Get the free Notice of Administrative Penalty

Get, Create, Make and Sign notice of administrative penalty

Editing notice of administrative penalty online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of administrative penalty

How to fill out notice of administrative penalty

Who needs notice of administrative penalty?

A Comprehensive Guide to the Notice of Administrative Penalty Form

Understanding administrative penalties

Administrative penalties are fines or sanctions imposed by government agencies or regulatory bodies in response to violations of rules or regulations. Unlike criminal penalties, which often involve legal proceedings and potential jail time, administrative penalties are typically resolved through an administrative process that is designed to be quicker and less formal. These penalties serve to enforce compliance with laws and regulations while promoting accountability.

The purpose of these penalties is to deter non-compliance and ensure that individuals and organizations adhere to established standards. They encompass a wide range of infractions, including but not limited to environmental violations, labor law breaches, and health code infringements. Common reasons for issuing penalties can include failure to obtain necessary permits, violations of safety regulations, and non-compliance with reporting requirements.

For instance, a business may receive an administrative penalty for discharging pollutants beyond legally acceptable levels, while an individual might face penalties for operating a vehicle without a proper license.

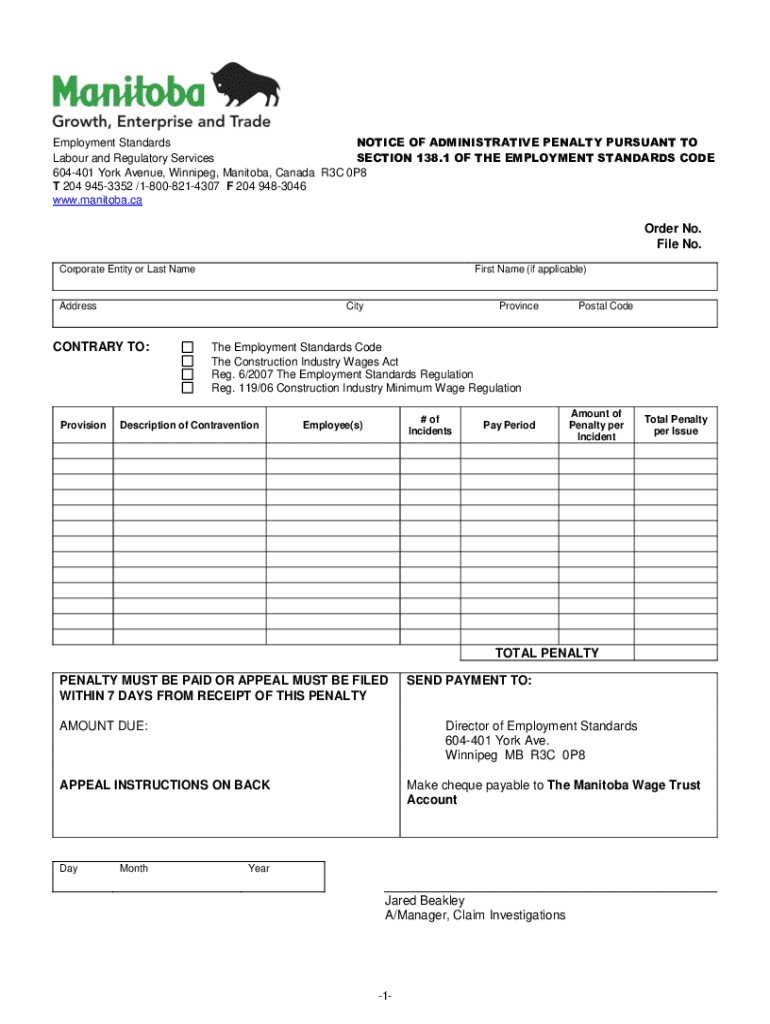

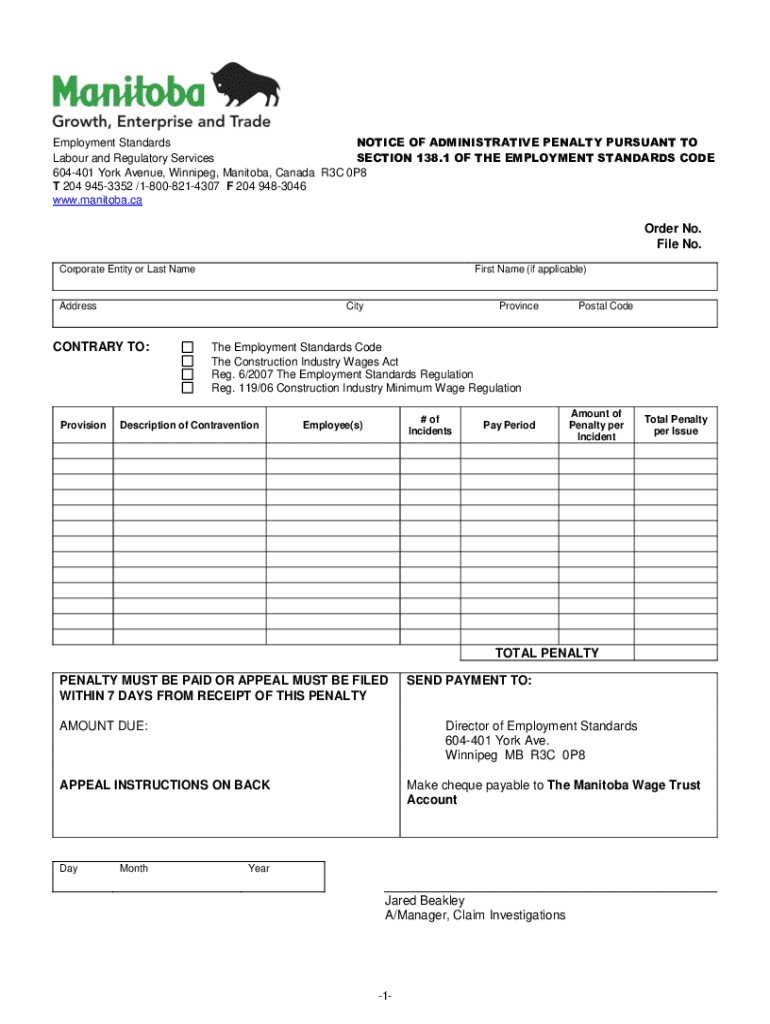

Overview of the notice of administrative penalty form

The Notice of Administrative Penalty Form is an official document issued to notify individuals or organizations of infractions that have taken place. This form plays a crucial role in the administrative process, formally outlining the violation and the resultant penalties. It serves both as a notification and as a record that details the nature of the offense, thus ensuring that the offending party is made fully aware of their obligations and rights regarding the penalty.

Key information included in the form typically encompasses the date of issuance, the details of the offending party, a description of the violation, and the penalty amount. This clear delineation of information ensures that all parties have a mutual understanding of the issue at hand.

Steps to fill out the notice of administrative penalty form

Filling out the Notice of Administrative Penalty Form may seem daunting, but following a structured process can simplify this task significantly. Here’s a step-by-step guide to ensure accuracy and compliance.

Modifying the form: Making edits and adjustments

In some cases, you may need to modify the Notice of Administrative Penalty Form. Utilizing platforms like pdfFiller can facilitate this process, allowing you to make necessary edits efficiently while ensuring compliance with legal standards.

Accessing pdfFiller is straightforward. Once on the platform, you can easily upload the Notice of Administrative Penalty Form and begin making alterations. When editing, accuracy is key; ensure all changes reflect the current situation correctly.

E-signing the notice of administrative penalty form

