Get the free this document allows taxpayers to request that their blackout data for discretion add comments and more msockid 30e609794e4f635e1b251f2b4f2662e9

Get, Create, Make and Sign this document allows taxpayers

How to edit this document allows taxpayers online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this document allows taxpayers

How to fill out nebraska e-file opt-out record

Who needs nebraska e-file opt-out record?

Understanding the Nebraska E-File Opt-Out Record Form

Understanding the Nebraska e-file opt-out record form

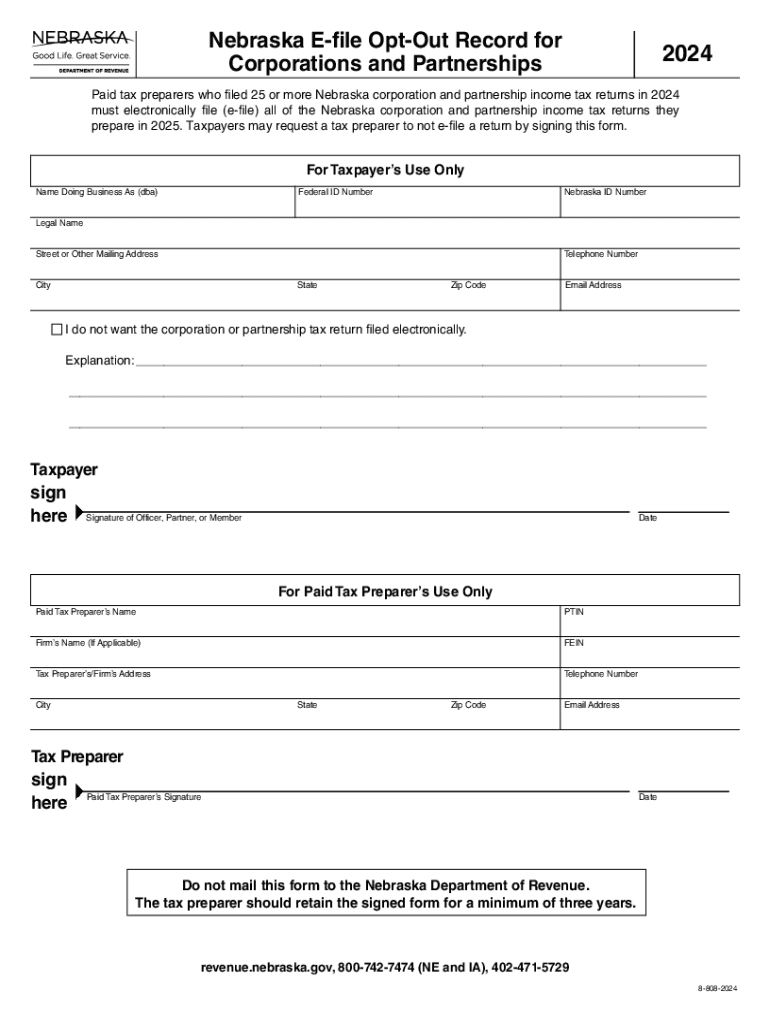

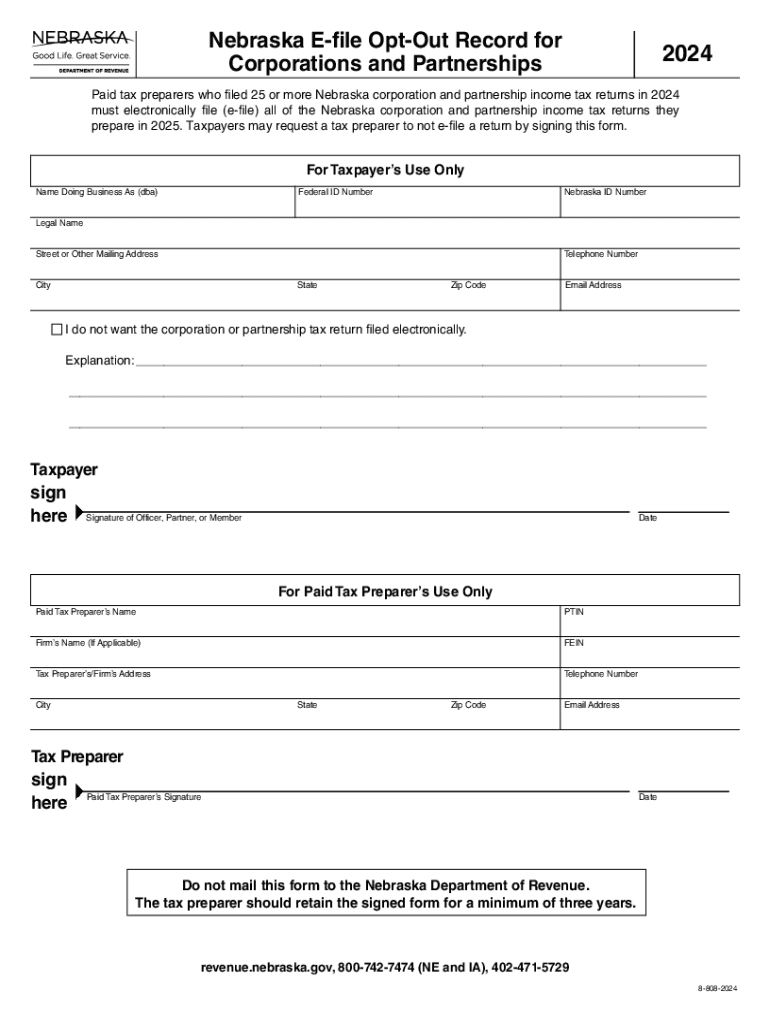

The Nebraska E-File Opt-Out Record Form is a key document for taxpayers who prefer not to use electronic filing. This form allows individuals and entities to formally notify the Nebraska Department of Revenue that they are opting out of the mandatory e-filing system. The process is designed to give individuals control over their filing methods, which can be crucial for those with specific preferences for paper submissions.

Opting out can be particularly important for taxpayers who may have concerns regarding digital security, or those who have had past experiences with electronic systems that did not meet their needs. By submitting this form, taxpayers ensure that their filing method respects their preferences and concerns.

Who needs to opt-out?

Various individuals and entities may find it necessary to opt out of e-filing in Nebraska. Generally, any taxpayer who meets the eligibility criteria can make this request. This might include individuals with unique or special filing circumstances, such as those who do not possess computer skills or prefer to manage their documents traditionally. Additionally, small business owners sometimes prefer paper filing to maintain a tangible trail of their tax submissions.

