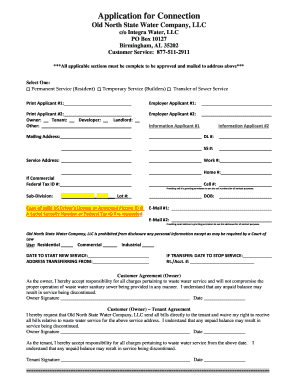

Get the free 990-t

Get, Create, Make and Sign 990-t

Editing 990-t online

Uncompromising security for your PDF editing and eSignature needs

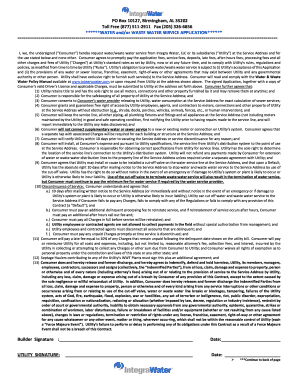

How to fill out 990-t

How to fill out 990-t

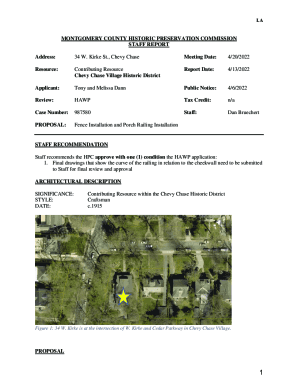

Who needs 990-t?

