Get the free Form 50-772-a

Get, Create, Make and Sign form 50-772-a

Editing form 50-772-a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 50-772-a

How to fill out form 50-772-a

Who needs form 50-772-a?

A comprehensive guide to form 50-772-A

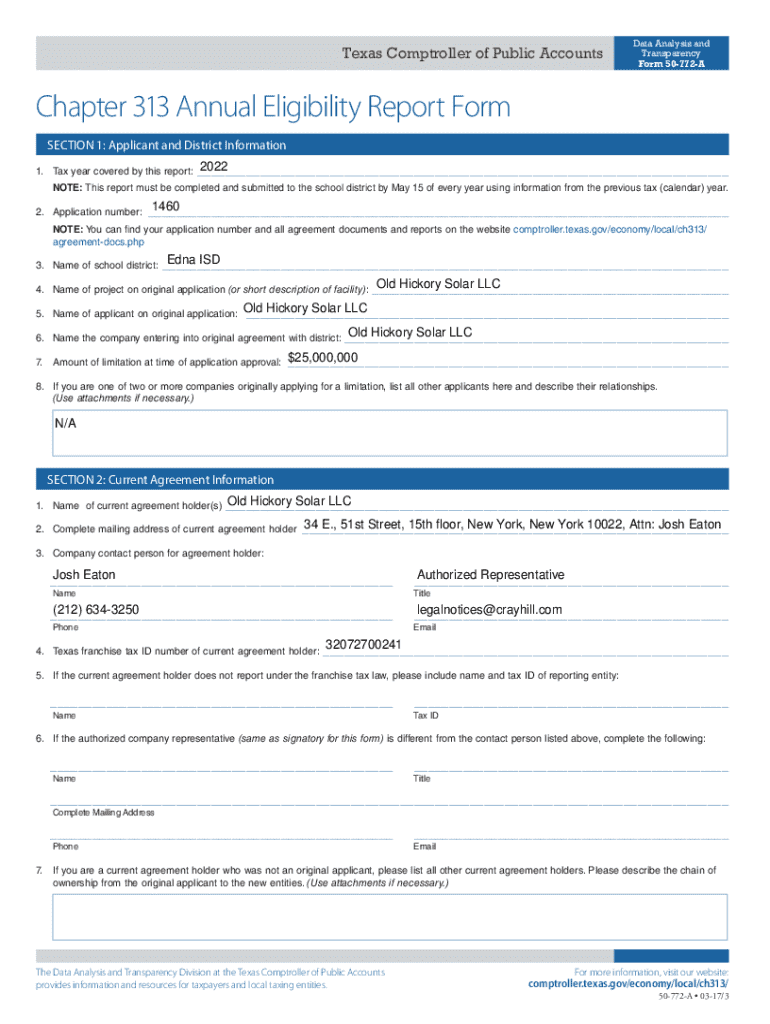

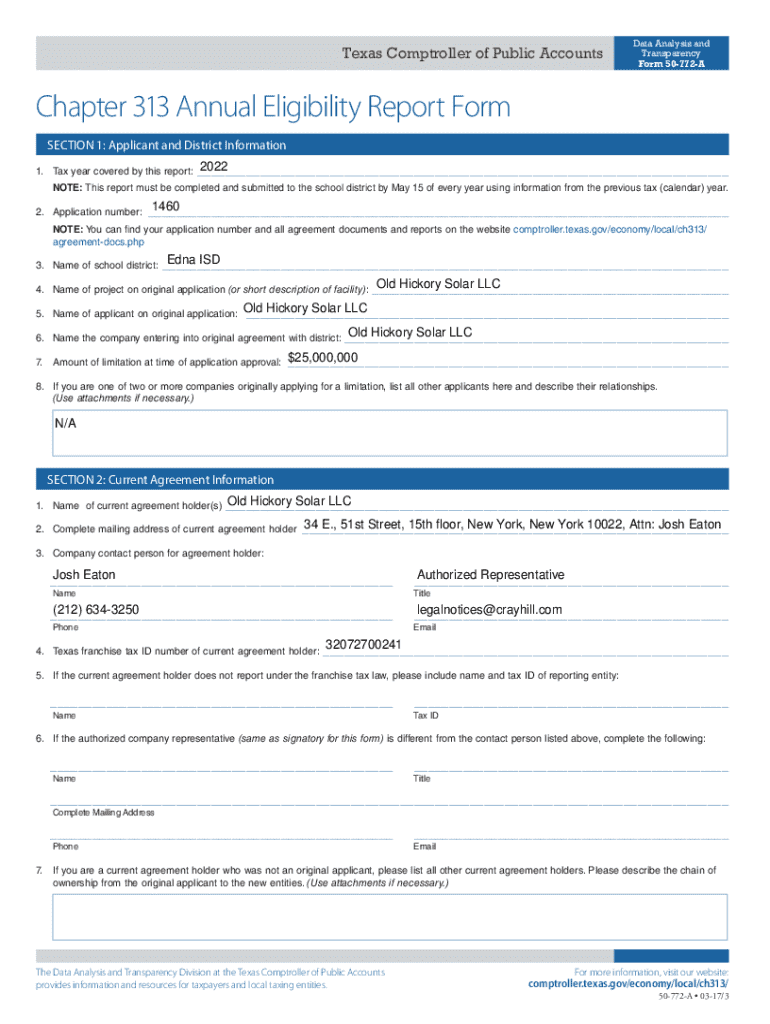

Overview of form 50-772-A

Form 50-772-A serves as a vital document for Texas taxpayers, used primarily to report property tax exemptions. It is specifically crafted for use in claiming exemptions on property taxes for various classifications, which can significantly benefit homeowners and business property owners alike.

