Get the free First Time Homebuyers Home Sweet Home Program

Get, Create, Make and Sign first time homebuyers home

How to edit first time homebuyers home online

Uncompromising security for your PDF editing and eSignature needs

How to fill out first time homebuyers home

How to fill out first time homebuyers home

Who needs first time homebuyers home?

How-to guide for first-time homebuyers home form

Understanding first-time homebuyer benefits

First-time homebuyers often enjoy specific advantages that streamline the home-buying process. Various programs exist at state, local, and federal levels designed to assist individuals stepping into homeownership. State and local offerings include programs that provide loans with favorable terms and conditions, as well as grants specifically for down payments. Federal programs, such as those offered by the FHA, VA, and USDA, cater to different homebuyer needs, making it easier to achieve homeownership. Understanding which programs apply to your situation is crucial for maximizing available benefits.

Financial assistance options include numerous grants and loans aimed at reducing upfront costs. Many states offer down payment assistance programs that can help you afford your future home more easily. Additionally, first-time homebuyers may benefit from tax deductions, notably the mortgage interest deduction, which allows you to deduct interest paid on your home loan from your taxable income. Understanding these tax benefits can significantly impact your overall financial situation as a homeowner.

Key documents needed for homebuying

When navigating the home-buying process, having the right documents ready is essential. Key forms include loan application forms and purchase agreements. The loan application is necessary for lenders to evaluate your financial stability and determine mortgage eligibility, while the purchase agreement outlines the terms of the property sale. Having these documents prepared and completed efficiently will streamline your interactions with realtors, lenders, and other parties.

Besides these forms, you will need identification and various financial documents. Proof of income is critical for lenders to assess your ability to repay the loan; this may include pay stubs, bank statements, and tax returns. Additionally, obtaining your credit report gives an overview of your credit history and financial responsibility. Collecting these documents ahead of time ensures you are prepared for discussions with lenders and real estate professionals.

The first-time homebuyer process

The homebuying process can feel overwhelming, especially for first-time buyers. Begin with assessing your financial readiness, which includes budgeting to determine how much you can realistically spend on a home. Understanding the difference between pre-qualification and pre-approval is also important; pre-qualification provides an estimate of what you might afford, while pre-approval provides a more reliable commitment from a lender, making you a stronger buyer.

Next, finding the right property involves research and the expertise of a real estate agent. Familiarize yourself with different neighborhoods, considering factors such as the quality of schools, proximity to amenities, and property values. After identifying a suitable property, making an offer is the next step. Implement competitive strategies, keeping in mind the importance of contingencies, which can protect you during the negotiation process.

Once your offer is accepted, the final stage includes closing procedures. Familiarize yourself with what to expect during closing and ensure you have all necessary closing documents. This stage typically includes finalizing your mortgage and signing ownership documents, which are critical in transitioning from buyer to homeowner.

The role of homebuyer forms and templates

Utilizing the correct forms and templates in the homebuying process is vital for ensuring legal compliance and protecting your interests. Standardized forms offer consistency across various transactions, minimizing the risk of errors. Moreover, proper documentation safeguards all parties involved, ensuring clarity and accountability.

Interactive tools available on platforms like pdfFiller enhance the homebuying experience. Online calculators help estimate mortgage payments based on interest rates, while document preparation checklists ensure that you gather all necessary paperwork. Leveraging these tools can simplify the process considerably.

Filling out and managing the homebuying form

Completing key forms accurately is essential for a successful home purchase. For instance, when filling out a loan application, attention to detail is critical; ensure that all requested information, including employment and income details, are entered correctly. This aspect of the process helps establish credibility with lenders and facilitates acceptance of your application.

In an age of digital documentation, using tools like pdfFiller can enhance how you manage your forms. With easy editing capabilities, you can quickly correct any errors before submission. Additionally, collaborating on forms becomes seamless through e-signatures and streamlined document flow, ensuring everyone involved in the process can efficiently communicate and execute required actions.

