Get the free Payroll Deduction - Request and Authorization Form

Get, Create, Make and Sign payroll deduction - request

How to edit payroll deduction - request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll deduction - request

How to fill out payroll deduction - request

Who needs payroll deduction - request?

Payroll Deduction - Request Form: Your Comprehensive Guide

Understanding payroll deductions

Payroll deduction refers to the process where an employer withholds a portion of an employee's earnings to pay for various expenses. This can include mandatory obligations like federal taxes, state taxes, and social security contributions, as well as voluntary deductions such as retirement savings contributions or health insurance premiums. Payroll deductions are essential as they streamline the process of paying recurring expenses directly from an employee’s paycheck, ensuring timely payments and improved financial management.

Common uses of payroll deductions encompass health insurance premiums, 401(k) retirement plan contributions, life insurance premiums, and union dues. Given that these deductions can substantially influence an employee's take-home pay, understanding them fully is crucial for financial planning.

Types of payroll deductions

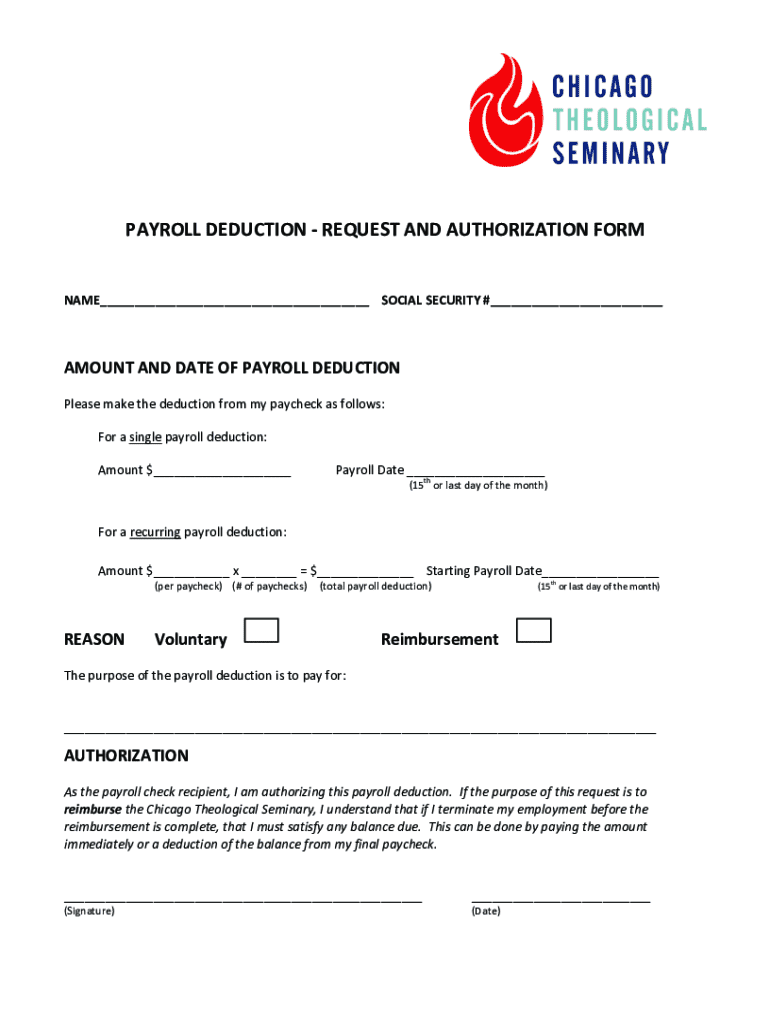

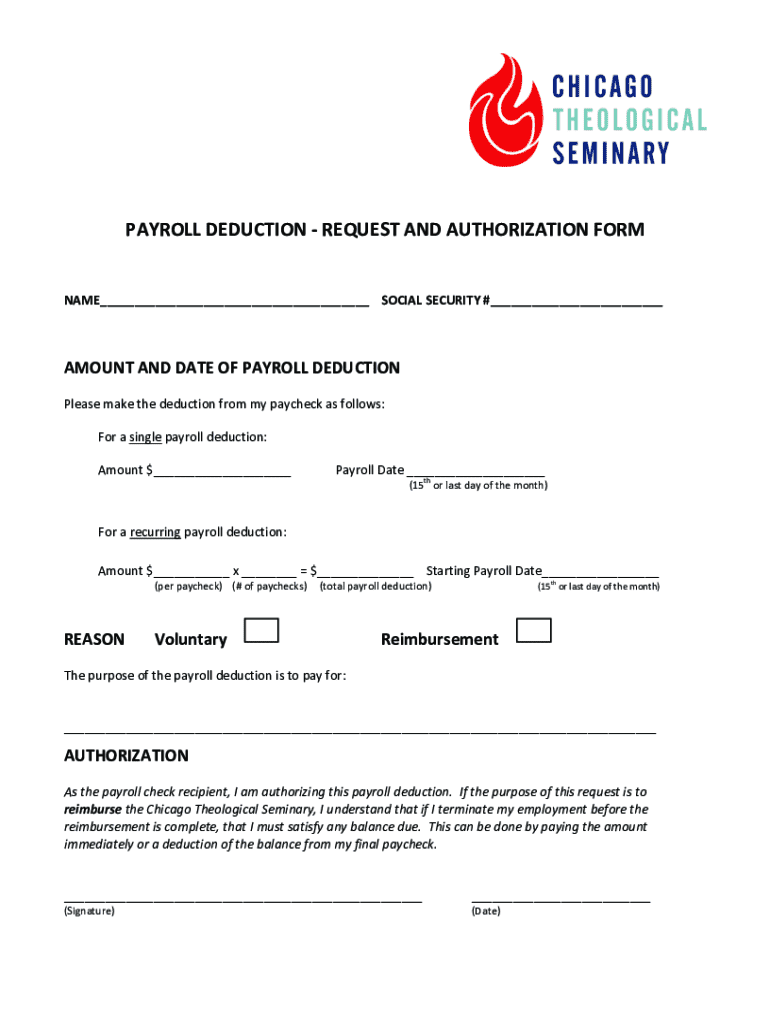

The payroll deduction request form: purpose and overview

A payroll deduction request form is crucial in the payroll process, serving as a formal document through which employees can specify the deductions they wish to have taken from their wages. This form may be necessary for both employees and contractors, streamlining documentation and ensuring clarity regarding the requested deductions.

