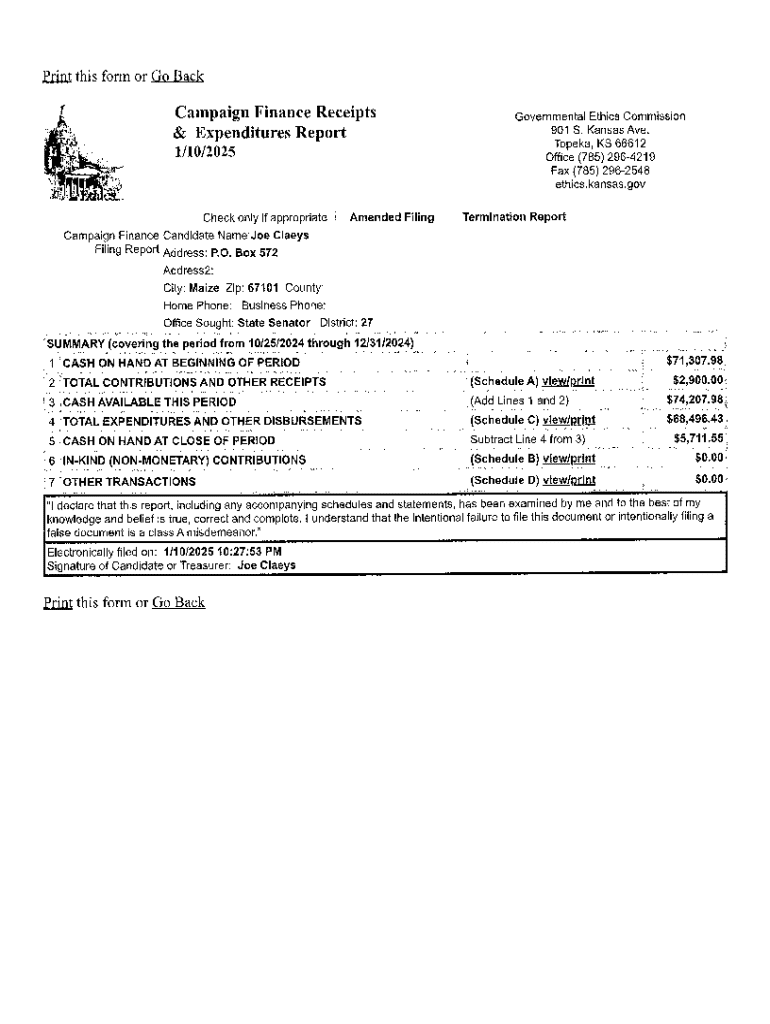

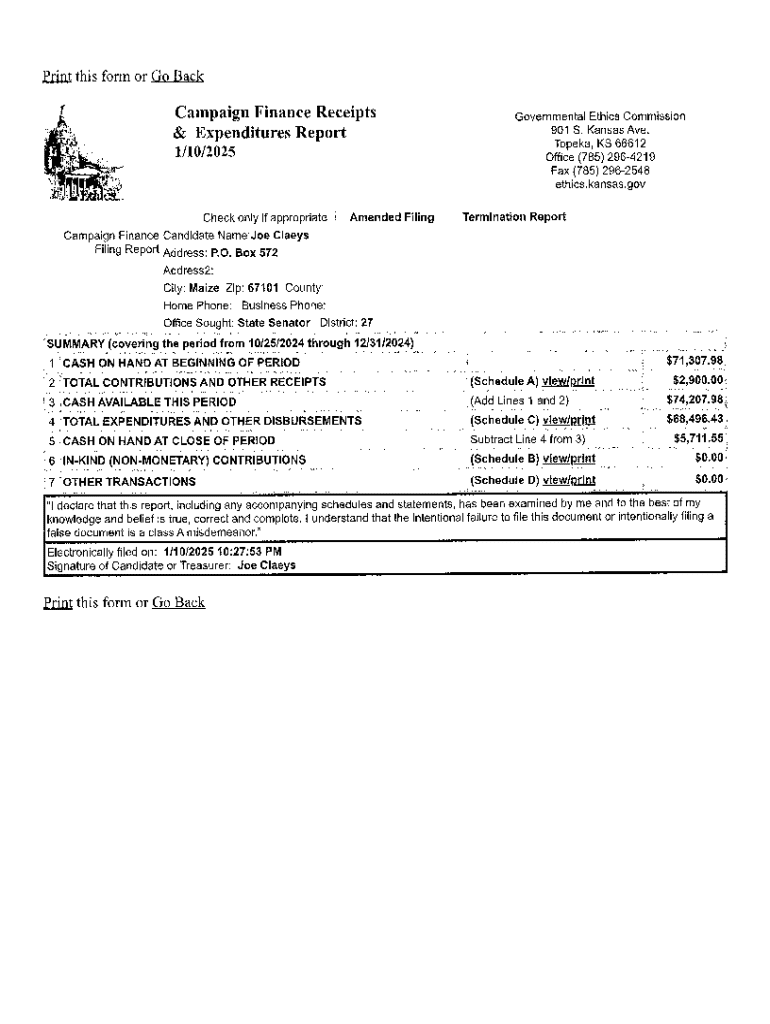

Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the Campaign Finance Receipts Expenditures Form

Understanding campaign finance forms

Campaign finance forms play a crucial role in promoting transparency and accountability within political fundraising and expenditure. Defined as documents that outline both the money raised and spent by a candidate or committee, these forms ensure that all financial activities related to a political campaign are documented meticulously. Compliance with these forms is essential for candidates, as failure to do so can lead to legal repercussions, including fines or disqualification from the electoral process.

