Get the free Monthly Return of Equity Issuer on Movements in Securities

Get, Create, Make and Sign monthly return of equity

How to edit monthly return of equity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly return of equity

How to fill out monthly return of equity

Who needs monthly return of equity?

Understanding the Monthly Return of Equity Form: A Comprehensive Guide

. Understanding the Monthly Return of Equity

Return on Equity (ROE) is a critical metric used to assess a company's profitability relative to shareholder equity. This financial ratio indicates how effectively management is using equity financing to generate profits. A high ROE suggests that a company efficiently uses investments from shareholders, while a low ROE may signal potential inefficiencies in profit generation.

Tracking monthly returns is vital for both investors and corporate managers. Investors utilize this metric to gauge a company's performance consistently, allowing them to make informed decisions regarding buying, holding, or selling stocks. For corporate management, understanding monthly returns can help in evaluating the effectiveness of strategic initiatives and identifying areas for improvement.

Common uses of monthly ROE reports include performance analysis, where stakeholders compare company performance against competitors, and forecasting future earnings, helping in strategic planning. This deep analytical approach allows companies to adapt swiftly to market changes and enhance overall performance.

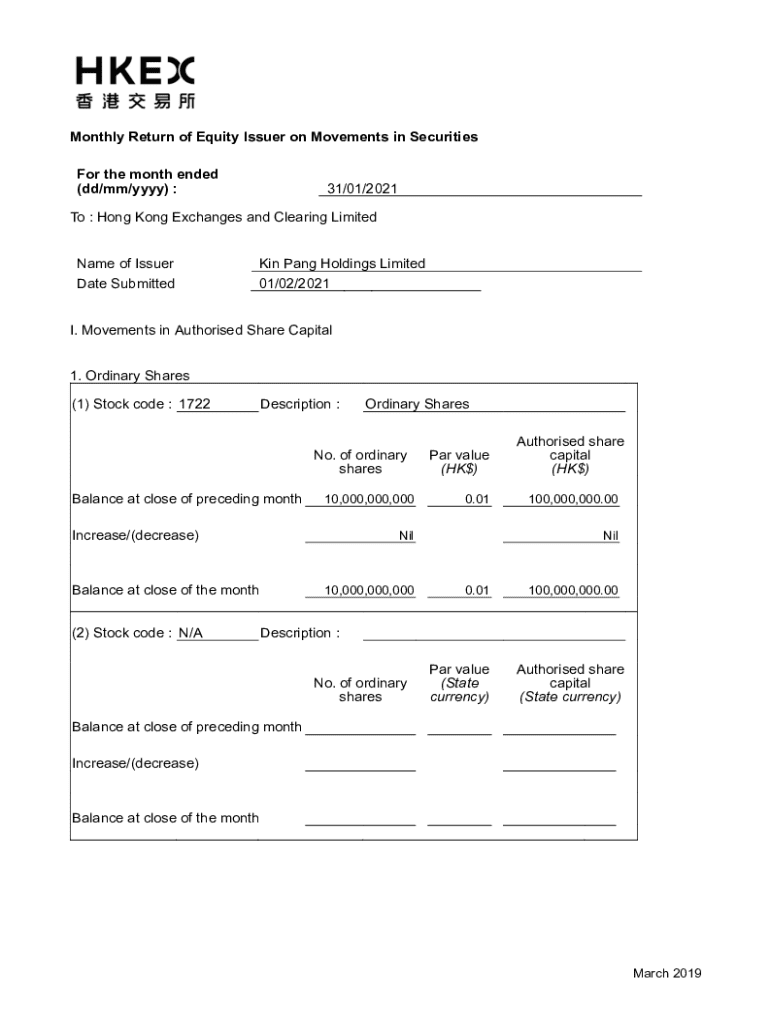

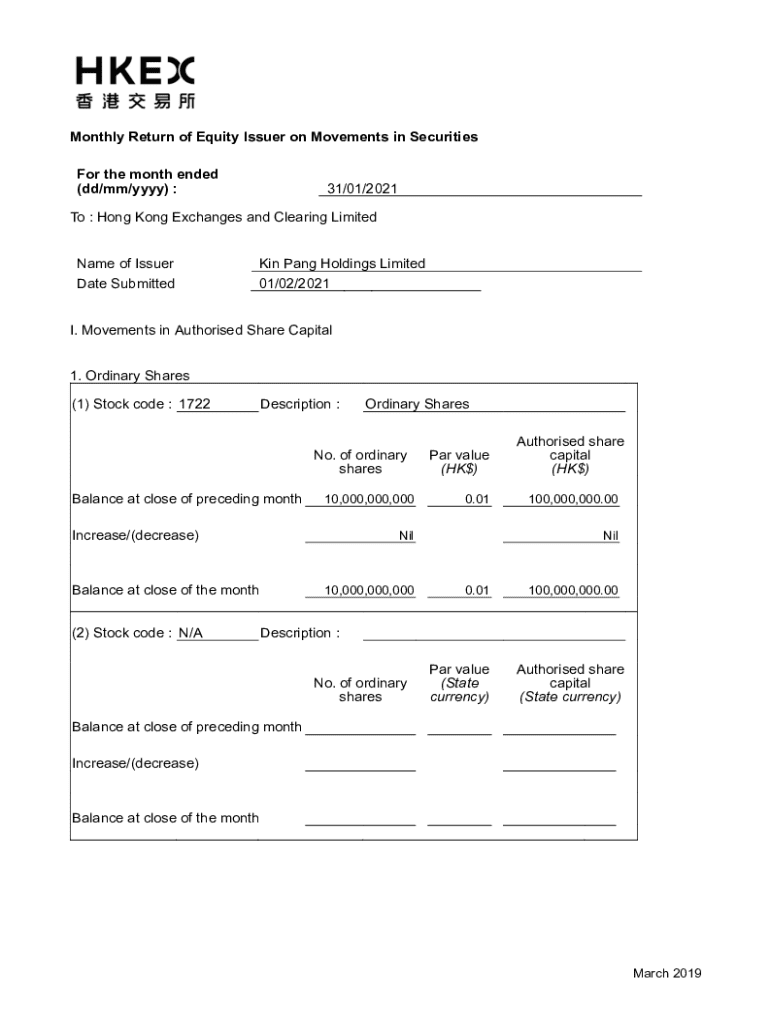

. The Monthly Return of Equity Form Overview