Common pitfalls and how to avoid them

First-time homebuyers often face common pitfalls that can complicate their journey. One of the most prevalent mistakes is underestimating costs related to homebuying, such as closing costs, property taxes, and maintenance fees. By being mindful of these expenses, you can prepare a more realistic budget and ultimately avoid financial strain.

Additionally, keeping organized records and maintaining regular communication with your lender and agents throughout the process helps ensure smooth sailing. Always document interactions and agreements to prevent future misunderstandings and ensure accountability from all parties.

Tips for a successful homeownership journey

Transitioning from buying to owning means preparing for responsibilities beyond closing day. Home maintenance essentials, such as regular inspections and timely repairs, ensure your investment remains sound. Being proactive about maintenance can lead to significant cost savings over time and help retain property value.

Building equity is one of the most compelling reasons to invest in homeownership. Understanding property value appreciation allows you to make informed decisions about selling or refinancing your property in the future. Financial planning for home equity loans can further enhance your investment strategy, allowing you to tap into the value of your home when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in first time homebuyers home without leaving Chrome?

How do I edit first time homebuyers home straight from my smartphone?

How do I fill out first time homebuyers home using my mobile device?

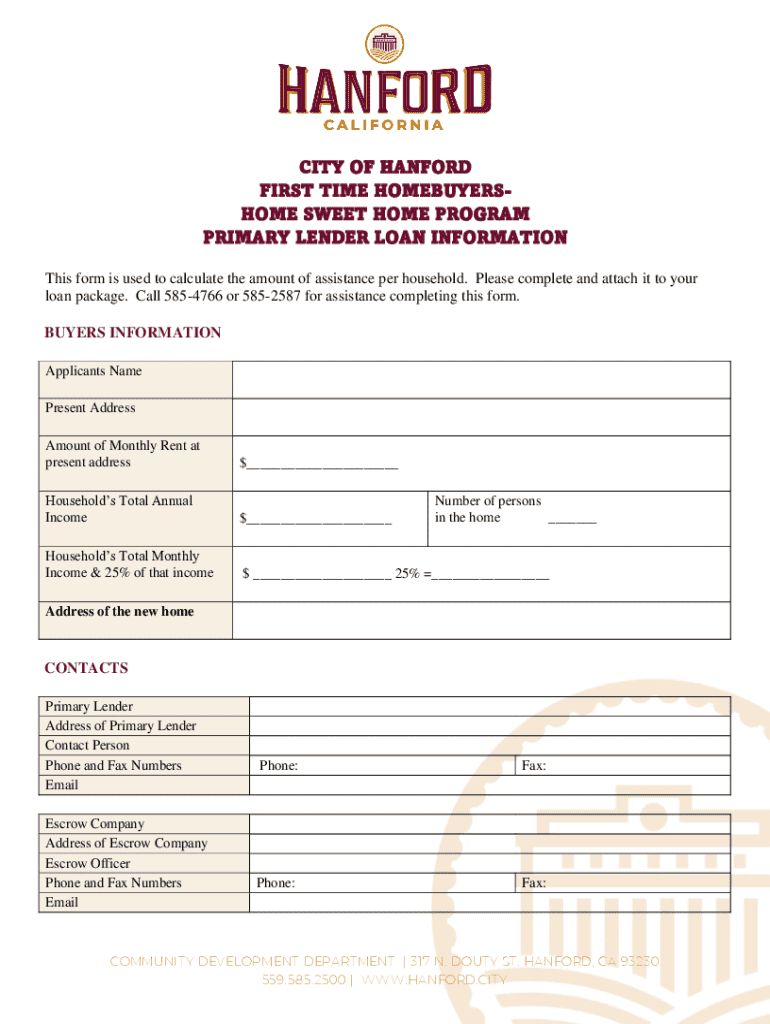

What is first time homebuyers home?

Who is required to file first time homebuyers home?

How to fill out first time homebuyers home?

What is the purpose of first time homebuyers home?

What information must be reported on first time homebuyers home?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.