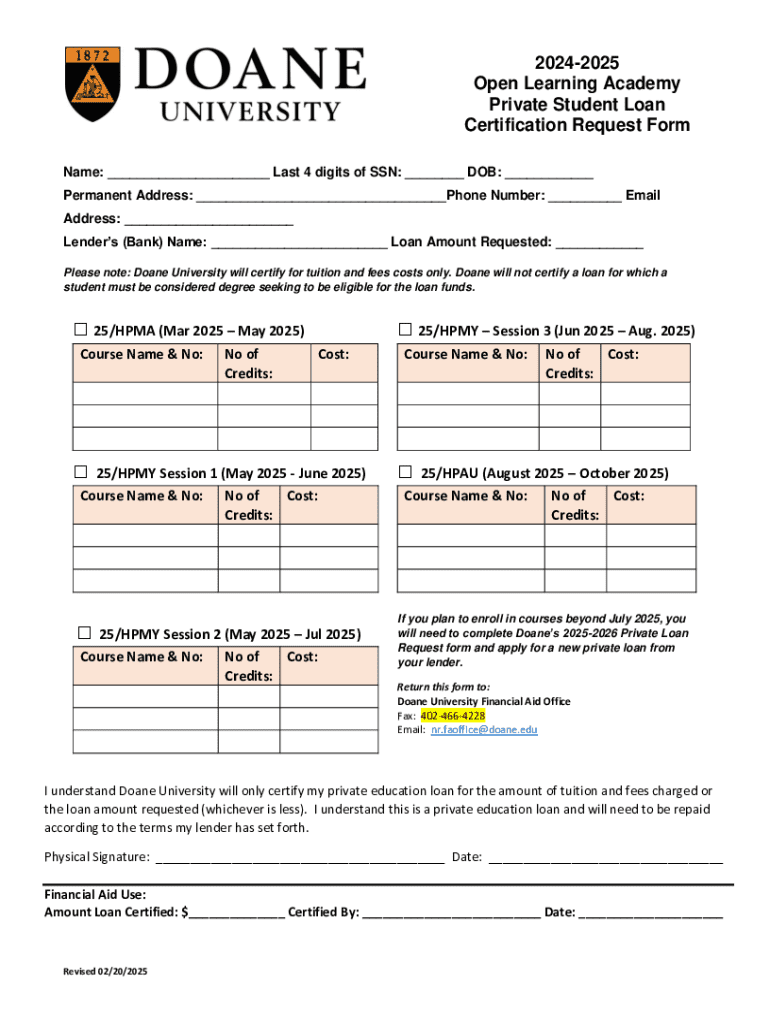

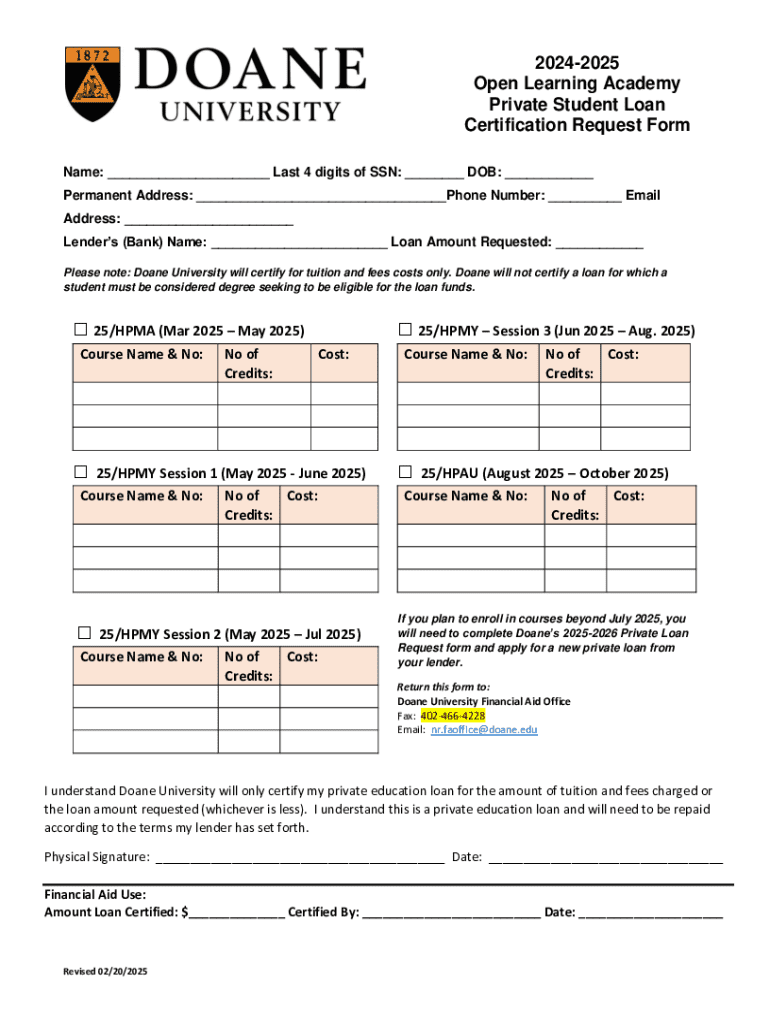

Get the free Private Student Loan Certification Request Form

Get, Create, Make and Sign private student loan certification

How to edit private student loan certification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out private student loan certification

How to fill out private student loan certification

Who needs private student loan certification?

Navigating the Private Student Loan Certification Form

Understanding the private student loan certification form

The private student loan certification form is a critical document that facilitates the process of securing private educational loans. Unlike federal loans that come with built-in protections and streamlined approval processes, private loans require certification to confirm that students are eligible based on their enrollment status and financial needs.

The importance of this form cannot be understated. It serves multiple purposes: first, it ensures that borrowers meet the necessary criteria set by lenders, aligning the funding with educational expenses. Second, it highlights the borrower’s financial situation, which aids lenders in determining the loan amount and terms.

Step-by-step process for completing the certification form

Completing the private student loan certification form is a straightforward process when approached methodically. Here’s a step-by-step guide to help you navigate it effectively.

Managing your private student loans

Understanding the nuances between private and federal student loans is imperative in your loan management journey. Private loans often carry different terms and conditions, and they lack the safeguards that come with federal options. This delineation becomes crucial when you’re completing the private student loan certification form.

Maintaining a handle on your loan amounts and terms is equally important. Regularly tracking your loan balance helps in managing future payments and understanding what your financial obligations will look like upon graduation.

FAQs about the private student loan certification form

Although the certification form is a common requirement, you may have several questions about the process. Below are some frequently asked questions that can help clarify doubts.

