-2025 free printable template

Get, Create, Make and Sign tc 40w form

Editing utah tc 40w online

Uncompromising security for your PDF editing and eSignature needs

UT TC-40W Form Versions

How to fill out 2024 tc 40w form

How to fill out 2024 utah tc-40w utah

Who needs 2024 utah tc-40w utah?

Understanding the 2024 Utah TC-40W Form: A Comprehensive Guide

Overview of the 2024 Utah TC-40W Form

The 2024 Utah TC-40W form is essential for anyone needing to report qualitative characteristics of their income on their state tax return. This form is specifically designed to calculate Utah’s withholding tax and is integral for ensuring that taxpayers meet their obligations accurately. The TC-40W not only serves this fundamental purpose but also guides filers on potential deductions and tax credits they may qualify for.

Significant changes have been made in the 2024 version aimed at streamlining the process and incorporating new tax regulations. It’s paramount for individuals and tax professionals to stay updated, as accurate filing can have substantial implications on financial responsibilities and entitlements. Understanding these changes is not merely a matter of compliance; it significantly influences a filer’s financial health.

Who needs to file the 2024 Utah TC-40W?

Any individual or organization earning income within Utah may be required to file the TC-40W form. Eligibility is primarily determined by the nature of the income and the residence status of the filer. For instance, individuals with jobs that have taxes withheld or those who are earning dividend income from Utah-based companies must file this form to account for state tax obligations.

Common situations necessitating the TC-40W include part-time workers, freelancers, and those with investments who earn income subject to Utah state taxes. The ramifications of not filing can vary, but they often lead to underpayment penalties. Consequently, understanding one’s status and obligations underlines the importance of this form.

