Get the free Budget/resource Worksheet

Get, Create, Make and Sign budgetresource worksheet

How to edit budgetresource worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budgetresource worksheet

How to fill out budgetresource worksheet

Who needs budgetresource worksheet?

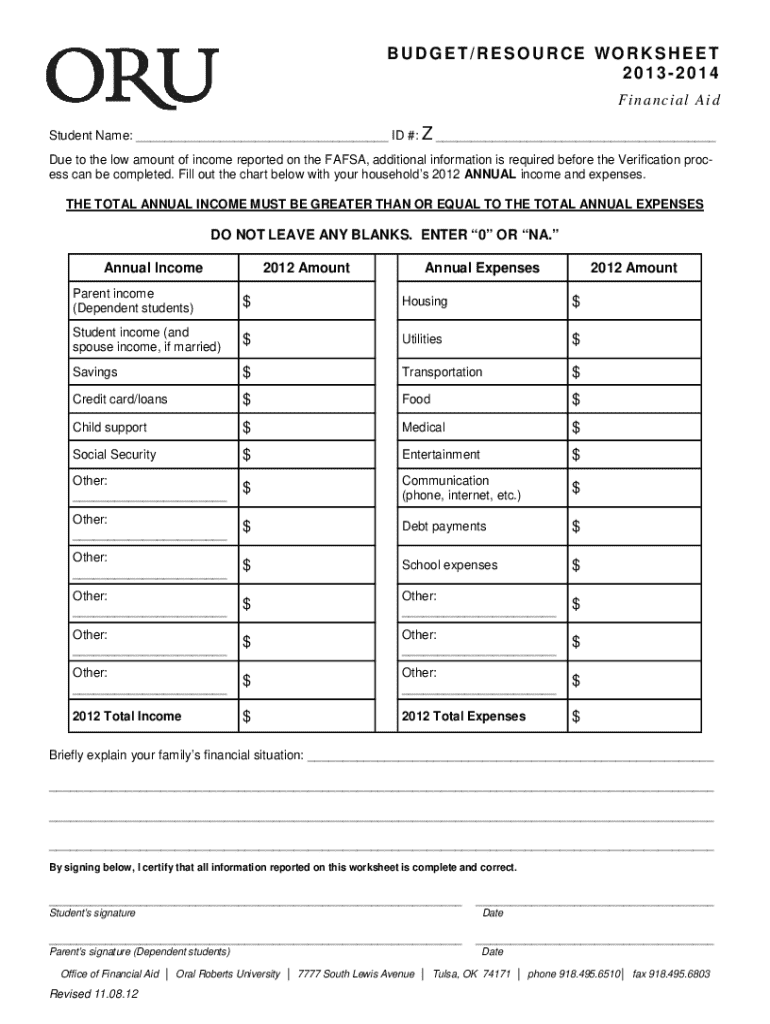

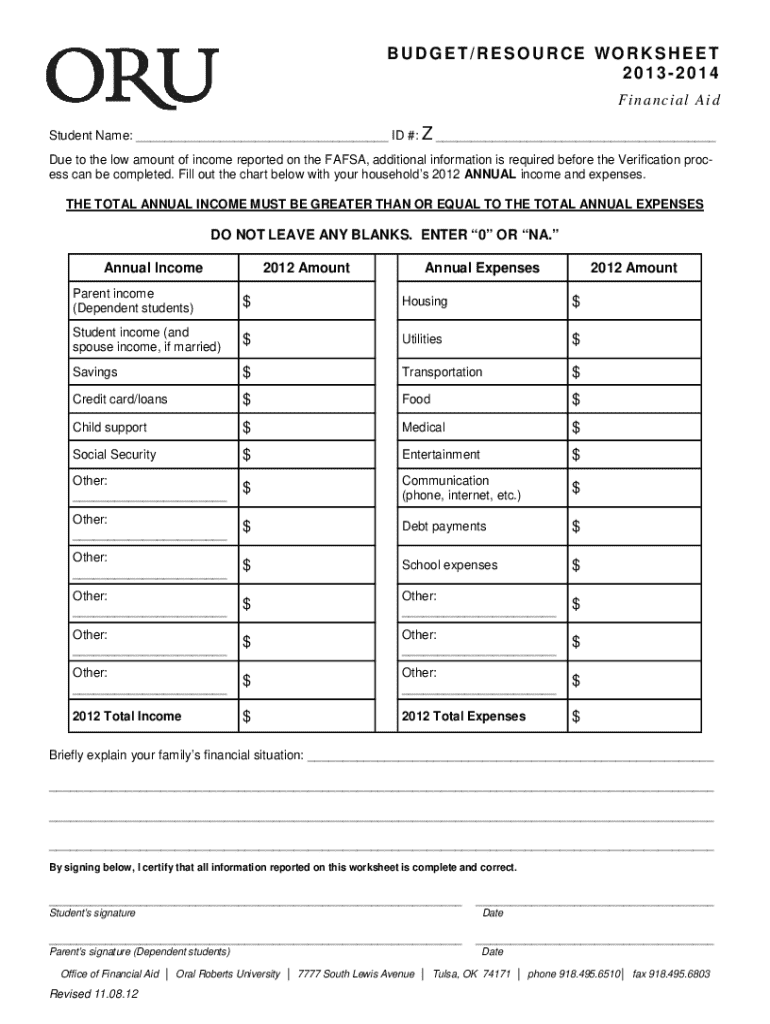

Comprehensive Guide to the Budget Resource Worksheet Form

Understanding the budget resource worksheet form

The budget resource worksheet form is a structured tool designed to facilitate the budgeting process for both individuals and teams. By providing an organized layout to outline income, expenses, and financial goals, this form plays a crucial role in effective financial planning. Its primary purpose is to assist users in gaining clarity about their financial situation, enabling informed decision-making concerning spending, saving, and investments.

The importance of utilizing a budget resource worksheet cannot be overstated. It not only helps track monetary movement across various categories but also allows for proactive management of finances, thereby alleviating the stress associated with financial uncertainty. Whether you are a freelancer managing multiple income streams or a family trying to balance limited resources, this worksheet can streamline your budgeting efforts.

Getting started with the budget resource worksheet form

To begin using the budget resource worksheet form, the first step is accessing the appropriate template. Users can easily find this on pdfFiller, which offers an intuitive platform for document management. The worksheet is available in both an online fillable version and a downloadable PDF format. This flexibility ensures that users can choose according to their preferences and needs.

Setting up your budget requires a clear understanding of your financial goals. Spend some time determining what you aim to achieve financially—be it saving for a vacation, paying off debts, or planning for retirement. Collect all necessary financial documents, including bank statements, pay stubs, and receipts. Having these resources at hand will enable you to fill out your worksheet accurately and comprehensively.