Key features of using pdfFiller for your certification form

Utilizing pdfFiller can streamline the process of completing your private student loan certification form remarkably. The platform offers assorted features that make your experience efficient and effective.

Navigating the loan application process

Choosing the right lender for private education loans involves more than just interest rates. Evaluating all aspects of the loan agreement, including repayment terms and customer support, is critical in making an informed decision.

Comparing loan options is essential. Consider the interest rates, loan terms, and specific conditions connected to the private education loan applicant self-certification. Understanding these elements can save you a significant amount of money long-term.

Future outlook: Trends in private education loans

Looking ahead to the 2024-25 academic year, potential regulatory changes may impact private loans. Staying informed about these developments is crucial for borrowers and prospective students.

As the landscape of private education loans evolves, adapt your financial strategies. Embrace best practices for loan management that leverage technology, such as utilizing tools like pdfFiller for comprehensive document management.

Contact information for assistance

If you have any concerns about filling out your private student loan certification form or navigating the loan application process, reach out for support. pdfFiller offers customer support for document-related inquiries.

Additionally, contacting your specific lender can clarify any questions regarding loan specifics. It’s always better to ask than to assume when it comes to your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get private student loan certification?

Can I create an electronic signature for the private student loan certification in Chrome?

How can I edit private student loan certification on a smartphone?

What is private student loan certification?

Who is required to file private student loan certification?

How to fill out private student loan certification?

What is the purpose of private student loan certification?

What information must be reported on private student loan certification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.