Get the free Tax Organizer

Get, Create, Make and Sign tax organizer

Editing tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer

How to fill out tax organizer

Who needs tax organizer?

Understanding the Tax Organizer Form: A Comprehensive Guide

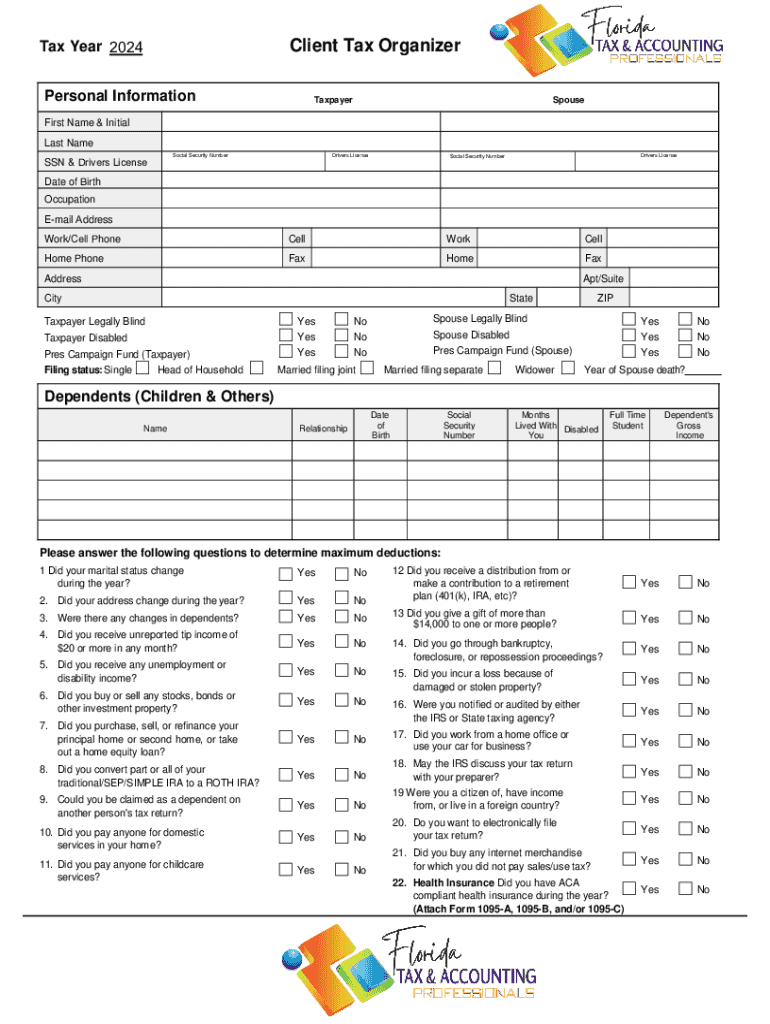

Understanding the tax organizer form

The tax organizer form is a crucial tool for both individuals and teams in filing annual tax returns. Functionally, it serves as a comprehensive checklist that assists taxpayers in compiling and organizing the necessary information needed to file their taxes accurately and efficiently. Rather than scrambling through various documents at the last minute, the tax organizer promotes a proactive approach by encouraging users to gather relevant data in advance.

Utilizing a tax organizer is important for a variety of reasons. Primarily, it streamlines the tax preparation process, significantly reducing the chances of errors that can arise from incorrect or omitted information. Furthermore, it ensures that taxpayers maximize potential deductions and credits by providing a structured framework for reporting income, deductions, and dependent information.

A tax organizer should be used each tax season, ideally at the beginning of the year, to help individuals and small businesses collect necessary documents in an organized manner. The timing of its use is vital because it allows ample time before the filing deadline for taxpayers to clear up any ambiguities or potential issues with their financial data.

Key components of a tax organizer form

The tax organizer form is segmented into several key components that guide users in gathering pertinent information. The first essential section is the personal information area, which captures the taxpayer's full name, mailing address, and contact details. A vital inclusion here is the Social Security Number (SSN) or Taxpayer Identification Number (TIN), as this unique identifier is critical for all tax-related processes.

The second component focuses on income information. Here, different types of income, such as wages, freelance earnings, and rental income, must be accounted for. Accompanying documentation, like W-2 forms and 1099s, must be attached to substantiate the reported income. The third component encompasses deductions and credits; taxpayers should include common deductions like mortgage interest, medical expenses, and charitable contributions. Additionally, it’s essential to be aware of applicable tax credits, which can significantly reduce the overall tax liability.

Lastly, dependent information is a must-have section in the tax organizer. Understanding who qualifies as a dependent can lead to added tax benefits. Therefore, it's crucial to maintain relevant documentation for each dependent, such as proof of residency and expense receipts, ensuring that everything aligns correctly when filing for credits associated with dependents.

