Get the free Sblc With Mt799 Issuance Agreement

Get, Create, Make and Sign sblc with mt799 issuance

How to edit sblc with mt799 issuance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sblc with mt799 issuance

How to fill out sblc with mt799 issuance

Who needs sblc with mt799 issuance?

Understanding SBLC with MT799 Issuance Form: A Comprehensive Guide

Understanding SBLC and MT799

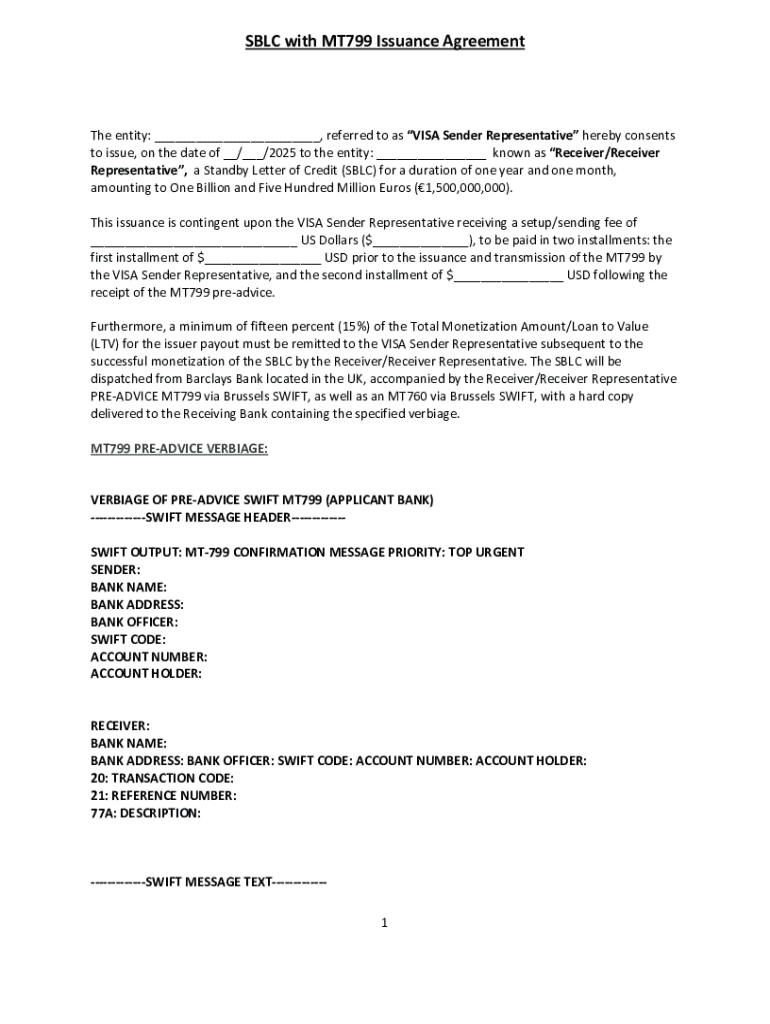

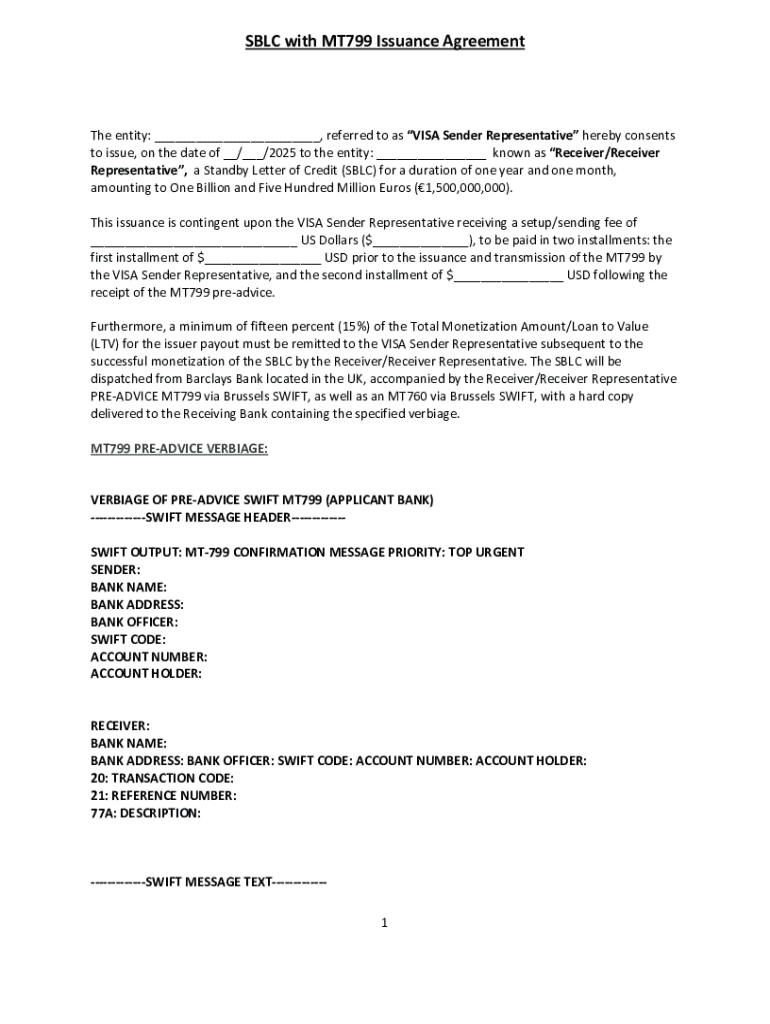

A Standby Letter of Credit (SBLC) is a financial instrument issued by a bank that guarantees payment to a beneficiary if the applicant fails to fulfill their financial obligations. It serves primarily as a security measure and is particularly useful in international trade scenarios where the risk of non-payment is significant. Investors and businesses rely on SBLCs to enhance their credibility and ensure the safety of transactions, particularly in unfamiliar markets.