The importance of compliance cannot be overstated. These forms not only satisfy legal obligations but also foster trust among voters by providing clear insights into how financial resources are utilized during a campaign. Accurate filing highlights the integrity of a candidate and, by extension, the electoral process as a whole.

Types of campaign finance forms

Campaign finance forms come in various types, each serving distinct purposes. The primary forms include receipts, which document the funds that a campaign receives, and expenditures, which track the spending of those funds. Understanding these forms is critical for candidates and their teams to ensure proper reporting and compliance with financial regulations.

Key components of the receipts expenditures form

The receipts expenditures form is divided into two main components — the receipt section and the expenditure section. Each serves a specific purpose and requires careful documentation to ensure compliance. In the receipt section, campaigns must provide comprehensive details about the sources of their funding, which might include individual contributions, small donor amounts, PAC donations, and so on.

Essentially, what counts as a receipt is any monetary contribution received during the campaign period. Proper documentation requires noting the donor's name, contact information, and the amount contributed. It's critical to maintain a record of these receipts not only for reporting but for platform transparency to voters.

Receipt section: essential elements

Expenditure section: detailing expenses

Similarly, the expenditure section requires campaigns to provide detailed accounts of their spending. Types of expenditures typically reported include media buys, personnel costs, travel expenses, and supplies. Each entry must be well-documented, with required details such as the vendor name, the purpose of the expenditure, the amount spent, and the date of the transaction.

Step-by-step guide to completing the form

Completing the campaign finance receipts expenditures form requires thorough preparation. Start by gathering all necessary information ahead of time. Organizing your data into categories — such as receipts and expenditures — can streamline the process significantly.

Filling out the form: a section-by-section breakdown

Once all information is gathered, it’s time to fill out the form. The first section requires personal or organization information, including the name of the candidate or committee, the address, and contact details. This information is crucial as it identifies the reporting entity.

Next, document the receipts by accurately categorizing incoming contributions. Each entry must be labeled clearly, detailing the donor information, amount, and date. For expenditure entries, follow the same thoroughness: list the vendor, amount spent, purpose, and date. Ensure all entries are accurate to avoid compliance-related issues.

Lastly, don’t forget the verification and certification process. Prior to submission, it's vital to review the form thoroughly. Double-check each entry for accuracy and completeness, and consider options for electronic signatures using pdfFiller for efficiency and compliance.

Common challenges and how to overcome them

Navigating the campaign finance receipts expenditures form can present various challenges. Frequent mistakes include misreporting amounts, failing to include necessary details, or misunderstanding the classification of contributions and expenditures. These missteps can have severe implications, including audits or fines.

Understanding regulations and legal requirements

Being aware of the regulations governing campaign finance forms is essential for candidates. Each jurisdiction may have unique rules regarding donation limits, reporting timelines, and form completion. Resources such as official state election office websites can provide invaluable guidance for candidates seeking to stay compliant.

Tools and resources for managing your campaign finance documents

Utilizing effective tools can significantly streamline the process of completing the campaign finance receipts expenditures form. pdfFiller, for example, offers features tailored to document management, such as easy editing and eSigning capabilities, all centralized in a cloud-based platform.

Interactive tools for tracking campaign finances

Various interactive tools are available for tracking campaign finances, providing candidates with real-time analytics and oversight. Simple apps can calculate total contributions and expenditures and help visualize financial data through charts and graphs.

Submission guidelines for campaign finance forms

Submitting the campaign finance receipts expenditures form is the final step in ensuring compliance. Depending on the jurisdiction, submissions might need to be made electronically or via traditional mail. Always check local election office instructions for submission methods, as they can vary significantly between states and localities.

Post-submission: what to expect

After submission, candidates should anticipate follow-up actions or possible audits, especially if discrepancies are noted in the reporting. Keeping thorough records of all financial activities is crucial for future reference and can aid in swift resolutions should any issues arise during post-submission reviews.

FAQs about campaign finance receipts expenditures form

Addressing common questions can demystify the complexities of campaign finance forms. Candidates often inquire about the acceptable forms of receipts, the legality of certain contributions, and how to best ensure compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my campaign finance receipts expenditures in Gmail?

How do I complete campaign finance receipts expenditures on an iOS device?

How do I edit campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.