Common reasons for opting out can include concerns about cybersecurity, past negative experiences with e-filing, or the nature of one’s business or personal circumstances that make paper filing more practical. It's vital for taxpayers to evaluate their situation carefully before making a decision.

Preparing to complete the Nebraska e-file opt-out record form

Before diving into the Nebraska E-File Opt-Out Record Form, it is essential to gather necessary documentation to ensure a smooth filing process. Having the right documents on hand can mitigate mistakes and streamline the completion process. Key documents include your tax return information, identification details, and any correspondence from the Nebraska Department of Revenue that pertains to your e-filing status.

Accurate personal information is crucial. Typically, mistakes in this process arise from incorrect names, addresses, or Social Security Numbers. Gathering these documents in advance can avoid delays and reduce the chances of your form being rejected.

Tips for gathering information

To effectively gather all required information for the Nebraska e-file opt-out record form, consider using a checklist. This organization method helps ensure you don’t overlook any important details. You may also want to contact your accountant or tax advisor, especially if you're dealing with complex tax situations. They can provide guidance on what specific information you need to have ready.

Additionally, it is vital to double-check the accuracy of all collected information. Missteps can lead to rejecting your opt-out request or, worse, complications with your tax filings. Before submitting, run through your checklist multiple times to confirm that everything is correct.

Step-by-step guide to completing the form

Accessing the Nebraska E-File Opt-Out Record Form is straightforward. You can find it on the Nebraska Department of Revenue website or utilize platforms like pdfFiller for convenient access and editing. These platforms offer easy navigation and additional tools that streamline the process of filling out and submitting tax forms.

