Get the free Business Account Application

Get, Create, Make and Sign business account application

How to edit business account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business account application

How to fill out business account application

Who needs business account application?

Business Account Application Form - How-to Guide

Understanding business account application form

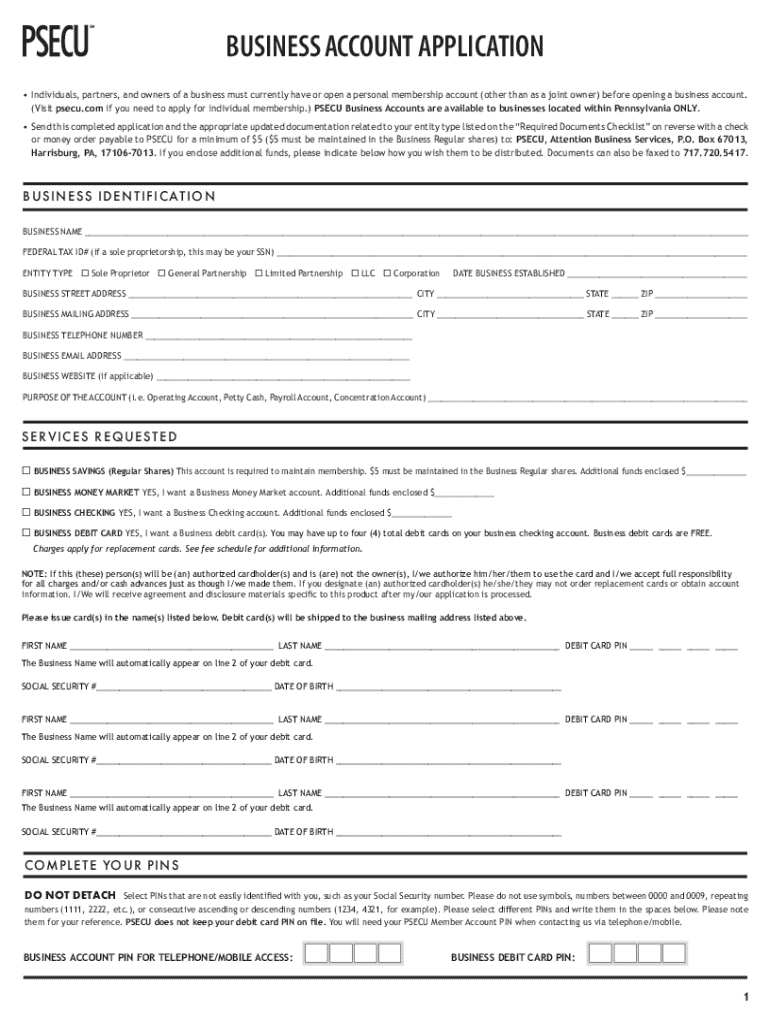

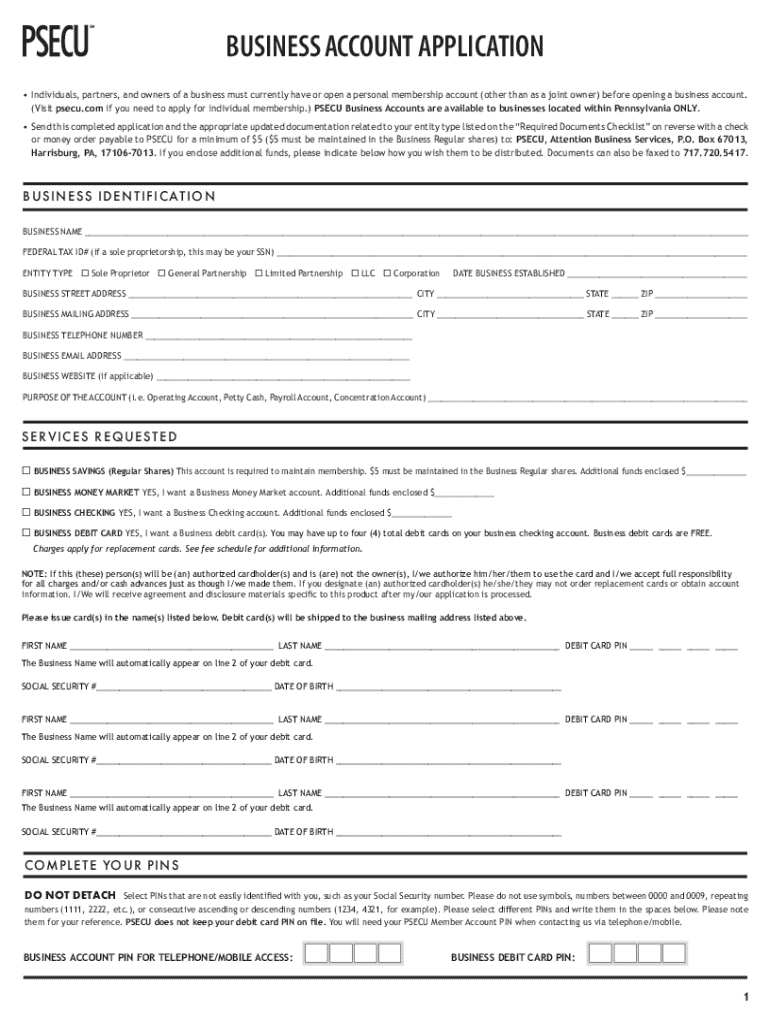

A business account application form is a critical document that enables businesses to open a bank account specifically designed for business use. The primary purpose of this form is to gather essential information about the business, its ownership, and its financial standing. The completion of this application is essential not only for opening a business account but also plays a pivotal role in underlining your legitimacy as a business entity to banks and financial institutions.

Submitting a thorough and accurate application can significantly impact your ability to grow and manage your business effectively. Understanding the nuances of the application process ensures that you present your business in the best light and avoid any pitfalls that could delay your access to necessary financial services.

The application process typically involves filling out multiple sections, each containing specific fields that require detailed input. Knowing what to expect on the form can ease the submission process.

Prerequisites for completing the application

Before initiating your business account application, it is essential to gather the required documentation. This generally includes your business registration details, tax identification number, and personal identification if you're the sole proprietor or a partner in the business. Presenting complete and accurate documents helps streamline the approval process.

Choosing the right type of business account is another critical aspect. Different business structures—such as sole proprietorships, partnerships, limited liability companies (LLCs), and corporations—may require slightly different applications and documentation.

It’s also essential to familiarize yourself with some common terms and definitions, such as 'DBA' (Doing Business As) and how business credit scores work, which can affect your eligibility for specific banking services.

Navigating the business account application form

To fill out the business account application form correctly, you'll need to navigate through several sections, each requiring different sets of information. The form typically begins with contact information, including your business name, address, and phone number. These details help banks communicate with you effectively.

The next critical section is business information, which includes your registered business name, legal structure, and a brief description of the services or products offered.

Utilize interactive tools and guides to assist you in filling out the form. Confirm that you've completed all required fields to avoid any processing delays.

Filling out the application form

Completing each section of the business account application form effectively requires a strategic approach. Start with financial data: ensuring accuracy is paramount as banks often scrutinize this information closely. Providing a clear and concise business description helps the bank understand your operations quickly.

For example, if a field requests revenue estimates, present approximate figures derived from your recent financial statements or forecasts. Similarly, ensure that the business description highlights your unique selling points and operational ethos.

