Get the free Monthly Return of Equity Issuer on Movements in Securities

Get, Create, Make and Sign monthly return of equity

Editing monthly return of equity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly return of equity

How to fill out monthly return of equity

Who needs monthly return of equity?

Monthly return of equity form: A comprehensive guide

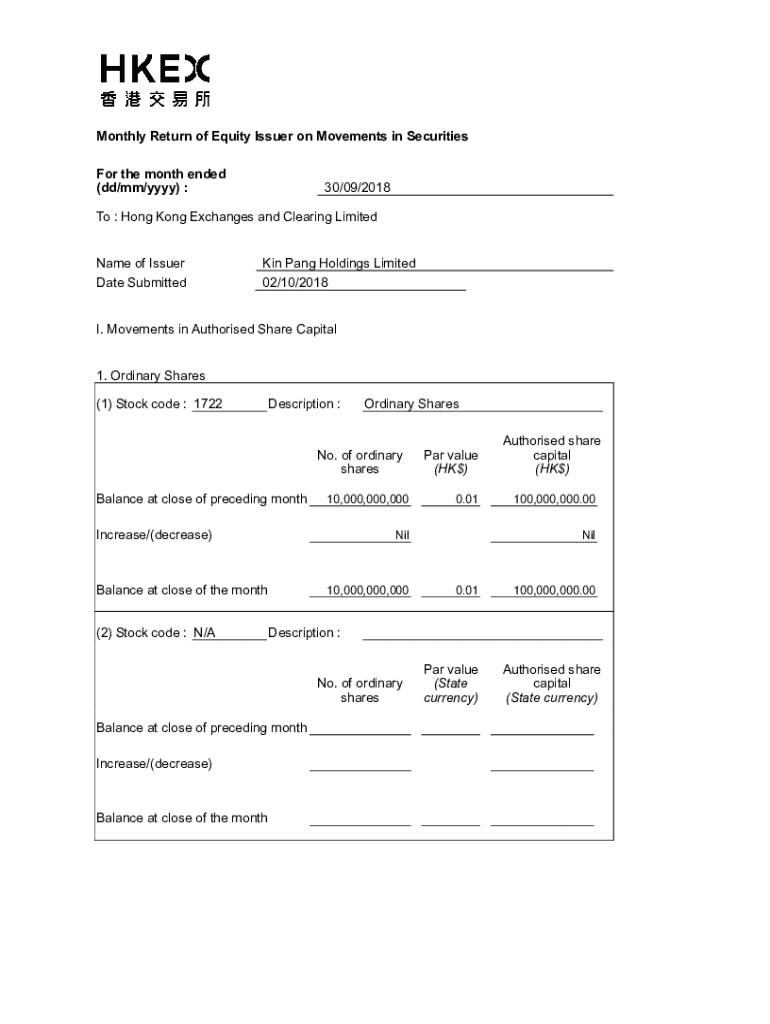

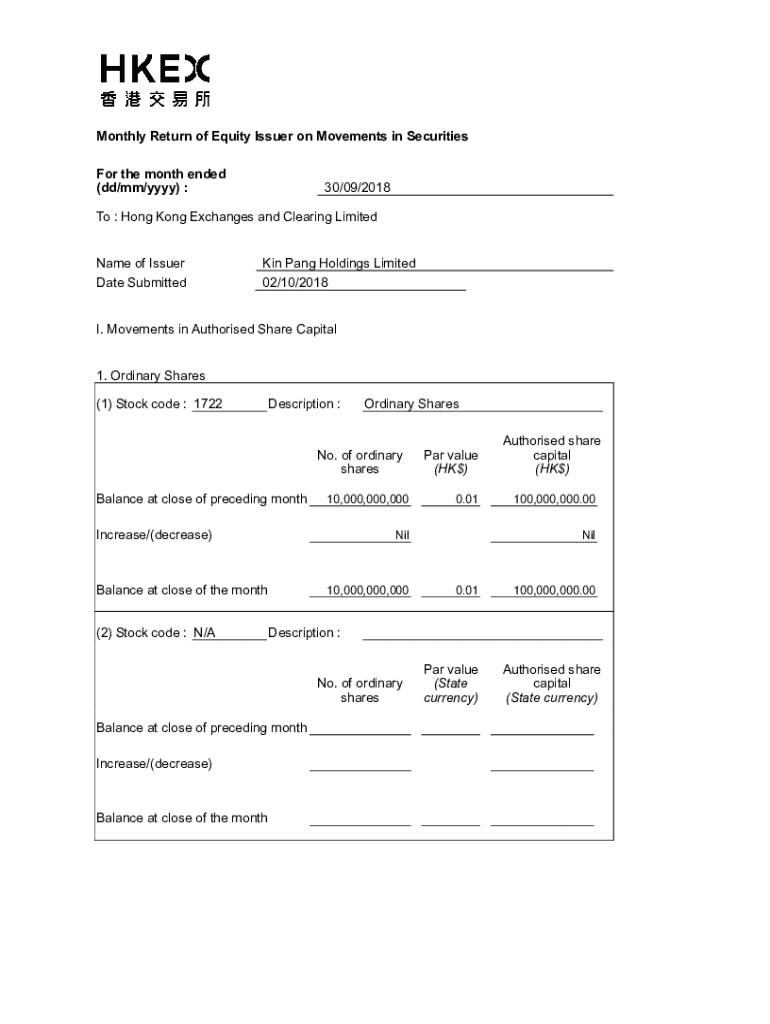

Understanding monthly return of equity

The monthly return of equity form is an essential tool for investors and financial managers, allowing them to assess the performance of their investments on a monthly basis. This form tracks the equity's return, enabling users to evaluate how their investments are growing or diminishing over time. The significance of these monthly returns cannot be understated; they form the bedrock of informed financial decision-making, allowing investors to pivot strategies based on empirical performance data.