Filling out the budget resource worksheet

Filling out the budget resource worksheet involves several key sections that detail your income and expenses. The process should be straightforward if you follow step-by-step instructions. First, you start by listing your income sources. This includes identifying every possible stream of income—whether it’s your regular salary, any freelance work, or side hustles—and estimating your monthly income from these sources.

Next, itemizing your monthly expenses is crucial. You’ll want to differentiate between fixed expenses, such as rent or mortgage and variable expenses—these can fluctuate from month to month, like groceries or entertainment. Be diligent about categorizing your expenses; common categories to include are housing, utilities, food, transportation, and personal care.

While entering your data, keep in mind some tips for accurate entry. If you have inconsistent income, look at your earnings over several months to establish an average. When projecting expenses, consider previous months' expenses to ensure you set realistic amounts. This foresight will help you maintain balance and stay on track.

Advanced budgeting techniques with the worksheet

Once you are familiar with the basics of the budget resource worksheet, consider exploring advanced budgeting techniques. For example, zero-based budgeting, which requires you to allocate every dollar of your income, ensuring all your expenses are accounted for each month without any leftover funds. This method can significantly enhance your spending awareness and encourage mindfulness towards saving.

Another effective approach is the cash envelope budgeting system. This method involves dividing your cash into envelopes for different spending categories, helping you limit your expenditures to specific amounts designated for each category. Additionally, the pay-yourself-first strategy ensures that you prioritize savings before addressing your spending habits. Implementing these advanced techniques in conjunction with your budget resource worksheet can refine your financial management significantly.