Special types such as corporations and LLCs have unique requirements. Distinguishing between the two when filling out the form can impact your account features and banking terms—addressing these distinctions effectively improves your application.

Submitting your business account application

Once you've completed your application form, it's time to submit it. Most banks today offer both online and paper submission options. Online submissions are usually faster and integrate tracking options, allowing you to monitor the status of your application in real-time.

After submission, keep an eye on the timelines provided by the bank for processing. Typical processing times might range from a few days to a couple of weeks, depending on the institution and completeness of your application.

After submission: what to expect

Once your application is submitted, you can anticipate several possible outcomes. You might receive an approval, request for additional information, or a denial. Understanding these potential pathways helps you prepare for follow-up actions as needed.

Many banks now provide an online portal where you can track your application status. Check this feature regularly to stay informed.

Managing your new business account

Once your business account is active, managing it effectively is key to leveraging its benefits. Accessing your account online often provides a user-friendly interface for engaging with your financial resources. Keep all documents supporting your account updated, including registration documents, tax IDs, and relevant agreements.

pdfFiller allows you to easily manage documents related to your business account. With it, you can securely eSign and collaborate on important documents without leaving your account. Utilizing features for editing and customizing forms directly contributes to efficient account management.

Helpful resources for business account management

Navigating the world of business banking can be challenging, but there are numerous resources available to aid you. From links to related business form templates offered by pdfFiller to useful business management tools and software, these resources can enhance your experience.

Financial guidance and consulting services can provide personalized insights tailored to your business model, ensuring that you operate effectively within the financial landscape.

Frequently asked questions

As you embark on your journey to open a business account, common queries arise regarding the application process and account maintenance. Understanding what to prepare for can save time and effort down the line. Most banks provide extensive FAQs, covering topics from application requirements to the implications of account compliance.

Make sure to note down contact information for further assistance, as bank representatives can clarify doubts specific to your situation.

Additional tools and support

pdfFiller provides interactive features that enhance the form-filling experience, allowing users to edit, eSign, and collaborate in real-time. Additionally, accessible customer support options ensure that help is just a click away for any inquiries concerning document management.

Engaging with community forums allows you to connect with other business owners and share advice, insights, and best practices regarding business account management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business account application in Chrome?

Can I create an electronic signature for the business account application in Chrome?

How do I edit business account application on an iOS device?

What is business account application?

Who is required to file business account application?

How to fill out business account application?

What is the purpose of business account application?

What information must be reported on business account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.