Monitoring monthly returns not only helps in reviewing past performance but also influences future investment choices. By regularly analyzing short-term returns, investors can quickly adapt their portfolios to capitalize on favorable trends or mitigate losses during downturns. Consequently, thorough attention to the monthly return of equity forms is essential for personal finance management, aiding in risk assessment, investment diversification, and aligning portfolios with financial objectives.

Components of the monthly return of equity form

Each monthly return of equity form comprises several critical sections that simplify the recording and analysis of investment performance. These components facilitate structured reporting, turning raw data into actionable insights. Understanding each section will enhance the accuracy of your financial reports and help in identifying trends relevant to your investment strategies.

Key sections explained

Each of these fields plays a role in computing total returns accumulated over time, influencing overall investment evaluations. Accurate entries ensure insightful analysis, leading to effective and tailored investment strategies.

Step-by-step instructions for completing the monthly return of equity form

Completing the monthly return of equity form may seem daunting at first, but by following a straightforward process, it can become an organized and manageable task. The first step in this process is gathering all necessary financial data, such as investment statements, previous returns, and any transaction records related to your equity investments.

Once you have the data, follow these detailed instructions for inputting information:

Best practices for filling out the monthly return of equity form

Adhering to best practices while filling out the monthly return of equity form not only enhances accuracy but also simplifies the process long-term. First and foremost, consistent record-keeping is vital – regular entries lead to fewer errors and more reliable data.

It's recommended to update the monthly return form regularly, ideally at the end of each month, covering all transactions as they happen for accuracy. This approach fosters transparency and aids in identifying patterns over time. Furthermore, be diligent in checking for common mistakes, such as miscalculating gains or omitting data entirely. Such oversights can profoundly impact financial analysis, leading to misguided investment strategies.

Interactive tools to enhance your experience

Utilizing interactive tools can significantly enhance your experience with the monthly return of equity form. Platforms like pdfFiller offer features designed to simplify the documentation process. For instance, their editable PDF options allow users to make changes effortlessly without starting from scratch.

Moreover, pdfFiller integrates seamlessly with many financial applications, enabling users to pull data directly into the form. This integration minimizes error while maximizing efficiency. The benefits of using a cloud-based document management system are numerous, including increased accessibility wherever you may be and the ability to collaborate with team members effortlessly.

Analyzing your monthly return of equity data

Interpreting the data from your monthly return of equity form allows investors to make informed decisions. Monthly fluctuations indicate market performance, and understanding these changes can reveal insights into market trends. A consistent rise or fall in returns may suggest a longer-term trend that could impact future investment strategies.

Utilizing tools for visualizing your financial growth enhances data interpretation. Graphs and charts effectively showcase trends over periods, offering a clear viewpoint of performance that raw numbers may not convey. Implementing these visual tools not only clarifies your investment trajectory but also assists in presenting data to stakeholders in a compelling manner.

Comparative analysis

Comparing the monthly return of equity to the annual return of equity provides essential insights for long-term financial planning. Monthly returns offer granular insights into short-term performance, while annual returns encapsulate overall growth or decline over a longer period. Depending on reporting needs, both metrics may serve unique purposes in a well-rounded financial analysis.

Understanding when to use each form of data can also enhance reporting accuracy. The timeframe of analysis factors into decision-making – monthly returns are more affected by market volatility, while annual returns provide stability. A balance of both will yield an informed investment approach, ensuring that your financial reports reflect the realities of fluctuating markets.

Real-world applications and case studies

Various sectors leverage the monthly return of equity form for strategic planning. For instance, venture capitalists may use it to evaluate a startup’s performance monthly, adjusting funding strategies accordingly. Similarly, portfolio managers assess monthly returns to determine which assets to retain or divest, optimizing portfolio performance.

Examples could include a tech company using monthly return analysis to highlight promising product lines or a retailer adjusting inventory based on sales performance feedback from monthly equity assessments. These practical applications show how crucial the monthly return of equity form can be in driving decision-making processes across diverse industries.

Frequently asked questions (FAQs)

The nuances of filling out the monthly return of equity form can lead to many common queries. One frequent question is what to do if you miss reporting a month; the best approach is to backtrack and enter the missed data promptly to maintain accurate records.

Another common concern addresses handling negative returns; it’s essential to accurately document these entries to reflect true performance. You might also wonder if adjustments can be made to past month entries—ideally, you should keep a version history or a record of changes to maintain financial transparency.

pdfFiller's advantage in managing monthly return of equity forms

pdfFiller offers unique features that significantly simplify the management of the monthly return of equity form. Its cloud-based platform supports easy documentation editing, e-signatures, and secure sharing options, making it an excellent tool for both individuals and teams handling sensitive financial data.

Additionally, the platform facilitates streamlined collaboration, allowing team members to review and edit documents in real-time. Compliance with data security standards is paramount in financial reporting, and pdfFiller’s robust security measures ensure your financial data remains protected while providing easy access to necessary documentation. This makes pdfFiller the ideal solution for effective and secure document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my monthly return of equity in Gmail?

How do I execute monthly return of equity online?

How do I edit monthly return of equity on an Android device?

What is monthly return of equity?

Who is required to file monthly return of equity?

How to fill out monthly return of equity?

What is the purpose of monthly return of equity?

What information must be reported on monthly return of equity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.