Get the free Business Corporation Annual Report

Get, Create, Make and Sign business corporation annual report

How to edit business corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business corporation annual report

How to fill out business corporation annual report

Who needs business corporation annual report?

Business Corporation Annual Report Form: A Comprehensive Guide

Overview of business annual reports

A business annual report is a comprehensive document that outlines a corporation's activities throughout the preceding year. This report not only serves as a financial summary but also provides insight into the company's performance, strategies, and overall health. For corporations, annual reports play a critical role in corporate governance as they assure stakeholders, investors, and regulatory bodies of compliance and accountability.

The importance of annual reports in corporate governance cannot be overstated. They ensure transparency and provide critical information necessary for stakeholders to make informed decisions. These reports typically include financial statements, management discussions, and data on corporate governance practices, making them vital for maintaining shareholder confidence.

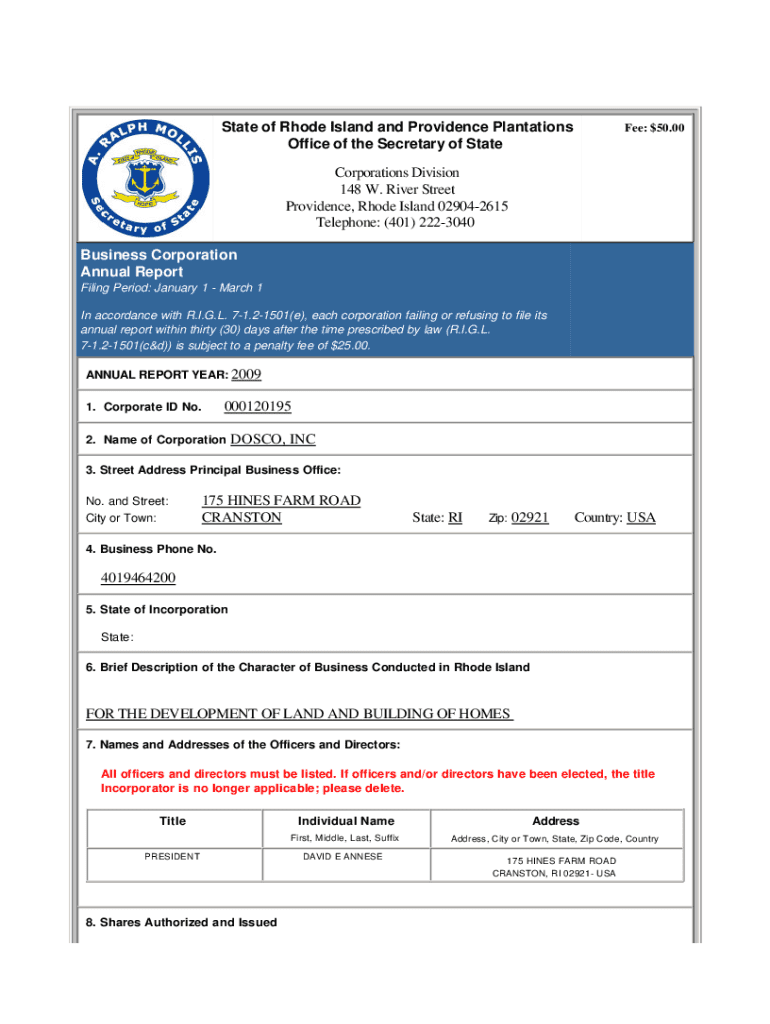

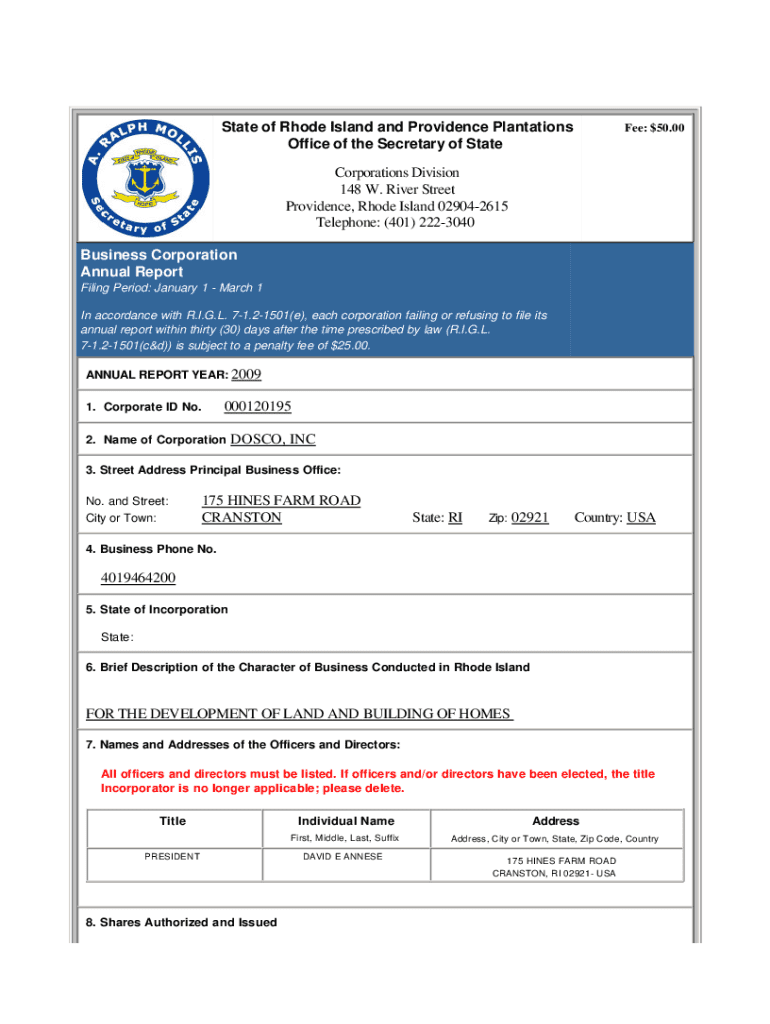

Understanding the business corporation annual report form

The business corporation annual report form is structured to capture essential information about a corporation's operations and finances. It consists of several key elements that share insights into the company’s performance and future prospects. A standard report form typically includes corporate details, required financial statements, and a section for management's discussion and analysis.