Moreover, the worksheet can be utilized for financial modeling, accommodating scenario planning for irregular incomes or seasonal spending adjustments. This flexibility allows users to prepare for fluctuations, enhancing overall financial resilience.

Editing and managing your budget resource worksheet

Managing your budget resource worksheet is crucial as financial situations can frequently change. pdfFiller’s editing tools make it simple to modify entries whenever needed, ensuring that your budget reflects your current financial status. As circumstances evolve, such as changes in income or unexpected expenses, revisit the worksheet to maintain accurate representations.

Collaborating with team members is equally essential for those managing budgets in group settings. pdfFiller allows you to share and discuss the worksheet with others involved in financial planning, which can lead to informed decisions and unified goals. When needed, signatures can be obtained through secure eSigning options available on the platform, enhancing document integrity and workflow.

Monitoring and adjusting your budget

Monitoring your financial progress against the budget set in your worksheet is essential for effective management. Conduct regular check-ins to ensure your actual spending aligns with your budget. Create monthly cash flow summaries to visualize how your spending compares to your planned budget and make adjustments accordingly. Not only does this practice provide insight, but it also encourages accountability in your financial activities.

Implementing best practices for staying on track is crucial. Set reminders for billing and payment due dates to prevent late fees and maintain good credit standing. Evaluate your financial health periodically; assess how well you are adhering to your budget and reconsider your financial goals as necessary. This continuous evaluation helps keep you aligned with your long-term financial objectives.

Integrating the budget resource worksheet with other financial tools

To enhance your budgeting efforts further, consider integrating the budget resource worksheet with other financial tools. Aligning your budgeting worksheet with financial software and applications can streamline your overall financial management. Many budgeting apps allow for direct data import, ensuring consistency across multiple financial documents while providing robust analytics.

Recommended tools to complement your budgeting efforts include financial planners, expense tracking apps, and investment tracking software. These resources can assist in maintaining comprehensive insights into your overall financial status, thereby empowering you to make informed decisions and strategically adjust your budget as necessary.

Common pitfalls and how to avoid them

While using the budget resource worksheet, users often encounter pitfalls that can derail their budgeting efforts. A frequent mistake is overestimating income while underestimating expenses. This discrepancy can lead to poor financial planning and stress. Another common issue arises from failing to account for irregular expenses—such as car repairs or unanticipated medical bills—which can disrupt carefully calculated budgets.

To avoid these pitfalls, it is crucial to maintain realistic projections in your budgeting worksheet. Incorporate a buffer for irregular expenses and conservative estimates for fluctuating incomes. Regular reviews and updates to your budget based on actual figures will also help maintain accuracy and prevent potential issues.

Engagement with budgeting community resources

Engaging with the budgeting community can be invaluable for continued learning and support. Joining online forums, attending budgeting workshops, or participating in webinars can provide insights into effective financial management practices. These resources often connect you with experienced individuals who can share their strategies and successes, encouraging you along your journey.

Additionally, pdfFiller offers community features where users can share their experiences and insights regarding budgeting and the use of the budget resource worksheet. Such engagement fosters a collaborative environment, providing motivation and tips that can help elevate your financial acumen.

Final thoughts on effective budgeting

Adopting a proactive approach to financial management is critical for success. The budget resource worksheet serves as a robust tool for organizing your finances, tracking progress, and instilling discipline in spending habits. Encouraging users to maintain an ongoing review and revision process will further strengthen their ability to adapt to changing financial landscapes.

Regularly revisiting and adjusting your budget ensures that it remains relevant and responsive to your needs. Through consistent practice, the budget resource worksheet can transform budgeting from a daunting task into a streamlined approach for achieving financial goals effectively and sustainably.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out budgetresource worksheet using my mobile device?

Can I edit budgetresource worksheet on an iOS device?

How do I complete budgetresource worksheet on an iOS device?

What is budgetresource worksheet?

Who is required to file budgetresource worksheet?

How to fill out budgetresource worksheet?

What is the purpose of budgetresource worksheet?

What information must be reported on budgetresource worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.