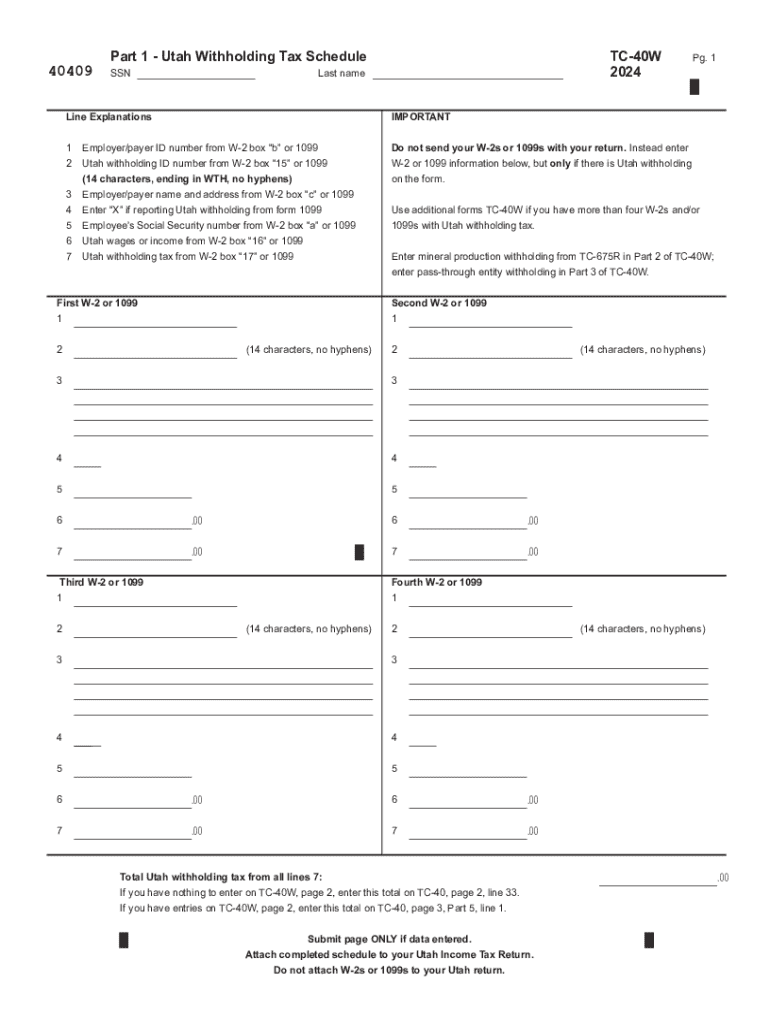

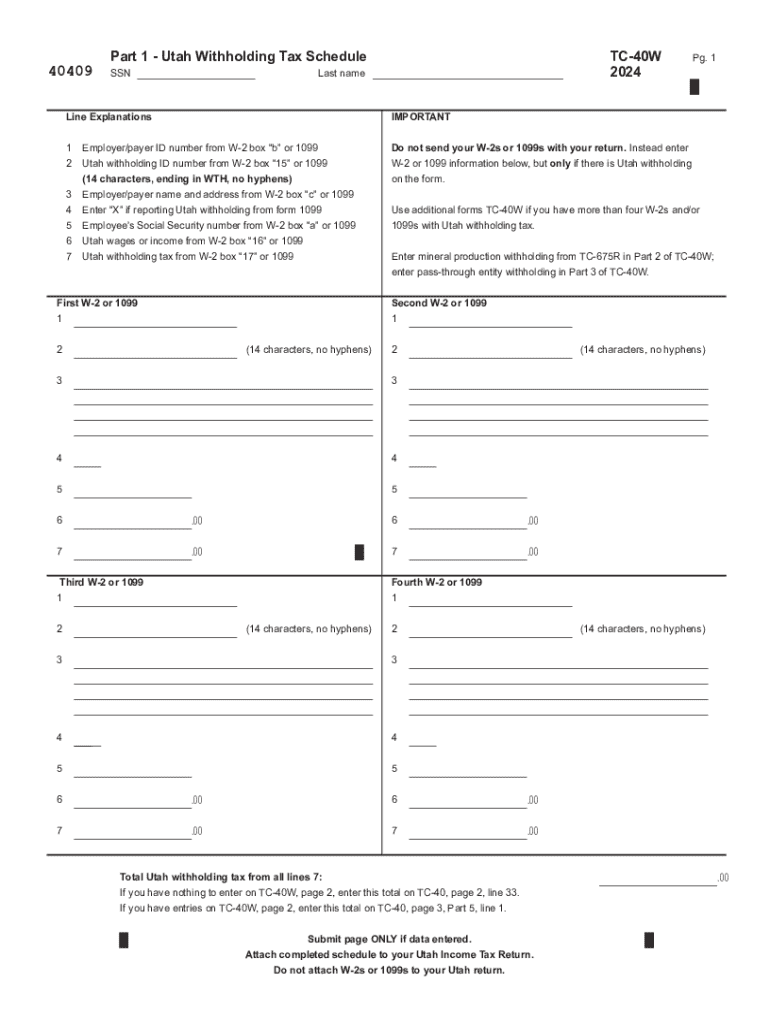

Detailed breakdown of the TC-40W form

The TC-40W requires various pieces of information that are essential for accurate reporting. The Personal Information section is typically the first component, demanding details such as your name, Social Security number, and residence address. This section lays the groundwork for your tax filings and must be devoid of errors.

Following the personal details, the Income Reporting section captures the taxable income you’ve earned during the previous year. Here, you’ll summarize wages from W-2 forms as well as non-wage income, making it crucial to cross-reference your documentation for precision. The subsequent Deductions and Credits section allows filers to lower their taxable income by claiming allowable deductions such as charitable contributions.

How to prepare for filing the TC-40W

Preparing to file the TC-40W involves a meticulous gathering of documentation related to your income. Begin with W-2 forms from employers, as they report wages directly taken from your paychecks. For self-employed individuals, 1099 forms will be crucial in reporting income. Additionally, gather records of any dividends, interest, or other income sources that may influence your Utah tax obligations.

To ensure blunders are avoided, it’s advisable to review prior year filings to detect changes that apply to your current situation. An important preparatory step is calculating any estimated taxes owed. This can help in budgeting for potential tax payments that might be necessary when filing the TC-40W, ensuring no unpleasant surprises arise post-filing.

Step-by-step instructions for filling out the TC-40W

Accessing the TC-40W form online is straightforward. You can find it on the official Utah state revenue website or directly through pdfFiller. The platform allows users to fill out the form digitally, streamlining the data entry process. Importantly, the pdfFiller interface features helpful interactive tools that guide you through each section, allowing for quick corrections and ensuring every detail is captured accurately.