The MT799 messaging service, part of the SWIFT network, is a key component in trade finance, facilitating secure, encrypted communication between banks about financial transactions. This message type does not transfer funds but serves to confirm intentions regarding the issuance of financial instruments like SBLCs. Through MT799, banks can assure lenders of the necessary arrangements in place.

The role of MT799 in SBLC issuance

The MT799 plays a crucial role in SBLC transactions by acting as a preliminary communication tool that establishes the groundwork for the actual issuance of the SBLC. When a party requests an SBLC, a corresponding MT799 message is initiated, detailing the agreement terms and signaling the intent. This approach is particularly important in complex transactions where multiple parties interact, ensuring transparency and alignment on expectations.

Key characteristics of SBLCs linked to MT799 messages include specificity, conditionality, and visibility. The MT799 identifies whether a bank can support the issuance and outlines the structure and requirements. This creates a documented trail that mitigates risks and makes subsequent steps smoother, ensuring all parties are informed and accountable.

Step-by-step process for issuing SBLC with MT799

Issuing an SBLC with an MT799 message involves a systematic process to ensure compliance and effectiveness. First, businesses must gather all necessary documentation required for the SBLC issuance. This typically includes a formal request letter, details of the underlying transaction, and identification documents.

Once documentation is prepared, reach out to your financial institution to commence the MT799 process. Discuss your requirements thoroughly to ensure clarity on expectations and timelines. Your bank will guide you in drafting the MT799 message, which must include specific details about the transaction, such as parties involved, amounts, and terms of the credit. Properly entering this information is critical as any discrepancies can lead to delays or complications in the issuance.

Important considerations when using MT799 for SBLC

When leveraging MT799 for SBLC issuance, it’s vital to navigate some common pitfalls. One issue may arise from inadequate documentation, resulting in delays or rejection of the issuance request. Ensure all submitted letters, forms, and agreements are comprehensive and correctly completed. Additionally, remain aware of international trade regulations that apply to the transaction. Failing to comply with these laws can introduce unwanted risks.

Moreover, understanding the costs involved in issuing an SBLC and using MT799 messages is essential. Banks often charge varying fees based on the complexity and risk factors of the transaction. Ensure that you inquire about all potential costs upfront to avoid surprise expenses later in the process.

Interactive tools and resources

To effectively manage and issue MT799 messages, utilizing interactive tools can streamline the process significantly. pdfFiller offers a document creation tool that enables users to create, edit, and manage their MT799 forms easily. This platform allows you to customize language, input the right details, and ensure compliance seamlessly.

Moreover, pdfFiller also provides sample templates for SBLC along with MT799 messages, serving as a guide for those unfamiliar with the required format. Users can interactively fill out these templates, ensuring they collect all necessary information without confusion.

Frequently asked questions

Several questions often arise among users new to the SBLC with MT799 process. One common inquiry pertains to the difference between MT799 and MT760. While MT799 is used for preliminary confirmations and intentions, MT760 specifically serves as advice for guaranteeing payment under an SBLC, making it more formal.

Another frequently asked question involves the duration of the MT799 issuance process. Timing may vary by institution, but generally, it takes a few hours to a couple of days. The final query usually relates to the possibility of amending an MT799 message after sending. Once transmitted, modifications are not feasible, emphasizing the necessity for accuracy before sending.

Expert insights and best practices

Expert opinions on optimizing the MT799 for SBLC issuance provide valuable insights. Specialists in trade finance suggest maintaining open communication with your financial institution throughout the process. Clear dialogue helps manage expectations and ensures that all parties are on the same page regarding requirements and timelines.

Additionally, working closely with financial experts to navigate the intricacies of SBLC and MT799 can mitigate challenges. Learning and understanding the specific language and documentation required in these transactions can foster expertise and confidence in handling future deals.

Troubleshooting common issues

Issues may arise during MT799 transactions, such as miscommunication or incorrect entry of details. If discrepancies occur, promptly contacting your bank for resolution is crucial. Financial institutions typically have dedicated teams to assist with troubleshooting, and timely communication can lead to swift solutions.

Additionally, disputes related to SBLC and MT799 may need resolution through negotiation. Should challenges arise that cannot be reconciled directly, seeking external arbitration might be necessary. It's prudent to document all communications and agreements during the process to streamline any potential dispute resolution.

The future of trade finance and MT799

As trade finance evolves, the issuance of SBLC with MT799 messages is expected to undergo significant changes. Emerging trends indicate a shift toward digitalization, where traditional paper-based documents are increasingly replaced by electronic formats, enhancing efficiency and reducing processing times.

Moreover, the integration of blockchain technology promises increased transparency and security in trade documents management, including SBLCs. These innovations aim to mitigate risks and streamline operations for businesses, potentially transforming the landscape of international trade.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the sblc with mt799 issuance in Gmail?

How can I edit sblc with mt799 issuance on a smartphone?

How do I complete sblc with mt799 issuance on an iOS device?

What is sblc with mt799 issuance?

Who is required to file sblc with mt799 issuance?

How to fill out sblc with mt799 issuance?

What is the purpose of sblc with mt799 issuance?

What information must be reported on sblc with mt799 issuance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.