Filling out the form itself involves several steps. Start by entering your personal information diligently in the designated section, including your name, address, and Social Security Number. Next, you will need to specify your reason for opting out of e-filing. This helps the tax authorities understand your needs better. Finally, do not forget to sign and date your application; without a signature, your request may be deemed invalid.

Utilizing pdfFiller's features

Using pdfFiller to edit the Nebraska E-File Opt-Out Record Form makes the process even more accessible. With pdfFiller, users can add annotations and comments to the form, which can facilitate a better understanding of why you're making specific choices on the form. Moreover, signing and dating the document within the platform is seamless. Features like electronic signatures are especially beneficial for maintaining a legally binding record without the need for physical paperwork.

Taking advantage of these tools not only streamlines your experience but also contributes to better document management overall. Utilizing a cloud-based solution like pdfFiller simplifies revisions and allows for easy access from any authorized device, eliminating traditional limitations.

Submitting the Nebraska e-file opt-out record form

Once you've completed the Nebraska E-File Opt-Out Record Form, it is crucial to submit it correctly. Submission methods include online uploads, mailing the form directly to the Nebraska Department of Revenue, or faxing it if necessary. Keep in mind any deadlines associated with your filing period—failure to submit on time could impact your tax situation.

After your submission, it is important to track its status. You can confirm receipt of your opt-out request by following up with the appropriate offices. If you do not receive a confirmation within a reasonable time frame, take the initiative to reach out and ensure your request is being processed properly.

Managing your e-file opt-out status

After opting out, you may wish to revisit your e-file opt-out decision. The process for updating or revoking your opt-out preference is straightforward, allowing flexibility should your needs change. Keeping an open line of communication, especially with tax professionals, is advisable so they may guide you appropriately. There may be times when your personal or business circumstances evolve, and revisiting your filing preference becomes essential.

Understanding state guidelines surrounding Nebraska's regulations on e-file opt-out remains crucial. Failing to align with these guidelines could result in complications or penalties in the future. Regularly reviewing your status and the state’s requirements will ensure you remain compliant and informed.

Troubleshooting common issues with the form

While completing the Nebraska E-File Opt-Out Record Form is generally straightforward, several common errors can lead to complications. Missing signatures, inaccurate personal information, or misunderstanding submission methods can all result in a rejected request. Taking the time to review the form and follow guidelines meticulously can prevent such issues.

If you do encounter problems during the process, reaching out to the Nebraska Department of Revenue or a tax professional can provide clarity. They can assist in resolving any issues to ensure your opt-out request proceeds smoothly.

Additional resources and tools

For users seeking enhanced assistance with their Nebraska E-File Opt-Out Record Form, leveraging interactive tools available on pdfFiller can be incredibly beneficial. These tools allow for custom templates and improved document management features that can streamline your overall experience. Using pdfFiller, individuals can also engage in collaborative workflows that can lead to enhanced understanding and support during the opt-out process.

Moreover, exploring other related forms and templates pertinent to tax filing in Nebraska can be instrumental. These additional resources can further inform you about your rights and responsibilities as a taxpayer. User testimonials and case studies provide valuable insight into how others have navigated this process successfully.

Empowering your document management experience

Choosing to manage your forms through pdfFiller greatly enhances your document handling experience. The platform simplifies editing, e-signing, and collaboration, all within an intuitive lineup of features. By using cloud-based document solutions, users not only streamline their workflows but also ensure compliance and accuracy in their document submissions. Accessing your forms from any device eliminates the restriction of being tied to one location, enhancing flexibility.

Ultimately, utilizing a platform like pdfFiller for managing the Nebraska E-File Opt-Out Record Form can significantly reduce the stress associated with traditional filing methods. The ease of connectivity, combined with robust features, empowers users to maintain control over their document management processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my this document allows taxpayers in Gmail?

How do I edit this document allows taxpayers online?

Can I sign the this document allows taxpayers electronically in Chrome?

What is nebraska e-file opt-out record?

Who is required to file nebraska e-file opt-out record?

How to fill out nebraska e-file opt-out record?

What is the purpose of nebraska e-file opt-out record?

What information must be reported on nebraska e-file opt-out record?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.