Get the free Credit Card Charge Receipt

Get, Create, Make and Sign credit card charge receipt

Editing credit card charge receipt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card charge receipt

How to fill out credit card charge receipt

Who needs credit card charge receipt?

Comprehensive Guide to the Credit Card Charge Receipt Form

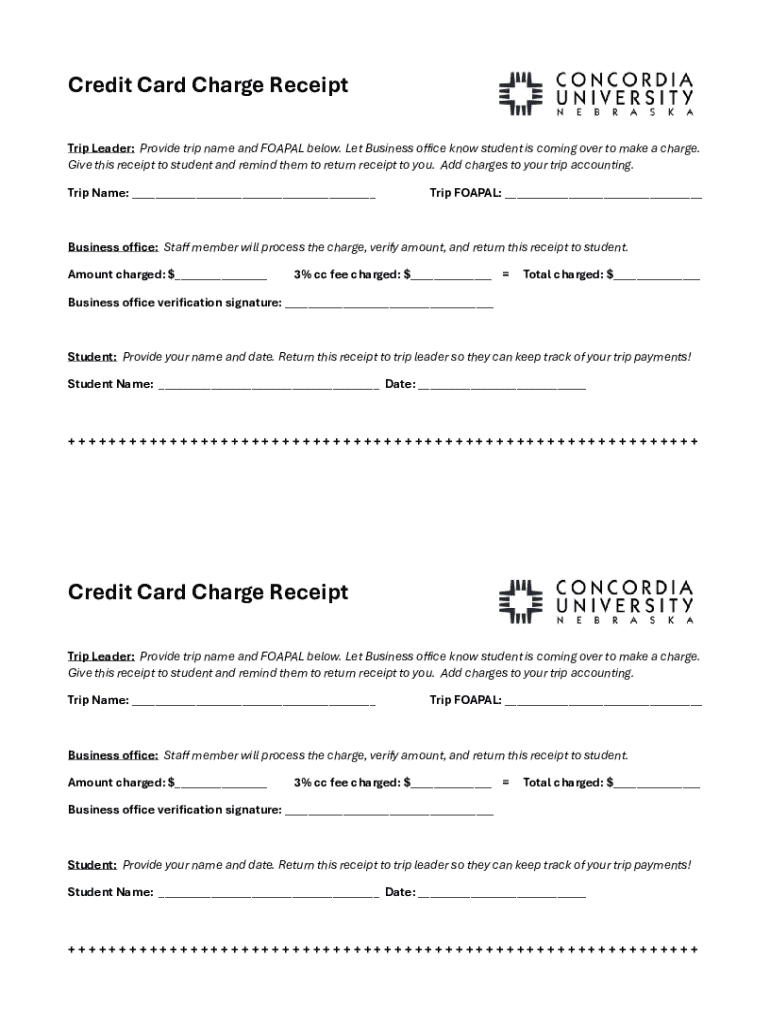

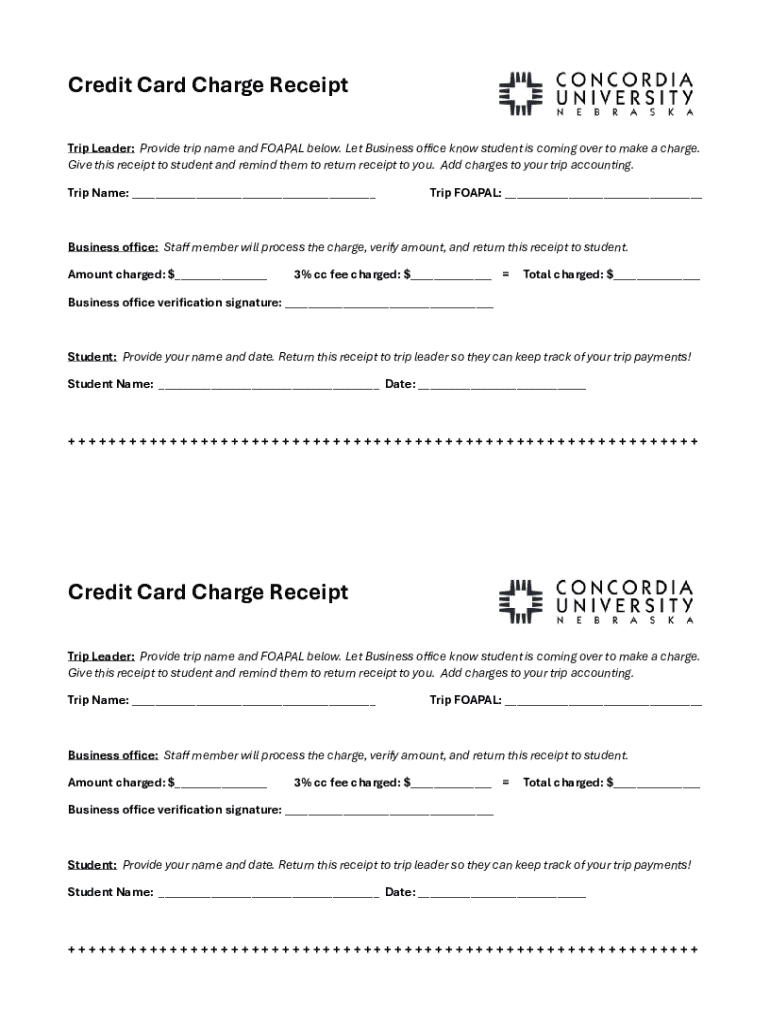

Understanding the credit card charge receipt form

A credit card charge receipt is a crucial document generated during a transaction involving the use of a credit card. It serves as evidence of the payment made between a merchant and a customer. With its legal significance and role in accounting, this form not only acts as a record of purchase but also provides a detailed account of the transaction for both parties.

The importance of the credit card charge receipt form cannot be overstated. It provides a safeguard against disputes and assists in tracking expenses. Whether for personal budgeting or business accounting, retaining these documents allows for better financial management and potential tax deductions.

You should use the credit card charge receipt form whenever a payment is made using a credit card. This includes retail purchases, online transactions, and service payments. Properly filled out, it aids in accountability and transparency.

Key components of a credit card charge receipt

A well-structured credit card charge receipt includes essential information that validates the transaction and makes tracking straightforward. Here are the key components to include:

In addition to essential information, you may consider including optional details to enhance clarity:

Step-by-step instructions for filling out the form

Filling out a credit card charge receipt form correctly is essential for clarity and legal purposes. Here’s a structured process to guide you through it.

Editing and customizing your charge receipt

Customizing your credit card charge receipt can make it more professional and aligned with your brand. Using pdfFiller's interactive tools, users can easily edit their receipts.

Start by customizing the layout and design, including adding your business logo to enhance branding. Additionally, adjusting fonts and colors can make the document visually appealing and easier to read.

Save different versions of the receipt template for future use. This not only streamlines your process but also ensures that receipts remain consistent across transactions.

Signing and authenticating the receipt

The authenticity of a credit card charge receipt is vital, especially when disputes arise. Utilizing pdfFiller, you can eSign receipts which enhances validation.

Best practices for securing signatures involve using encrypted eSignature solutions to ensure the integrity of your documents. A properly signed receipt serves as a legal document, fortifying both parties against fraud.

Ultimately, the importance of authenticity in charge receipts speaks to the level of professionalism and security one offers to customers. A well-authenticated receipt can significantly reduce the potential for disputes.

Managing and storing charge receipts