An electronic signature (e-signature) can be vital in the administrative processes related to the Notice of Administrative Penalty Form. These signatures serve the same legal purpose as handwritten ones, making document transactions more efficient.

Using pdfFiller, e-signing the form is simple and secure. The platform offers step-by-step instructions for e-signing, ensuring that users can validate their forms digitally with ease.

Collaborative approaches: Involving your team or legal advisor

Filling out the Notice of Administrative Penalty Form can benefit greatly from collaboration. Engaging your team or consulting with a legal advisor can provide insights that ensure the form is completed accurately and comprehensively.

pdfFiller allows users to invite collaboration through document-sharing features. This means multiple stakeholders can review and contribute to the form without confusion, making the process smoother.

Submitting the notice of administrative penalty form

Understanding the submission process of the Notice of Administrative Penalty Form is crucial for compliance. Submissions can vary depending on the agency or jurisdiction involved.

Typically, forms can be submitted online, by mail, or in person; it is vital to confirm the correct method of submission with the issuing authority. Furthermore, if a penalty must be paid, clarify the accepted payment methods, which may include online payment options or telephone payment systems.

Addressing disputes and appeals

If you find yourself contesting an administrative penalty, being informed about the options available for appeal is essential. You may appeal if you believe the penalty was unjustly applied.

Each jurisdiction may have specific timelines and required documentation for filing an appeal, which often includes a formal written appeal along with the relevant evidentiary materials.

Managing future penalties: best practices

To minimize the risk of future administrative penalties, businesses should adopt best practices that encompass compliance and due diligence. Establishing a robust framework for compliance can include regular training and audits to ensure adherence to legal standards.

Maintaining thorough records of compliance activities can safeguard against potential infractions. Engaging actively with regulatory bodies can also lead to better awareness of changes in regulations and aid in maintaining compliance.

Additional tools and features from pdfFiller

pdfFiller offers a robust set of tools that enhance document management significantly. From e-signing capabilities to collaborative features, users can streamline the processing of forms like the Notice of Administrative Penalty Form.

Integrating pdfFiller into your workflow not only simplifies the document creation process but also fortifies compliance through error reduction and efficiency. Moreover, customer support and help resources are readily available to assist users in navigating the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute notice of administrative penalty online?

How do I fill out notice of administrative penalty using my mobile device?

Can I edit notice of administrative penalty on an Android device?

What is notice of administrative penalty?

Who is required to file notice of administrative penalty?

How to fill out notice of administrative penalty?

What is the purpose of notice of administrative penalty?

What information must be reported on notice of administrative penalty?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.