Corporate details such as the company's name, address, and Employer Identification Number (EIN) need to be accurately reported. The financial statements generally required encompass the balance sheet, income statement, and cash flow statement. The management's discussion and analysis provide an opportunity for leaders to contextualize financial data, highlighting achievements, challenges, and future plans.

Notably, the specific requirements and forms can vary by state or jurisdiction, meaning it's crucial to consult local regulations to ensure compliance when preparing your business corporation annual report form.

Filing requirements for business annual reports

Filing requirements for business annual reports differ significantly from state to state, highlighting the importance of understanding the regulations specific to your jurisdiction. Corporations and Limited Liability Companies (LLCs) often face different requirements; while corporations typically need to file detailed financial reports, LLCs might submit less comprehensive documentation.

When filing your annual report, ascertain the specific checklist for your state. Many states provide clear guidelines on what needs to be included, while some may possess unique conditions based on business type or industry. Also, keep an eye on filing timelines, as delays can lead to penalties and complications.

How to complete the business corporation annual report form

Completing the business corporation annual report form requires attention to detail and an organized approach. Begin by gathering all necessary documentation, including corporate records and financial statements from the previous year. This foundational step is crucial to ensure accuracy and compliance.

Next, accurately fill in your corporate information, including the legal name, physical address, and EIN. Preparing financial statements should follow; ensure that these documents are up to date, reflect accurate figures, and comply with accounting standards. Finally, review the report thoroughly to check for compliance with your state’s requirements, and avoid common errors that could cause complications.