The Monthly Return of Equity Form serves as a standardized method for companies to report their financial performance each month. This form helps streamline the tracking and analysis of monthly profits and shareholder equity, which is essential for gaining insights into the company's operational efficiency.

Key components of the form include required financial data, which typically encompasses net income, beginning equity, and other relevant variables. It's important to consider the selected timeframe, which in this case, is focused on monthly performance. This regular evaluation allows stakeholders to stay updated with timely and actionable insights.

. Step-by-Step Guide to Filling Out the Monthly Return of Equity Form

Filling out the Monthly Return of Equity Form involves several steps that ensure accurate reporting. The first task is gathering required data, which includes financial statements such as the balance sheet and income statement. Make sure to focus on the specific month you are reporting on, as this will form the foundation of your calculations.

Once you have compiled your data, start completing the form by inputting the initial equity data from the beginning of the month. Next, calculate the net income for that month by subtracting total expenses from total revenues. It is crucial to ensure these figures are accurate as they directly impact the ROE.

After populating the required fields, you need to calculate the Monthly ROE using the formula: ROE = (Net Income / Shareholder’s Equity). This formula gives you a direct measure of profitability against the equity invested. For clarity, consider a scenario where a company has a net income of $10,000 and shareholder equity of $100,000. This would result in an ROE of 10%.

