Get the free Non-profit Corporation Annual Report

Get, Create, Make and Sign non-profit corporation annual report

How to edit non-profit corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-profit corporation annual report

How to fill out non-profit corporation annual report

Who needs non-profit corporation annual report?

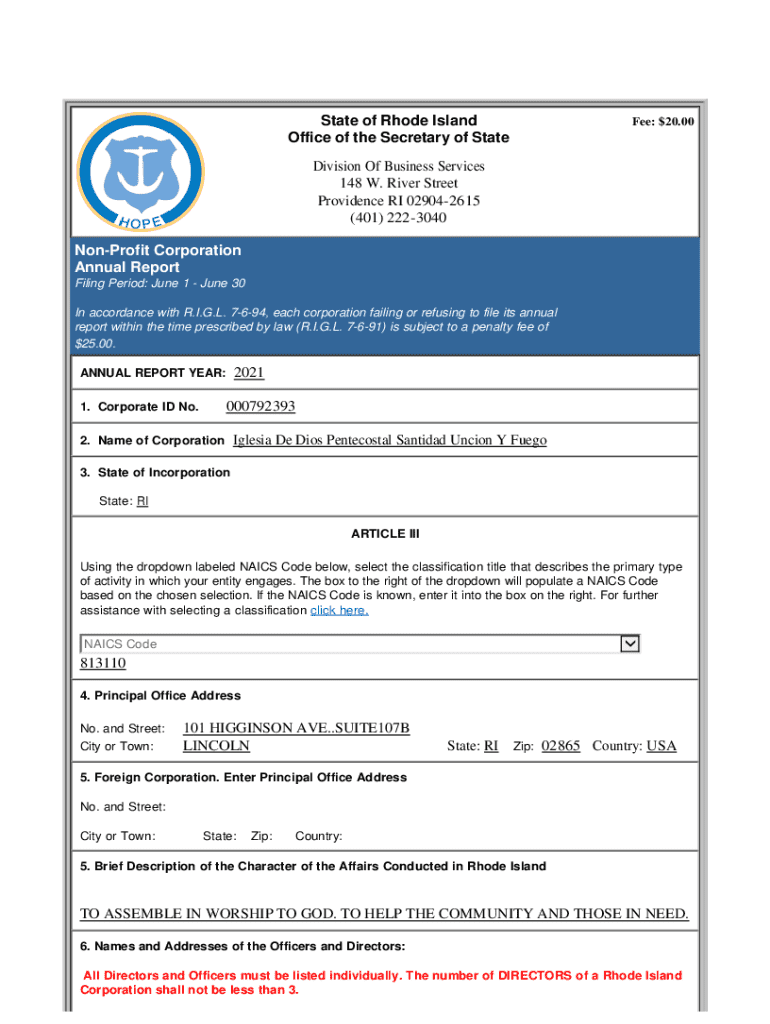

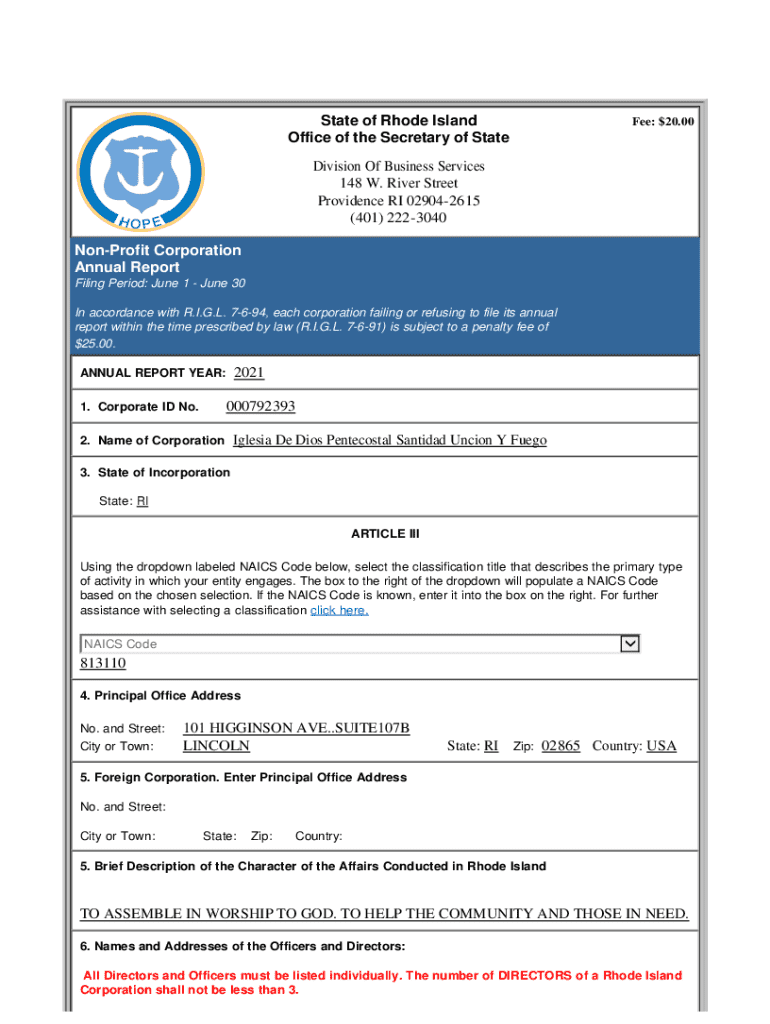

A Comprehensive Guide to Non-Profit Corporation Annual Report Form

Understanding non-profit corporation annual reports

Non-profit corporation annual reports serve as essential documents that encapsulate the organization's activities, financial health, and overall impact over the past year. These reports should clearly communicate the non-profit’s mission and the strides taken to achieve it. The primary purpose of an annual report is not only to keep stakeholders informed but also to maintain transparency and foster trust within the community.

