Get the free Dual Taxation - Unbalanced and Arbitrary

Get, Create, Make and Sign dual taxation - unbalanced

Editing dual taxation - unbalanced online

Uncompromising security for your PDF editing and eSignature needs

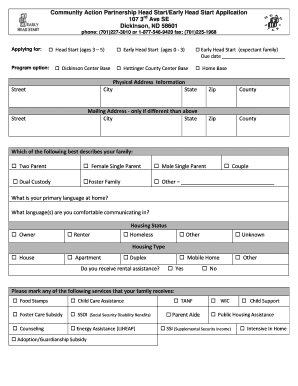

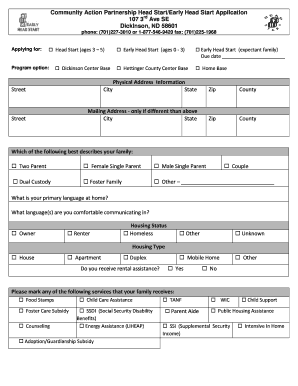

How to fill out dual taxation - unbalanced

How to fill out dual taxation - unbalanced

Who needs dual taxation - unbalanced?

Dual Taxation - Unbalanced Form: Understanding Its Implications and Strategies

Understanding dual taxation

Dual taxation refers to the taxation of the same income by two different jurisdictions, leading to a situation where an individual or business is taxed in both their home country and the country where they earn income. This can cause significant financial burdens, especially for expatriates and businesses with international operations. Dual taxation impacts not only personal incomes but also corporate earnings, forcing companies to navigate complex tax codes while attempting to minimize their tax liabilities.

Definition of dual taxation

The essence of dual taxation lies in the overlapping claims of tax rights by different governments, often due to differing fiscal policies, tax treaties, or bilateral agreements. This can result in a higher effective tax rate for individuals and corporations, discouraging foreign investment and impeding economic growth.

Historical context of dual taxation

Historically, dual taxation has evolved alongside globalization. As trade and borders have expanded, the need for dual taxation frameworks has increased. Early tax treaties aimed at reducing double taxation were established after World War II, but these agreements have not always kept pace with the rapid changes in the global economy, leading to today's unbalanced forms of dual taxation.

The unbalanced nature of dual taxation

Dual taxation is often regarded as unbalanced due to the disparities it creates among various income earners and geographical regions. Wealthier individuals and corporations can afford specialized tax advisors to navigate these complexities, while lower-income earners or smaller businesses may struggle under the burden of multiple tax liabilities.

Identifying the disparities

These disparities manifest in several dimensions. For instance, expatriates who earn income in foreign countries may find themselves paying taxes both in the host and home country. Similarly, businesses offering cross-border services face increased tax rates due to compliance with multiple jurisdictions. This results in a disproportionately higher tax burden on these groups, further widening the economic gap.

Case studies highlighting unbalanced dual taxation

A prime example is the technology sector, where many companies earn substantial revenues abroad but face tax liabilities in their home countries. For instance, a U.S.-based tech company that earns profits in Europe may be subject to EU VAT and additional local taxes, resulting in a compounded tax obligation. This dual taxation can deter innovation and new investments in foreign markets, affecting overall economic growth.

Mechanisms of dual taxation and its effects

Understanding the mechanisms of dual taxation involves looking at international tax treaties and national tax regulations. While treaties exist to mitigate double taxation, they often fall short in addressing the unbalanced nature of the issue, causing confusion and frustration among taxpayers.

Tax treaties and their role

Tax treaties are designed to prevent double taxation and encourage cross-border trade; however, their complexity can lead to misunderstandings and inadequate coverage. Many treaties do not account for evolving global economy circumstances, leading to gaps that leave taxpayers with unresolved tax obligations.

Economic implications of dual taxation

The consequences of unbalanced taxation are far-reaching, impacting everything from personal investment decisions to government revenue collections. High effective tax rates due to dual taxation can inhibit foreign direct investment, ultimately stunting economic growth in both the host and home countries. Additionally, individuals may face a disincentive to engage in foreign employment or investments due to the financial risks posed by dual taxation.

Current negotiations and challenges

Countries worldwide are currently engaged in negotiations to address the challenges posed by dual taxation. While progress is made in harmonizing tax policies, there remains a lack of cohesive international standards, complicating the efforts to achieve fair taxation.

