Get the free Boe 577

Get, Create, Make and Sign boe 577

Editing boe 577 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe 577

How to fill out boe 577

Who needs boe 577?

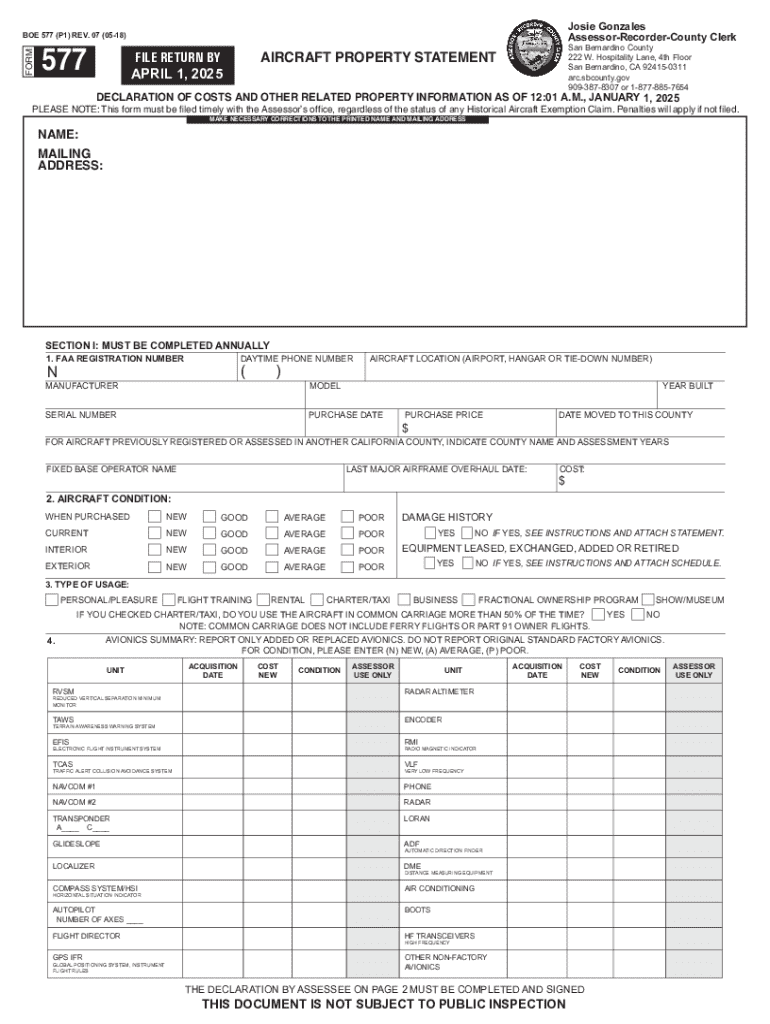

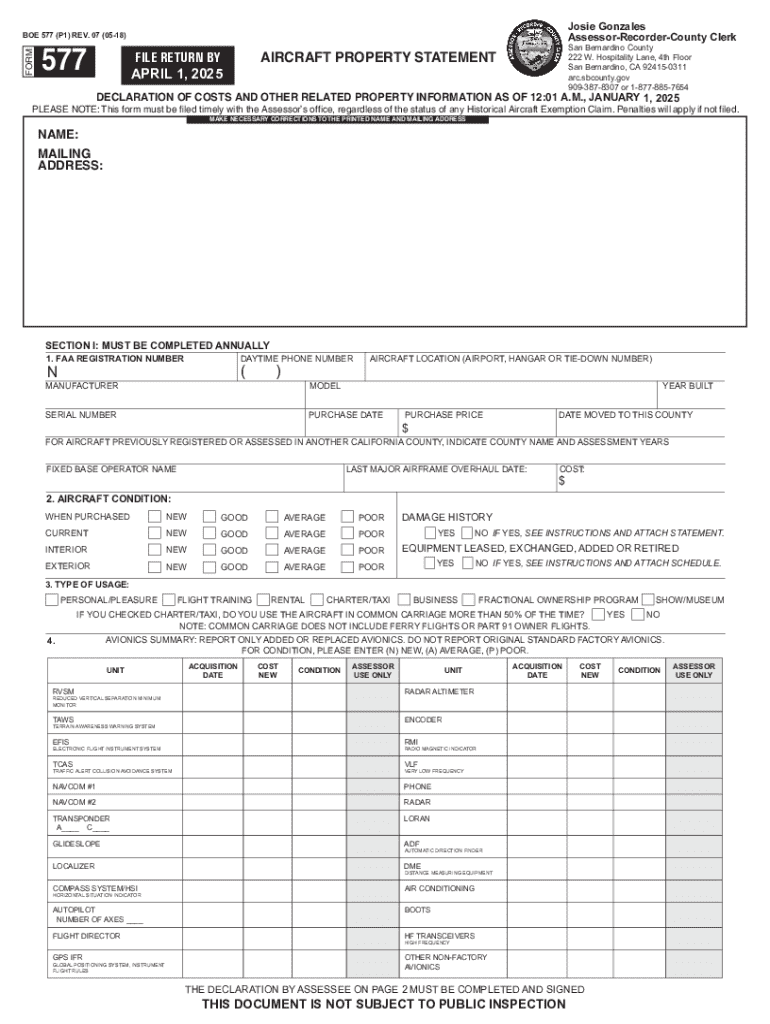

A comprehensive guide to the BOE 577 form: Understanding property tax assessments in California

Understanding the BOE 577 Form

The BOE 577 form, formally known as the 'Claim for Homeowners’ Property Tax Exemption,' is a pivotal document in California that property owners must understand. This form is essential for claiming an exemption on the property taxes of qualified residential properties, allowing homeowners to secure a reduction in their property tax assessment.

Filing the BOE 577 form is not merely a bureaucratic requirement; it holds substantial financial implications for homeowners. By successfully submitting this form, individuals can claim an exemption that reduces their property tax burden, thereby easing the financial strain on their household budget. The importance of this form cannot be understated in the context of residential property ownership in California.

Who needs to complete the BOE 577 form?

The BOE 577 form is primarily targeted at California property owners, including individuals who own a home, rental properties, and property managers representing businesses. This form is often required when homeowners want to apply for the Homeowners' Property Tax Exemption, thereby reducing their taxable property value.

Scenarios necessitating completion of the BOE 577 form include new homeowners moving into a property, individuals purchasing a home for the first time, or those undergoing status changes, such as marriage or divorce. It's essential to dispel misconceptions that only long-time homeowners or those with significant property tax bills need to file this form; all qualifying property owners should consider submitting for the exemption.

