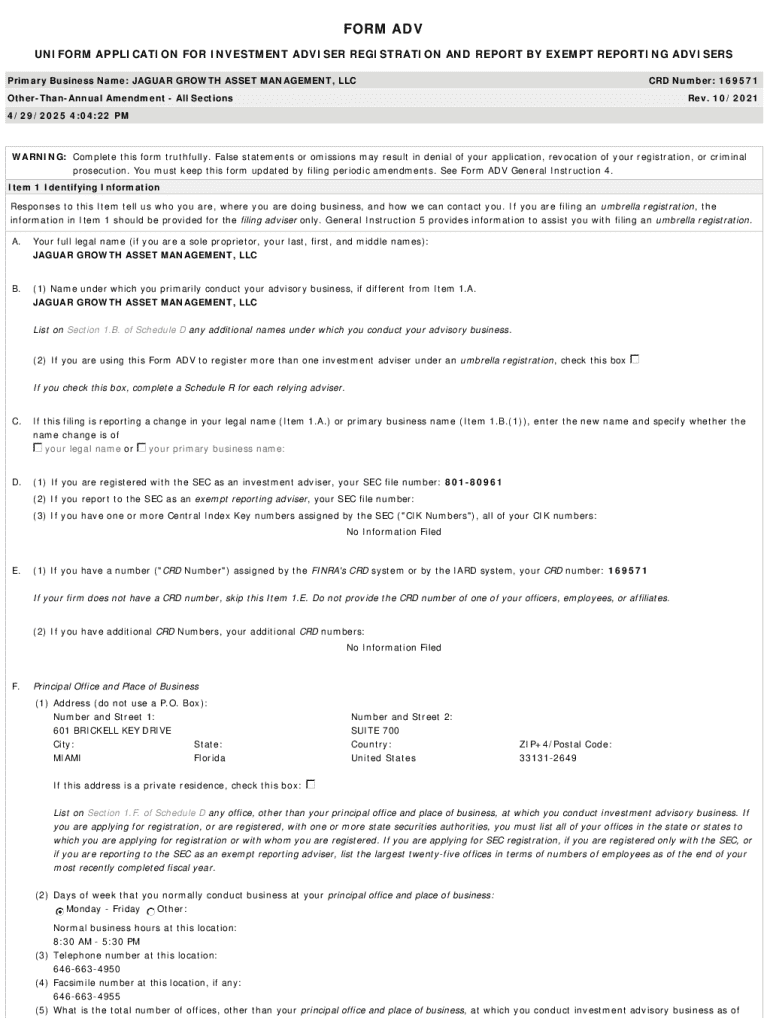

Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Understanding Form ADV: A Comprehensive Guide

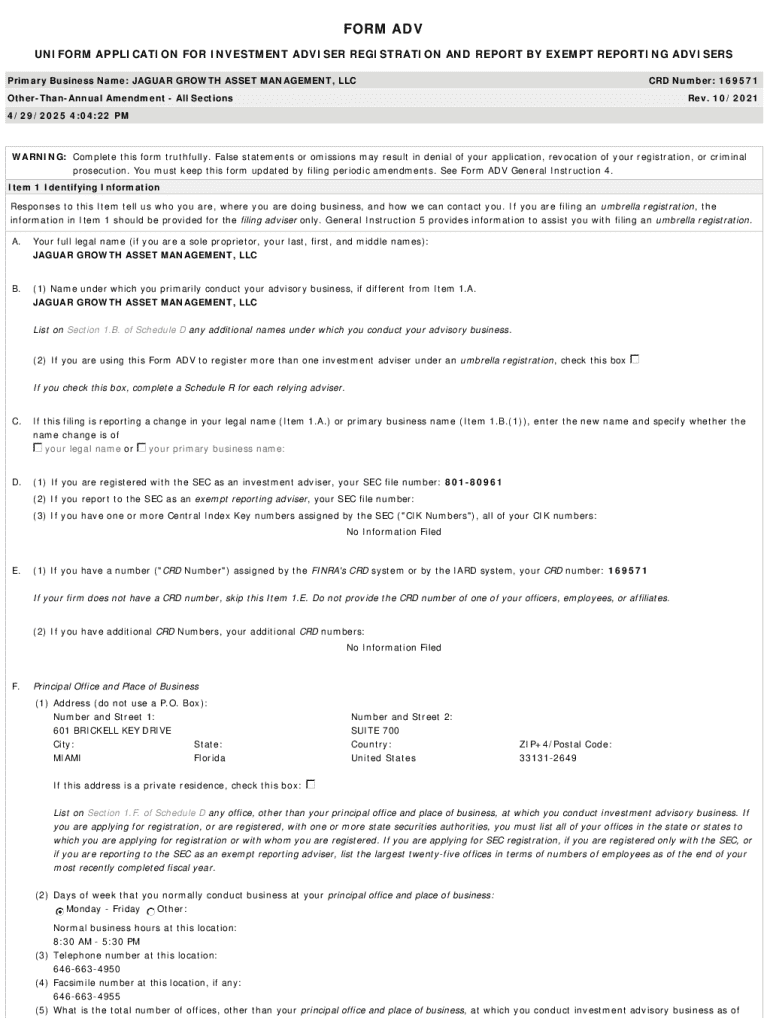

Understanding Form ADV

Form ADV is a critical regulatory document used in the financial advisory industry, primarily intended for investment advisers. This document serves to enhance transparency and provide vital information to clients about the firm’s operations, ownership, and business practices. Its importance cannot be overstated, as it equips clients with the knowledge to make informed choices about their financial management options.