Proper management and storage of credit card charge receipts are essential for any business or personal financial tracking. Utilizing cloud-based storage solutions, such as pdfFiller, enables you to access your documents from anywhere.

Establishing best practices for document management could include organizing receipts by date, transaction type, or vendor. A well-structured storage system ensures quick retrieval when needed.

Additionally, setting up a backup system is crucial to prevent data loss. Always ensure you are compliant with legal and financial regulations by retaining receipts for the appropriate time.

Frequently asked questions (FAQs)

Navigating the nuances of credit card charge receipts often raises additional questions. Here are answers to some frequently asked questions:

Related forms & resources

In addition to credit card charge receipts, it’s valuable to explore other related forms that can enhance your transaction management process. These include:

You can also access customizable templates for these forms through pdfFiller, making transaction documentation easy and professional.

Exploring additional tools for document management

Beyond filling out and storing credit card charge receipts, pdfFiller offers a robust range of document solutions that can enhance how you manage all your forms and contracts.

The platform integrates with various tools, providing enhanced productivity. Utilize the document-sharing and collaboration features to streamline the way you work with teammates and clients.

Maximizing efficiency with these solutions not only saves time but also improves your overall workflow, making your financial documentation management more seamless.

User experiences and testimonials

Numerous individuals and teams have successfully adopted pdfFiller for their credit card charge receipt management. Feedback from users consistently highlights the platform's contribution to simplifying documentation processes.

Case studies reveal how businesses have reduced processing times and enhanced financial tracking by switching to digital charge receipts, proving the effectiveness of this approach.

Community reviews often mention the ease of use and reliability of pdfFiller, solidifying its place as a favorite document management tool among small businesses and freelancers alike.

Additional support

For those seeking personalized assistance, pdfFiller offers numerous support options. This includes easy access to tutorials and documentation on form usage to ensure users get the most out of their experience.

Engaging in webinars and Q&A sessions can further facilitate in-depth learning about managing credit card charge receipts and various other forms, empowering users to become proficient in their documentation practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card charge receipt in Gmail?

How do I edit credit card charge receipt in Chrome?

How do I fill out credit card charge receipt on an Android device?

What is credit card charge receipt?

Who is required to file credit card charge receipt?

How to fill out credit card charge receipt?

What is the purpose of credit card charge receipt?

What information must be reported on credit card charge receipt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.