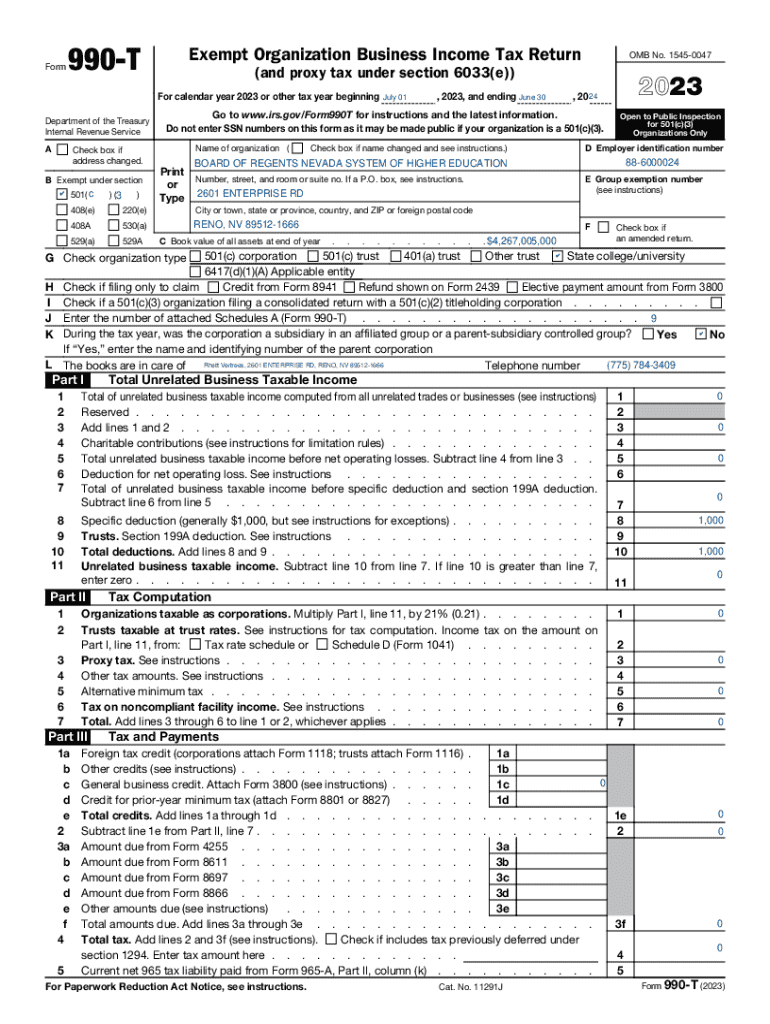

Complete Guide to the 990-T Form: Tax Needs for Nonprofits

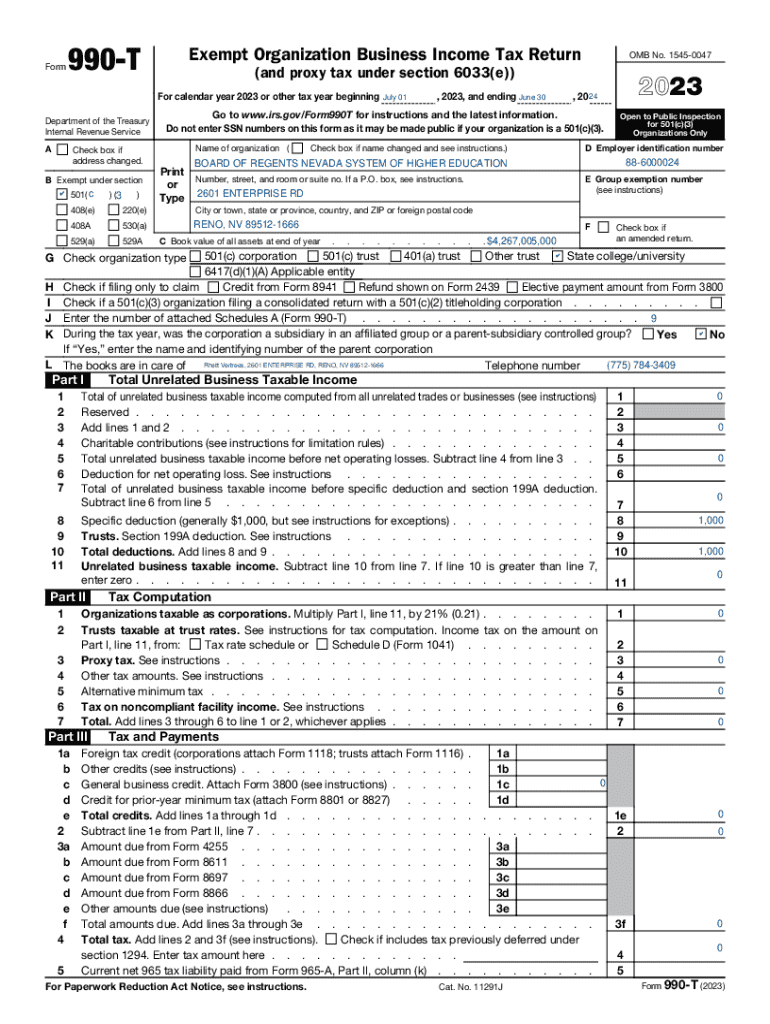

What is the 990-T Form?

The 990-T Form is a reporting document used by certain tax-exempt organizations to report unrelated business income (UBI) and calculate the corresponding tax owed. This includes organizations that qualify under IRS regulations, such as charities, educational institutions, and religious organizations. Understanding the importance of this form is crucial, as it safeguards these entities against compliance issues with the IRS, ensuring they maintain their tax-exempt status.

The 990-T form not only helps the IRS track the unrelated business income generated by exempt organizations but also ensures transparency, aiding in the assessment of taxes owed. This form becomes necessary when exempt organizations engage in business activities that are not substantially related to their exempt purpose, thus generating taxable income.

Who must file the 990-T Form?

Organizations that are often required to file the 990-T Form include charities, educational institutions, hospitals, and other entities that qualify for tax-exempt status under Section 501(c) of the Internal Revenue Code. The primary criterion for filing is generating $1,000 or more in gross unrelated business income in a taxable year. If an organization meets this threshold, it must file, reflecting its UBI activities.

Certain exemptions exist; for instance, organizations without taxable income or those generating revenue solely from passive investments may not need to file. Understanding these exemptions can help organizations minimize unnecessary paperwork and focus on their core missions.

When is the deadline to file the 990-T Form?

Typically, the deadline for filing the 990-T Form aligns with the due date for the organization's income tax return, including any extensions. For calendar-year organizations, this is usually April 15. However, many file for an extension, offering an additional six months, making the extended deadline October 15. Keeping track of these dates is vital to avoid penalties.

Failing to file the 990-T Form on time can result in penalties ranging from $20 to $100 per day, significantly impacting resources. If an extension is filed, it's essential to ensure that all necessary forms are submitted by the extended deadline to avoid these financial repercussions.

Understanding the components of the 990-T Form

The 990-T Form encompasses several parts and supporting schedules, each addressing different aspects of unrelated business income and tax calculations. Part I collects data on income, deductions, and taxable income, while Part II and Part III focus on tax computations and payments, respectively. Each section offers insights into the organization’s financial activities and obligations.

Schedules may also accompany the filing, such as Schedule A for specific details on certain types of income. Knowing what to include in these schedules is crucial for compliance and accuracy.

How to file the 990-T Form electronically

Filing the 990-T Form electronically simplifies the submission process, providing a faster and more efficient approach compared to traditional paper filing. e-filing allows organizations to submit forms securely over the internet, reducing the time needed to receive confirmations from the IRS. Organizations can take advantage of platforms like pdfFiller, which streamlines this process with features that enhance usability.

The benefits of e-filing extend beyond efficiency; organizations can also reduce the risk of manual errors and save valuable time for other mission-driven activities.