Key sections of the BOE 577 form

The BOE 577 form comprises several critical sections, each designed to capture specific information about the property and its ownership. Understanding these segments is vital for accurate and successful completion of the document.

Section A requires property identification, where you will input your property’s address and Assessor's Parcel Number (APN). Section B focuses on ownership details, confirming who legally owns the property. Section C encompasses a description of the property, including its use and characteristics, which helps tax assessors determine eligibility for exemption. Lastly, Section D gathers claimant information, ensuring the correct party is associated with the claim.

Step-by-step instructions for filling out the BOE 577 form

Filling out the BOE 577 form correctly is crucial for a successful tax exemption claim. Start by gathering all necessary information, such as your property details. As you fill out the form, ensure that each piece of information is accurate. For instance, when entering details in Section A, double-check the property address and APN against official documents to avoid any errors.

Each section has specific requirements: in Section B, be precise about ownership status—if you're a tenant, a family member, or an heir, indicate that clearly. In Section C, describe the property accurately—missing key details could lead to rejection of the claim. Pay attention to Section D as well; incorrect claimant information can delay processing.

To enhance your understanding, utilizing visual examples and screenshots can be incredibly beneficial. Annotated examples of a filled-out form can illustrate common pitfalls and best practices. This will empower users to navigate the form with greater confidence.