Methods of filing your annual report

Business owners can choose between online filing or submitting their annual report via mail. Each method has its advantages and drawbacks. Online filing is usually faster and offers instant confirmation, while mail submissions may take longer to process and could face delays.

When opting for online filing, navigate to your state’s website to access their web portal. On the other hand, if you prefer filing by mail or in person, ensure your documents are correctly formatted and sent to the appropriate address. Also, be mindful of associated filing fees—some states charge different fees for online submissions compared to mail-in submissions.

Managing your annual report filing

To ensure timely compliance with your annual report filings, investing in tools and resources for tracking deadlines is essential. Setting alerts or reminders can help prevent oversight, particularly during busier business periods. Services like pdfFiller offer convenient document management solutions, allowing users to organize their annual reporting documents efficiently.

Organizing documents in a systematic manner guarantees quick access when needed. During the filing process, retaining copies of submitted reports is also critical for compliance verifications and future reference.

Potential consequences of non-compliance

Failure to file the business corporation annual report by the deadline can lead to serious repercussions. Penalties often include fines, and in some cases, your corporation may face administrative dissolution, rendering it inactive. Understanding these potential consequences underscores the importance of adhering to filing schedules.

If you miss a filing deadline, consult your state’s guidelines on rectifying missed filings. Usually, states provide specific steps for reinstating your corporation, which may involve additional fees or compliance measures.

Frequently asked questions (FAQs)

Understanding the purpose of an annual report is essential for business owners. Essentially, it provides stakeholders with a detailed overview of corporate performance and future outlook. Small business owners often inquire about exemptions, where some jurisdictions may allow certain businesses to skip filing under specific conditions.

Other common concerns involve changes to the corporate structure or management that require updates in the filings. For assistance in filing, many states have resources available to provide support for businesses navigating these requirements.

Related documents and forms

Filing an annual report can involve several related documents and forms that ensure comprehensive compliance with state regulations. These may include forms for amendments, financial statements, or special resolutions. Familiarizing yourself with these additional documents can streamline the annual reporting process.

It is important to follow links to your state-specific filing resources to access templates or additional guidance tailored to your corporation’s needs.

Additional insights

Annual reports play a significant role in attracting investors and stakeholders. They not only detail past performance but also project transparency and accountability, two factors that are immensely appealing to potential investors. Currently, there’s a trend towards more detailed disclosures in annual reports, where companies incorporate sustainability practices and corporate social responsibility information.

Understanding these evolving trends can help businesses leverage their reports for growth. As public expectations shift, companies that uphold transparency and actively share their strategies are more likely to succeed.

Innovative tools for easier filing

In the digital age, utilizing tools like pdfFiller can simplify the entire process of filling out the business corporation annual report form. With features aimed at enhancing collaboration, such as shared access for team members, and eSigning capabilities, managing your documents has never been easier.

The cloud-based document platform offered by pdfFiller allows users to create, edit, and manage their forms from anywhere at any time. This flexibility can significantly streamline annual report preparations, ensuring that all necessary documentation is maintained and filed on time.

Important contact information

For further assistance regarding filing requirements, consulting local business resources or your state’s regulatory body is advised. Organizations like chambers of commerce often provide guidance and support to businesses navigating compliance and reporting issues.

Additionally, consider reaching out to professional services specializing in corporate compliance to get tailored support that suits your business needs.

Stay updated on annual reporting requirements

The landscape of business regulations is always shifting, hence subscribing to relevant newsletters for the latest updates can be beneficial. Engaging with forums and communities focusing on business compliance can also provide valuable information and best practices.

Following compliance updates from regulatory bodies ensures that businesses remain informed and prepared for upcoming changes that could affect their annual report filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute business corporation annual report online?

How do I make edits in business corporation annual report without leaving Chrome?

Can I edit business corporation annual report on an iOS device?

What is business corporation annual report?

Who is required to file business corporation annual report?

How to fill out business corporation annual report?

What is the purpose of business corporation annual report?

What information must be reported on business corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.