Filling out the form through pdfFiller not only simplifies completion but also gives options for saving and editing your entries before submission. After completing the form, utilize best practices to enhance accuracy. Double-check numbers and entries, and consider involving a tax professional for higher complexity cases.

eSigning and submitting the 2024 Utah TC-40W

One of the significant advantages of using pdfFiller is its integrated eSigning functionality. Understanding the signature requirements of the TC-40W is vital. Once you complete the form, you need to add a signature affirming the information is true and accurate. eSigning through pdfFiller is a seamless process—simply click on the designated eSign button, where you can create a digital signature using your mouse, touchscreen, or upload an image file of your handwritten signature.

After signing, you have the option to submit the form electronically or via traditional mail. E-filing can expedite processing times and reduce the chances of errors commonly associated with physical mailing. Be mindful of submission deadlines to avoid penalties, as late filings can incur fines.

FAQs related to the Utah TC-40W form

Considering the intricacies involved with tax filings, there are numerous questions surrounding the TC-40W. Common queries typically include those on specific deductions, income reporting nuances, and eligibility requirements. Addressing these upfront can prepare individuals for a smoother filing experience. It’s not uncommon for first-time filers to feel overwhelmed by the process; thus, FAQs can serve as an invaluable resource throughout the submission journey.

If uncertainties or issues arise while filling out the form, many platforms like pdfFiller provide round-the-clock support and troubleshooting resources. This proactive approach allows individuals to resolve concerns without frustration and make informed decisions regarding their tax filings.

Managing your tax documents with pdfFiller

Beyond just filing forms, pdfFiller allows you to manage your tax documents efficiently. Organizing your forms and templates makes it easier for both individuals and teams to locate necessary information when needed. The platform also includes collaboration tools that are exceptionally beneficial for those filing jointly or managing shared finances. These functionalities encourage efficient communication and easier adjustments to financial records.

Security is always a top concern for tax documents. pdfFiller incorporates robust security features that protect sensitive information against breaches, providing peace of mind as you store and manage your files. Moreover, accessing archived forms and records gives users insight into past filings, allowing for more informed decision-making as taxpayers prepare for future submissions.

Implications of filing the TC-40W

Filing the TC-40W has crucial implications for your tax liability. Properly reporting your income ensures compliance and can even streamline the refund process should you be eligible for any credits. Tax liability can be significantly reduced when appropriate deductions are claimed, as these can lead to a more favorable net tax owed. Understanding your tax obligations through the TC-40W can thus enhance your financial planning strategies.

Furthermore, the repercussions of filing, or neglecting to file, the TC-40W mean that proper attention must be directed to each element of your submission. Ensuring all calculations are correct avoids audits and penalties post-filing. Therefore, post-submission, evaluating your tax planning for the year following the TC-40W is advisable to prepare for potential changes in income or tax laws.

Additional tools and resources available on pdfFiller

Utilizing pdfFiller not only helps with the TC-40W but also grants access to a plethora of other relevant Utah tax forms. This breadth of resources is especially beneficial for filers navigating complex tax situations, as forms can be compared and considered side-by-side. Furthermore, interactive calculators and estimators available on pdfFiller can aid in budgeting for future tax obligations and preparing for various financial scenarios.

Investing in tools found on pdfFiller empowers users to better understand their tax situation, enabling informed decisions that can lead to improved outcomes when dealing with state taxes. This not only promotes a proactive approach to tax management but also instills confidence before each filing season.

People Also Ask about ut tc 40w

Am I subject to Utah withholding?

How much state tax should I withhold Utah?

How is Utah state tax withholding calculated?

Does Utah have a withholding form?

What is the state tax withholding in Utah?

What is the format for Utah withholding account number?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my utah tc 40w form directly from Gmail?

How can I modify utah tc 40w form without leaving Google Drive?

Can I create an electronic signature for the utah tc 40w form in Chrome?

What is tc-40w?

Who is required to file tc-40w?

How to fill out tc-40w?

What is the purpose of tc-40w?

What information must be reported on tc-40w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.