By adhering to legal requirements and compliance standards, non-profits can ensure they are operating within the law. Most jurisdictions require non-profits to file an annual report with pertinent details regarding their financial status, operations, and governance. Failure to comply with these regulations can lead to financial penalties and loss of tax-exempt status.

Key components of a non-profit annual report

A non-profit annual report is composed of several essential elements that collectively tell the story of the organization's year. First and foremost is the mission statement, which articulates the cause the organization supports and its vision for the future. This statement should be front and center to reinforce the non-profit’s core purpose.

Following the mission statement, a financial overview must be presented, which breaks down revenue sources, expenditures, and a balance sheet overview. These figures provide stakeholders with insight into how funds are being utilized and the sustainability of the organization. Highlighting major achievements and impact stories will connect donors and volunteers with the results of their contributions.

Formatting your non-profit annual report

When formatting your non-profit’s annual report, choosing the right medium is crucial. Some organizations prefer hard copies to distribute at annual meetings, while others leverage digital formats to reach a broader audience. Digital reports allow for interactive elements that can engage readers and provide more information easily.

Visual elements play a significant role in enhancing engagement. Infographics, charts, and photographs can illustrate data and convey emotions effectively. A clean layout and professional design that aligns with your brand will make the report more inviting and easier to navigate, ultimately increasing readership and impact.

Steps to prepare your non-profit annual report

To prepare an effective non-profit annual report, start by gathering financial and operational data from all relevant departments. This includes collecting income statements, balance sheets, and project outcomes to provide a comprehensive overview of your organization’s performance. Conducting stakeholder interviews can also add depth to your narrative, bringing in testimonials and personal insights.

Once you have the necessary information, draft the report by utilizing templates for consistency. These templates can guide you in structuring the layout while adhering to best practices. After drafting, allocate time for editing and refining the content to ensure clarity and impact before finalizing and distributing the report to stakeholders.

Best practices for non-profit annual reports

Adopting best practices in non-profit annual reports can significantly enhance the credibility and engagement of your report. Transparency is key; providing clear disclosures about financial matters fosters trust. Engaging storytelling that captures your organization’s journey and the impact made is crucial for rallying support. Accessibility features, such as multilingual options or large print editions, can help ensure all stakeholders can access the report.

Additionally, it's beneficial to incorporate metrics to showcase success and impact. Including measurable outcomes not only illustrates accountability but also demonstrates the effective use of funds, which is imperative for attracting future support and grants.

Tools and resources for creating your annual report

pdfFiller provides an array of tools for creating non-profit corporation annual reports. Its cloud-based platform allows users to edit PDFs seamlessly, e-sign documents, and collaborate effectively on report content. Utilizing features like interactive editing and digital signing can increase efficiency significantly in the report preparation process.

Moreover, recommended software and design platforms enhance your report's visual appeal. Resources such as Canva or Adobe InDesign can assist in creating professional-grade visuals. Studying examples of inspiring non-profit annual reports can also provide insight and inspiration for your own.

Frequently asked questions (faqs)

Many individuals wonder whether non-profits are required to publish annual reports. Generally, the requirement varies by state or country; however, transparency is always regarded as good practice. Stakeholders appreciate communication about financial health, even if not mandated.

As for the level of detail necessary, reports should be sufficiently detailed to convey their story but not overwhelming. Summarizing key points effectively can help. Additionally, alongside the annual report, non-profits may need to file Form 990 with the IRS, which outlines financial activities, thus needing to be maintained in parallel.

Enhancing future annual reports

Feedback from stakeholders can serve as a powerful tool in enhancing future annual reports. Actively seeking input regarding what was helpful or what aspects could be improved can lead to valuable revisions. Adapting your reporting strategies to incorporate innovative strategies, like multimedia storytelling, can further broaden engagement.

As regulations and community standards continue to evolve, staying updated and adapting reports accordingly is essential. Embracing changes can help ensure compliance and maintain the relevance of the report, reinforcing trust and engagement with your audience.

Additional types of reports for non-profits

Beyond the annual report, non-profits may engage in bi-annual reporting for more frequent updates on progress and financial health. Grant reports, which delve into the specifics of funded projects, are closely linked to annual reporting but serve a more targeted audience. Impact assessments complement annual reports by providing detailed metrics on the effectiveness of specific initiatives.

These reports highlight the ongoing narrative of an organization, showing responsiveness to both donor and community needs. Understanding the diverse reporting landscape allows non-profits to communicate effectively across different channels and engage varied audiences.

Navigating challenges in annual reporting

Non-profit organizations often encounter challenges when preparing annual reports. Common pitfalls include excessive jargon that alienates readers or financial data that lacks context, rendering it meaningless. Handling complex financial information can be daunting, but clear explanations and graphical representations can simplify intricate concepts for readers.

In challenging times or following setbacks, restructuring your reporting strategy can offer fresh perspectives, helping to reconnect with stakeholders while acknowledging challenges faced. Ultimately, the aim should be fostering resilience while communicating effectively to both assure and inform all partners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in non-profit corporation annual report?

Can I sign the non-profit corporation annual report electronically in Chrome?

How do I edit non-profit corporation annual report straight from my smartphone?

What is non-profit corporation annual report?

Who is required to file non-profit corporation annual report?

How to fill out non-profit corporation annual report?

What is the purpose of non-profit corporation annual report?

What information must be reported on non-profit corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.