Overview of international negotiations

International negotiations often center around proposals for new treaties or modifications to existing agreements. Discussions frequently focus on reducing the tax rates that apply to cross-border transactions and harmonizing reporting standards to ease compliance burdens for multinational companies.

Barriers to resolution

Key obstacles to achieving equitable agreements include differing national interests, economic policies, and competing claims over tax rights. Countries may be reluctant to cede taxing authority over their citizens or businesses, hindering negotiations and prolonging the unbalanced nature of dual taxation.

Strategies for individuals and businesses

In light of the complexities surrounding dual taxation, there are several strategies individuals and businesses can implement to manage their tax obligations more effectively.

Effective tax planning

Effective tax planning is paramount for individuals working in multiple jurisdictions. This includes understanding tax treaties that apply to your situation and leveraging available credits to minimize double taxation. Engaging with tax professionals who specialize in international tax laws can provide invaluable guidance tailored to specific situations.

Resources for businesses

For businesses, proactive strategies include conducting rigorous compliance checks, utilizing a cross-border tax advisor, and exploring tax-efficient structures to operate internationally. These steps can help streamline operations and reduce the adverse impacts of dual taxation.

Flipping the narrative on taxation

To resolve the burdens associated with dual taxation, innovative taxation strategies must be considered. These alternatives can level the playing field and alleviate the financial pressures felt by individuals and businesses.

Alternative approaches to taxation

One promising approach is implementing digital taxation frameworks that are simpler and more transparent. Countries could adopt standardized tax practices that reduce complexities and streamline compliance. By focusing on equitable tax structures, nations can encourage fairer distribution of tax burdens.

The role of technology in document management

Technology, too, plays a vital role in mitigating the challenges posed by dual taxation. Solutions like pdfFiller empower users to manage their documents effectively—from editing and signing to ensuring compliance with tax obligations, all in a single, cloud-based platform. Such tools can significantly ease the process of documentation and form management for individuals and businesses alike.

Future implications of dual taxation

Looking ahead, the landscape of dual taxation is likely to undergo significant changes as global economies adapt to shifts in business models and labor markets. Governments must remain nimble to foster an environment conducive to innovation and economic growth.

Predicting trends in global taxation

Experts predict a trend toward increased cooperation among jurisdictions, leading to more standardized international tax policies. This may include the introduction of global minimum tax rates that could simplify compliance and reduce disparities caused by unbalanced taxation.

Preparing for change

To stay ahead of potential changes in taxation policy, individuals and teams should continuously educate themselves on tax regulations affecting their circumstances, engage with tax professionals or attend workshops, and leverage technology to manage documentation and filing processes seamlessly. Being proactive can help mitigate risks associated with dual taxation.

Interactive tools and resources

Utilizing modern technology can aid individuals and businesses significantly in navigating dual taxation effectively. Tools available today simplify the myriad challenges posed by document management and tax compliance.

Document management solutions

One such resource is pdfFiller, a platform that offers comprehensive document management capabilities. Users can create, edit, and manage their tax documents with ease, reducing the time and frustration involved in tax preparation.

Template examples for tax forms

Additionally, pdfFiller offers a range of templates to assist users in navigating the complexities of tax obligations under various dual taxation frameworks. These templates can guide users through filling out essential forms accurately and efficiently.

Engaging in the conversation

Engaging with the broader community is crucial for addressing the challenges posed by unbalanced dual taxation. Individuals and businesses must remain proactive in seeking advice, participating in discussions, and advocating for changes that promote fair tax practices.

Community outreach and consultation opportunities

Consultation with tax professionals and participation in local forums can provide insights into effective tax strategies and emerging regulations. Such outreach efforts can foster collaboration and educate stakeholders on the implications of dual taxation.

Advocacy for fair tax practices

Individuals can actively advocate for reforms that address the imbalances in dual taxation by reaching out to their representatives and supporting organizations that focus on tax equality. By raising awareness, stakeholders can influence policies that lead to a more equitable tax environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit dual taxation - unbalanced online?

Can I create an eSignature for the dual taxation - unbalanced in Gmail?

How do I fill out the dual taxation - unbalanced form on my smartphone?

What is dual taxation - unbalanced?

Who is required to file dual taxation - unbalanced?

How to fill out dual taxation - unbalanced?

What is the purpose of dual taxation - unbalanced?

What information must be reported on dual taxation - unbalanced?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.