Understanding who needs to use this form is crucial. Individuals or entities who own real property and seek exemption from local property taxes due to specific circumstances—such as being a veteran, a senior citizen, or operating as an organization for charitable purposes—are the primary users of form 50-772-A. Knowledge of eligibility criteria is paramount to ensure compliance and avoid penalties.

Key features of form 50-772-A

Form 50-772-A includes several distinct sections tailored to gather comprehensive information necessary for assessing your exemption claim. Each section requires careful attention to detail: from personal information about the claimant to specifics regarding the property in question. Failure to provide accurate details can lead to rejection of the application, thus missing out on potential tax savings.

Understandably, many users often have questions about their responsibilities concerning this form. FAQs typically revolve around submission deadlines, acceptable evidence for claims, and consequences of inaccuracies. It's essential to familiarize yourself with these common queries to navigate the process smoothly.

Step-by-step instructions for completing form 50-772-A

Before diving into the form, ensure that you have all the necessary documents at hand. Essential information includes prior tax returns, property deeds, and any documentation supporting your exemption status. Being well-prepared reduces the risk of confusion when filling in details.

When filling out the form, start with the Personal Information Section, providing accurate details about yourself or your organization. Next, move on to the Tax Information Section, where you'll indicate property specifics. Lastly, make sure to complete the Signatures and Certifications section with accurate signatures to validate your claim.

Editing and modifying form 50-772-A

Utilizing pdfFiller's platform allows effortless editing and modifying of form 50-772-A. The platform offers interactive tools that simplify the process, whether you're making corrections or updating information. A user-friendly interface ensures you can navigate the editing process seamlessly.

To upload and modify the form, start by accessing pdfFiller and selecting 'Upload Document.' Once uploaded, you can use various editing tools to amend any sections. The process is straightforward, enabling users to adjust text, insert images, or highlight critical areas, thus enhancing clarity.

Signing and submitting form 50-772-A

Once your form is complete, it’s time to sign it digitally. PdfFiller provides an efficient eSignature process that eliminates the need for printing and physically signing the document. It enables users to securely sign with just a few clicks, ensuring the document is legally binding and immediately ready for submission.

Regarding submission guidelines, follow the instructions provided on the form. Typically, completed forms must be sent to the local appraisal district in Texas by the specified deadline, which can vary depending on the type of exemption being claimed.

Tracking your form submission

To confirm receipt of your form, keep track of any confirmation details provided at the time of submission. Many appraisal districts offer online systems to track your submission status, which can alleviate concerns about whether your form was received on time.

In case of any discrepancies or follow-ups, it’s advisable to reach out directly to the appraisal district or utilize the tracking system. Being proactive can help mitigate any issues that may arise and ensure your exemption claim is processed without delay.

Managing your form records

Proper document management practices are vital for maintaining your form records. With pdfFiller’s platform, you can easily store your completed forms securely in the cloud. This offers peace of mind as you can access them at any time and from any location, eliminating concerns about losses or damages to physical documents.

If you're working as part of a team, pdfFiller also offers collaborative features. You can share documents with teammates, allowing for real-time collaboration, which is particularly helpful for organizations that may require multiple inputs to finalize submissions.

Understanding the implications of form 50-772-A

Filing form 50-772-A can significantly impact your tax situation by providing potential exemptions that lower your property tax burden. Understanding how this form affects your taxable liabilities is crucial for effective financial planning and long-term strategies in property management.

For those wanting a deeper insight into Texas tax rules, various state resources offer comprehensive information. Engaging with these resources allows taxpayers to navigate exemptions and understand their broader implications on financial responsibilities.

User support and assistance with form 50-772-A

In instances where challenges arise during the completion of form 50-772-A, accessing pdfFiller’s customer service can provide the necessary assistance. Their support team is available to help troubleshoot and clarify any complexities you may encounter throughout the process.

Engaging with community forums is another effective way to seek guidance. Users often share helpful insights and experiences that can assist others navigating similar situations. Utilizing these resources can significantly enhance your understanding and use of form 50-772-A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 50-772-a for eSignature?

How can I get form 50-772-a?

How do I edit form 50-772-a straight from my smartphone?

What is form 50-772-a?

Who is required to file form 50-772-a?

How to fill out form 50-772-a?

What is the purpose of form 50-772-a?

What information must be reported on form 50-772-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.