What you’ need to file the 990-T Form online

Before beginning the online filing process for the 990-T Form, ensure you gather all necessary documents and information. This includes previous financial statements, tax records, and any details regarding unrelated business income sources. Having these documents readily available not only streamlines the process but also enhances the accuracy of the information submitted.

Following these preparatory steps will provide a framework for effective filing and help avoid delays.

Filling out the 990-T Form: a step-by-step guide

Completing the 990-T Form may seem daunting, but breaking it down into smaller sections can simplify the process. First, start with Part I, where you will enter all income and deductions related to unrelated business activities. Be careful to categorize income accurately, as misclassification can lead to substantial tax issues.

Reviewing the filled-out form before submission is crucial. Double-check every figure and ensure all necessary schedules are attached. Common mistakes include incorrect calculations and missing signatures, which can lead to delays in processing.

What are the penalties for filing the 990-T Form late?

Timeliness in filing the 990-T Form is crucial, as late submissions incur penalties. The penalties vary based on how late the form is filed and can accumulate quickly. Generally, a penalty of $20 per day is assessed for late filings, with a maximum of $10,000.

To avoid these penalties, create internal reminders aligned with IRS deadlines and maintain accurate records year-round.

Frequently asked questions about the 990-T Form

Organizations frequently express concerns about the 990-T Form, particularly regarding the complexities of filing procedures and the implications of taxable income. One common question is whether unrelated business income such as advertising revenue needs to be reported. The answer is yes, as it often constitutes UBI.

Addressing these frequently asked questions proactively can help organizations navigate the complex landscape of unrelated business income reporting.

Helpful resources for completing the 990-T Form

Utilizing helpful resources can make the process of filling out the 990-T Form more manageable. pdfFiller offers interactive tools that streamline filling and editing your forms, ensuring accuracy. Additionally, IRS resources provide extensive guidelines on requirements and procedures.

Leveraging these resources ensures a smoother filing experience, aiding in consistency and compliance.

Integrating the 990-T Form with other forms and schedules

The 990-T Form does not exist in isolation; it interacts with other IRS forms, especially the Form 990, which is the annual return for tax-exempt organizations. Organizations must ensure that information reported on the 990-T aligns with data presented in Form 990 to prevent any discrepancies.

Understanding how the 990-T integrates with other compliance requirements is crucial for accurate reporting and maintaining tax-exempt status.

The pdfFiller advantage: streamlined document management

pdfFiller not only simplifies the filing process for the 990-T Form but also enhances overall document management for organizations. With its robust platform, users can easily collaborate, sign electronically, and edit forms seamlessly. This ensures that teams can focus on their missions without the burden of administrative overhead.

These advantages make pdfFiller an essential tool for organizations looking to optimize their filing process and enhance efficiency.

Tips for efficient team management during the filing process

Managing a team during the filing process can be streamlined with proper organization and communication. Clearly defined roles help ensure everyone knows their responsibilities when filling out the 990-T Form.

Implementing these strategies will help alleviate potential stress and enhance the overall efficiency of the organization.

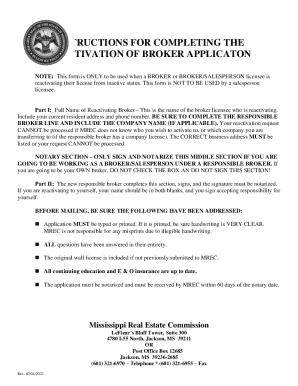

Recent updates and changes to IRS Form 990-T

Being aware of any updates to the 990-T Form is essential for compliance and accurate reporting. Changes can include adjustments to the thresholds for taxable income, new reporting requirements for certain activities, and modifications in deduction regulations. Staying informed about these changes ensures that organizations are always following the current IRS guidelines while filing.

Recognizing these updates can directly impact filing practices and help organizations avoid penalties related to outdated submissions.

Success stories: how pdfFiller helped organizations with their 990-T filings

Many organizations have successfully streamlined their filing processes by utilizing pdfFiller. Testimonials frequently highlight the ease of use and time-saving features that assist in completing the 990-T Form accurately and efficiently. For instance, several nonprofits have reported reduced filing errors and improved team collaboration through the platform, enabling more focus on their core missions.

Such success stories illustrate how pdfFiller empowers organizations to navigate their tax responsibilities with confidence while reducing complexities and ensuring compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 990-t directly from Gmail?

Can I edit 990-t on an iOS device?

How do I fill out 990-t on an Android device?

What is 990-t?

Who is required to file 990-t?

How to fill out 990-t?

What is the purpose of 990-t?

What information must be reported on 990-t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.