To ensure accuracy, pay attention to common errors such as miscalculating figures or incorrectly entering data. Best practices include maintaining consistent financial records and regularly updating information to reflect the most recent performance metrics.

. Analyzing Monthly Return of Equity

Once you have calculated the ROE, interpreting the results is crucial. Understanding short-term versus long-term trends can provide insights into the company’s performance trajectory. For example, a consistently high ROE may indicate strong operational efficiency, while fluctuations may suggest underlying challenges or opportunities that need addressing.

It is also valuable to benchmark against industry standards. This helps to ascertain whether the company's performance aligns with competitors and identifies areas for improvement. Evaluating the implications of your ROE can yield different conclusions; a high ROE often suggests effective management and solid growth potential, while a low ROE may indicate the need for strategic adjustments.

. Tools for Managing and Analyzing Monthly ROE Data

Utilizing innovative tools like pdfFiller can significantly enhance your management of Monthly Return of Equity documentation. With pdfFiller, users can easily create, edit, and manage PDF documents, streamlining the reporting process. Cloud-based solutions such as these provide accessibility from anywhere, ensuring stakeholders can retrieve essential financial information at any time.

Additionally, integrating spreadsheets for advanced analysis can enrich your ROE evaluation. Creating ROE templates in Excel allows for more detailed calculations and trend analyses, incorporating other financial metrics to provide a holistic view of company performance.

. Comparative Analysis of Return on Equity

When examining ROE, it is essential to compare monthly figures against quarterly and annual returns. Monthly ROE provides timely insights, but it should be complemented by longer-term metrics to give a fuller picture of financial health. Monthly reporting can reveal issues quickly, but overemphasis on short-term results can lead to shortsighted decision-making.

Each reporting frequency has its own advantages and limitations. Monthly reporting enables quicker adjustments in strategy, whereas quarterly and annual reports capture broader trends. Utilizing a mix of these reporting intervals can provide a comprehensive view of historical performance.

. Case Studies

Examples of effective monthly ROE monitoring can provide valuable lessons. In Case Study 1, a high-performing company recognized its strong profitability through a sustained ROE above 15%. This allowed them to attract more investment and sustain growth. Their management team used insights from the monthly ROE figures to guide expansion strategies and reinvest profits efficiently.

Conversely, Case Study 2 presents a company that experienced a decline in ROE from 12% to 8%. This change triggered a thorough evaluation of operational efficiencies and expense management, leading to strategic decisions that ultimately stabilized shareholder sentiment and improved financial health in subsequent months.

. Frequently Asked Questions (FAQs)

Common queries surrounding the Monthly Return of Equity often include questions about the importance of regular tracking and how variations in monthly reports can affect investor perception. Others may seek clarity on what constitutes a 'good' ROE for their specific industry. Providing thorough guidance on these questions can help create a better understanding and set realistic expectations.

It is also essential to clarify misunderstandings, such as the belief that a high ROE is always beneficial without context. External factors must be considered, making it important to educate on nuanced evaluations of ROE figures.

. Conclusion: Best Practices for Monthly ROE Management

Regular updates and monitoring of the Monthly Return of Equity are pivotal for insightful financial management. Establishing a routine review process can ensure that stakeholders remain informed of performance changes and trends.

Encouraging continuous learning among team members about financial metrics and their implications not only enhances decision-making but also aligns all parties with the company’s strategic goals.

. Interactive Tools

Accessing template downloads for the Monthly Return of Equity Form can facilitate ease of use. Utilizing pdfFiller's features for enhanced document management allows users to create, edit, and eSign their documents seamlessly. This all-in-one solution fosters collaboration, ensuring team members can engage with the form wherever they are.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute monthly return of equity online?

Can I create an electronic signature for the monthly return of equity in Chrome?

How can I edit monthly return of equity on a smartphone?

What is monthly return of equity?

Who is required to file monthly return of equity?

How to fill out monthly return of equity?

What is the purpose of monthly return of equity?

What information must be reported on monthly return of equity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.