Any firm that provides investment advice for compensation is required to file Form ADV. This includes both large and small advisory firms, ensuring that regulatory oversight is maintained across the industry. The document not only helps clients understand what services they can expect but also outlines the fee structures, potential conflicts of interest, and the adviser’s background.

The structure of Form ADV

Form ADV is comprised of two main parts: Part I and Part II, each featuring distinct elements crucial for both regulators and clients. Part I includes the firm's basic information, while Part II serves as a detailed brochure outlining the advisory business.

In Part I, key items include:

Part II further delves into specific advisory services, featuring:

Accessing and reviewing Form ADV

Finding a firm’s Form ADV is straightforward, thanks to the SEC’s Investment Adviser Public Disclosure (IAPD) database. This user-friendly online service allows potential clients to search for a firm’s Form ADV by name or registration number, providing easy access to vital information.

In addition to the IAPD, prospective clients can visit state regulatory websites to obtain the Form ADV pertinent to local firms. Each state may have its specific regulations, so checking these resources is essential when making important financial decisions.

When reviewing a firm's Form ADV, here are some critical elements to focus on:

Critical insights from Form ADV

While Form ADV provides a foundation of information, it’s essential to recognize its limitations. The document may not cover every aspect of a firm's operational norms or hidden risks. For instance, it does not capture every complaint or detail about an adviser’s interactions with clients. As such, additional research is crucial.

Consider looking into independent reviews, testimonials, and any available performance reports to gain a more comprehensive understanding. Engaging with former clients or industry professionals can also yield insights that Form ADV does not disclose.

Tips for reading and interpreting Form ADV

When reading Form ADV, focus on several key elements to guide your assessment of a financial advisory firm. First, thoroughly evaluate the fees outlined in Part II, as they directly impact your returns. Transparent fee structures tend to indicate a trustworthy advisor.

In addition to fees, check the following aspects for red flags:

The role of eSigning in document management

In an increasingly digital landscape, managing documents like Form ADV has become more streamlined with eSigning solutions. Tools like pdfFiller simplify the process of filling out, signing, and managing Form ADV documents with efficiency.

Utilizing pdfFiller offers numerous advantages, including enhanced collaboration features that allow teams to work together seamlessly. This streamlined document management capability reduces the likelihood of errors in submissions and ensures all necessary parties can review and sign off on the document quickly.

Choosing the right financial advisor

When selecting a financial advisor, Form ADV should be your primary resource. Start by asking essential questions, including:

Additionally, evaluate the credentials of potential advisors. Look for certifications such as CFA or CFP, and ensure they adhere to fiduciary standards and comply with regulatory mandates.

Form ADV variants and enhancements

Understanding the distinctions between Form ADV and other financial disclosure forms, such as Form CRS, can further enhance your knowledge. Form CRS is designed to provide a concise view of the relationship between the client and their advisor, focusing primarily on disclosures rather than the detailed operational information found in Form ADV.

It’s also crucial for advisers to maintain an updated Form ADV. Changes to business operations or ownership should be reflected immediately to preserve trust and ensure compliance with regulatory expectations.

Advantages of using pdfFiller for form management

pdfFiller provides several key features beneficial to users managing Form ADV. The cloud-based accessibility allows users to fill out forms from any device, promoting flexibility and efficiency in document handling.

Moreover, real-time collaboration and document management tools enable teams to work together effectively, regardless of their physical locations. Enhanced security features ensure compliance and protect sensitive information during the form’s lifecycle.

Tips for filling out and filing Form ADV

For advisors completing Form ADV, adhering to best practices is essential for accuracy and transparency. Review each item carefully to ensure all information is up-to-date and precise. Misrepresentations or errors can lead to disciplinary actions, undermining the firm's integrity.

Common mistakes include:

Summary of the Form ADV journey

Adhering to best practices for ongoing compliance and monitoring is vital in managing Form ADV. Regular updates and reviews can prevent discrepancies and build client trust. Engaging with technology, particularly tools like pdfFiller, can significantly simplify the documentation, compliance, and monitoring process, enabling firms to focus more on their advisory roles rather than administrative burdens.

Overall, as financial regulations evolve, leveraging effective document management solutions becomes imperative for both compliance and client satisfaction within the financial advisory sector.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form adv online?

How do I edit form adv on an Android device?

How do I complete form adv on an Android device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.