Editing and modifying the BOE 577 form

In today's digital age, modifying forms like the BOE 577 is straightforward with the right tools. PDF editors like pdfFiller allow users to edit their forms efficiently. With features such as text editing, you can easily correct any mistakes or update your information without having to start from scratch.

Interactive tools available on pdfFiller enhance the user experience, allowing you to add signatures electronically, apply stamps, and make comments. These features not only minimize the time spent on modifications but also ensure accuracy. Furthermore, pdfFiller allows for version management, enabling users to save and review different iterations of their documents easily.

Signing the BOE 577 form

When finalizing your BOE 577 form, signing is a crucial step, and understanding the eSignature laws in California is essential. California recognizes electronic signatures as valid if they meet specific criteria, streamlining the submission process for many homeowners.

Using pdfFiller’s eSignature feature not only complies with these regulations but also provides security during transmission. With encrypted transactions, users can be assured that their information remains confidential. Thus, when signing your BOE 577 form through pdfFiller, you can maintain compliance and security effectively.

Submitting the BOE 577 form

Once the BOE 577 form is accurately completed and signed, the next step is submission. You can submit the completed document electronically through designated California state portals, which is often quicker and more efficient than traditional methods. Alternatively, you can mail your form directly to your local county assessor's office.

When mailing, ensure that you send your form to the correct address for your county and pay attention to submission deadlines. Typically, these forms must be submitted within a specific timeframe to be processed for the current assessment year, so verifying deadlines is crucial to avoid delays in your tax exemption claim.

Frequently asked questions about the BOE 577 form

When navigating the BOE 577 form, many users have common queries that arise throughout the process. For instance, what should you do if there is a mistake on the form after submission? Generally, you may correct mistakes by submitting an amended form or contacting your local assessor’s office for guidance.

Additionally, users often wonder about filing the form late. In most cases, late submissions will not be accepted for the current year’s exemption, but there may be options for appeal. Handling disputes regarding assessments can also be nuanced; filing an appeal is recommended, along with seeking assistance from tax professionals or local offices.

Related forms and resources

In addition to the BOE 577 form, various other related forms might be beneficial for property owners in California. Users can find complementary forms on the pdfFiller platform and access added resources for a better understanding of tax exemptions and assessments.

For personalized assistance, it’s crucial to maintain contact with local county assessor offices. They provide precise guidance on completing forms accurately and offer insight into the appeals process should any disputes arise.

Troubleshooting common issues with the BOE 577 form

While filling out the BOE 577 form, users may encounter technical issues, especially when using online tools. pdfFiller offers troubleshooting resources to identify and resolve submission errors. Users should ensure they carefully follow the guidelines during the signature process, as any discrepancies may lead to submission rejections.

If errors arise during submission, consulting the help section on pdfFiller can provide actionable solutions. Understanding common issues helps users navigate the form with fewer frustrations, ensuring successful submissions and prompt assessments.

Up-to-date information on the BOE 577 form

Staying informed about the BOE 577 form and related regulations is crucial for property owners. As property tax laws can change, it’s wise to check for updates regularly. Recent changes may include adjustments in filing requirements, updates to electronic submission processes, or modifications in the exemption amounts.

The California State Board of Equalization typically publishes any amendments formally, and users are encouraged to visit their site or legal resources periodically to stay informed about such changes.

Enhancing document management with pdfFiller

pdfFiller is more than just a tool for filling out forms like the BOE 577; it’s a comprehensive platform for document management. Its features allow for seamless collaboration, making it easier for teams to work together on form completion and revisions from anywhere.

For users managing multiple forms and documents, the cloud-based solution offers flexibility and organization that traditional methods lack. Testimonials from satisfied users highlight pdfFiller's efficiency and user-friendly interface, simplifying the document management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit boe 577 online?

How do I edit boe 577 in Chrome?

How do I edit boe 577 on an Android device?

What is boe 577?

Who is required to file boe 577?

How to fill out boe 577?

What is the purpose of boe 577?

What information must be reported on boe 577?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.