The key elements of the payroll deduction request form typically include personal information such as name, employee ID, and department, as well as details related to specific deductions requested. This makes it easier for human resources or payroll departments to process requests accurately.

Key elements of the form

Step-by-step guide: completing the payroll deduction request form

Completing the payroll deduction request form correctly is vital for accurate processing. Following a structured approach can aid in making sure the request is clear and complete.

Step 1: Gather required information

The first step is to collect necessary personal details, including your name and employee ID. Additionally, research relevant deduction information like available health insurance plans or retirement accounts to ensure you choose the right options.

Step 2: Fill out the form accurately

Input your personal information correctly, paying particular attention to spelling and numerical values. Be sure to specify correct deduction amounts, as discrepancies can lead to processing delays.

Step 3: Review and double-check

Verifying information for accuracy is crucial. Review your filled-out form against the original requirements and ensure all sections are completed. A good checklist for review includes: 1. **Spelling of name and ID** 2. **Deduction amounts** 3. **Eligibility for selected plans** 4. **Signatures, if required**

Step 4: Submission of the form

The final step involves submitting your completed form. Depending on your organization's policies, this could be done in person, through an online portal, or via email. It is beneficial to follow up with the HR department to confirm that your request was received and is being processed.

Editing and managing your request form in pdfFiller

In an increasingly digital world, pdfFiller provides invaluable tools for users to edit their payroll deduction request forms with agility and ease. Utilizing this platform can significantly streamline document management.

Utilizing pdfFiller's features to edit your form

With pdfFiller, changes to saved forms are a simple task. Users can leverage tools like text fields and dropdown menus to update information and tailor their requests to fit evolving circumstances.

Signing your form electronically

eSigning using pdfFiller significantly enhances the process's efficiency. The step-by-step process to sign your form electronically involves: 1. **Choose the document** to be signed 2. **Select the eSignature feature** available on the platform 3. **Sign electronically** using a mouse, stylus, or uploaded signature.

Collaborating with others

Collaboration features within pdfFiller allow users to share forms with colleagues or HR for input and approval, enabling a more streamlined process. Features that facilitate collaboration include comment options and version control, ensuring everyone stays aligned.

FAQs about payroll deduction request forms

Understanding common queries regarding payroll deduction request forms can ease anxiety and make the process smoother. Here are answers to frequently asked questions.

What to do if your form is denied?

If your form is denied, it's usually due to inaccuracies or missed information. The first step is to reach out to your HR department to understand the reasons for denial and ask for guidance on how to rectify the situation.

How to change your deductions after submission

To revise your deductions mid-pay period, you typically need to fill out a new payroll deduction request form. Clearly indicate the changes you wish to make and submit it as soon as possible to ensure updates are applied in future paychecks.

What records should you keep?

It's essential to maintain a copy of your submitted form for your records, particularly for future reference in case of discrepancies. pdfFiller aids in record management by allowing users to securely store their documents in the cloud with easy access.

Troubleshooting common issues

Even with a straightforward form, users may face challenges. Recognizing and addressing these issues early can prevent unnecessary delays.

Technical issues with the due form

If you encounter problems filling out or submitting the form, check for common issues such as browser compatibility, pop-up blockers, or internet connectivity. Resetting your browser or clearing its cache can often resolve the problem.

Understanding payroll deductions adjustments

Reading your payslip accurately is fundamental in tracking changes in deductions. Familiarize yourself with how each deduction reflects on your payslip, so you’ll know what to expect and can reconcile any differences.

Best practices for managing payroll deductions

Regular management of payroll deductions helps ensure they reflect your financial priorities. Periodic reviews can identify unnecessary deductions or opportunities for increased savings.

Regularly reviewing your deductions

Setting time aside to review your deductions every few months can help you make informed decisions about your payroll options. Look for changes in life circumstances, such as marriage or children, which may affect your deduction choices.

Communicating with HR

Effective communication with your HR department regarding your payroll deductions is critical. Always feel free to ask questions or express concerns. Keep the lines of communication open, as this could assist in smoother processes.

Advantages of using pdfFiller for your payroll deduction request form

Utilizing pdfFiller for your payroll deduction request forms offers numerous benefits that enhance the overall management experience.

Accessibility: create and manage from anywhere

The cloud-based solution of pdfFiller allows users to create, edit, and manage their documents from any location. This is particularly advantageous for busy professionals who need accessibility on the go.

Streamlined document management solutions

pdfFiller provides a range of templates and forms beyond payroll deduction requests, making it a flexible management tool for various administrative needs. This streamlined approach boosts efficiency and minimizes the risk of errors.

Secure and compliant document handling

With compliance being vital for document handling, pdfFiller ensures that your personal and financial information is securely managed, providing peace of mind as you submit sensitive forms like payroll deduction requests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find payroll deduction - request?

Can I sign the payroll deduction - request electronically in Chrome?

How do I edit payroll deduction - request straight from my smartphone?

What is payroll deduction - request?

Who is required to file payroll deduction - request?

How to fill out payroll deduction - request?

What is the purpose of payroll deduction - request?

What information must be reported on payroll deduction - request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.