Step-by-step guide to filling out your tax organizer form

Filling out your tax organizer form can seem daunting at first, but following a structured approach simplifies the task. Begin by gathering all necessary documents, including W-2s from employers, 1099s for freelance or contract work, and documentation for any other forms of income. This prepares you to report accurate figures in the income information section.

Next, accurately fill out the personal information section—double-check names and identification numbers to avoid errors. When reporting income, adhere strictly to the supporting documents; this ensures that different income types, such as dividends or interest, are correctly counted. For claiming deductions and credits, familiarize yourself with tax strategies; organizing your expenses through categories can maximize claim opportunities.

Finally, include dependent information. Ensuring that you gather all necessary documentation makes it easier to support your claims. Utilize checklists to keep track of what’s been documented, so nothing slips through the cracks when it’s time to submit your tax organizer form.

Editing and customizing your tax organizer form

Editing your tax organizer form should never be a tedious task. Platforms like pdfFiller offer interactive editing features that allow you to personalize your tax organizer to meet your specific needs. This includes the ability to easily modify text, adjust layouts, and even add annotations where necessary.

Enhancing your tax organizer is straightforward. For users requiring additional sections or custom fields, pdfFiller makes it easy to tailor your form based on personal requirements, ensuring an efficient document that reflects unique financial situations. Moreover, the option to merge other pertinent documents means that all related financial information can be presented in a comprehensive and organized manner, simplifying the submission process.

eSigning and submitting your tax organizer form

Once your tax organizer form is complete and customized, it’s essential to ensure it’s submitted securely and efficiently. Utilizing the eSignature features in pdfFiller provides a secure way to sign your tax documents electronically, which is especially beneficial in avoiding delays often associated with traditional mailing or printing methods.

To securely submit your completed form, use the uploading and sharing options available within pdfFiller, ensuring your documents reach the intended recipient efficiently. Remember to verify submission confirmations and keep digital copies of the files for your records, which is crucial for future reference or in case of potential audits.

Collaborating on your tax organizer form

Collaboration during tax preparation can be invaluable, particularly for teams or couples filing jointly. pdfFiller simplifies the process of sharing your tax organizer form with advisors or team members, enhancing the accuracy and thoroughness of your tax filing. Real-time collaboration allows multiple users to work on the same document, providing immediate feedback and edits.

Managing changes is also streamlined with pdfFiller. Users can track document versions to see what has been modified over time, allowing for easy review and discussion around specific entries. This collaborative feature ensures that all input is noted and incorporated, minimizing mistakes in the final filing of the tax documents.

Tips for efficient tax organizer management

To manage your tax organizer effectively, developing a habit of organizing financial documents year-round is key. Consistently maintaining updated tax records helps alleviate stress as the tax season approaches. Categorize receipts, bank statements, and other essential documents systematically; this ensures easy retrieval when completing your tax organizer form.

Utilizing tools like pdfFiller not only aids during tax season but supports ongoing document management. Features like cloud upload and storage ensure safe keeping of your financial data, allowing you to access it anytime from anywhere. This accessibility can significantly ease the tax preparation process year after year.

Troubleshooting common issues

In the course of filling out your tax organizer form, mistakes can sometimes occur. Common filling errors include incorrect social security numbers, misreported income figures, and omitted deductions. To mitigate such mistakes, thorough reviews of all entries should be made prior to the final signing and submission of the document.

If you do make an error on your tax organizer, take immediate action. Most platforms, including pdfFiller, allow you to edit documents post-submission, and steps can often be taken to file amendments if necessary. If any complications persist, contacting support for assistance can clarify any confusing aspects of the tax filing process.

Exploring additional resources

Navigating the complexities of tax regulations can be daunting. A wealth of educational articles on tax-related topics can provide insightful information and guidance on best practices for filing. Communities and forums often share experiences and tips that can further inform your approach to using a tax organizer.

Furthermore, accessing templates and forms beyond tax organizers can be helpful for understanding other necessary documentation for tax filing. Staying informed about the latest tax regulations and guidelines can equip you with essential knowledge, ensuring that you safeguard yourself against common filing pitfalls.

Related topics and content suggestions

For individuals and teams interested in enhancing their tax-related skills, exploring client tax organizers or understanding the nuances of business brochures and forms can be valuable. Everyone can benefit from reviewing various free tax organizers available online, which can inspire more efficient strategies in their own tax planning. Additionally, integrating technology into your tax filing processes often yields time-saving benefits, encouraging a streamlined approach that ultimately leads to stress-free submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the tax organizer in Gmail?

How do I edit tax organizer on an iOS device?

How do I edit tax organizer on an Android device?

What is tax organizer?

Who is required to file tax organizer?

How to fill out tax organizer?

What is the purpose of tax organizer?

What information must be reported on tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.